What’s really happening in the Cipla–Pfizer tie‑up

At first glance, the announcement looks modest: Cipla gets exclusive rights to market and distribute five established Pfizer brands—Corex Dx, Corex LS, Dolonex, Neksium and Dalacin C—for five years in India, while Pfizer continues to manufacture and supply. There is no upfront payment disclosed; commercial terms are kept confidential, and Pfizer simultaneously signals a reduction in its India field force tied to this transition.[2][1]

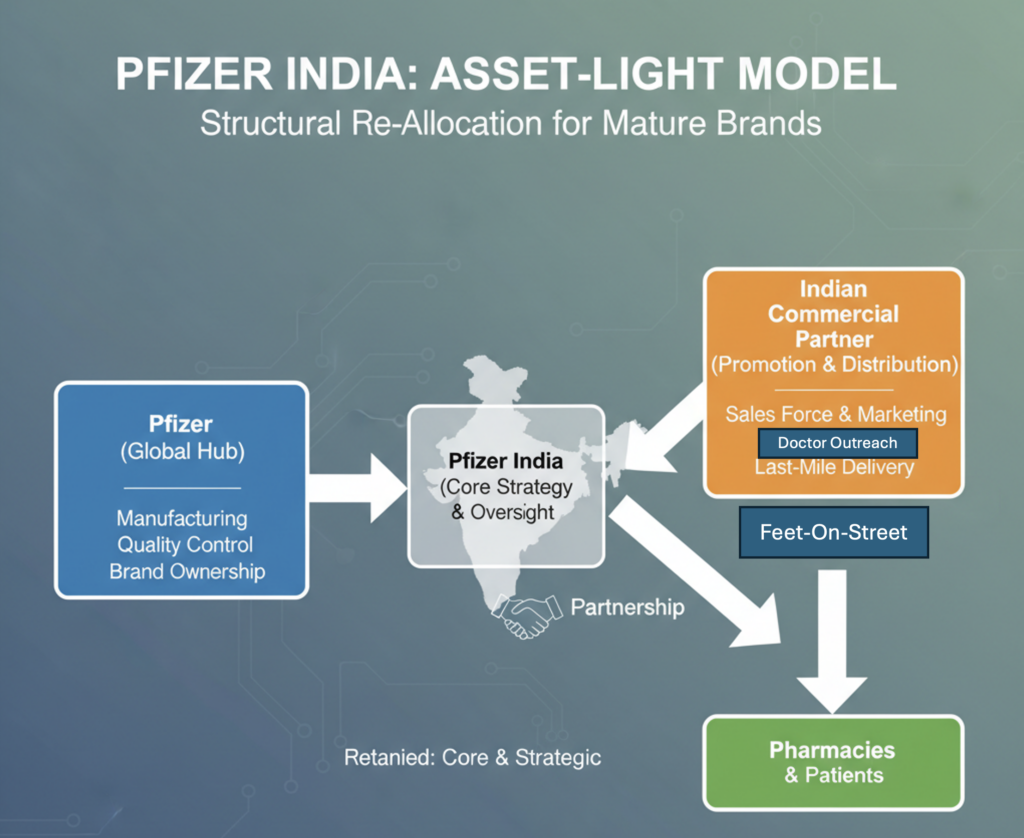

Behind those dry bullets lies a clear message:

- Pfizer is shifting to an “India‑lite commercial, asset‑light” model for mature brands. It retains manufacturing, quality, and brand ownership, but outsources the expensive, people‑heavy promotion and last‑mile distribution to a partner better suited to Indian scale and complexity.

- Cipla is positioning itself as a commercialization platform for global innovators. After signing an agreement with Eli Lilly to distribute tirzepatide (Mounjaro, branded as Yurpeak in India), Cipla now adds a Pfizer bundle, reinforcing its role as the preferred local engine for reach and retail execution.[3]

This is not a co‑marketing sideshow; it is a structural re‑allocation of who does what in India’s branded‑generics value chain.

