By MedicinMan Editorial Team

India’s pharmaceutical dominance doesn’t rest on a thousand companies — it’s powered by a focused core.

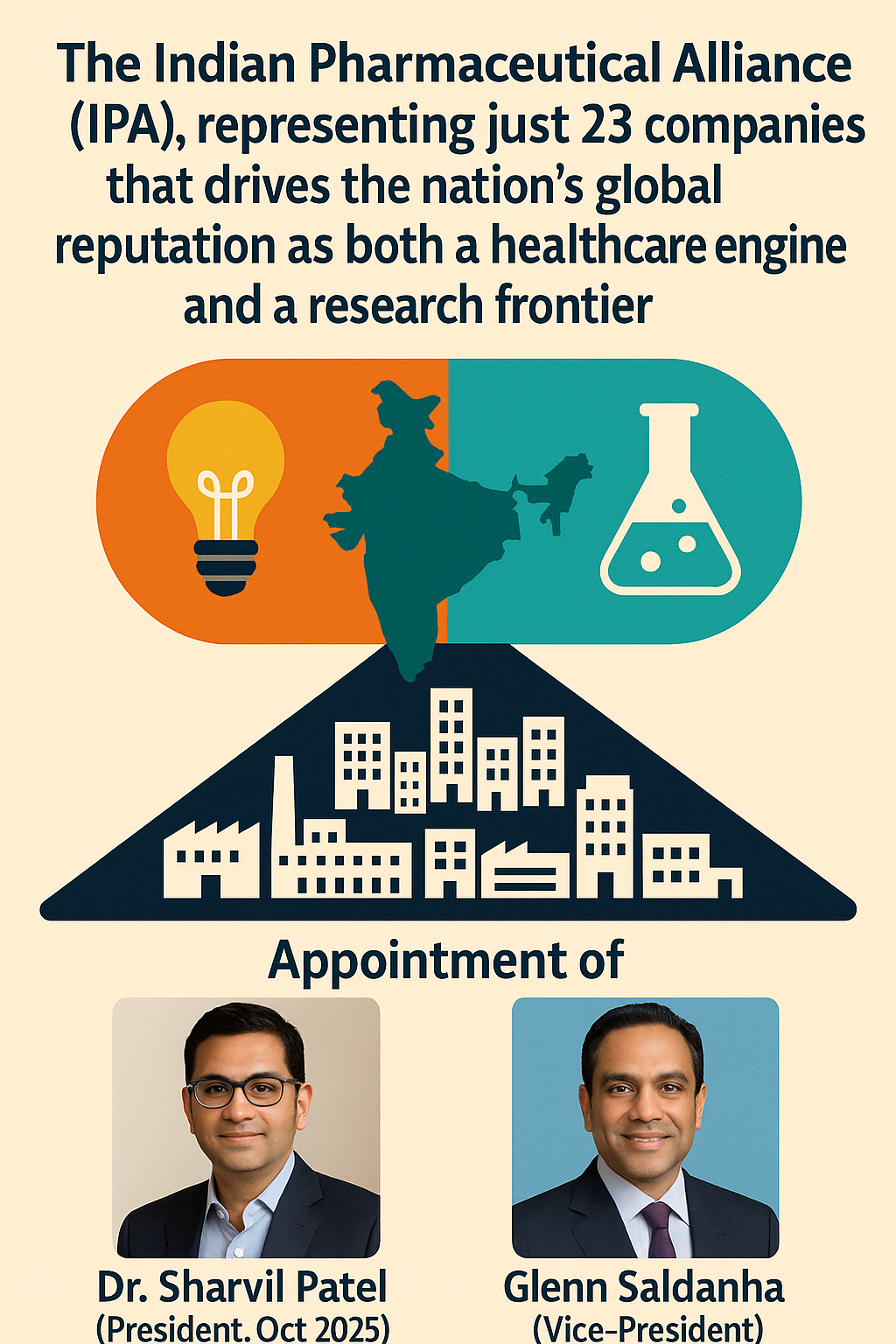

The Indian Pharmaceutical Alliance (IPA), representing just 23 companies, that drives the nation’s global reputation as both a healthcare engine and a research frontier.

These companies aren’t just manufacturers; they’re the architects of India’s move from “pharmacy of the world” to “innovation hub of the decade.”

The Power Core: Inside the Indian Pharmaceutical Alliance (IPA)

India’s regulated-market pharma strength is concentrated in a compact group—not thousands of firms. The Indian Pharmaceutical Alliance (IPA) is a club of research-led domestic companies (currently listed by IPA as 20+ “current members”), historically “representing 23 national research-based companies.” Collectively, they serve ~60% of India’s domestic market and contribute ~80% of exports and >85% of private-sector pharma R&D investment—so their influence far exceeds their headcount. IPA India

What the numbers actually say

- Scale (revenue): Across 14 IPA members with verifiable FY24 disclosures, combined revenue is ≥ ₹2.51 lakh crore. Adding the remaining members with published numbers (e.g., Intas, Abbott India, Piramal Pharma, Alembic, Ipca, Divi’s, Ajanta, Natco, Emcure, etc.) implies a reasonable total in the ~₹3.0–3.3 lakh crore range. This is an estimate; see Appendix for per-company sources and the subtotal math. Ipca+13Sun Pharmaceutical Industries+13Dr. Reddy’s+13

- People: Summing disclosed headcounts for the larger, listed IPA members (Sun, Dr. Reddy’s, Cipla, Aurobindo, Lupin, Zydus, Biocon, Alkem, Glenmark, Torrent, Mankind, etc.) already gets you well past 1.8–2.0 lakh employees. Including sizable private/other listed members (e.g., Intas, Abbott India, Piramal Pharma, Ipca, Divi’s, Emcure, Alembic, Natco, USV, Macleods, Wockhardt, Cadila Pharma, Panacea) makes ~3.0–3.5 lakh a defensible range for the cluster. (Company headcounts are reported heterogeneously; see methodology note.)

