India’s diagnostics market is undergoing a quiet but profound shift as at-home testing, e-pharmacies and quick commerce collide on the patient’s smartphone screen. From Zepto’s partnership with Orange Health Labs to Apollo 24/7’s omnichannel diagnostics network and PharmEasy’s Thyrocare-powered home collection, the lab now comes to the consumer instead of the other way around. This convergence is reshaping competitive dynamics for pharma companies, payers and health systems that depend on diagnostics as the front door to care.[1][2][3][4][5]

India’s at-home diagnostics moment

Several forces have converged to fuel this boom in home diagnostics: post-Covid familiarity with home sample collection, rapid growth of e-commerce, and a middle class that is increasingly health- and convenience-conscious. India’s quick commerce market alone is expected to grow strongly through 2030, and diagnostics offers these platforms a higher-margin, higher-trust category beyond groceries. At the same time, established diagnostic brands and hospital networks are digitising aggressively, offering app-based booking, real-time tracking of phlebotomists and same-day reports.[2][9][4][5][6]

On one side are quick commerce players such as Blinkit, Zepto and Swiggy Instamart, which already run dense dark-store networks and high-frequency customer relationships. These companies are beginning to plug diagnostics into their apps through specialist partners, promising sample collection in under an hour and reports within a few hours, as seen in Zepto’s tie-up with Orange Health Labs. On the other side stand full-stack diagnostic and e-health platforms like PharmEasy (via Thyrocare), Apollo 24/7 and national chains such as Dr Lal PathLabs and House of Diagnostics, which bring decades of lab expertise and clinical governance to the same at-home experience.[12][13][14][9][4]

Competitive landscape in India

The table below maps key players that combine digital interfaces with home sample collection. It focuses on those most relevant to the convergence of quick commerce and diagnostics.

| Player | Core model today | Diagnostics play | Home collection promise | Distinctive strengths |

|---|---|---|---|---|

| Blinkit (Zomato) | Quick commerce for grocery and essentials via dark stores.[16][17] | Piloting or exploring diagnostics through partnerships and health check bundles, positioned as another “instant” service category (various industry reports and commentary). | Likely to offer fast scheduling windows in major cities, leveraging existing delivery density (timelines vary by city). | Huge urban footprint, strong brand recall in instant delivery, ability to cross-sell tests alongside groceries and OTC products.[16][17][5] |

| Zepto | Quick commerce with 10-minute delivery and new “Super Mall” for high-value items.[7][12] | Zepto Diagnostics within Zepto Pharmacy via Orange Health Labs, offering full body checkups, CBC, thyroid and other tests.[7][12][13] | Sample collection in about 60 minutes and reports in roughly six hours in covered localities.[7][12] | Young brand with high app engagement, dense dark stores and a focused partnership that can be scaled city by city.[7][12][13] |

| Swiggy Instamart | Quick commerce arm of Swiggy, delivering groceries and household items.[19][16] | Has experimented with online retail and may explore diagnostics through health partners as category adjacency (analyst commentary and market tracking). | Potential for quick time-slot booking using existing logistics network in metros. | Strong technology stack, cross-sell from Swiggy’s food user base, and experience in category expansion.[19][16][5] |

| PharmEasy (with Thyrocare) | E-pharmacy and digital health platform with medicines, teleconsults and diagnostics.[1][20][21] | Large test menu and health packages processed through NABL-accredited Thyrocare and other partner labs.[1][3][21] | Free or discounted home sample collection across many pin codes, with reports usually within defined timelines via app.[1][3][22] | Deep diagnostics focus, national lab network, aggressive pricing and integration with medicines and teleconsults.[1][3][22] |

| Apollo 24/7 / Apollo Diagnostics | Integrated health ecosystem with hospitals, clinics, diagnostics and digital health.[2][9][4][23] | Extensive test menu, preventive packages and hospital-linked diagnostics delivered through 100+ labs and thousands of collection centres.[2][9][4][23] | Home collection often within 30 minutes in major cities, with same-day reports for many tests.[2][24][25] | Powerful healthcare brand, clinical governance, omnichannel presence and ability to link diagnostics to specialist care.[2][9][4][23] |

| Dr Lal PathLabs | Pan-India diagnostics chain with strong B2C and B2B presence.[11] | Offers a broad spectrum of tests and packages with online booking and home sample collection in many cities.[11] | Doorstep collection with digital report delivery through web and app, timelines varying by test and location.[11] | Trusted stand-alone pathology brand with extensive franchise network and doctor referrals.[11][5] |

| House of Diagnostics (HOD) | Multi-city diagnostic chain offering pathology and radiology.[18] | Provides online booking, full health packages and at-home sample collection in select cities.[18] | Home sample collection with report delivery via digital channels.[18] | Strong presence in imaging plus pathology, enabling comprehensive checkups around a single digital interface.[18] |