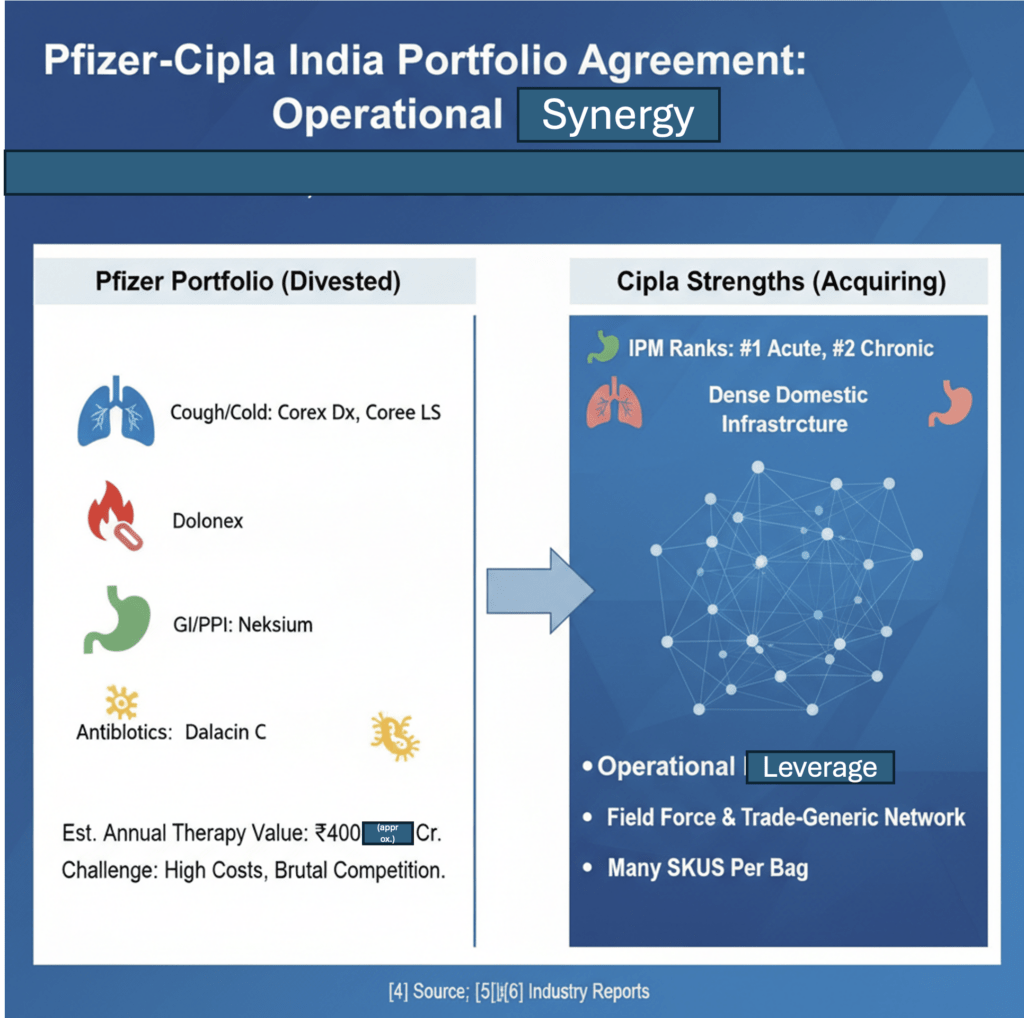

Why these “ordinary” brands are a big deal

The portfolio covered by the agreement is solidly acute: cough/cold (Corex Dx, Corex LS), pain/NSAID (Dolonex), GI/PPI (Neksium), and antibiotics (Dalacin C). These are not breakthrough molecules, but they are high‑velocity, trust‑based brands sitting in large, habit‑driven therapies.[4]

Estimates put the combined annual therapy value of these products at roughly ₹400–₹430 crore. For Pfizer, that pool is meaningful but not enough to justify maintaining a full‑fledged field force and distribution apparatus in a market where branded‑generic competition is brutal and promotional costs are rising. For Cipla, the same pool drops into an already amortised acute‑plus‑chronic footprint:[4]

- Cipla is already number one in acute therapies and number two in chronic in the Indian Pharmaceutical Market (IPM), with strong positions in respiratory and GI.[5][6]

- Its field force and trade‑generic network are designed to carry many SKUs per bag; adding these Pfizer brands increases yield per doctor call and per chemist visit with almost no incremental fixed cost.

