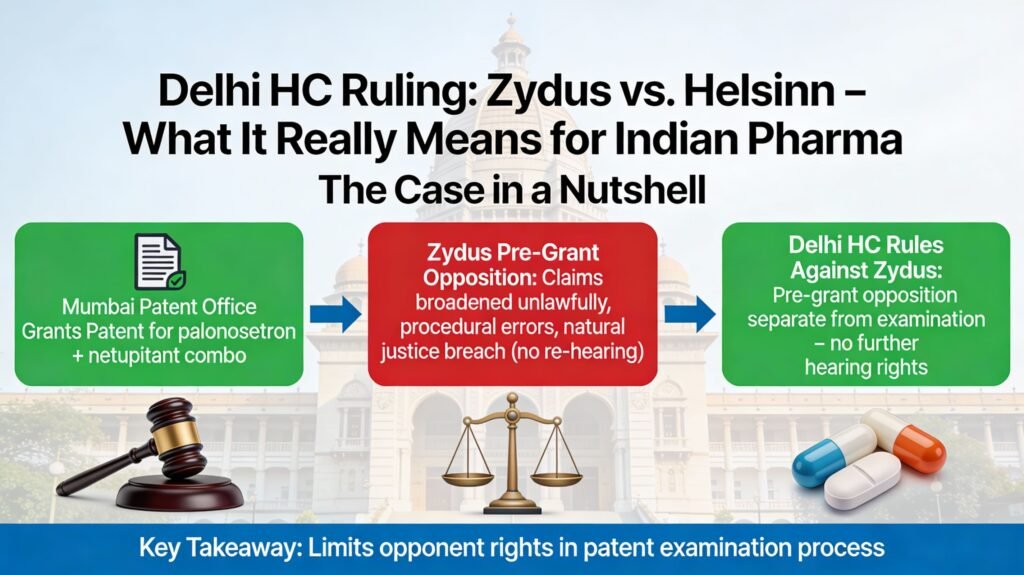

On December 24, 2025, the Delhi High Court delivered a ruling that, while technical on its face, carries deep strategic consequences for India’s pharmaceutical ecosystem. In Zydus Healthcare Ltd. v. Assistant Controller of Patents & Anr., the court refused to upset the grant of a patent to Swiss drugmaker Helsinn for a nausea medication — and in doing so, clarified how India’s patent system is meant to operate in practice.

The Case in a Nutshell

At issue was a patent for a combination anti-emetic drug (palonosetron + netupitant) granted by the Mumbai Patent Office. Zydus had challenged the grant, arguing:

· Amendments to the claims unlawfully broadened scope,

· The controller erred procedurally,

· Natural justice was breached because Zydus wasn’t heard again during the examination after its pre-grant opposition.

