While there is a big buzz around digital adoption by Indian Pharma, necessitated by the disruption brought about by Covid-19, it is also a good time to discuss the future of Indian Pharma market and how it is likely to shape up.

This article by Rajeev Kumar was published in the April 2018 issue of MedicinMan. It will be great to listen to the perspectives of Indian Pharma leaders. Do share your thoughts here about the challenges, opportunities and the future of Indian Pharma.

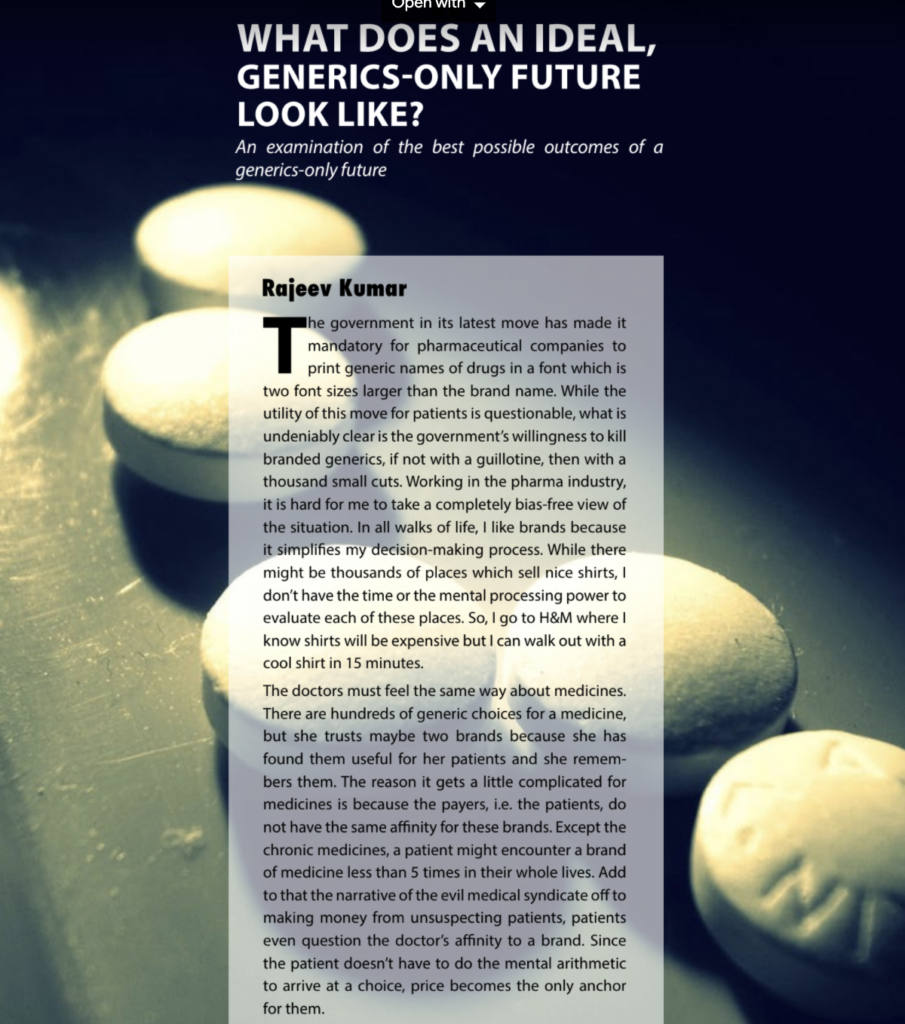

What does an ideal generics-only future look like?