SWOT: quick commerce in diagnostics

Quick commerce platforms bring formidable advantages to the diagnostics table. Their strengths lie in massive, high-frequency user bases, habit-forming apps, and mature last-mile logistics optimised for speed and density. They can surface diagnostics contextually—during medicine purchases, health content browsing or even routine grocery orders—reducing the friction that traditionally kept preventive testing low.[14][5][7][15][16]

However, they also face structural weaknesses. Healthcare is a trust-intensive category, and these firms typically lack deep clinical expertise, depending heavily on external lab partners for quality, accreditation and medical governance. They must also navigate a more stringent regulatory environment around advertising, consent and handling of sensitive health data than they are used to in food and grocery. For them, diagnostics is both an opportunity to increase average order value and a reputational minefield if anything goes wrong at the lab end.[26][5][6][7][18]

Opportunities are significant. Rising urban incomes, the growth of chronic disease and the spread of corporate wellness programs all point toward greater demand for convenient health checks and monitoring. Quick commerce players can pilot region-specific packages, dynamic pricing and bundled offers with medicines or teleconsults, then scale winners rapidly across their networks. Yet threats loom from regulators, powerful lab brands that may negotiate tough commercial terms, and rival quick commerce apps chasing the same health-conscious customers.[5][6][11][15][16]

SWOT: digital-first diagnostics and e-health platforms

Digital-first diagnostics players and lab chains occupy the other side of the convergence. Their primary strength is clinical depth: NABL-accredited labs, experienced pathologists and radiologists, and well-defined protocols for sample handling and quality control. They also enjoy strong brand recognition among doctors and hospitals, which still drive a large share of test volumes through referrals.[4][11][18][1][2]

At the same time, many of these organisations are still evolving their consumer-technology capabilities. Historically, patient journeys were designed around physical centres; only in recent years have they adopted app-based booking, real-time phlebotomist tracking and personalised engagement. Fixed lab infrastructure and regulatory compliance add cost and complexity, which can cap how aggressively they discount or expand into thinly populated markets.[24][22][11][18][1]

Opportunities abound in partnerships and ecosystem plays. PharmEasy’s integration of medicines, teleconsults and diagnostics, and Apollo’s ability to funnel diagnostics users into hospital-based speciality care, show how these players can move from one-off tests to lifetime health relationships. Yet they, too, face threats—from commoditisation as deep discounts make consumers chase the lowest price, from device-based point-of-care testing nibbling at routine volumes, and from aggressive quick commerce platforms that may capture the top of the funnel and bargain hard on margins.[9][27][21][1][2]

Porter’s lens on the new battlefield

Viewed through Porter’s Five Forces, the entry of quick commerce intensifies rivalry in diagnostics. Consumers in major cities can now choose between walking into a local lab, booking through an e-health platform, or scheduling a pick-up via their favourite grocery app, often with similar test menus and discounts. Buyer power is high: switching costs are low, price comparison is easy, and corporate buyers such as insurers and large employers negotiate aggressively for packages and wellness programs.[6][11][18][1][5]

Suppliers—labs in the case of quick commerce platforms, and reagents and skilled staff in the case of lab chains—enjoy moderate to high power. A limited pool of high-quality national labs and pathologists makes it difficult for platforms to switch partners quickly, especially in specialised tests and high-volume cities. Meanwhile, the threat of new entrants is moderated by the capital and compliance requirements of lab infrastructure on one side and the technology and logistics sophistication needed for quick commerce on the other. The biggest long-term substitute threat may come from point-of-care home devices and wearables that displace some routine lab tests altogether, although full-spectrum diagnostics will still require centralised labs for the foreseeable future.[27][8][10][11][18]