Leadership & Agenda 2025

- New IPA leadership: Dr. Sharvil Patel (MD, Zydus Lifesciences) is IPA President and Glenn Saldanha (Glenmark) is Vice-President (appointed Oct 4, 2025). This matters: Zydus has scaled both innovation (NCEs, vaccines, biologics) and global generics, and Patel has publicly argued for India’s “innovation for the world” push. Pharmabiz+2The Economic Times+2

So what’s the real “power” of the IPA cohort?

It’s strategic convergence—scale x science x standards.

- Scale: They anchor most of India’s exports and a majority of domestic formulations by value, with multiple members above ₹10,000 cr revenue individually (Sun, Dr. Reddy’s, Cipla, Aurobindo, Zydus, Lupin, Biocon, Alkem, Glenmark, Torrent, Mankind). Mankind+10Sun Pharmaceutical Industries+10Dr. Reddy’s+10

- Science: IPA members account for the vast bulk of private R&D in Indian pharma (>85%), and several lead India’s biosimilars/biologics (e.g., Biocon) and NCE/NBE efforts (e.g., Zydus). IPA India+1

- Standards & voice: IPA coordinates on quality, affordability, IP, trade, and supply-chain resilience—often shaping policy stances during volatile episodes (e.g., tariff scares, export policy, quality summits). BioVoiceNews+2Reuters+2

The hard trade-offs for the next decade

- Affordability vs. innovation (pricing pressure vs. R&D recovery),

- Access vs. compliance (supply reliability and GMP everywhere),

- Volume-to-value shift (biosimilars, complex generics, NCEs),

- Digital/AI across development, manufacturing, and safety.

Executive takeaways

- Concentration is a feature: A few dozen firms drive most revenue, exports, and R&D—use this to focus industrial policy (regulatory capacity, clinical-trial infrastructure, biologics ecosystems).

- Leadership momentum: With Sharvil Patel now president, expect a stronger, coordinated push on innovation-with-access (biosimilars, vaccines, complex generics, NCEs) and global quality signaling to regulators and buyers. Pharmabiz

Appendix — Data points & sources (FY24 unless noted)

IPA scope/representation

- IPA “represents 23 national research-based companies… >85% of private R&D, ~80% of exports, ~60% of domestic market.” IPA India

Leadership

- Appointment of Dr. Sharvil Patel (President, Oct 2025) and Glenn Saldanha (Vice-President). Pharmabiz+1

Company revenues (consolidated, ₹ crore)

- Sun Pharma: ₹47,758.5 (FY24 consolidated sales). Sun Pharmaceutical Industries

- Dr. Reddy’s: ₹27,916.4 (FY24 total). Dr. Reddy’s

- Cipla: “revenue crosses ₹25,000+” (FY24 results summary). BioVoiceNews

- Aurobindo: ₹29,559.3 (FY24 revenue; FY25: ₹32,345.6). Equitymaster

- Zydus Lifesciences: ₹19,547.4 (FY24 revenue from operations). Zydus Life

- Lupin: ₹20,010.8 (FY24 Total Revenue from Operations). Lupin

- Biocon: ₹15,621 (FY24 consolidated revenue). Biocon

- Alkem: ₹12,667.6 (FY24 total revenue from operations). admin.alkemlabs.com

- Glenmark: ₹11,813.1 (FY24 consolidated revenue). Glenmark Pharma

- Torrent: ₹10,562 (FY24 revenue from operations; audited). Torrent Pharmaceuticals

- Mankind: ₹10,335 (FY24 revenue). Mankind

- Divi’s Laboratories: ₹8,184 (FY24 consolidated total income). divislabs.com

- Ipca Laboratories: ₹7,705 (FY24 consolidated revenue from operations; press release table). Ipca

- Ajanta Pharma: ₹4,209 (FY24 revenue from operations). Ajanta Pharma

Subtotal (above 14 companies): ≥ ₹2,50,889 crore (simple sum).

Note: Remaining IPA members (e.g., Intas, Abbott India, Piramal Pharma, Alembic, Natco, Emcure, USV, Macleods, Wockhardt, Cadila Pharmaceuticals, Panacea Biotec) would lift the total into the ~₹3.0–3.3 lakh crore band; several of these have public FY24 figures but are omitted here for brevity.

Examples of additional sources you can use if you need the full roll-up: Intas FY24 revenue commentary (~₹19,667 cr). Alembic AR 2024-25 notes FY24 base and FY25 growth context. Natco FY25/FY24 run-rate. Planify+2alembicpharmaceuticals.com+2

AI Generated Images for Illustration E&OE