“We are getting too happy, for too little”: these words of a senior pharma journalist a decade back sound prophetic now. Consolidation, CRAMS, para IV filings and challenges to innovators, acquisitions, out-licensing, US and developed markets business growth – key themes a decade back – are now replaced with headwinds in US, pricing pressure in developed markets, quality issues, price regulation in domestic market, policy on generics only prescription, etc.

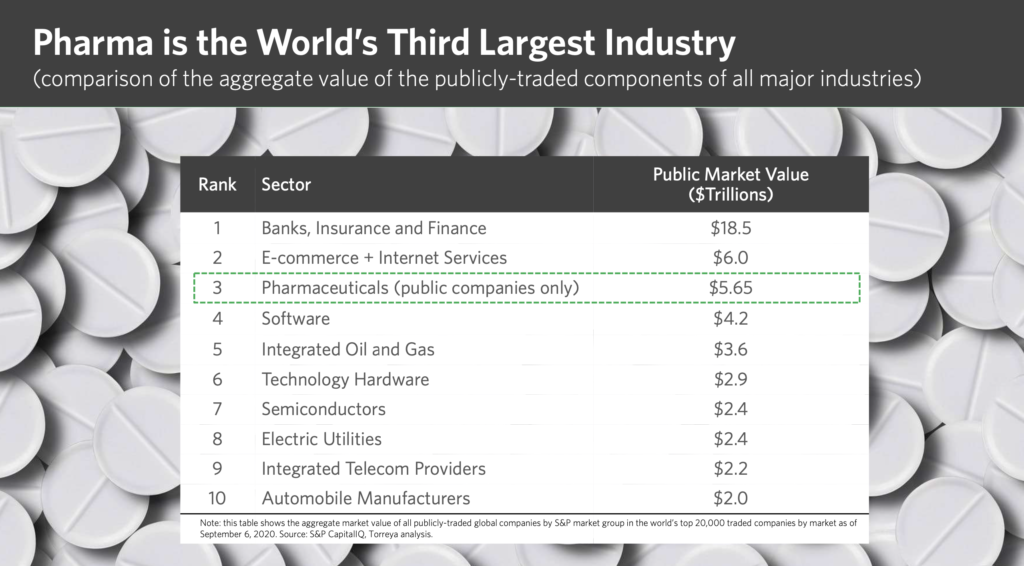

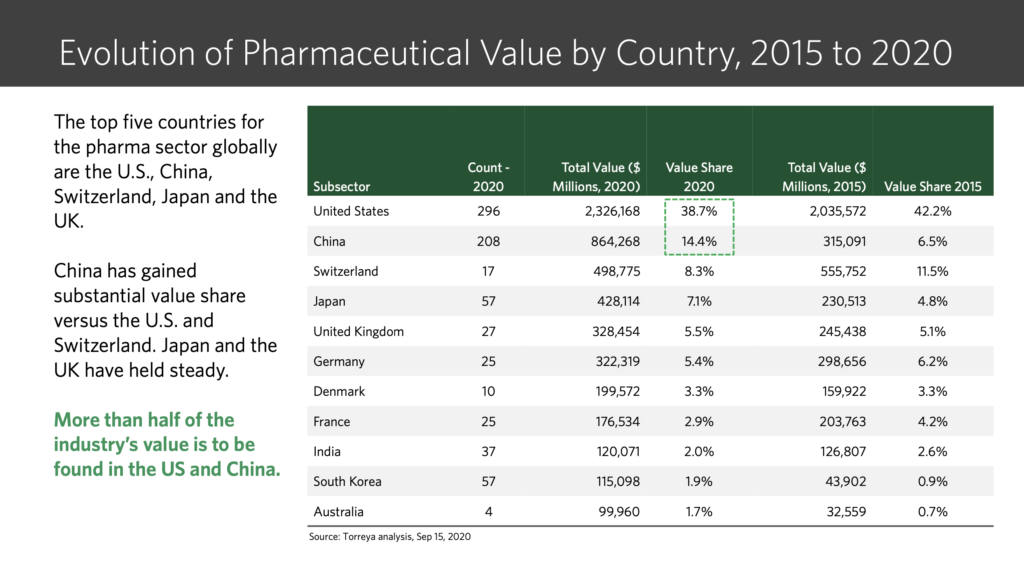

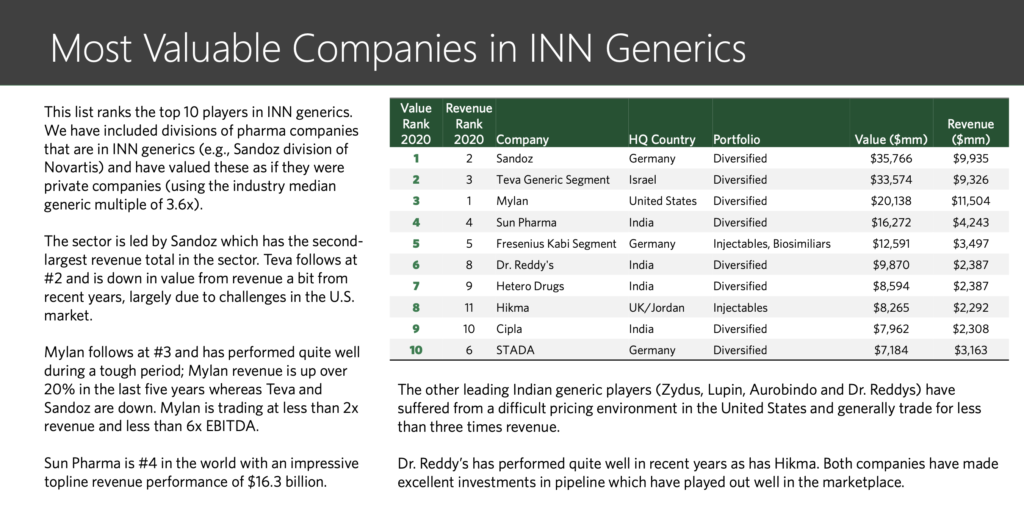

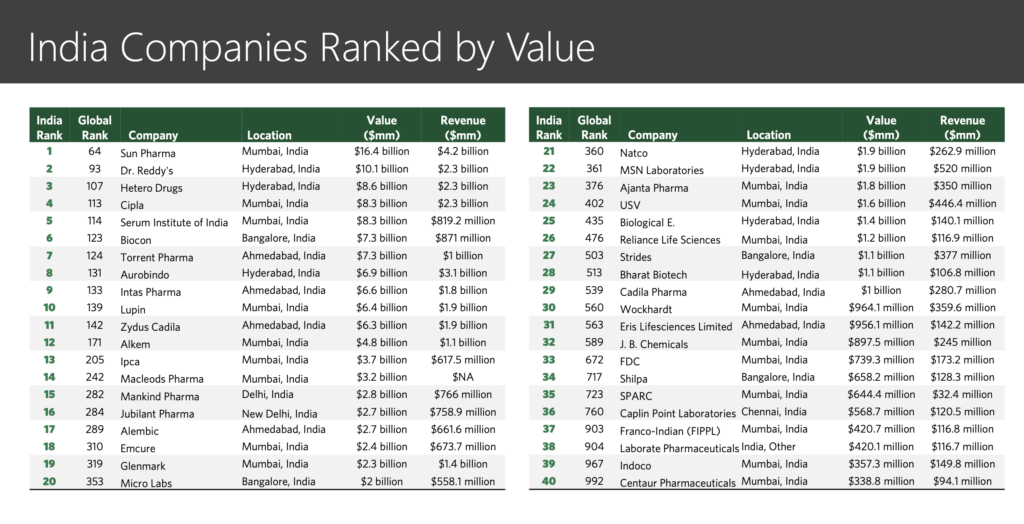

When I entered the workforce in 2000, the world had just gotten over the Y2K paranoia and Indian pharma was an on a global spree. Starting with generics – over 40% of generics in US are provided by Indian companies – it’s now speciality products and bio-similars where Indian companies are making a mark. If from 1970’s, when Indian pharma was on upswing, till 2000’s, when questions of survival were being discussed, the three decades were about the stories of success. In the two decades of the new century, one has observed four waves that set the narrative for the sector, what we can call as: Survival quandary (2000’s), Navigation in post-patent era (2005), Turbulence (2012) and now the Technology impetus (2020). Let me briefly describe the four narrative shapers.

The survival quandary in 2000’s