What convergence means for pharma

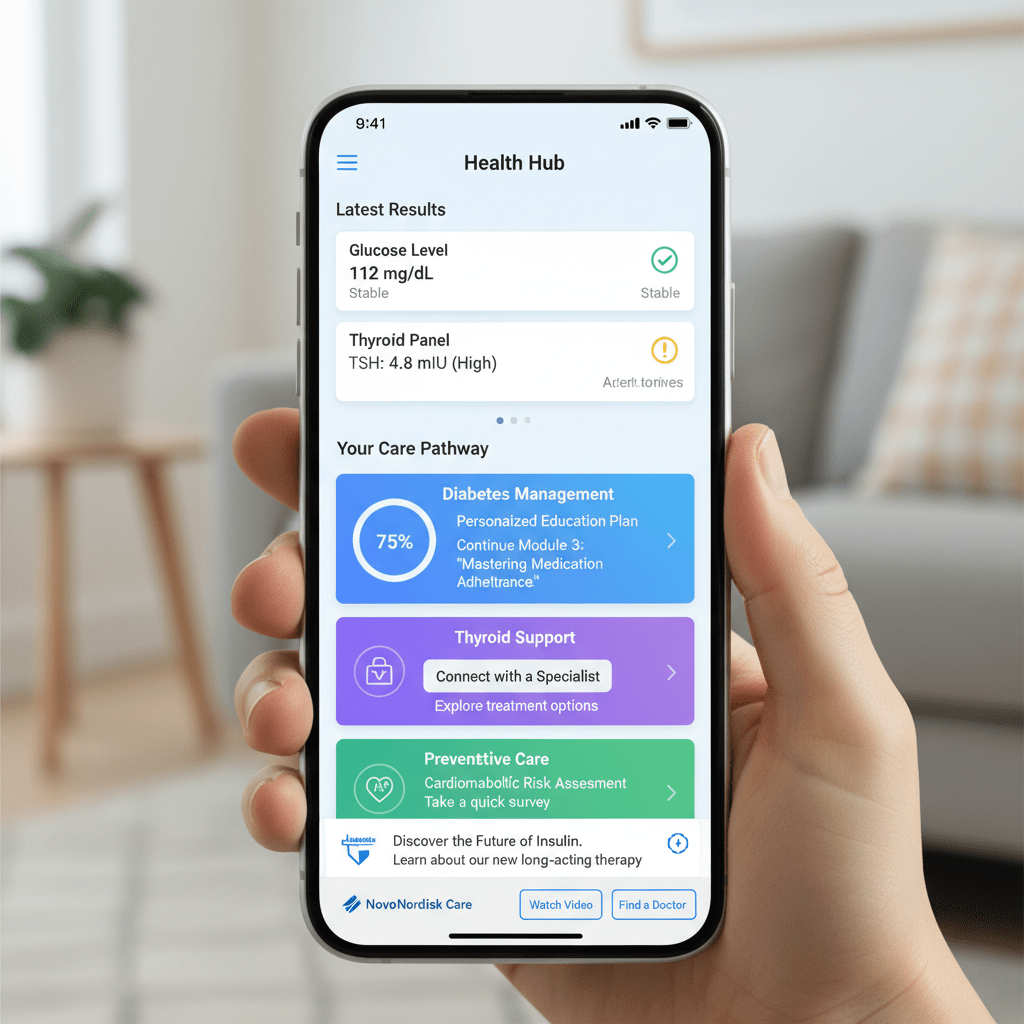

For pharmaceutical companies, diagnostics-on-demand changes how patients enter and move through the care pathway. Faster, more frequent testing makes it easier to detect diseases earlier, titrate doses rapidly and maintain tight control in chronic conditions such as diabetes, thyroid disorders and dyslipidaemia. Pharma marketing and medical teams will find new touchpoints on quick commerce apps and diagnostic platforms, where educational content, adherence programs and risk-screening campaigns can be embedded directly into test booking and reporting flows.[21][28][1][5][6]

At the same time, the convergence shifts influence from individual prescribers to platforms that control patient journeys and data. Pharma will need sophisticated, compliant partnership models with both quick commerce and diagnostic ecosystems—co-creating disease management bundles, supporting quality-improvement programs and leveraging anonymised real-world data for insights, while staying on the right side of promotion regulations. This could blur traditional lines between “brand marketing” and “health services,” requiring new capabilities in product design, health analytics and outcome-based contracting.[8][5][6]

Implications for insurers and health systems

Insurers have long struggled with underutilisation of preventive health benefits, even when checkups are offered free or subsidised. At-home diagnostics dramatically lower friction, making it easier to nudge policyholders into regular screening and monitoring programs. Quick commerce and diagnostics platforms can become powerful allies in reducing claims costs through early risk identification, proactive disease management and data-driven underwriting—provided privacy and consent frameworks are robust.[26][5][6]

For public and private health systems, this convergence offers a chance to extend reach without building brick-and-mortar labs everywhere. Partnering with digital diagnostics networks can help programmes for TB control, non-communicable diseases and maternal health reach urban and peri-urban populations at lower marginal cost. At the same time, regulators must ensure that quality standards, accreditation, data security and grievance redressal keep pace with innovation, so that convenience does not come at the cost of clinical accuracy or patient safety.[23][9][5][6][8]