So the real value is not scientific novelty, but operational leverage: familiar brands grafted onto a very dense domestic infrastructure.

Impact on Cipla’s acute‑therapy position

Will this dramatically change Cipla’s IPM ranking? Unlikely. Cipla already commands roughly 5% of the IPM, with acute contributing a substantial share. Adding ₹400–₹430 crore of annualised therapy value nudges its overall market share up by a few basis points, but the visible impact will be sharper inside specific acute sub‑segments:[7][8]

- Respiratory acute (cough/cold). Cipla dominates respiratory; plugging Corex into this engine should stabilise and potentially grow the brand while lifting Cipla’s share of the cough‑preparation basket more than overall IPM share.[9]

- Pain, GI and anti‑infectives. Here the incremental gains will be regional and doctor‑cluster driven—where Cipla’s coverage is stronger than Pfizer’s was, the same molecule will suddenly have more rep‑time, more samples, and more chemist pressure.[10]

The more interesting impact is qualitative:

- Cipla gets acute brands that fit perfectly into its prescriber and chemist universe without new R&D or manufacturing risk.

- Because there is no disclosed upfront, economics skew towards contribution margin rather than capital deployment; it is accretive to ROCE if Cipla simply executes better than Pfizer on the same molecules.[4]

In other words, this is about sharpening the quality of acute revenues, not chasing flashy volume headlines.

The new division of labour: Pfizer de‑commercialises, Cipla industrialises

The deal formalises a division of labour that many MNCs have quietly favoured for years:

- Pfizer’s role: focus capital and management attention on pipeline assets, vaccines and complex products, while treating older established brands as supply‑side annuities—manufactured in compliance‑heavy plants, sold on a relatively predictable transfer‑price basis to a local partner. The field‑force reduction announcement underscores that this is a structural, not cyclical, pullback from frontline promotion.[11][1]

- Cipla’s role: act as a high‑throughput, high‑coverage commercialization platform—deploying its 11,500‑plus India field force and a deep trade‑generic infrastructure to push these brands into every addressable corner of the country.[12][13]

This is structurally similar to the Lilly–Cipla tirzepatide partnership: Lilly manufactures and owns the global brand; Cipla drives promotion and distribution in India (Yurpeak) using its reach and market insight. Put together, these alliances make Cipla the Indian “go‑to” for multinationals that want India’s volumes without building a nation‑wide sales machine.[3]