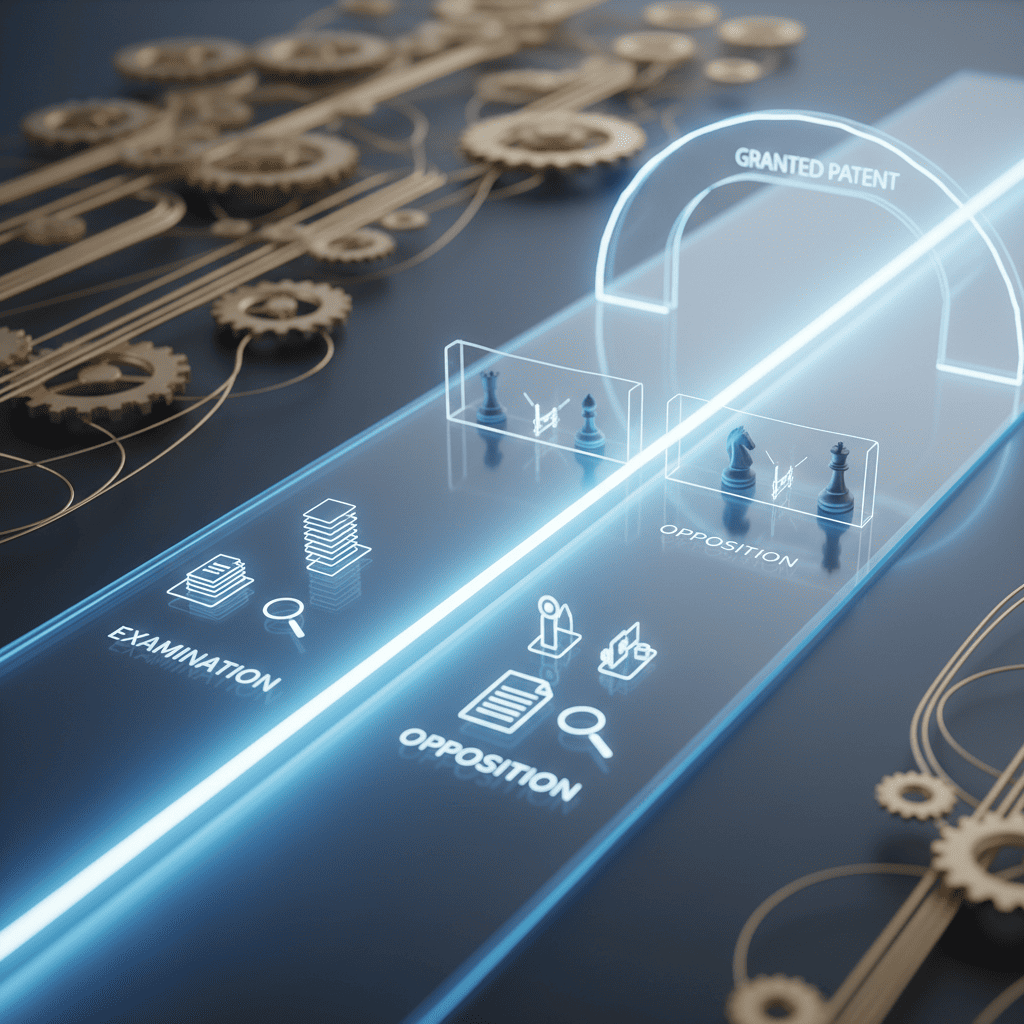

The High Court disagreed on all counts. Importantly, the bench held that a pre-grant opposition and the substantive examination process are separate — and an opponent doesn’t get a seat at the examination table beyond the pre-grant hearing.

Why It Matters — And Fast

This isn’t just another judgment. It is a precedent with thrust and far-reaching implications for how Indian pharma litigates and innovates.