India’s experiment with merging quick commerce and diagnostics is still in its early innings, but the direction of travel is clear. As groceries, medicines, lab tests and doctor consults converge in a handful of apps, control over the health consumer will become one of the most hotly contested battlegrounds in the country’s healthcare economy. Stakeholders who understand this new landscape—and collaborate intelligently across traditional boundaries—will be best placed to harness it for better access, earlier diagnoses and more sustainable health outcomes.[5][6][8]

Sources

[1] Diagnostics & Lab Tests Online – Mumbai – PharmEasy https://pharmeasy.in/diagnostics

[2] Blood Test at home | Blood Test Near Me https://www.apollo247.com/lab-tests

[3] PharmEasy Labs (Powered by Thyrocare) https://pharmeasy.in/diagnostics/lab/thyrocare-navi-mumbai-82

[4] Apollo 247 – Online Doctor Consultation & Book Lab Tests at … https://www.apollo247.com

[5] India Q-commerce Industry Size & Share Analysis https://www.mordorintelligence.com/industry-reports/q-commerce-industry-in-india

[6] Indian E-commerce Industry Analysis https://www.ibef.org/industry/ecommerce-presentation

[7] Zepto launches Super Mall, expands pharmacy to diagnostics services https://economictimes.indiatimes.com/tech/technology/zepto-launches-super-mall-expands-pharmacy-to-diagnostics-services/articleshow/125490789.cms

[8] The rise of quick commerce: transforming India’s retail … https://www.kearney.com/industry/consumer-retail/article/the-rise-of-quick-commerce-transforming-india-s-retail-consumer-behaviors-and-employment-dynamics

[9] Home Diagnostics Services https://www.apollohomecare.com/home-diagnostics/

[10] India Quick Commerce Market Outlook to 2030 https://www.nexdigm.com/market-research/report-store/india-quick-commerce-market-report/

[11] Dr Lal PathLabs: Diagnostic Centre and Pathology Lab for … https://www.lalpathlabs.com

[12] Zepto pilots Super Mall for high-value orders, launches … https://www.business-standard.com/companies/news/zepto-super-mall-diagnostics-pilot-launch-125112000951_1.html

[13] Zepto is entering its next era, and it’s bigger than groceries. … https://www.instagram.com/reel/DRb_5lwgSlP/

[14] 🚨 Zepto launches ‘Zepto Pharmacy’ for 10-minute medicine … https://www.instagram.com/p/DNFitTfKg9a/

[15] Quick Commerce Business Model Explained https://binmile.com/blog/quick-commerce-companies-and-business-model/

[16] Top Quick Commerce Players in India: 2025 Market Leaders https://metricscart.com/insights/top-quick-commerce-players-in-india/

[17] Blinkit, Zepto, Swiggy: A brief history of quick commerce, its … https://indianexpress.com/article/explained/explained-economics/history-of-quick-commerce-future-in-india-10152934/

[18] HOD | House Of Diagnostics | Diagnostic Centre | Pathology Lab https://www.hod.care

[19] Zomato’s Blinkit and Swiggy Instamart expand dark stores … https://www.linkedin.com/posts/inc42_news-in42-zomato-activity-7307680108343922689-DSJO

[20] Book Blood and Lab Tests Online with Home Sample Collection https://pharmeasy.in/diagnostics/all-tests

[21] Book Full Body Checkup Online at Best Price – PharmEasy Labs https://pharmeasy.in/diagnostics/health-checkup-packages

[22] Book Lab Tests in Bengaluru at Your Home | Low Prices – PharmEasy https://pharmeasy.in/diagnostics/all-tests/bengaluru-113

[23] Apollo Diagnostics: Diagnostic Centers & Pathology Labs … https://apollodiagnostics.in

[24] Blood Test at home in Delhi https://www.apollo247.com/lab-tests-city/delhi

[25] Blood Test at home in Noida https://www.apollo247.com/lab-tests-city/noida

[26] At-home blood tests are soaring, and throwing up wrong results https://the-ken.com/story/at-home-blood-tests-are-soaring-and-throwing-up-wrong-results/

[27] Thyrocare: Home https://www.thyrocare.com

[28] Book Thyroid Care, get free Sample Collection – PharmEasy https://pharmeasy.in/diagnostics/packages/thyroid-care-1809

[29] Buy Test Products Near You | Delivery in 10 Mins https://www.zepto.com/brand/Test/

[30] Apollo Full Body Checkup Basic Test https://www.apollo247.com/lab-tests/apollo-full-body-checkup-basic

[31] All Packages https://apollodiagnostics.in/packages-booking

All Images Are AI Generated for Illustration Only. E&OE