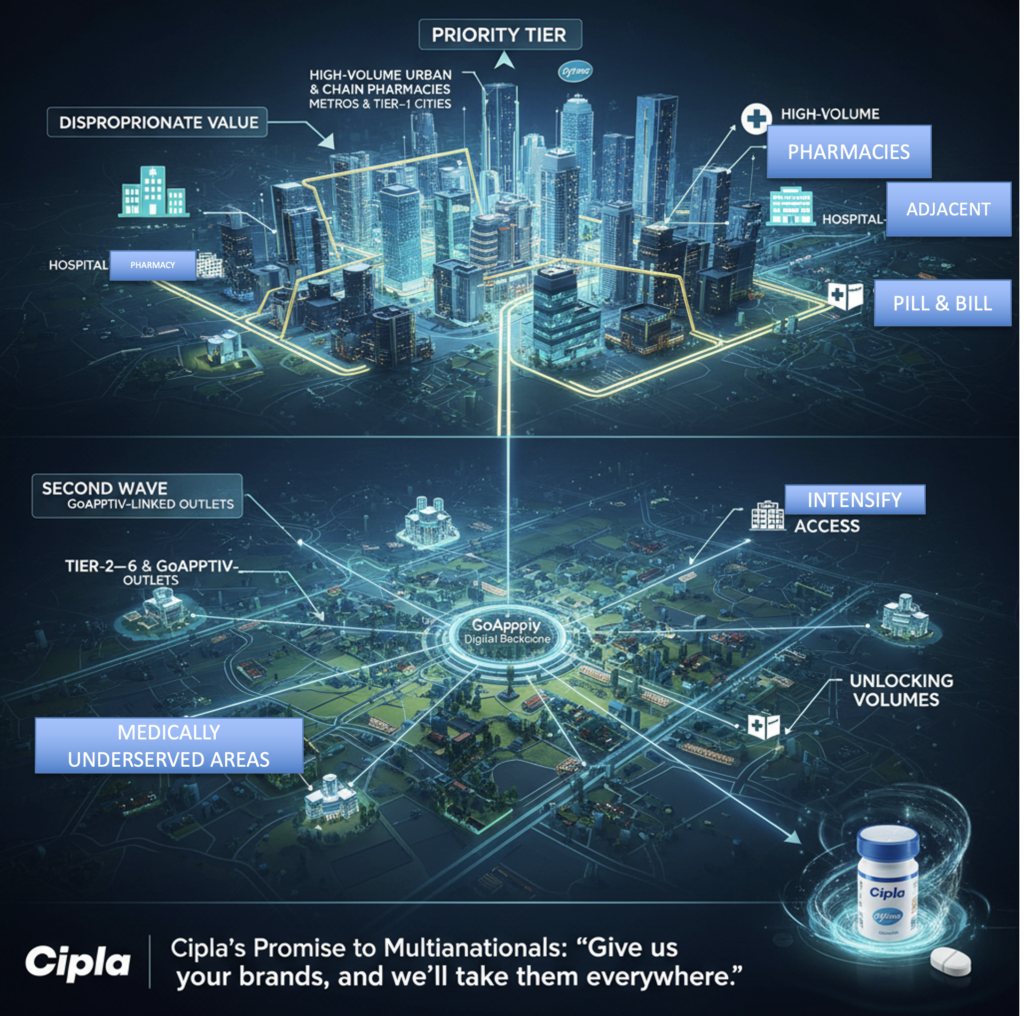

Distribution networks: from metro‑centric to last‑mile grid

For years, Pfizer’s India distribution has been comparatively metro‑heavy and specialist‑centric, befitting an innovator with a smaller branded‑generics footprint. Cipla’s network, by contrast, is built around depth and density:

- Coverage of more than 150,000 pharmacies and medical stores, with a deliberate expansion into tier‑2 to tier‑6 towns and rural markets.[14][12]

- A strong presence in the fast‑growing trade‑generics channel, where margins are higher but relationships and logistics capability matter more than brand glamour.[15]

Once the transition completes:

- Corex, Dolonex, Neksium and Dalacin C move from a relatively narrow urban corridor to Cipla’s full grid—more towns, more villages, more B‑ and C‑class outlets.

- Pfizer’s own reps step back; Cipla’s MRs, who already carry a large acute portfolio, simply add these brands into their call lists, increasing frequency and breadth of coverage without proportionate cost.

This is why the official communication leans on the phrase “intensifying healthcare access across India”: the deal is literally swapping one distribution graph for a much denser one.[2]

Pharmacy stocking: what changes under Cipla

The pharmacy is where theory meets reality. Under Cipla stewardship, three shifts are likely.

1. Wider and deeper stocking

Cipla’s trade‑generic and branded business model depends on always‑available status in pharmacies it serves. With hundreds of brands and a strong order‑aggregation model, pharmacists treat Cipla as a primary supplier rather than a niche vendor.[13][15]

- The Pfizer SKUs will simply be added to existing Cipla order cycles, meaning more outlets will stock them by default rather than on special request.

