Pharma in the New Normal – COVID-19 Pandemic and Post-pandemic Challenges

2020 has been a challenging year for all industries. For pharma and its HCP customers even more so. All eyes are on the companies developing vaccines and drugs for treatment of COVID-19, while doctors have closed their doors for pharma reps. Long established processes have been disrupted and complex market strategies have been rendered useless.

Each pharma no matter big or small, innovative, or generic, had to improvise and come up with contingency plans to save the year. Some have been slower waiting for the old ways to come back, others have been more agile experimenting with digital and expanding boundaries, most are in the middle digitally curious but not risking too much.

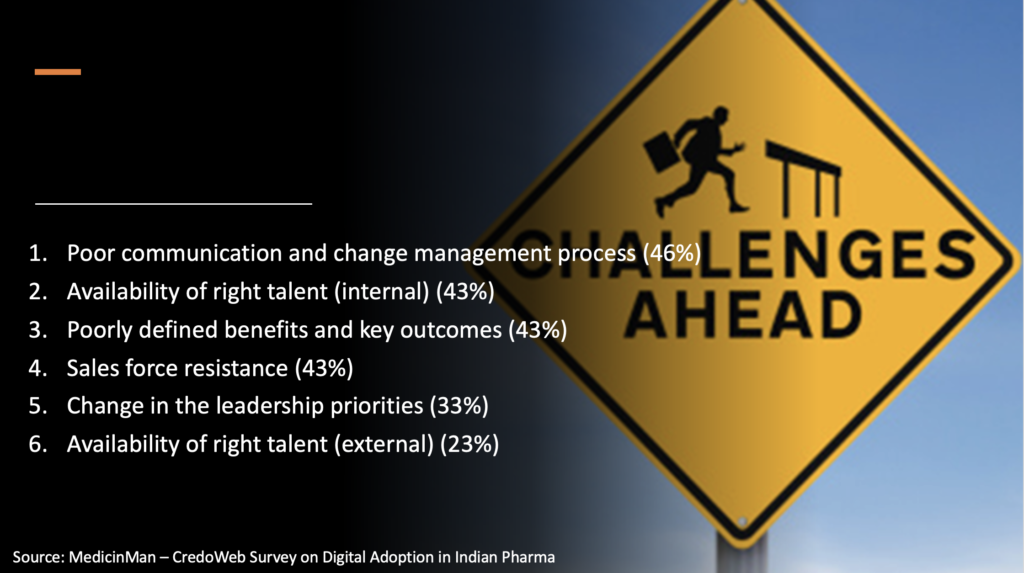

And while vaccination is already on its way, and the end of the current crisis seems near the challenges posed by the sudden “black swan” event will continue to exist in the future. To meet these challenges each organization must find its own recipe, developing new business processes, testing out new tactics, breaking silos, and retraining teams for new collaborations, implementing new strategies and offering more value-added service to its HCP customers. Fully adopting these new capabilities and practices at scale across the commercial organization will require an ambitious transformation of the traditional commercial model (“McKinsey“)

Digital Engagement Model – Veeva

- Limited access to HCPs

- Majority of pharma respondents chose changes in consumer attitudes and behaviour as an issue that will have the greatest impact on their company (Deloitte)

- The number of accessible prescribers in the U.S. has declined to an estimated 47% in recent years. (Veeva)

- 43% of HCPs said that they are currently restricting who can enter the office for professional reasons (no pharmaceutical reps), especially oncologists (46%) and immunologists (44%) (Accenture)

- Before COVID-19, 64% of meetings with pharma sales reps were held in person. During the pandemic, this shifted to 65% of meetings held virtually, consistent across therapeutic area

- Customers will only set aside time for a digital meeting if the information and resources shared directly impact the care they can provide to patients. This Crequires a level of planning and data collection in advance of engagement that biopharma is not accustomed to (Dan Rizzo, Veeva)

- 74% agreed pharma should “stay out of the hospital/clinic until the pandemic is better controlled (McKinsey)

- 44% of physicians surveyed in Japan indicate that the crisis will have a lasting impact on their willingness to welcome pharma representatives for live meetings

- Delayed launches

- 88% of HCPs want companies to continue to launch new products for conditions they treat despite ongoing prevalence of COVID-19 (launches cannot be postponed for long) with 39% reporting that their likelihood of starting patients on recently launched treatments increased since COVID-19

