Background

Core Healthcare Ltd., popularly known as Core Parenterals, was incorporated in 1986 and began commercial production in 1988. It revolutionized the Indian intravenous (IV) fluid market by introducing Form-Fill-Seal (FFS) technology, replacing traditional glass bottles with pharma-grade polyethylene bottles. This innovation reshaped the industry, setting new standards for quality and manufacturing efficiency.

By 2002, Core Healthcare was producing nearly 1 billion IV fluid bottles annually, becoming Asia’s largest IV fluid producer. Its growth trajectory was meteoric and inspiring, positioning it as an icon of Indian pharmaceutical innovation.

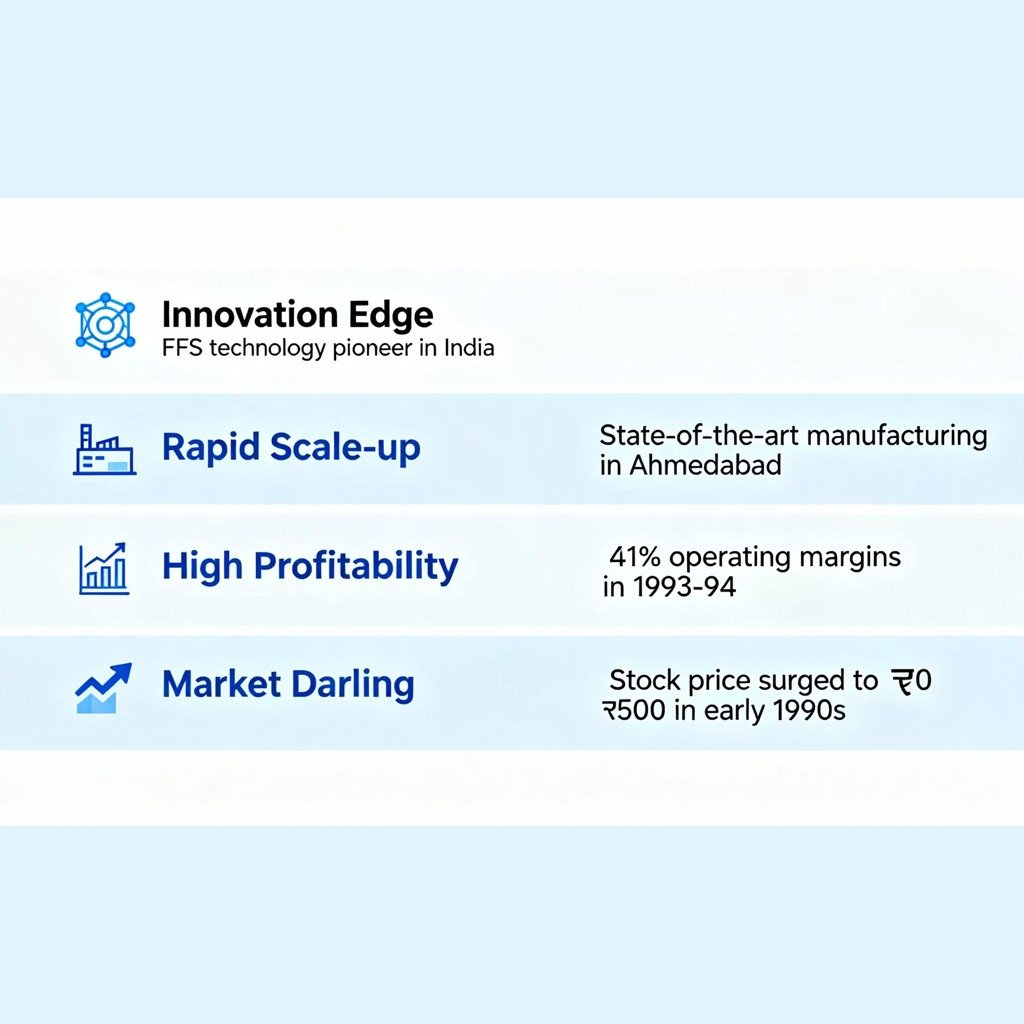

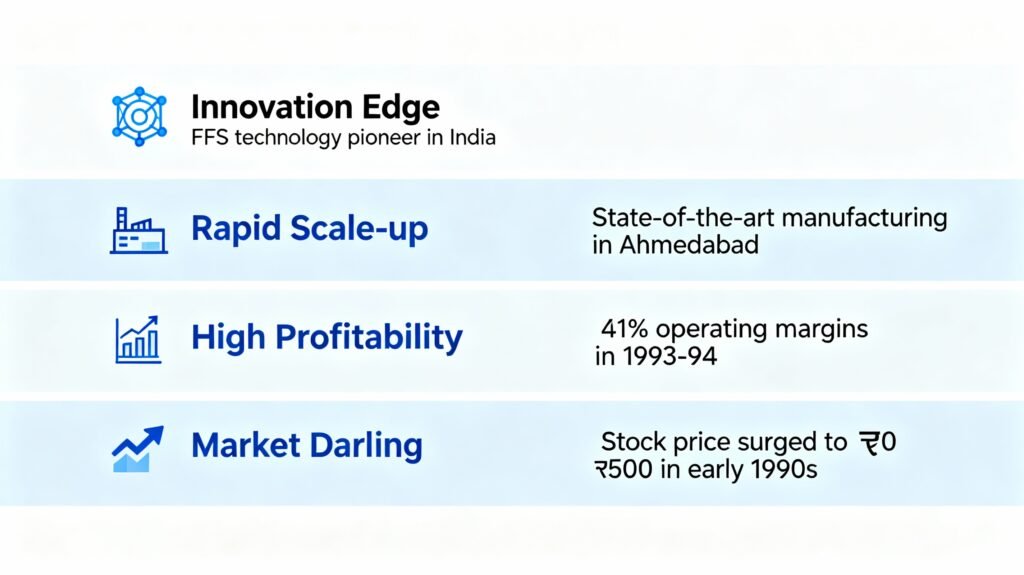

The Rise

- Innovation Edge: Core was the first to implement FFS technology for IV fluids in India, gaining significant credibility among hospitals and government procurement authorities. This innovation gave it a clear competitive advantage and market leadership.

- Rapid Scale-up: State-of-the-art manufacturing facilities in Ahmedabad powered exponential production growth.

