Part 1: Pharma GCCs in India — Orange Markets of Nagpur?

One has to travel to Nagpur and see for oneself the Orange Markets, as I did every month during my days as the Area Sales Head for Western India. The sheer size, quantity and variety and colors are astounding. Nagpur is also known as the “Orange City”. So when I read a LinkedIn post likening Pharma GCCs to Nagpur Orange Market, it really caught my attention and ignited my nostalgia for the sweet memories of the difficult to navigate orange markets of Nagpur. Santra has many meanings in Indian lingo. But that’s atopic for another day.

Coming to Pharma GCCs, for years now, the Global Capability Center (GCC) phenomenon has been sold as India’s next big growth engine. From industry associations pushing the FDI story to advisory firms monetizing “India setup strategies,” the optics have been perfect. But for pharma service providers, the reality is a little less exciting.

The Pain Points That Haven’t Gone Away

Domestic players were already stuck in the grind:

• Margins under constant pressure

• Long, drawn-out payment cycles

• Aggressive talent poaching between firms

Now global service providers are being re-routed into India conversations simply because GCC decision-makers sit here. But that doesn’t mean there’s a bigger opportunity — just more competition in the same pool.

Selling Oranges in Nagpur

That’s what the GCC story feels like for many service providers. Yes, there’s demand, but everyone’s already there, and buyers have all the power. With oversupply, commoditization is inevitable.

Why This Matters

Pharma GCCs may look like a gold rush, but for most service providers it means:

• Cost-based negotiations

• Transactional contracts

• Zero pricing power

The smart play isn’t to chase every GCC account. It’s to move up the value chain — IP-driven platforms, niche consulting in regulatory science, digital health, and building capabilities that can’t be easily commoditized.

Bottom Line: Pharma GCCs in India may make for great headlines. But for service providers, the opportunity isn’t in chasing the cart — it’s in building a differentiated stall right next to it.

Part 2: Pharma GCCs in India — The Numbers Behind the Noise

If Part 1 asked the tough questions, Part 2 is about giving you the data behind the narrative. Let’s break down the scale and trajectory of pharma GCCs in India.

