India’s Booming Pain Management Market: Trends, Growth & Consumer Behaviors

Rapid Growth of Pain Management in India

The pain management industry in India has experienced remarkable growth over the past five years. Indians are increasingly turning to over-the-counter (OTC) remedies—pills, sprays, and topical creams—to alleviate aches and pains. According to industry data, this has contributed more than a billion dollars to the market during this period, making pain management the largest segment in the non-prescription medicine category.

Key Drivers of Market Expansion

- Surge in Brand Launches: On average, five new pain relief brands have been launched every week since the beginning of the pandemic. In 2020, there were 1,552 brands; by 2025, the number soared to 2,771.

- Consumer Behavior Shifts: Urbanization and the rise in chronic illnesses have driven consumers to seek faster, more convenient remedies that are readily available across platforms.

- Immediate Relief Demand: Modern consumers are increasingly attentive to managing pain quickly, leading to a preference for products offering rapid relief over traditional treatments.

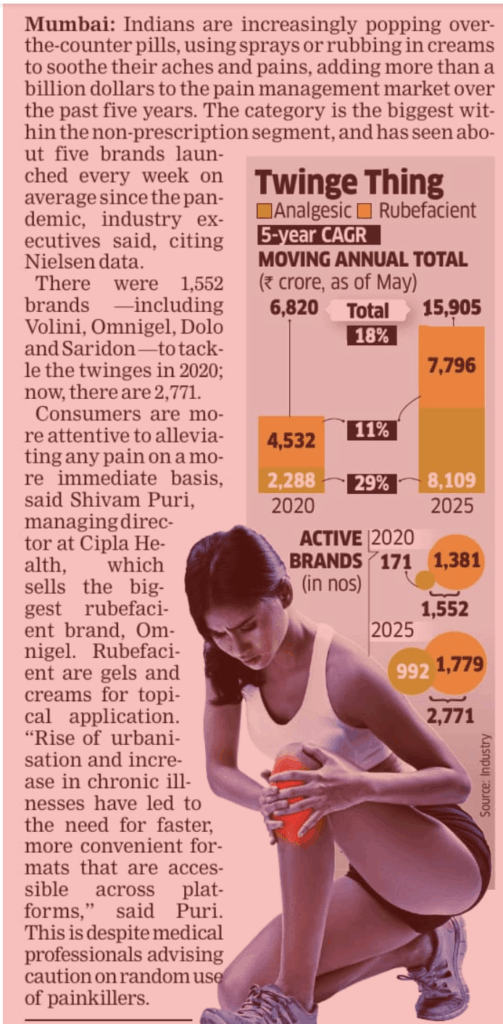

Market Composition: Analgesics vs. Rubefacients

The market is broadly divided between analgesics (which relieve pain internally, like pills) and rubefacients (topical gels and creams for external application).

Market Value and Growth

| Category | 2020 Value (₹ crore) | 2025 (Projected, ₹ crore) | 5-year CAGR |

|---|---|---|---|

| Analgesic | 4,532 | 7,796 | 11% |

| Rubefacient | 2,288 | 8,109 | 29% |

| Total | 6,820 | 15,905 | 18% |

- The rubefacient segment, led by brands like Omnigel, is expected to outpace analgesics in growth, with a projected 29% CAGR from 2020 to 2025. Analgesics, while larger, grow at a slower rate (11% CAGR).

Brand Proliferation

| Year | Number of Active Brands |

|---|---|

| 2020 | 1,552 |

| 2025 | 2,771 |

- Major analgesic brands include Volini, Omnigel, Dolo, and Saridon.

- The number of active brands is projected to almost double in five years, highlighting intense competition and consumer demand.

Industry Insight

Shivam Puri, managing director at Cipla Health (which markets Omnigel), notes that consumer priorities have shifted toward “faster, more convenient formats that are accessible across platforms.” This evolution is a response to the increasing prevalence of chronic pain and urban lifestyles.

Medical Caution

Despite the surge in demand, medical professionals continue to warn against the random, unsupervised use of painkillers, emphasizing the need for responsible consumption.

In summary, India’s OTC pain management market has seen explosive growth—driven by changing lifestyles, greater health awareness, and the proliferation of convenient treatment options. As the sector evolves, both opportunities and challenges will persist: brands must innovate for speed and convenience, while ensuring consumer safety and education remain paramount.