Indian pharma wrapped up November 2025 with serious velocity. Growth wasn’t just linear — it was driven by a new value engine powered by GLP-1s, chronic-care momentum, and a pricing mix shift that meaningfully elevated the industry’s baseline. Even using only public data, the signal is unmistakable: November marked a strategic pivot point for the Indian Pharmaceutical Market (IPM).

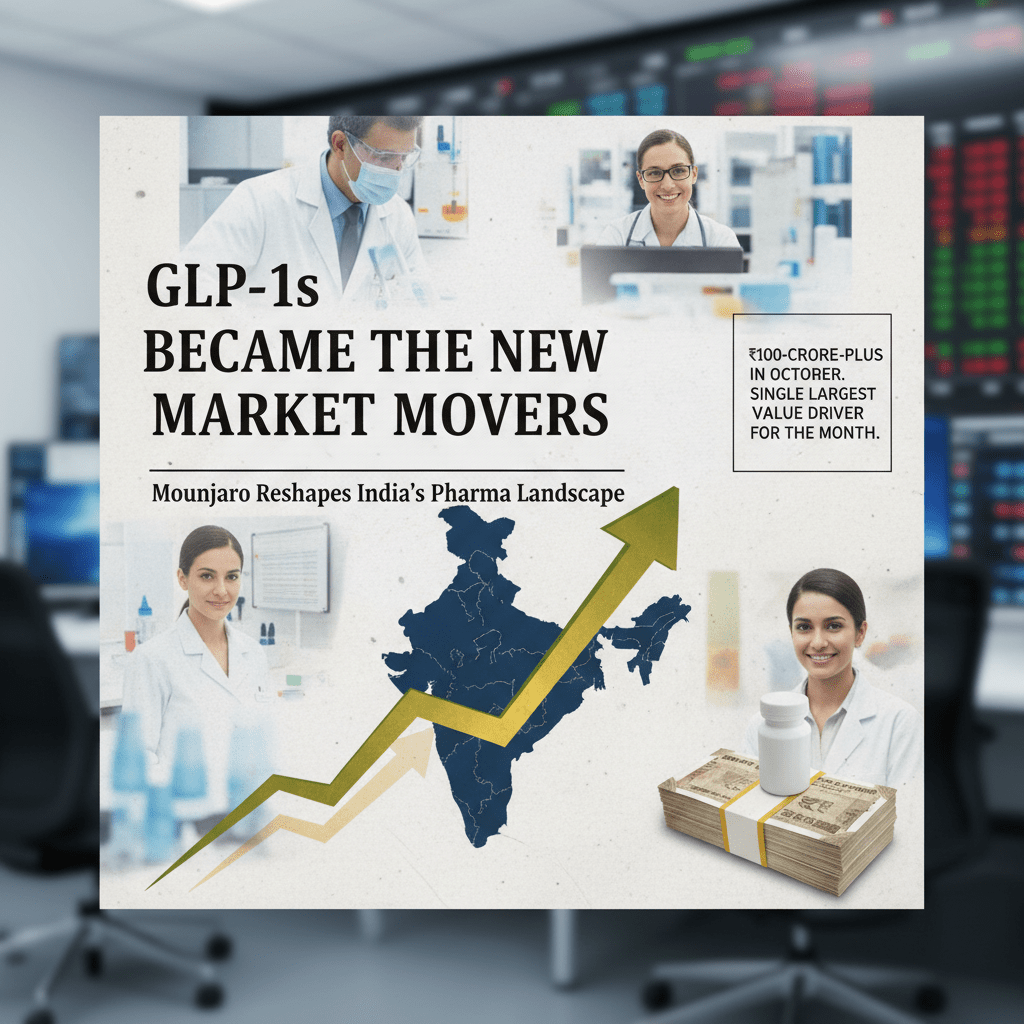

GLP-1s Became the New Market Movers

November was the month when tirzepatide truly reshaped the landscape.

Publicly available data shows Mounjaro delivering a ₹100-crore-plus performance in October, placing it at the top of India’s value charts. The spillover was immediate — physician adoption, patient demand, and clinical excitement carried this momentum into November.

Even without access to proprietary trackers, one takeaway is crystal clear:

Mounjaro was the single largest incremental value driver for the month.

For an industry used to steady-chronic growth curves, this kind of value concentration is rare — and game-changing.

Chronic Therapies Continued to Anchor the Market

The old reliables didn’t lose pace — they accelerated.

Across public tracker extracts and regional reporting, chronic therapies remained the backbone:

- Cardiac

- Anti-diabetic

- Gastrointestinal

These categories provided November’s stability layer, ensuring the market stayed buoyant even before factoring in high-value new launches.

