Here is an analytical blog comparing the IQVIA MFR Dec 2025 report with the previously reviewed PharmaTrac Dec 2025 report:

1. Market Size and Growth: Broad Alignment

Both reports confirm that the IPM is growing steadily, though with slightly different numbers:

- PharmaTrac: Estimates IPM at ₹2.40 lakh crores with 8.2% MAT growth (realistic scenario).

- IQVIA: Reports IPM at ₹2.50 lakh crores with 8.9% MAT growth.

The difference (~₹10,000 Cr) likely stems from data sources, sample coverage, and projection models. Both, however, signal a post-pandemic stabilization, with chronic therapies outpacing acute ones.

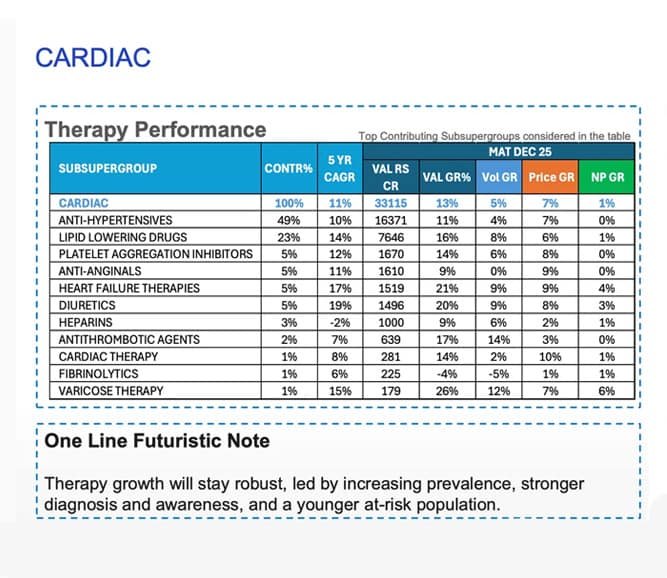

2. Therapy Performance: Chronic Leads, Acute Lags

Both reports highlight Cardiac and Anti-Diabetes as top growth therapies, but IQVIA provides a more granular metro- and state-level breakdown.

- Cardiac: PharmaTrac reports 13% growth; IQVIA shows 12.9%.

- Anti-Diabetes: Both note strong growth, but IQVIA adds that GLP-1 agonists are reshaping the category, with Mounjaro emerging as a top brand in metros.

- Anti-Obesity: PharmaTrac dedicates a full section to GLP-1 and future generics; IQVIA notes Mounjaro’s explosive growth but doesn’t delve as deeply into future genericization.

Key Insight: IQVIA’s therapy tables include monthly vs. MAT comparisons, showing December 2025 saw stronger growth across most therapies—likely due to seasonal and year-end buying.

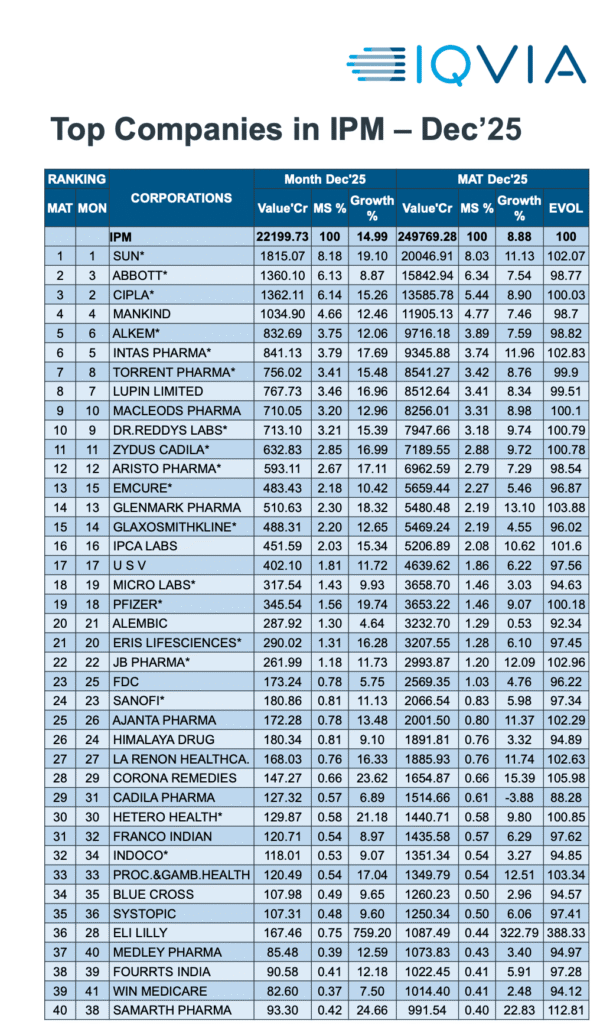

3. Corporate Landscape: Sun Pharma Leads, but MNCs Grow Faster

Both agree on the top players: Sun Pharma, Abbott, Cipla, Mankind, and Alkem dominate.