The India GCC Landscape

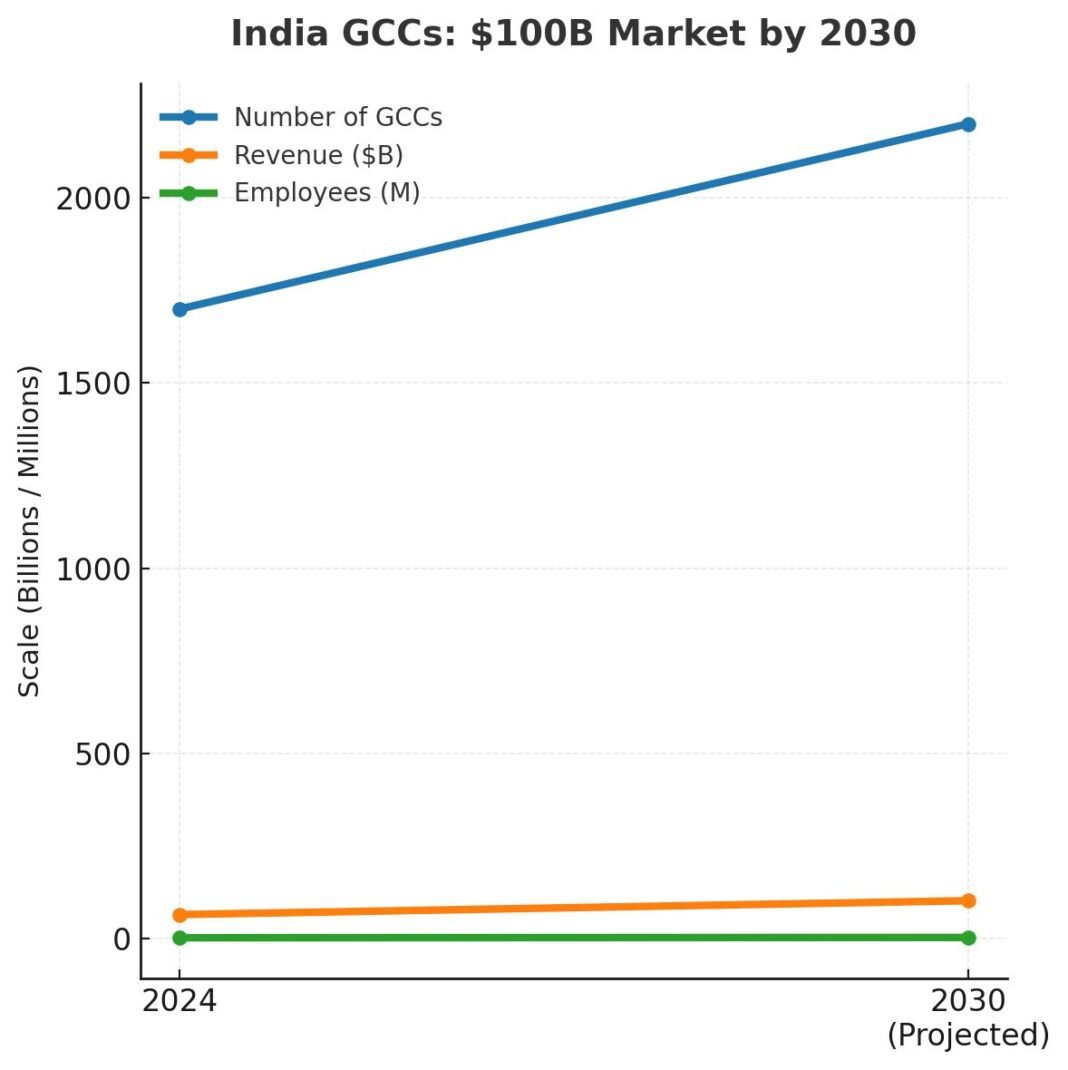

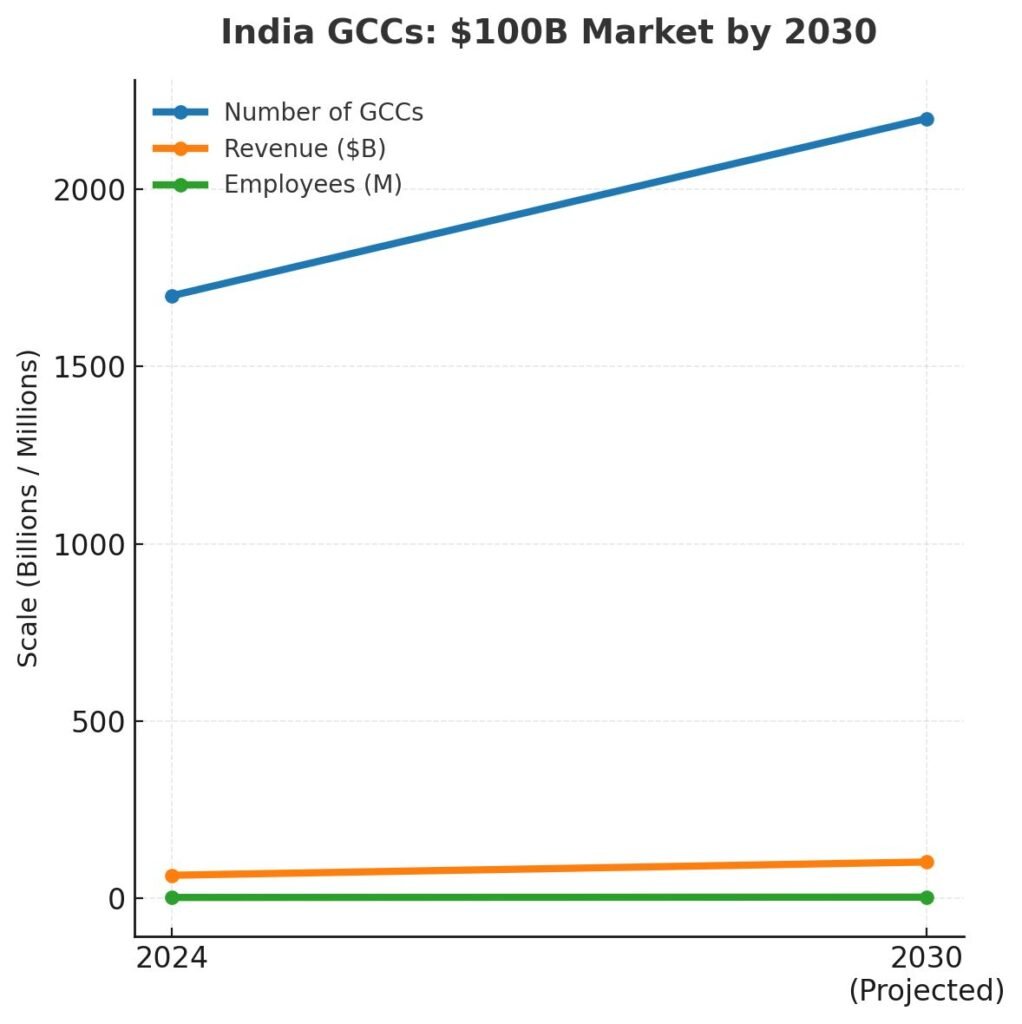

• India hosts 1,700+ GCCs (FY2024), generating $64.6B in revenue and employing 1.9M professionals.

• By 2030, that number will climb to 2,200 GCCs, $100B+ revenue, and ~2.8M employees.