- Depth per SKU (more bottles of Corex, extra strips of Neksium or Dolonex) will rise because the incremental logistical cost to the chemist is near zero when bundled into a Cipla order.

2. Better economics for retailers

Cipla typically couples its brands with competitive margins and practical credit terms, especially in trade‑generics and semi‑urban markets. As Pfizer brands shift into this framework:[16][17]

- Pharmacists gain margin and credit comfort versus what they received under Pfizer’s leaner distribution set‑up.

- When substitution leeway exists within a molecule or class, better economics will naturally steer the chemist toward the Cipla‑routed Pfizer brand.

3. Data‑driven replenishment and schemes

Cipla has been investing steadily in GoApptiv, a digital health‑tech company that provides last‑mile, data‑driven distribution solutions; Cipla now holds more than 20% in the company and uses its platform to track secondary sales, run targeted schemes, and plug availability gaps in underserved geographies.[18][19]

- Pharmacies integrated into this “phygital” network will receive smarter replenishment nudges and promotional triggers for the Pfizer brands, reducing stock‑outs and aligning inventory with real demand.

- In practical terms, a chemist in a tier‑3 town or rural belt is more likely to see automated or rep‑prompted reminders to restock these SKUs, rather than remembering them as a legacy MNC line.

The net effect: more outlets, more units per outlet, and more consistent shelf presence than under Pfizer’s own distribution.

Which pharmacies get priority

Cipla will not treat all outlets equally on day one. A rational roll‑out will prioritise:

- High‑volume urban and chain pharmacies

- Metros and tier‑1 cities where Pfizer already had a presence and where Cipla now has substantial throughput will see the earliest push, because they generate disproportionate value per call.[20][21]

- Hospital‑adjacent and high‑prescription independents will be migrated quickly into Cipla’s ordering and scheme structure to avoid revenue leakage during transition.[1][2]

- Tier‑2–6 and GoApptiv‑linked outlets

- Cipla’s stated growth theme is deepening penetration in tier‑2–6 towns and rural markets through its expanded retail taskforce and GoApptiv‑enabled channels.[22][23]

- Pharmacies connected to this digital backbone, or sitting in medically underserved pockets, will form the second wave—critical for delivering on the “intensifying access” narrative and for unlocking volumes Pfizer could never reach directly.[24][18]

In essence, the Pfizer brands enter Cipla’s A‑list of priorities because they are now part of Cipla’s promise to multinationals: “Give us your brands, and we’ll take them everywhere.”

What this signals for the future

Zooming out, the Cipla–Pfizer alliance, layered on top of the Lilly–Cipla deal, hints at what the next decade of Indian pharma might look like:

- A handful of Indian companies (Cipla, Sun, Lupin, etc.) become commercial hubs, specialising in distribution, regulatory navigation and doctor–chemist engagement at national scale.

- Global innovators become product and manufacturing hubs, pushing R&D and high‑complexity production while using Indian partners to convert molecules into prescriptions and retail units.

- Mature innovator brands that once justified their own field force become candidates for similar supply‑plus‑marketing alliances, especially where multinational cost structures cannot compete with local branded‑generic economics.

For Cipla, the game is clear: own access—to doctors, chemists, and patients—so completely that every multinational with Indian ambitions has to at least knock on its door. For Pfizer, the message is equally clear: India remains important, but as a partner‑market where it can monetise assets without owning every inch of the commercial stack.

That is what is really happening behind the seemingly “unexciting” announcement of a few cough syrups, PPIs and antibiotics changing hands.