- PharmaTrac: Highlights Sun’s 12.2% growth and strong performance by Torrent, Intas.

- IQVIA: Adds that MNCs grew at 11.1% vs. Indian companies’ 8.4%, despite Indian firms holding 83.6% market share.

Notable Difference: IQVIA provides regional top company rankings, revealing strong regional leaders like Aristo in Bihar and MacLeod’s in cardiac-heavy regions.

4. Brand Rankings: Chronic and Acute Mix

Both lists are dominated by chronic brands, but IQVIA’s ranking includes more acute and OTC brands in top 40.

- Common Top Brands: Augmentin, Glycomet GP, Foracort, Mounjaro, Thyronorm.

- IQVIA Exclusive: Includes Electral, Liv-52, Betadine—reflecting acute/OTC strength.

- PharmaTrac: More focused on chronic Rx brands.

Takeaway: IQVIA’s list reflects a broader market view including OTC and acute care, while PharmaTrac’s seems more chronic-prescription-oriented.

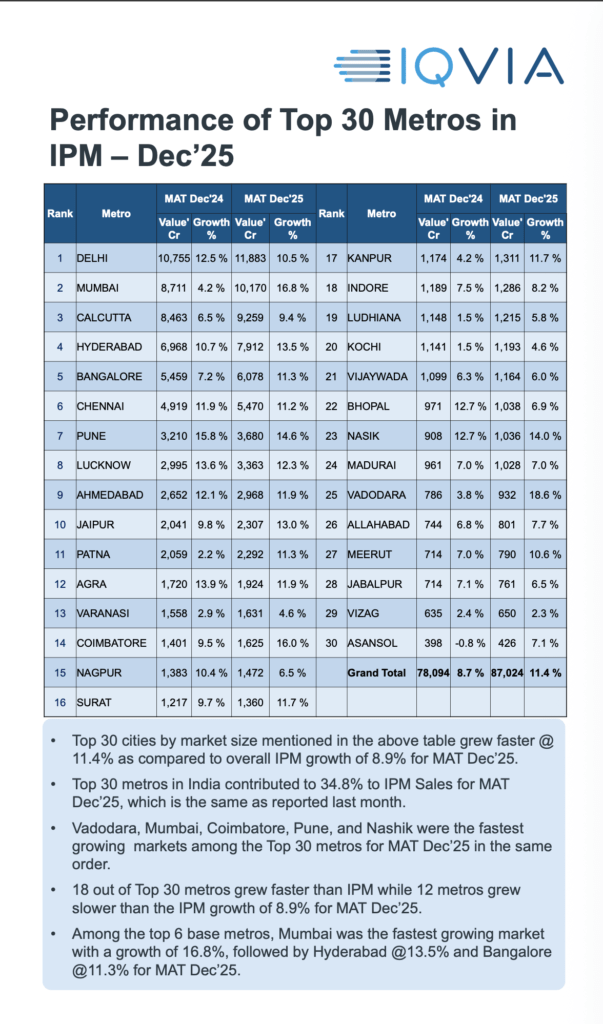

5. Regional Insights: IQVIA’s Strength

This is where IQVIA vastly outperforms in depth. It provides state- and metro-level breakdowns for 30+ regions, showing:

- Fastest-growing metros: Mumbai (16.8%), Hyderabad (13.5%), Bangalore (11.3%).

- State-level leaders: UP is the largest market (11.1% of IPM), but Jharkhand (12.2%) and Gujarat (11%) grew fastest.

- Regional brand preferences: e.g., Pan-D (Alkem) leads in Kolkata, Monocef (Aristo) in Bihar.

PharmaTrac’s report lacks this granularity, focusing more on national therapy and corporate trends.