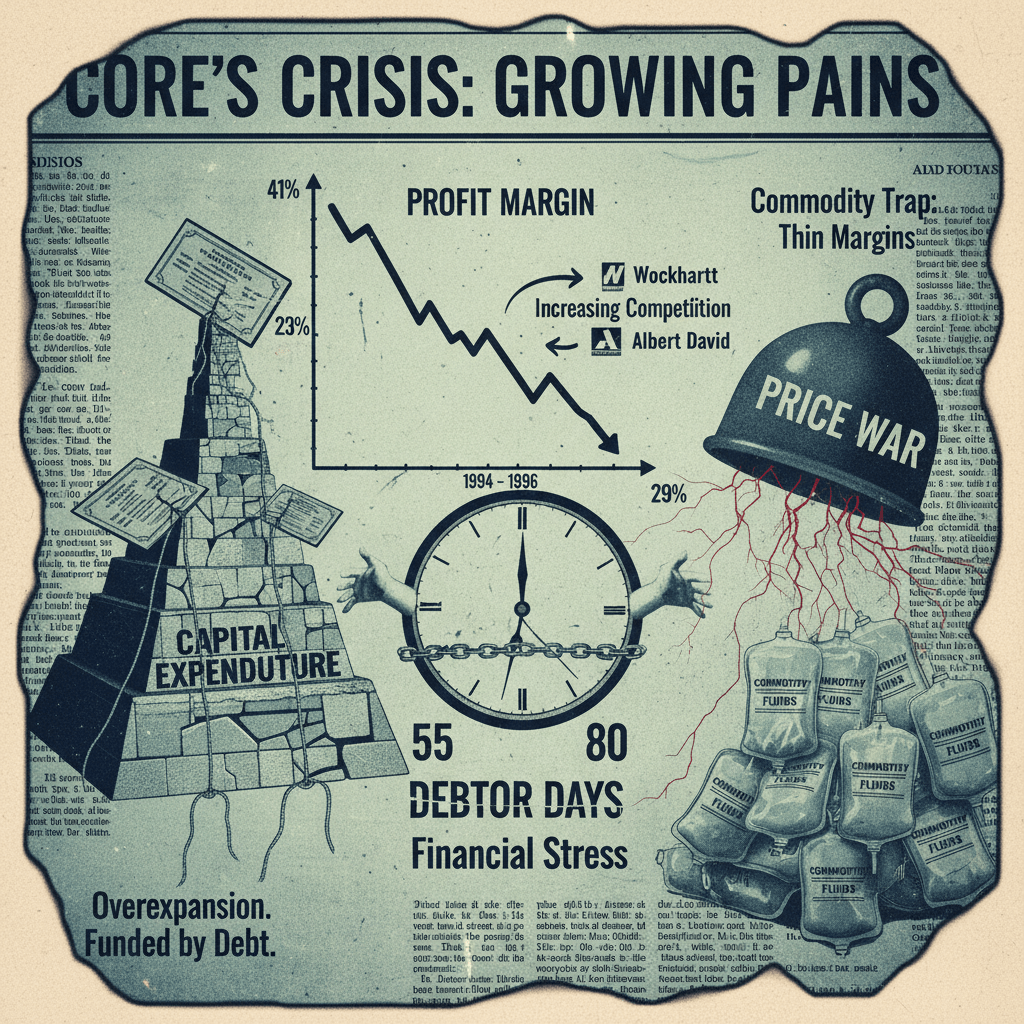

- High Profitability: Core commanded extraordinary operating margins—around 41% in 1993–94, ranking among the highest in the pharma sector during that era.

- Market Darling: The company’s stock price soared, touching ₹500 levels in the early 1990s, reflecting investor confidence and market dominance.

The Challenges

- Increasing Competition: The mid-1990s saw new entrants, notably Wockhardt and Albert David, launch IV fluid products, sparking intense price competition. Core’s margins sharply declined from 41% to 29% within two years.

- Financial Stress: Debtor days—the time taken to collect receivables—almost doubled from 55 to 80 days, straining working capital.

- Overexpansion: Heavy capital expenditure, funded largely by debt, created unsustainable financial leverage.

- Commodity Trap: Unlike branded formulations, IV fluids are largely commoditized, volume-driven products with thin margins. Core’s pricing power eroded quickly amidst competition.

Source: Business Standard – “Growing Gains, Growing Pains”

The Collapse

- Debt Overhang: By the early 2000s, Core’s debt ballooned to ₹650 crore principal, with interest liabilities exceeding ₹1,000 crore.

- ARCIL Takeover: In 2004, Asset Reconstruction Company of India Ltd. (ARCIL) acquired Core’s debt at a steep 40% discount and initiated efforts to find buyers for the distressed assets.

- Asset Sale Efforts: Global pharma majors such as Fresenius and Baxter, along with local powerhouse Zydus Cadila, engaged in discussions to acquire Core’s IV fluid assets.

- Demise: With failed turnaround efforts, Core was dismantled, and its once-iconic brand disappeared from the Indian pharmaceutical landscape.

Lessons Learned

- Innovation ≠ Moat: Core’s pioneering FFS technology was easily replicable. Without continuous innovation or additional differentiators, the initial advantage quickly faded.

- Commodity Trap: IV fluids resulted in a commoditized product category with limited pricing power; cost leadership became the only viable strategy in a shrinking margin environment.