- Sacrifice short-term sales for long-term stability – difficult step for the near-future oriented management of big pharma

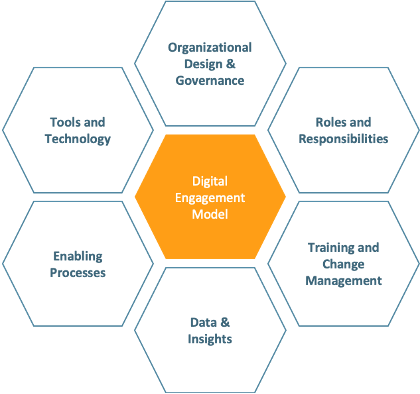

- Need for data-driven approach to sales and marketing

- Investments in data, systems, and analytics – as well as efficient approaches to measuring the appropriateness of new channels and customer engagement (McKinsey)

- Understand engagement trends, capture HCPs preferred communication methods, personalize feedback (Veeva), what the customer needs and through what channel.

- Modular content and data will also be key in optimizing engagement and enabling digital excellence moving forward. Branded and unbranded content to meet the needs of the moment. Reusage of content from other markets.

- Rethinking of customer engagement approaches – responsive interaction model and predictive analytics (McKinsey)

- Moving away from the traditional “push digital channels” of banner ads, HQ-driven emails and web-based content that are already out of date in a COVID-19 world to more engaging ways to interact virtually with customers (e.g., virtual peer-to-peer sessions, medical webinars on the latest data, multi-customer videoconferences on treatment protocols)

- Sales training and regular sales communication

- Need for constant training and re-training for new roles and functions

- Increase confidence and success, rep-sent emails show significant engagement with an average open rate of 37% in contrast to the 3% average open rate of headquarter-sent emails (PharmaExec)

- Cross-functional collaboration across customer-facing (or interfacing) functions ranging from medical information, to events management, digital and in-person channels

- Transitioning from organizations structured around the brand to structuring around customer type

- Raise Digital IQ of the organization (McKinsey)

- What digital tools to use?

- Clear need for pharma to build a much more engaging suite of virtual interaction models (McKinsey)

- Decision whether to build own solution or buy an existing external service

- There are several traditional digital solutions, many non-pharma specific and only a handful of innovative and interactive pharma-oriented marketing communication service providers

- Is the service easy to integrate with existing CRM and other internal systems?

- Training of teams – how fast can happen and how much change it brings to sales force work

- Prepare for future

- Mindset & Organization – coordinate between sales and marketing to improve HCP engagement (Dan Rizzo, Veeva)

- Reimagine service and value propositions for health systems

- Culture of innovation, new ideas tested, new models introduced, new formats used, enabling processes

- Agile decision-making processes to develop current content and (re)deploy resources can help

Mobilize strategic working groups to scale-up and accelerate the changes that have previously been contemplated for the commercial model but have not had the resources, remit or required urgency to truly be pushed forward.

Historically, many in the industry have had a vision for how to transform the customer interaction model but has suffered from “pilot paralysis” and/or unwillingness to risk near-term sales disruptions to make a change with long-term benefits. Now, for many, the disruption has happened. (McKinsey)

Improvise, adapt, overcome. The motto of the marine corps should be guiding pharma in times of critical events. No one can prepare for every possible event, but you will be better positioned to tackle all challenges when you foster a creative culture of work and agile process of ideas generation and implementation along the vertical and horizontal structures in the company.

