- Explosive value growth, limited volume growth – IPM expanded massively in value since the 1990s, driven by higher prices, premium therapies, and chronic disease management, but didn’t proportionally expand in terms of medicine volumes sold.

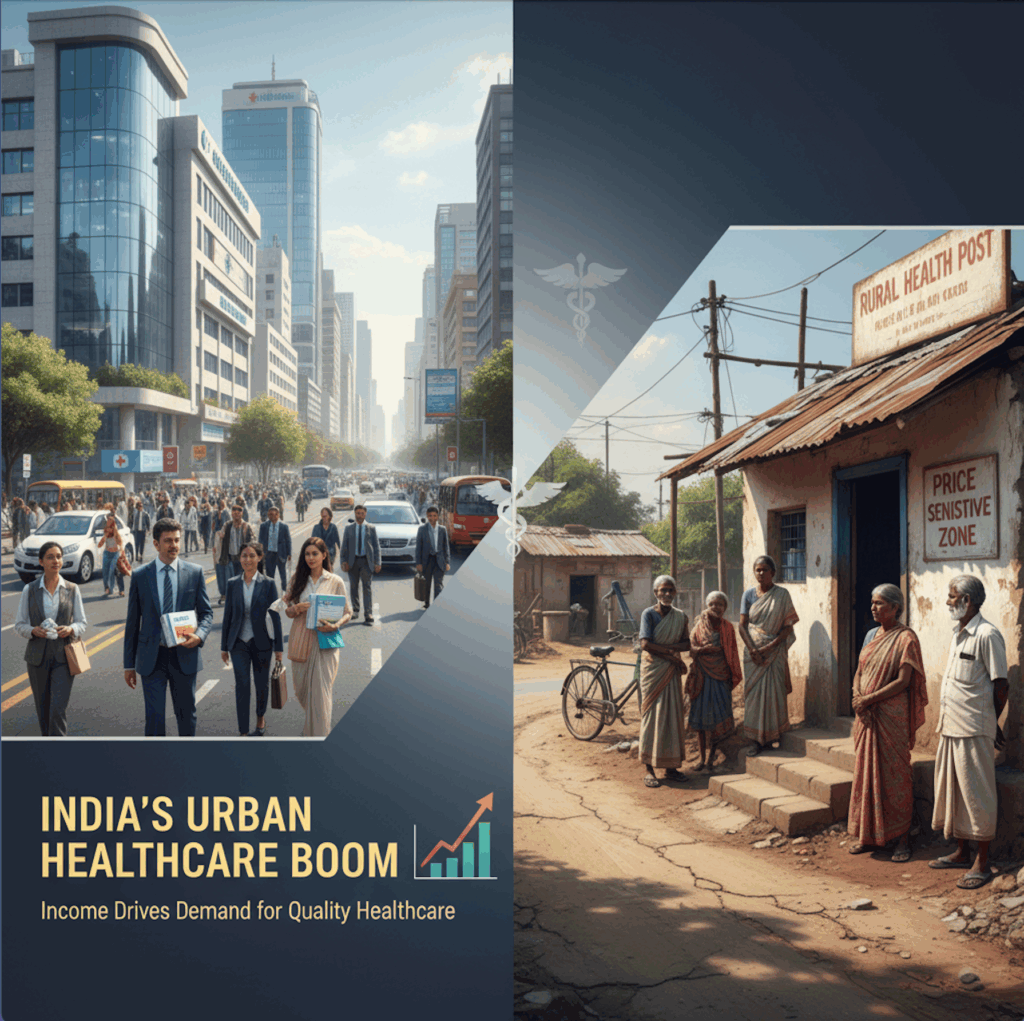

- Population & income growth concentrated demand – Even though India’s population doubled and the middle class surged, demand stayed concentrated in urban areas because healthcare is a superior good (spending rises faster with income).

- Urban focus over rural expansion – Rising incomes, urbanization, and better infrastructure made cities more attractive for pharma companies, while rural areas remained price-sensitive and infrastructure-poor.