6. New Launches and Innovation

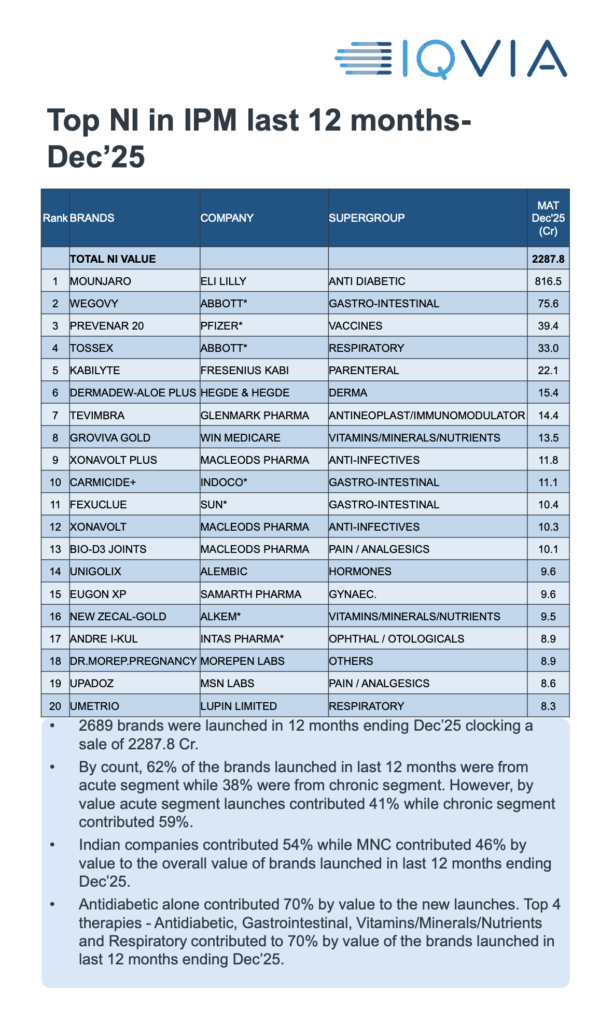

- IQVIA: Reports 2,689 brands launched in 12 months ending Dec ’25, with 59% of value from chronic therapies. Anti-diabetes alone contributed 70% of launch value.

- PharmaTrac: Highlights new molecules in cardiac, anti-obesity, and respiratory, but doesn’t quantify launch volume.

Insight: Both agree that chronic therapies, especially diabetes, are innovation hotspots.

7. Acute vs. Chronic Trend

Both reports note the chronic growth premium:

- IQVIA: Chronic grew at 12%, acute at 6.9% for MAT Dec ’25.

- PharmaTrac: Also notes chronic outpace, especially in cardiac, diabetes, neuro.

8. Channel and Consumer Shifts

- PharmaTrac: Discusses OTx/OTC shift in dermatology, nutritionals, and analgesics.

- IQVIA: Highlights MNC strength in chronic and Indian dominance in acute, but doesn’t deeply explore channel dynamics.

9. Forward-Looking Views

- PharmaTrac: Provides scenario-based forecasts (optimistic, realistic, pessimistic) for 2026.

- IQVIA: More descriptive, with less explicit forecasting but strong regional predictive insights based on current growth.

10. Data Presentation and Usability

- PharmaTrac: Cleaner, more visual, therapy-focused; easier for strategic planning.

- IQVIA: Dense, data-rich, excel-style tables; ideal for sales, regional strategy, and benchmarking.

Conclusion: Which Report to Use When?

- For Corporate Strategy & Therapy Planning: PharmaTrac offers clearer macro insights, therapy forecasts, and innovation tracking.

- For Field Force, Regional Strategy & Market Execution: IQVIA is unmatched in geographic granularity, brand tracking, and launch analytics.

- For Investment & Portfolio Decisions: Use both—PharmaTrac for category trends, IQVIA for regional execution and competitive benchmarking.

The Indian pharma market is not monolithic; it’s a sum of diverse regional markets, therapy behaviors, and competitive battles. Together, these reports provide a 360-degree view—one from 30,000 feet, the other from the ground.

This analysis is based on the IQVIA MFR Dec 2025 and PharmaTrac IPM Performance MAT Dec 2025 reports. Data is subject to differences in methodology, coverage, and projection models.

Published on www.medicinman.net

Author: Insights Team

Date: January 28, 2026