Pharma & Life Sciences GCCs

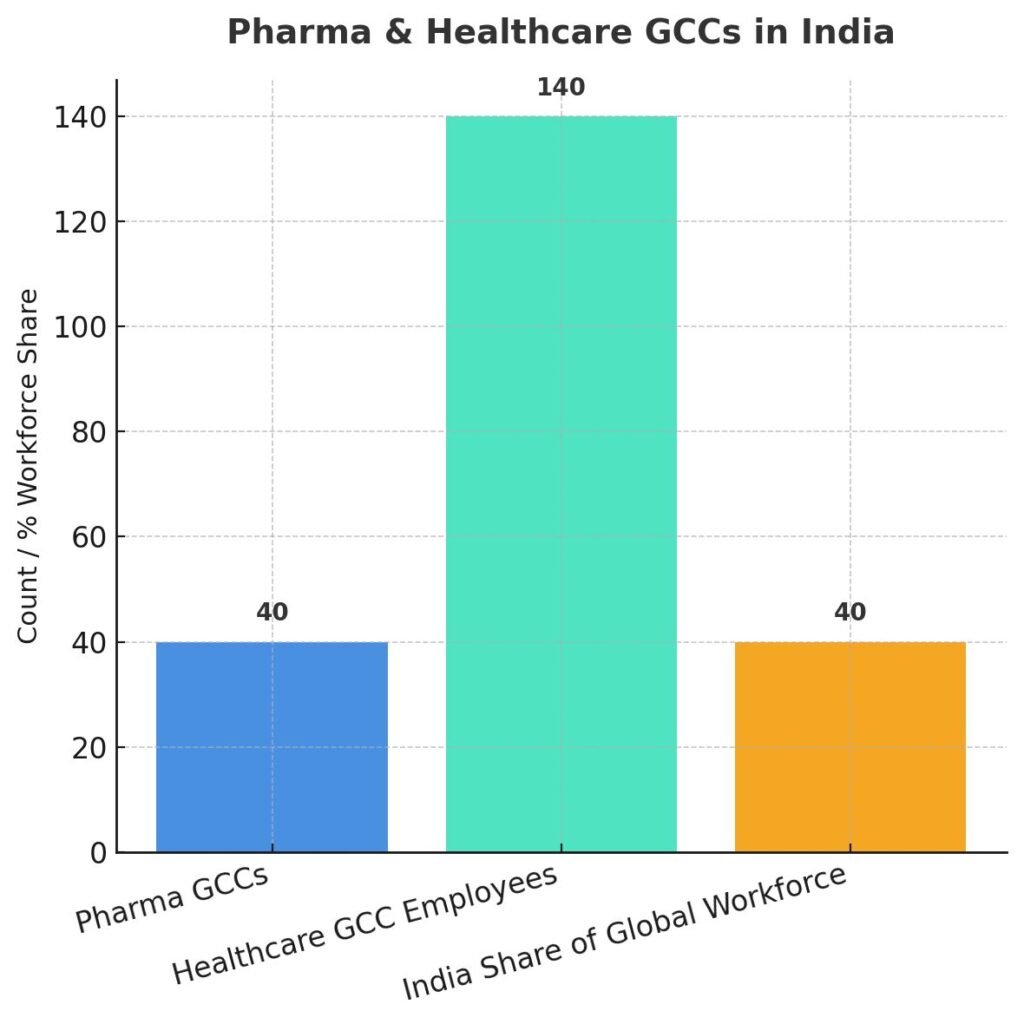

• India is home to ~40 pharma GCCs, led by giants like Sanofi, Lilly, Takeda, BMS, and Amgen.

• Across healthcare verticals, there are 100+ healthcare GCCs with ~140,000 professionals.

• Pharma commercial services within India GCCs have grown 2.5x in just 5 years, with India accounting for 40% of the global pharma GCC workforce.

Recent Big Moves

• Sanofi is investing €400M (~$437M) in Hyderabad to double its GCC workforce to 2,600 by 2026.

• Eli Lilly opened a Hyderabad GCC in 2024, scaling from 100 staff to 1,500 by 2026–27, focusing on AI and automation.

• Eisai Pharma is building a new GCC in Vizag to drive digital healthcare and academic collaboration.

• Tier-II & III cities are emerging hotspots, fueled by infrastructure, digital connectivity, and government incentives.

The Pharma Context

• India’s pharma industry will grow to $130B by 2030, up from ~$50B today.

• It already supplies 20% of the world’s generic medicines and 60% of global vaccines.

What This Means for Service Providers

The numbers are big, the growth is real, and pharma GCCs are here to stay. But the trap is commoditization. If service providers keep chasing cost-driven contracts, they’ll be squeezed harder.

The smarter play is differentiation:

• IP-led solutions (AI for pharmacovigilance, regulatory automation)

• Specialized consulting (compliance, commercial analytics, digital health strategy)

• Platform partnerships with big tech and health-tech disruptors

Bottom Line: Pharma GCCs may be India’s headline story. But the real winners will be the service providers who stop playing commodity games and start creating indispensable value.