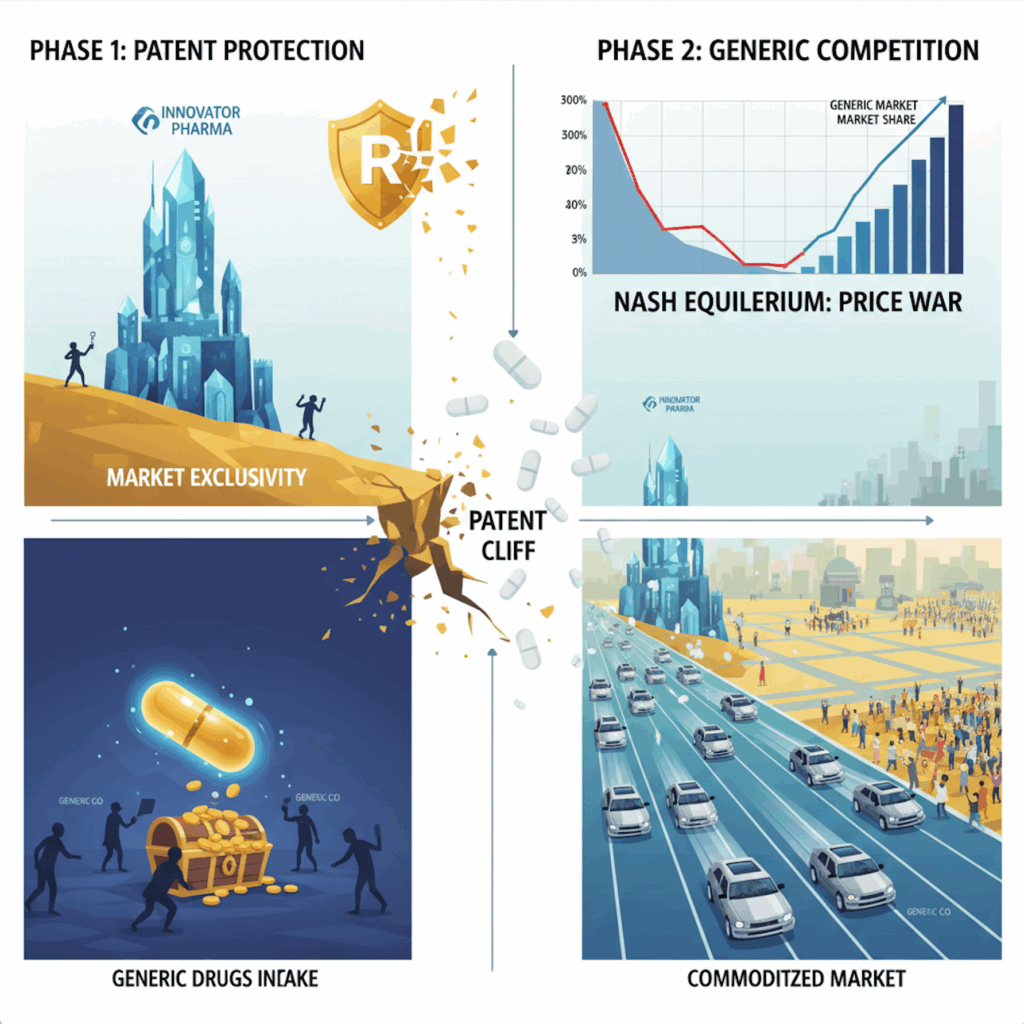

- Game theory explains market behavior – Firms faced two choices: expand rural access (high cost, delayed returns) or compete for urban share (lower cost, immediate returns). The Nash equilibrium was clear: all players chose to fight in urban markets.

- Fragmentation & hyper-competition – Thousands of companies entered, but instead of creating new demand, they carved up the same patient pool, leading to intense share battles.

- Stable but suboptimal outcome – For firms, this strategy made sense; for society, it left 40–50% of India underserved. Policy and partnerships will be needed to shift this equilibrium toward true access expansion.

Link to the post https://open.substack.com/pub/mypharmareviews/p/the-indian-pharma-market-through?r=3oyin&utm_campaign=post&utm_medium=web&showWelcomeOnShare=true