1. Overall Market Growth & Trends (IPM Key Highlights):

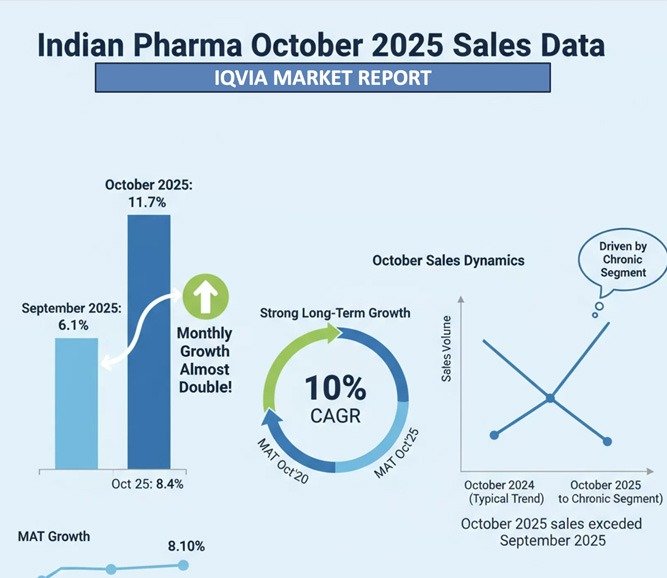

- Robust Monthly Growth: The IPM experienced a significant surge in monthly growth for October 2025, reaching 11.7%, a substantial increase from 6.1% in September 2025.

- Healthy MAT Growth: Correspondingly, the Moving Annual Total (MAT) growth for October 2025 also improved to 8.4% compared to 7.8% in September 2025.

- Strong Long-Term Growth: The IPM has demonstrated a healthy Compound Annual Growth Rate (CAGR) of almost 10% over the observed period (MAT Oct’20 to MAT Oct’25), indicating sustained expansion.

- October Sales Dynamics: While October sales are typically lower than September, October 2025 showed a higher sale, particularly driven by the chronic segment, due to lower growth reported in the preceding month.

2. Segment-Specific Growth (Acute vs. Chronic):

- Chronic Segment Stability: Chronic growth has been less volatile, ranging from 7% to 16.5% over the years, suggesting a more consistent demand.

- Acute Segment Fluctuations: Acute segment growth has shown greater fluctuation, ranging between 1.4% (lowest in Oct’22) and 17.6%.

- MNC Outperformance: MNC companies are showing better growth than Indian companies in both acute and chronic segments, and this gap is widening.

3. New Product Introductions:

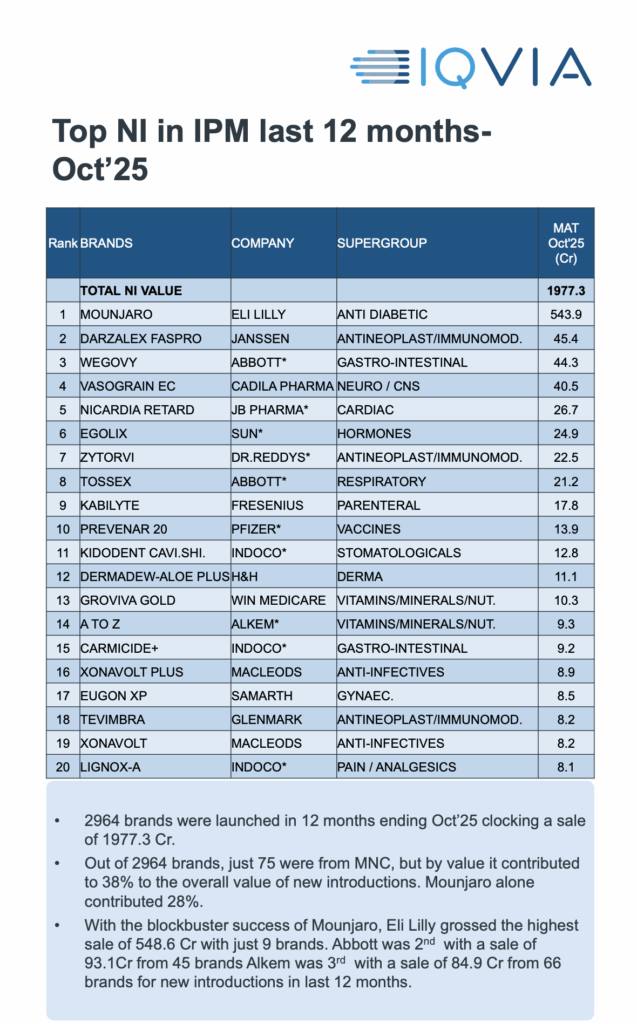

- Significant Volume of New Brands: A total of 2964 new brands were launched in the 12 months ending Oct’25, contributing 1977.3 Cr in sales.

- MNC Dominance in Value: Despite only 75 out of 2964 new brands being from MNCs, they contributed a disproportionately high 38% to the overall value of new introductions.

- Mounjaro’s Blockbuster Launch: Eli Lilly’s Mounjaro was a standout, contributing 28% to the total value of new introductions and driving Eli Lilly to the highest sales in this segment.

4. Top Companies and Brands:

- Leading Companies (Oct’25 IPM): SUN, ABBOTT, CIPLA, MANKIND, and ALKEM are the top 5 companies by value in October 2025.

- High Growth Companies: Glenmark Pharma (17.01%), Intas Pharma (18.89%), and Ajanta Pharma (19.28%) showed strong monthly growth. Glenmark Pharma also demonstrated high MAT growth (12.17%).

- Top Brands (Oct’25 IPM): FORACORT, AUGMENTIN, GLYCOMET-GP, PAN, and MIXTARD lead in October 2025.

- Exceptional Brand Growth: Beyond Mounjaro, Rybelsus (38.08% MAT growth) and Influvac (24.9% growth from MNC companies) are notable high-growth brands.

5. Therapeutic Area Performance:

- Cardiac Leads: The Cardiac therapeutic class holds the largest market share (13.1% in Oct’25, 13.2% MAT Oct’25) and shows strong MAT growth of 12.0%.

- High Growth Therapeutic Areas: Antineoplast/Immunomodulators (16.3% MAT growth) and Vaccines (10.8% MAT growth) are experiencing robust growth. Antiviral also shows strong monthly growth (21.5%).

- Deviation between Monthly and MAT Growth: Antiviral and Antineoplast/Immunomodulator therapies showed the highest deviation, indicating recent surges or fluctuations.

6. Regional and Metro Performance:

- Jharkhand, Bihar, and Delhi are Fastest Growing: Among states, Jharkhand (12%), Bihar (11.6%), and Delhi (10.5%) are the fastest growing for MAT Oct’25.

- North Zone Dominates: The North Zone contributes the highest to IPM sales (27%), followed by the South (26%), East (25%), and West (22%).

- Top Metros Outperform: The top 30 cities grew faster (10.3%) than the overall IPM growth (8.4%) for MAT Oct’25, collectively contributing 34.7% to IPM sales.

- Fastest Growing Metros: Vadodara, Pune, Mumbai, Patna, and Nashik were the fastest-growing metros. Mumbai stood out among top base metros with 14.9% growth, followed by Hyderabad (12.5%) and Chennai (11.3%).

- Smallest Markets: Goa and Himachal Pradesh represent the smallest pharma markets among the states.

In summary, the Indian pharmaceutical market is experiencing healthy growth, particularly driven by new product introductions, strong performance from MNCs, and robust expansion in specific therapeutic areas and key metropolitan centers.

All Images are AI Generated for Illustration Only. E&OE