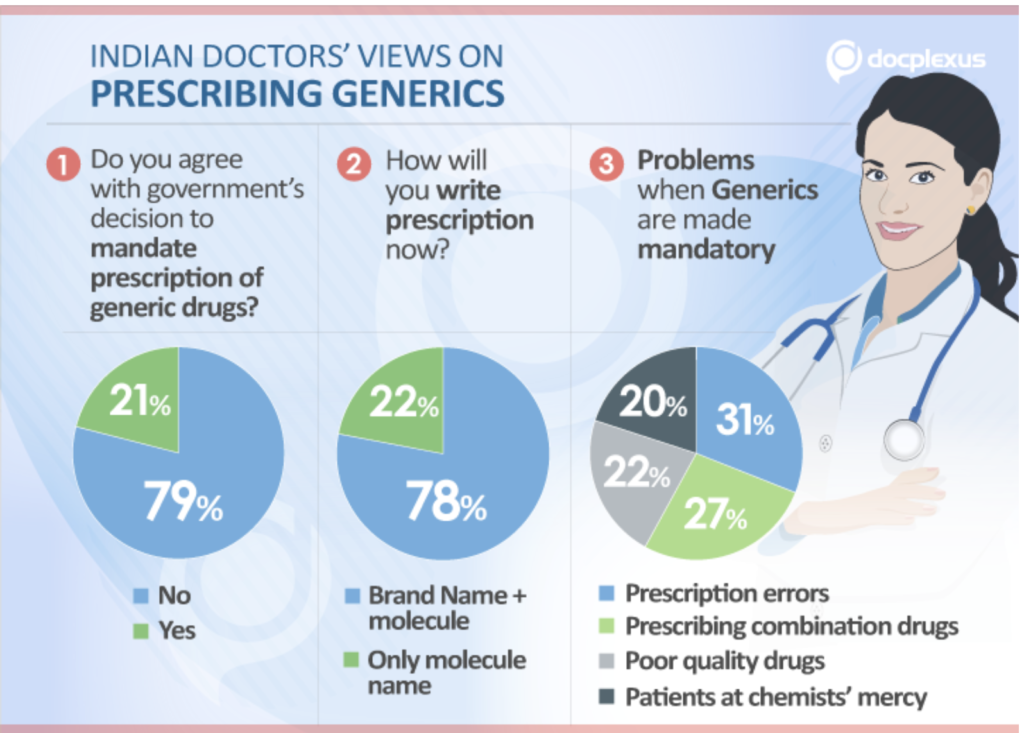

The government in its latest move has made it mandatory for pharmaceutical companies to print generic names of drugs in a font which is two font sizes larger than the brand name. While the utility of this move for patients is questionable, what is undeniably clear is the government’s willingness to kill branded generics, if not with a guillotine than with a thousand small cuts. Working in the pharma industry, it is hard for me to take a completely bias-free view of the situation. In all walks of life, I like brands because it simplifies my decision-making process. While there might be thousands of places which sell nice shirts, I don’t have the time or the mental processing power to evaluate each of these places. So, I go to H&M where I know shirts will be expensive but I can walk out with a cool shirt in 15 minutes.

The doctors must feel the same way about medicines. There are hundreds of generic choices for a medicine, but she trusts maybe two brands because she has found them useful for her patients and she remembers them. The reason it gets a little complicated for medicines is because the payers, i.e. the patients, do not have the same affinity for these brands. Except the chronic medicines, a patient might encounter a brand of medicine less than 5 times in their whole lives. Add to that the narrative of the evil medical syndicate off to making money from unsuspecting patients, patients even question the doctor’s affinity to a brand. Since the patient doesn’t have to do the mental arithmetic to arrive at a choice, price becomes the only anchor for them.

Now, what if the government is able to remove this choice from the doctor’s hands, as it is very eager to do? As things stand now, I would still let my doctor make the choice of brand of the drug for me than the chemist.

I decided to do a thought experiment- what effect would an ideal generics-only prescription rule have on the Indian Pharmaceutical Industry? Ideal is the keyword here because governments have been known to make irrational choices in a hurry. In my thought experiment, the government thinks rationally and for the long term and is willing to take tough choices which do not necessarily yield results before the next general election.

The Quality Question: The day when every HCPs, every regulator and every patient can answer the below question in an affirmative is the day when the Gx-only Rx rule can be called ideal:

Does every medicine on every shelf of every pharmacy in every corner of the country have the same efficacy and safety as promised?

The answer to this single question can alter the landscape for the Indian pharma market. We are a long way away from answering this question with even a ‘maybe’. Getting to ‘yes’ will take strengthening the number, capabilities and transparency of regulators. This will take major upgrade of manufacturing facilities, which will increase manufacturing costs. And it will take patience.

If, and that’s a huge if, that happens how will Gx-only Rx change the industry?