Sources

[1] Pfizer ties up with Cipla in first India partnership https://upstox.com/news/business-news/latest-updates/pfizer-ties-up-with-cipla-in-first-india-partnership-what-s-in-the-deal/article-186476/

[2] Pfizer & Cipla Announce Exclusive Marketing and … https://www.cipla.com/press-releases-statements/pfizer-cipla-announce-exclusive-marketing-and-distribution-partnership

[3] [PDF] Lilly and Cipla sign marketing and distribution agreement for second … https://www.cipla.com/sites/default/files/Lilly-Cipla_Tirzepatide.pdf

[4] Cipla Gets Exclusive Rights to Distribute Pfizer Brands in India https://www.indiapharmaoutlook.com/news/cipla-gets-exclusive-rights-to-distribute-pfizer-brands-in-india-nwid-4661.html

[5] Cipla Ltd is a pharmaceutical company. It is … – Adityatrading.in https://adityatrading.in/Posts/cipla-ltd-overview

[6] Cipla’s revenue share FY 2025, by medical therapy – Statista https://www.statista.com/statistics/986139/india-cipla-revenue-share-by-therapy/

[7] Indian Pharma Market Performance – April 2025 | MedicinMan https://medicinman.net/2025/05/indian-pharma-market-performance-april-2025/

[8] India Branded Pharma: Sales, Share, and Therapy Trends. https://thegreyswan.substack.com/p/india-branded-pharma-sales-share

[9] Corex cough syrup gets Cipla boost as Pfizer strikes exclusive India … https://www.moneycontrol.com/news/business/corex-cough-syrup-gets-cipla-boost-as-pfizer-strikes-exclusive-india-deal-13733802.html

[10] Cipla Secures Exclusive Rights to Sell Corex, Dolonex, Neksium … https://medicaldialogues.in/news/industry/pharma/cipla-secures-exclusive-rights-to-sell-corex-dolonex-neksium-dalacin-c-under-pfizer-deal-161008

[11] Pfizer inks 5-year pact with Cipla for marketing 4 key brands in India. https://prysm.fi/news/pfizer-inks-5-year-pact-with-cipla-for-marketing-4-key-brands-in-india

[12] Cipla AR 2024 25 | PDF | Governance | Business https://www.scribd.com/document/906092231/Cipla-AR-2024-25

[13] Annual-Report-2023-24-(Double page).pdf https://www.cipla.com/sites/default/files/Annual-Report-2023-24-(Double%20page).pdf

[14] Annual-Report-FY-2022-23.pdf https://www.cipla.com/sites/default/files/Annual-Report-FY-2022-23.pdf

[15] Top drugmakers bet on trade generics to grow beyond metros https://economictimes.com/industry/healthcare/biotech/pharmaceuticals/top-drugmakers-bet-on-trade-generics-to-grow-beyond-metros/articleshow/102255444.cms

[16] [PDF] 22nd January, 2020 (1) SSE Ltd Listing Department (2 … – Cipla https://www.cipla.com/sites/default/files/Letter_89.pdf

[17] [PDF] Cipla Limited – CARE Ratings https://www.careratings.com/upload/CompanyFiles/PR/202508120858_Cipla_Limited.pdf

[18] Cipla to further invest in digital tech company GoApptiv … https://www.cipla.com/press-releases-statements/cipla-to-further-invest-in-digital-tech-company-goapptiv

[19] [PDF] Acquisition of additional stake in GoApptiv Private Limited – Cipla https://www.cipla.com/sites/default/files/Acquisition-of-additional-stake-in-GoApptiv-pvt-ltd.pdf

[20] CIPLA Marketing Strategy: India’s Largest Pharma … – Digitofy https://digitofy.com/blog/cipla-marketing-strategy/

[21] Cipla, Pfizer ink partnership for exclusive marketing of four … https://economictimes.com/industry/healthcare/biotech/pharmaceuticals/cipla-pfizer-ink-partnership-for-exclusive-marketing-of-four-brands-in-india/articleshow/126071956.cms

[22] Cipla to further invest in digital tech company GoApptiv https://www.cipla.com/sites/default/files/Press-Release-Cipla-to-further-invest-in-digital-tech-company-GoApptiv.pdf

[23] Annual Report 2023 24 CIPLA | PDF | Business https://www.scribd.com/document/781377968/Annual-Report-2023-24-CIPLA

[24] Cipla’s Rural Healthcare Strategy | PDF | Health Care – Scribd https://www.scribd.com/presentation/530952002/FM-cipla