India’s chronic disease burden is expanding, and November’s performance reflects a structural trend, not a seasonal spike.

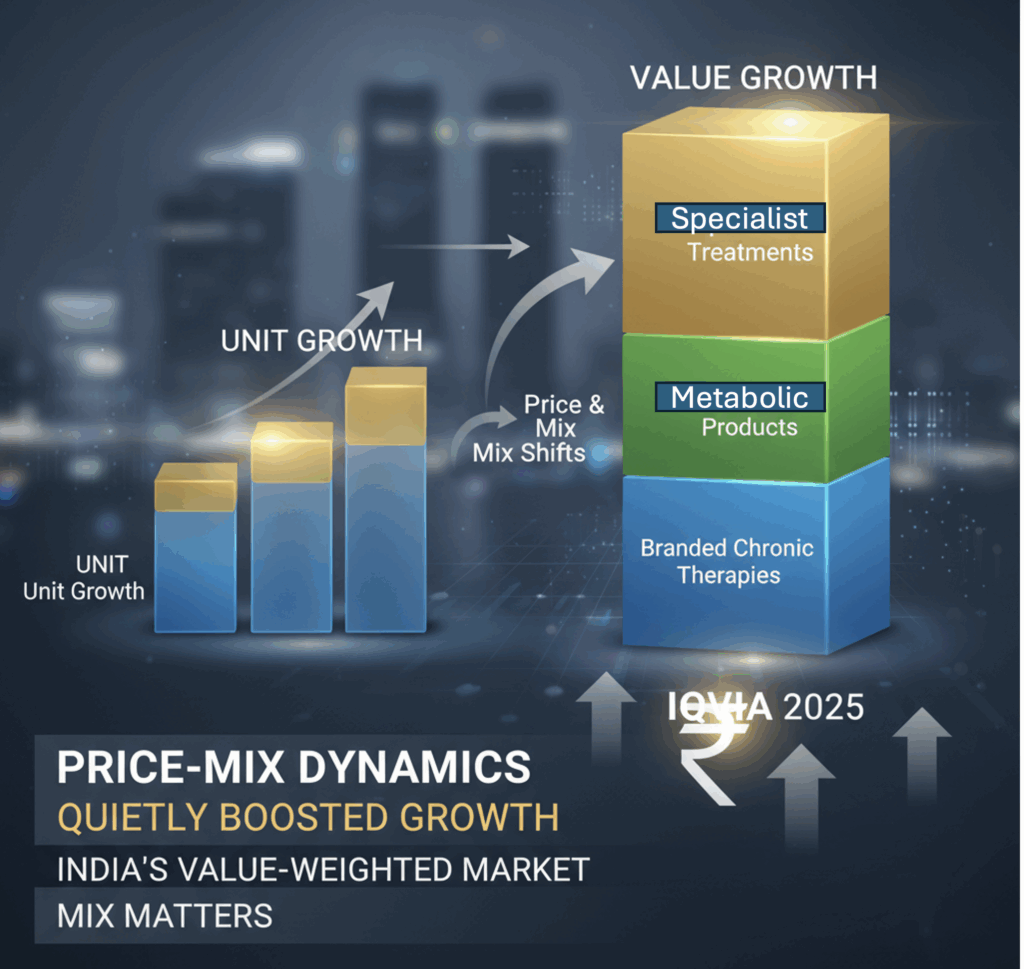

Price–Mix Dynamics Quietly Boosted Growth

IQVIA’s public quarterly briefs have been consistent: price and mix shifts are fueling 2025’s value story.

In November, this played out through:

- Premium positioning of branded chronic therapies

- Launch pricing of metabolic products

- Stronger mix contribution from specialist treatments

The result? Even modest unit growth translated into outsized value growth. In a value-weighted market like India’s, mix matters — and November proved it again.

Regional Markets Signalled Early Demand Pockets

Several state-level reports and media articles citing Pharmarack data highlighted sharp chronic therapy uptake in regions like Gujarat. These pockets are becoming early indicators of metabolic-care adoption as well.

What’s emerging is a two-speed India:

- Metros leading on GLP-1 interest

- High-burden regions accelerating chronic uptake and ready to scale into newer therapies

That’s a strong forward signal for companies planning 2026 strategies.

Competitive Dynamics Intensified Ahead of December

November wasn’t just about performance — it was the build-up to a competitive battle.

Global coverage around GLP-1 access, WHO commentary, and clinical evidence created a high-noise environment. In India, anticipation was rising for Novo Nordisk’s December launch of Ozempic, which will directly challenge Mounjaro’s early lead.