- Consolidation in the Indian manufacturers– First, the fly-by-night “hyper-local” operators who create a small niche by “servicing” a handful of doctors, will disappear. Only serious Indian players will be able to maintain the quality requirements and survive. Even these Indian companies will refocus their portfolio to products where they are capturing more of the value stream. Third party manufacturing will remain but only for players who can buy large enough quantity to gain purchasing power with the supplier.

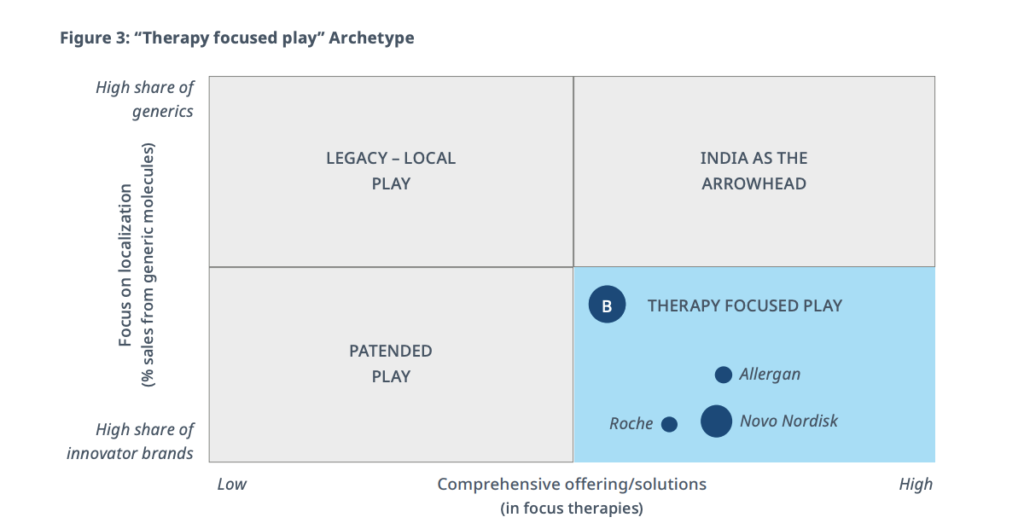

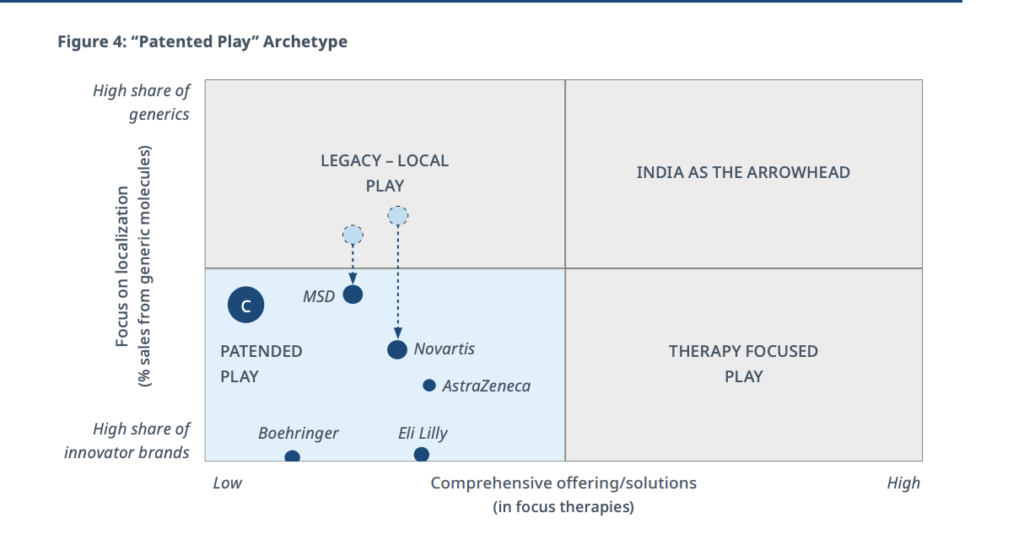

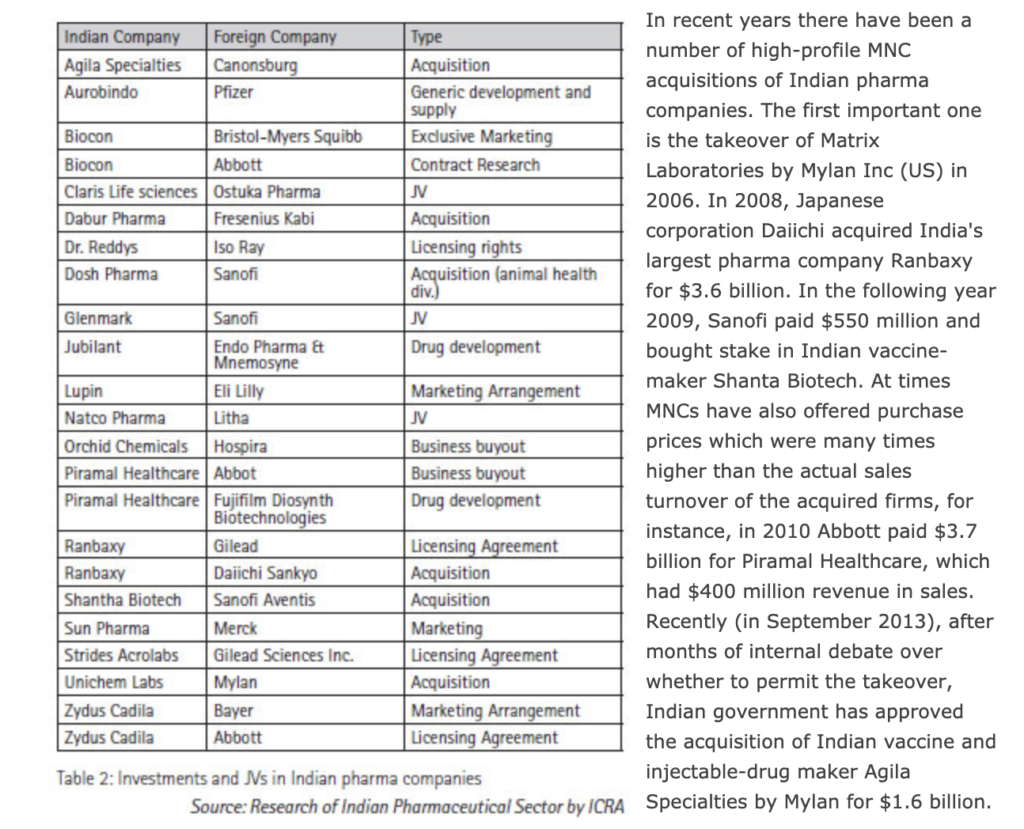

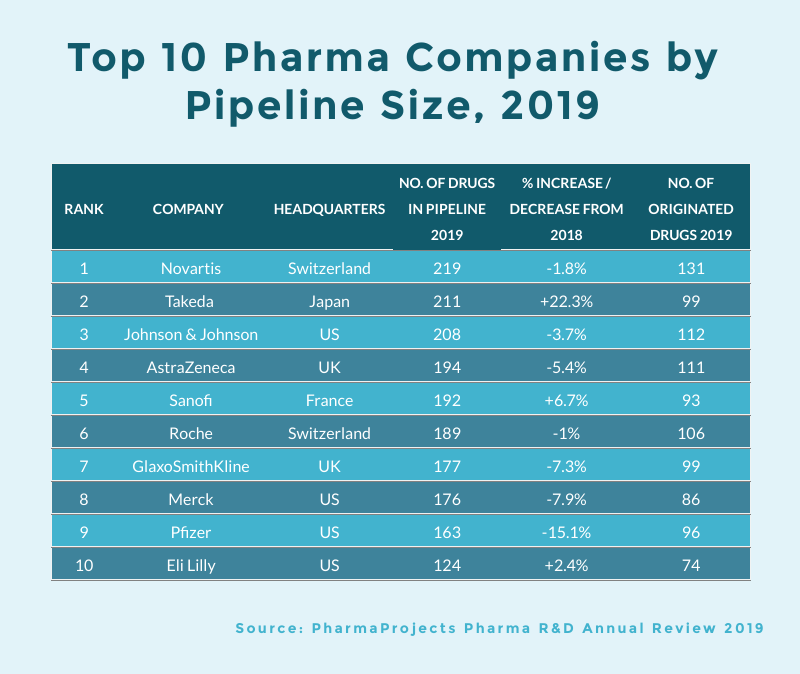

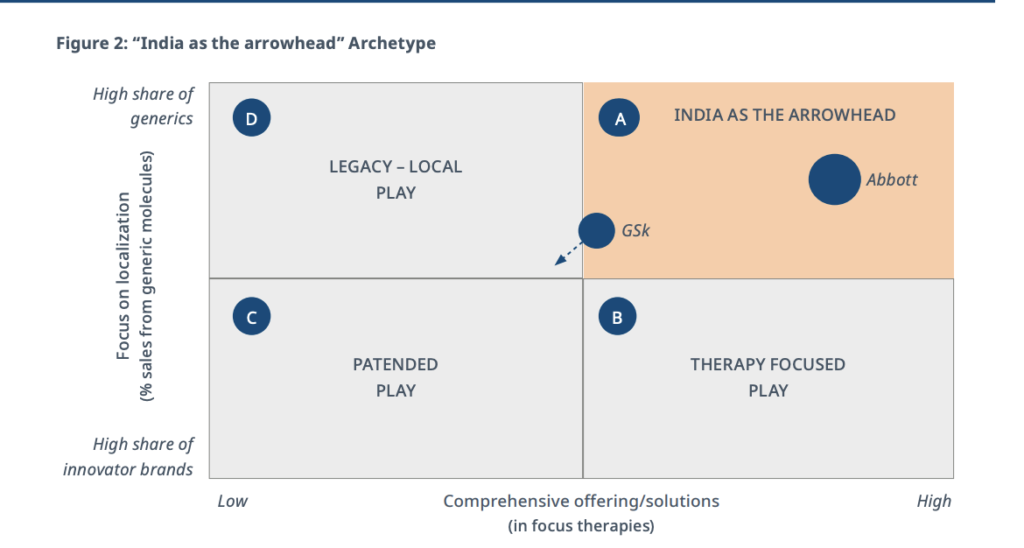

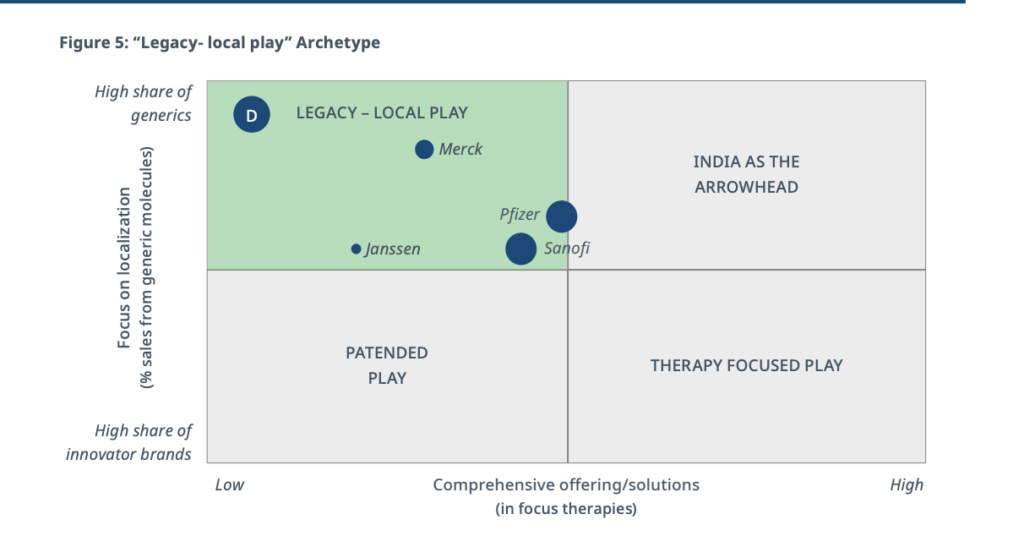

- MNCs will bring new products– The IPR environment has improved a lot in India over the last decade. The major obstacle to new product launch in India today is not the IPR but the price. MNCs will not be able to charge a premium for their off-patent product neither will they be able to win in the Gx space unless they have their manufacturing in India. The seriously India-invested players will have no choice but to bring in their international portfolio to India, at a more palatable price point. With the government working on increasing medical coverage, volume projections in India might start to look better for some of these drugs. But even if the volume does not increase, I don’t believe they will have a choice.