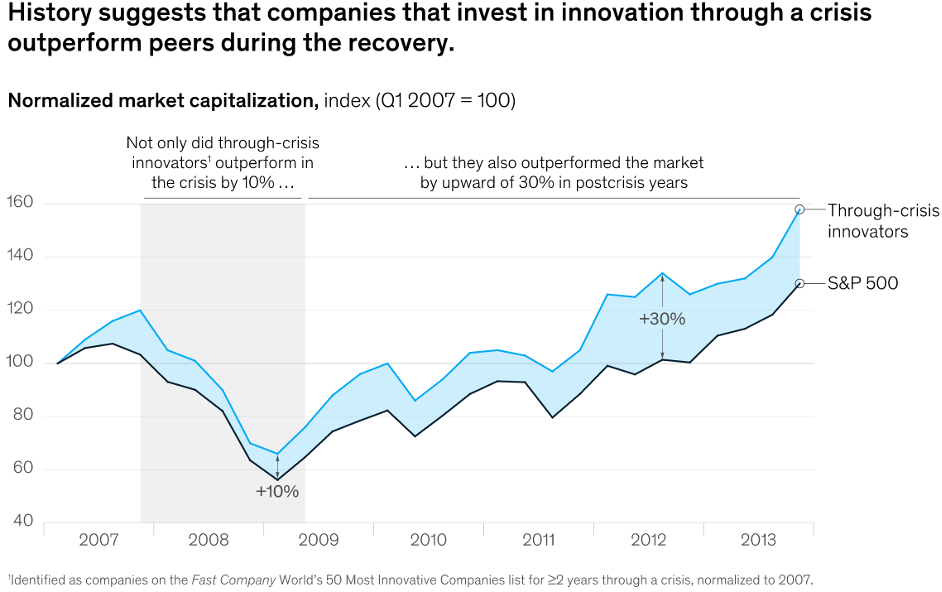

The best time to invest in innovation was yesterday, the second-best time is today. This chart shows how innovative companies not only outperform the market during crisis but even more so when “everything returns to normality”.

“COVID-19 in Pharma Commercial” McKinsey & Company

COVID-19 is driving lasting changes in what healthcare providers need and value. (Accenture). Revamp how you engage with HCPs/practices and patients to be able to personalize value propositions to respond to each stakeholder’s needs and create an agile operating model that “tests and learns”.Regardless of what the “next normal” looks like, transition out of the crisis is likely to require greater integration of in-person and remote interactions, careful tailoring of mix by geography/specialty/site of care, and tailoring to individual physician / patient preferences and expectations (ideally informed by two-way interaction). Virtual Engagement is here to stay, requiring new ways of creating meaningful connections.

Authors: Dr. Peter Velev and Maksim Marinovski

Sources

https://www.credoweb.com/resources/pharma-in-the-new-normal-covid-19-pandemic-and-post-pandemic-challenges

“Biopharma Leaders Prioritize R&D, Technological Transformation, and Global Market Presence.” Deloitte Insights, 2020, www2.deloitte.com/uk/en/insights/industry/life-sciences/pharmaceutical-industry-trends.html.

“COVID-19 in Pharma Commercial: Navigating an Uneven Recovery.” McKinsey and Company, May 2020, www.mckinsey.com/jp/~/media/McKinsey/Locations/Asia/Japan/Our%20Insights/CODIV19-in-Pharma/COVID-19%20-in-pharma-Commercial-Ev2.pdf.

“Going Digital: Four Considerations for a Remote Launch: Veeva.” Veeva Systems Europe, 1 Dec. 2020, www.veeva.com/eu/going-digital-four-considerations-for-a-remote-launch/.

“Guide to Digital HCP Engagement.” Veeva, 2020, www.veeva.com/wp-content/uploads/2019/04/Guide-to-Digital-HCP-Engagement.pdf.

“Monitoring the Impact of COVID-19 on the Pharmaceutical Market.” IQVIA, 18 Dec. 2020, www.iqvia.com/-/media/iqvia/pdfs/files/iqvia-covid-19-market-tracking-us.pdf?_=1609929286227.

“Reinventing Relevance:New Models for Pharma Engagement with Healthcare Providers in a COVID-19 World.” Accenture, May 2020, www.accenture.com/_acnmedia/PDF-130/Accenture-HCP-Survey-v4.pdf#zoom=40.

Rizzo, Dan. “Digital Redefining Role of Pharma Reps.” PharmExec, 4 Dec. 2020, www.pharmexec.com/view/how-digital-will-redefine-the-role-of-the-rep-in-2021-and-beyond.

Rizzo, Dan. “The Accelerated Path to Digital Field Engagement.”LinkedIn, 24 Mar. 2020, www.linkedin.com/pulse/accelerated-path-digital-field-engagement-dan-rizzo/.

“Shaping the Future of European Healthcare.” Deloitte, www2.deloitte.com/uk/en/pages/life-sciences-and-healthcare/articles/european-digital-health.html.

“What Has Been the Impact of COVID19 on the Pharmaceutical Market – EU5?” IQVIA, 16 Dec. 2020, www.iqvia.com/-/media/iqvia/pdfs/files/iqvia-covid-19-eu5-newsletter.pdf?_=1609929304629.