For November, this meant two things:

- Physicians were primed for metabolic interventions.

- Companies were gearing up for portfolio repositioning.

We’re entering the most competitive metabolic-care phase India has ever seen.

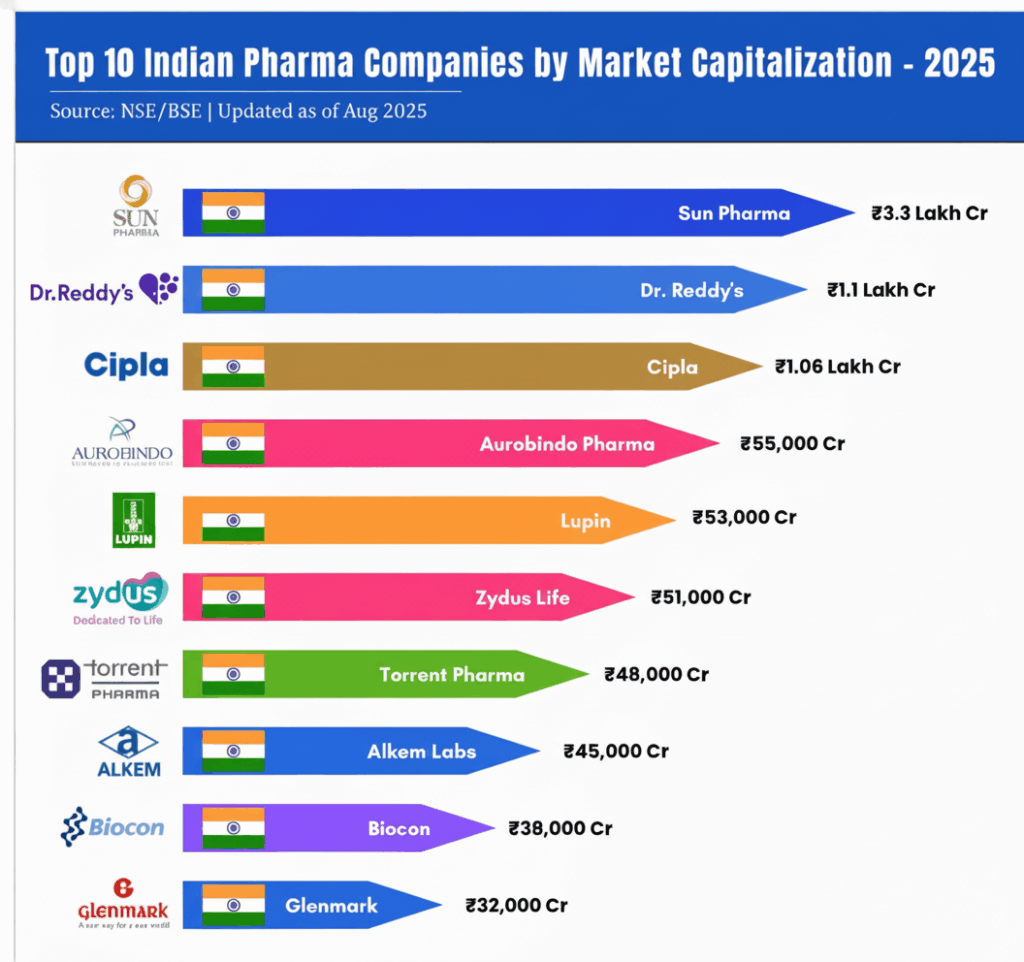

Quarterly Company Insights Reinforced the Trendline

Public filings from large players like Sun Pharma, Cipla, Glenmark, and Alkem show domestic formulations growing solidly through 2025.

The common threads:

- Strong chronic-care portfolios

- Specialty product-led momentum

- Sustained domestic demand tailwinds

These reinforce that November’s growth had a solid structural foundation, not just a launch-led spike.

What November Really Tells Us

Stacking all public data together gives November a distinct profile:

- A wave of high-value innovation (GLP-1s) drove sharp value acceleration.

- Chronic therapy categories stayed robust and dependable.

- Price–mix effects amplified growth beyond volumes alone.

- Regional markets continued shaping demand dynamics.

- Competitive pressure ramped up ahead of December launches.

This makes November one of the defining months of 2025 — not because of a specific proprietary number, but because of what the month signals about India’s evolving pharma landscape.