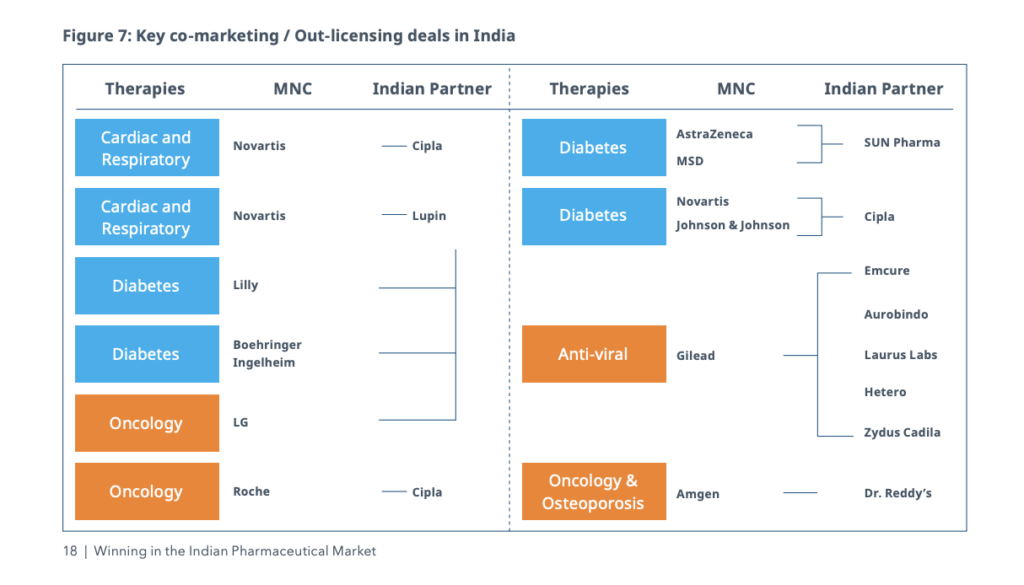

- Or MNCs will partner with Indian companies to manufacture or market– The non-invested MNCs will take the tie-up route even more aggressively. With the pricing pressure increasing everywhere else, India and China will at least be in the second wave of new product introductions after US, Europe and Japan. MNCs being left with no choice but to introduce new product is the biggest positive I see from the Gx only move.

- Marketing will change– With no brand, there will be no brand management. Retailer and distributor engagement will become FMCG-like. No company can offer disproportionately high margins to retailers because free market will take care of that. The interesting question is, will companies continue to promote the off-patent molecules to the doctors? Maybe top 2 players will, not more than that. Number of medical reps will fall dramatically, but some of them will be absorbed to increase the penetration of these companies to the hinterland.

- More R&D in India by MNCs and Indian companies? – Okay, this is more like a wish than any possibility. One way to price new products for Indian markets is to bring R&D to India and bring down R&D cost. Also, will Indian companies finally start taking R&D more seriously. What’s wrong in wishing?

- Customers will win– If done well, I see it as a net positive move for the patients. Despite the narrative, in India medicines are among the cheapest in the world so there is no upside for patients there. Patients will, though, have access to quality medicines at rational prices. New, innovative medicines from around the world will be available for them.

And lastly, it will be a plus for the industry after the initial pains- entry barriers will increase, competition will reduce and the serious players can focus on science.

Join Digital Excellence Pharma Academy (DEPA) – a partnership between MedicinMan and CredoWeb to enable Indian Pharma sales and marketing professionals to gain insights that will trigger digital adoption in their companies through a series of 40+ webinars and live discussions, every Wednesday and Friday at 5 PM

Go to www.credoweb.in and register as a Pharma Professional and await the invitation to join – please provide accurate details about your company, designation, mobile and email to facilitate quick verification. DEPA is open to people working with Indian pharma/devices/diagnostic and disposable companies.

Reach out to Anup Soans: anupsoans@medicinman.net or use the social media buttons below.