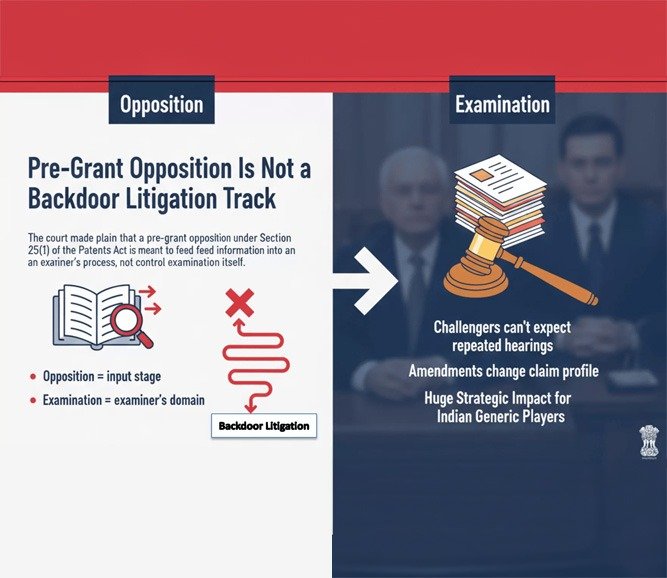

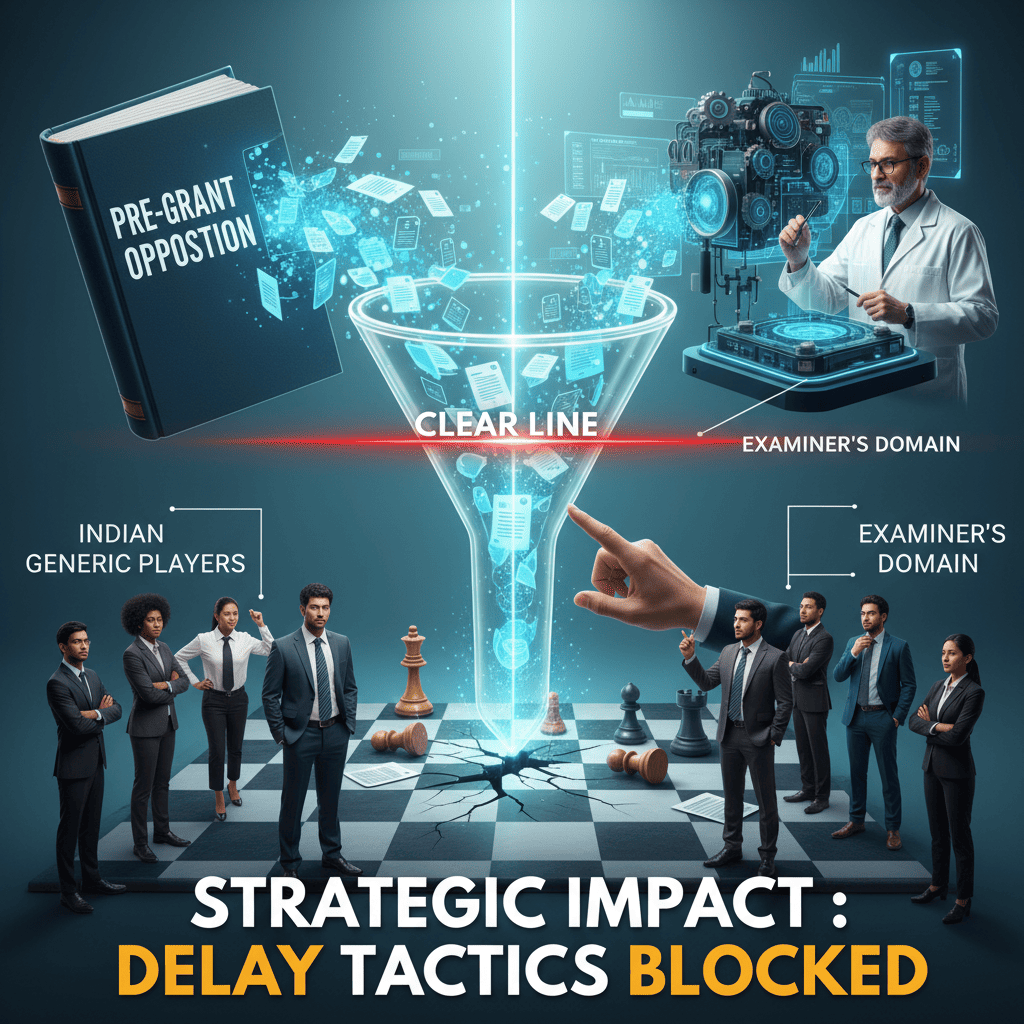

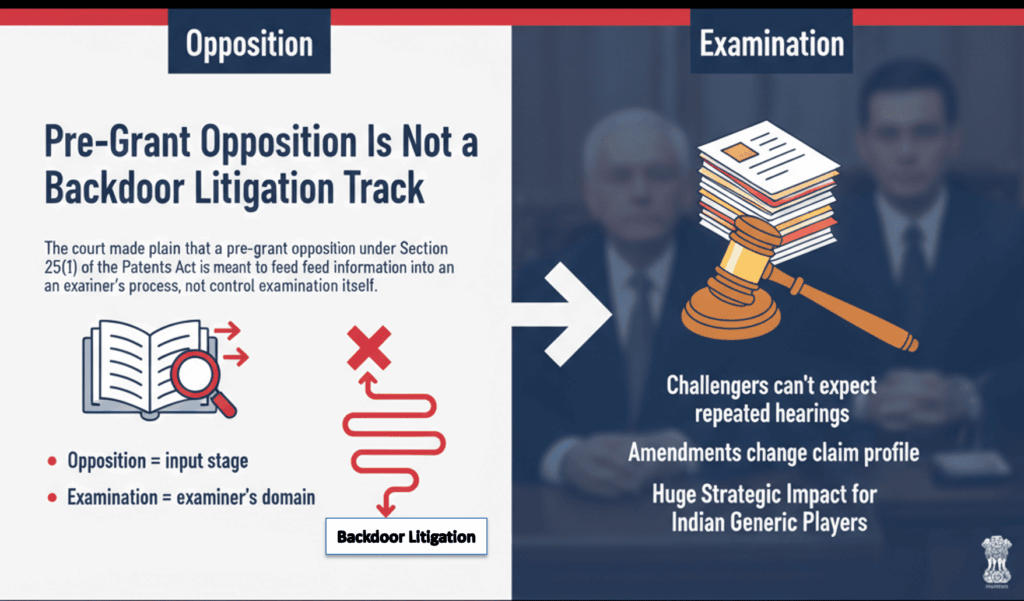

1. Pre-Grant Opposition Is Not a Backdoor Litigation Track

The court made plain that a pre-grant opposition under Section 25(1) of the Patents Act is meant to feed information into an examiner’s process, not control the examination itself.