Strategic Outlook: What Leaders Should Watch

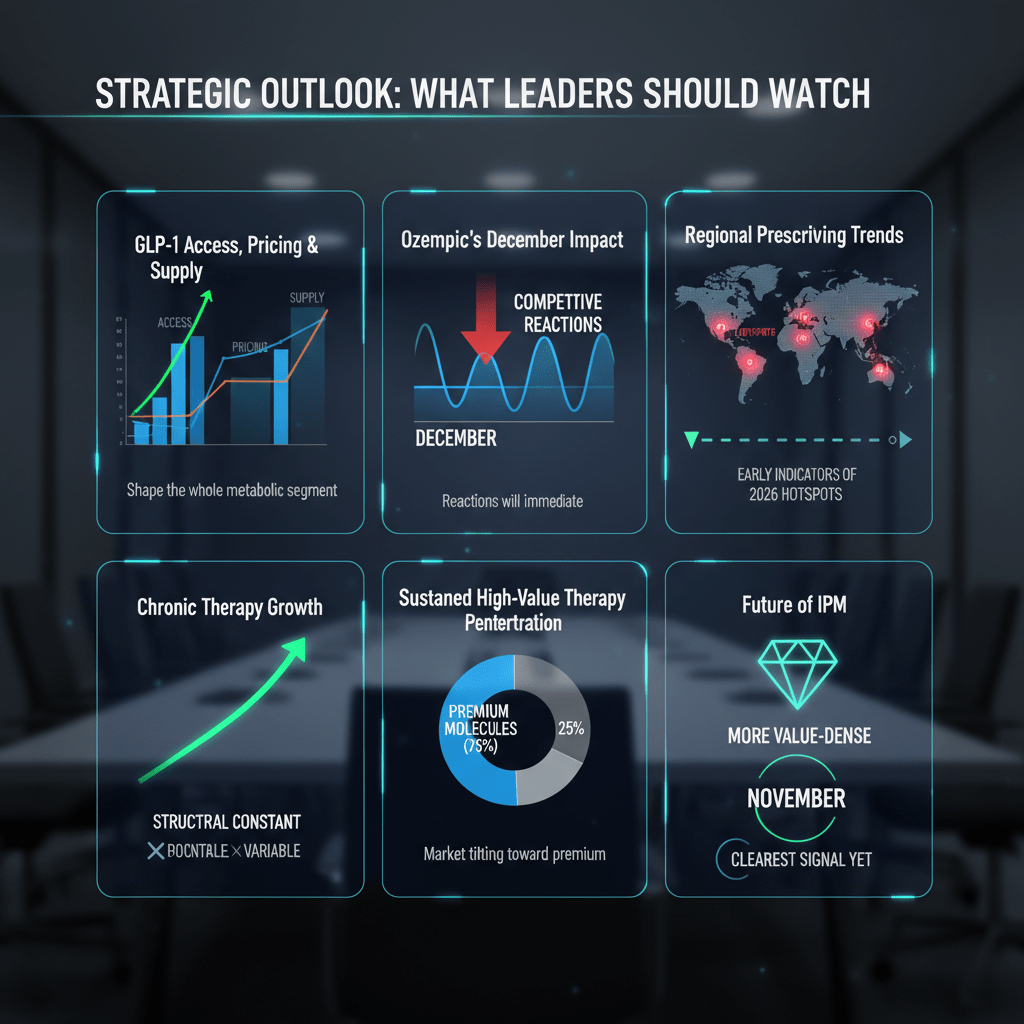

Here’s the near-term playbook:

- Track GLP-1 access, pricing, and supply — these will shape the whole metabolic segment.

- Watch Ozempic’s entry impact in December — competitive reactions will be immediate.

- Monitor regional prescribing trends — they’re early indicators of 2026 hotspots.

- Expect sustained high-value therapy penetration — the market will keep tilting toward premium molecules.

- Model chronic therapy growth as a structural constant, not a variable.

The future of the IPM is getting more value-dense — and November was the clearest signal yet.

Appendix: Public Sources Used

(All data references are from publicly accessible sources. No proprietary IQVIA, AIOCD AWACS, Pharmarack, or PharmaTrac datasets were used.)

- Public reports on Mounjaro (tirzepatide) and its market performance.

- Global and WHO commentary on GLP-1 access and clinical adoption.

- Media reports on Ozempic’s expected December 2025 India launch.

- IQVIA India public quarterly (Q2 2025) presentation covering growth drivers and chronic-therapy trends.

- Publicly posted Pharmarack and PharmaTrac snapshots showing directional chronic therapy growth and market themes.

- Regional media citing Pharmarack data on chronic therapy uptake in Gujarat.

- Public company quarterly commentary (e.g., Glenmark) on domestic formulations growth.

- Market-size context from IBEF/Bain publicly available reports.

All Images are AI Generated for Illustration. E&OE