- Debt Discipline: Excessive borrowing to finance capacity expansion compromised financial sustainability.

- Lack of Diversification: Over-reliance on a single product category heightened vulnerability to competitive pressures.

- Leadership Blind Spot: Failure to pivot strategically when market dynamics changed sealed Core’s fate.

Strategic Takeaways for Today’s Healthcare Players

- Growth must be backed by sustainable cash flow—avoid aggressive overleveraging.

- Build brand stickiness; commoditized products require clear differentiation strategies.

- Consider partnerships, joint ventures, or alliances to share investment risks in capital-intensive models.

- Constant innovation is vital to retain first-mover advantage and fend off emerging competition.

- Keep agile leadership commitment to strategic shifts aligned with market evolution.

Epilogue

Core Parenterals’ story encapsulates a classic lifecycle of disruptive innovators: moving from leadership and dominance to irrelevance within two decades. For contemporary healthcare and pharmaceutical leaders, it offers a poignant reminder—scale without strategy is precarious, and technology absent business foresight is ephemeral.

Sources

- Economic Times – Company History of Core Healthcare

https://economictimes.indiatimes.com/core-healthcare-ltd/companyhistory/

(Provides background details on company incorporation, FFS technology, and production scaling) - Business Standard – “Growing Gains, Growing Pains”

https://www.business-standard.com/article/companies/growing-gains-growing-pains-112022801017_1.html

(Discusses the rise, competition challenges, margin pressures, and operational issues faced by Core Parenterals) - Business Standard – “Arcil finalises buyer for Core Healthcare”

https://www.business-standard.com/article/companies/arcil-finalises-buyer-for-core-healthcare-104021601027_1.html

(Focuses on debt acquisition by ARCIL, asset sale attempts, and the end of Core Parenterals as a business)

All Images Are AI Generated for Illustration Only. E&OE