This draws a clear line:

· Opposition = input stage

· Examination = examiner’s domain

That means challengers can’t expect repeated hearings every time the applicant amends the claims during examination — even if those amendments substantially change the claim profile.

For Indian generic players who have traditionally used procedural challenges to delay or derail filings, this has huge strategic impact.

2. Efficiency Wins Over Procedural Tacticality

The court’s insistence on a streamlined process aligns with broader jurisprudence in India — that examination and opposition are parallel but independent proceedings. That’s consistent with earlier Delhi HC case law (e.g., Novartis v. Natco Pharma).

From the regulator’s perspective, this reduces ground for stalling tactics. For applicants, that brings predictability and speed — important for high-value or life-cycle managed products.

3. Jurisdictional Clarity Reduces Forum Shopping

Because the Mumbai Patent Office granted the patent, the Delhi bench declined jurisdiction — reinforcing that patent challenges must go to the High Court territorially aligned with the granting office.

That knocks out a common tactic where challengers file in preferred jurisdictions, dragging timelines unpredictably.

Deeper Strategic Implications for Indian Pharma

Here’s how this ruling reshapes the landscape:

A. Generics Can’t Rely on Procedure as a Primary Weapon

Indian generics have long used pre-grant oppositions not just to oppose patents on substantive grounds, but as a delay lever. This ruling takes much of that leverage away — opponents must now front their strongest arguments early and crisply.

The era of procedural shadowboxing is shrinking.

B. Patent Prosecution Will Be Leaner, Not Meaner

Originators benefit from a system that distinguishes examination from opposition. Clear lines mean that:

· Amendments aren’t stalled by unnecessary process,

· Examiners can focus on substance,

· Applicants get timing certainty.

This is crucial for companies investing in new formulations or combination products where rapid clarity on patentability matters commercially.

C. Litigation Strategy Is Shifting Upstream

Generic firms must now prepare to:

· Elevate technical evidence and prior art rather than procedural grievances,

· Invest in scientific counter-arguments early,

· Consider post-grant opposition or revocation suits where the law allows.

That’s a shift from the delays game to a merits game.

D. Compliance Over Contestation

The court underscored that:

· There’s no requirement for a separate order on voluntary amendments pre-FER, and

· Refusal to grant another hearing doesn’t automatically violate natural justice if statutory rights were respected.

So the focus moves from technical process objections to strict statutory compliance combined with scientific clarity. That’s healthier for the ecosystem.

Reading Between the Lines

This ruling doesn’t signal that Indian courts are suddenly pro-big pharma. It signals that:

· Ambiguity is not a tool,

· Procedure without substance isn’t a strategy,

· And most importantly,

· Patentability debates must be grounded in tech and law, not tactics.

For Indian pharma — traditionally strong in generics and oppositions — this means leveling up:

From procedural ping-pong to evidence-driven technical IP engagement.

What’s Next?

Indian pharma companies need to adapt IP playbooks:

· Build technical challenge dossiers earlier,

· Align opposition strategies with examination timelines,

· Rethink forum preferences, and

· Invest in science-driven patent analytics.

In a world where global R&D pipelines are tight and patent stakes are high, India’s ecosystem is moving toward clarity, not chaos.

Sources

- Zydus Healthcare Ltd v Assistant Controller of Patents & Anr (Delhi HC, Dec 24, 2025): Full coverage. LiveLaw[1]

- Judgment Citation 2026 LLBiz HC (DEL) 3: Key holdings summary. SupremeToday[2]

- Novartis AG v Natco Pharma (DB Delhi HC, 2024): Parallel tracks doctrine. SpicyIP PDF[5]

- Akynzeo Patent Family (IN 426553): Drug and global patents. DrugPatentWatch[6]

- Helsinn Patent Enforcement: Ongoing suits. CaseMine[3]

- Akynzeo India Launch: Clinical context. Economic Times[7]

- Opposition-Examination Parallelism: Precedent analysis. SpicyIP[8]