Post liberalisation and in anticipation of patent adherence, the panacea touted for the Indian pharmaceutical industry were two – new drug discovery and global expansion, especially US. In 1990’s itself, Indian companies set in momentum, efforts on both fronts. An out-licensing for a research molecule by an Indian company in late 1990’s heralded a new chapter, so also the rapid expansion in US market. How will the Indian industry survive post 2005 was a question on everyone’s mind.

The navigation (2005)

Consolidation was a big word. The expectation was Indian companies will sell out in the patent era. The industry dynamics were expected to change by 2008. By 2010, some acquisitions by foreign companies did happen, but didn’t change the scenario as envisaged. On the contrary, the US business was booming, patent challenges through para IV filings, CRAMS, clinical research, outsourcing to India, had become the buzzwords. India emerged as ‘Pharmacy to the world’ for providing affordable medicines. There were more out-licensing deals for research molecules. Indian companies went and acquired companies around the world. International business contributed more revenues than domestic for many large Indian companies.

The turbulence (2012)

Both MNC’s and Indian companies faced turbulence, for different reasons though. For MNC’s, conversations around patent and IPR peaked: compulsory licensing, evergreening, Section 3d of patent act, dominated news. Form 483 became like a nemesis for Indian companies, impacting the quality perception of Indian products. A senior journalist called this time as “silentitis” (a condition of pharma companies going into silence and disengaging with media). The external conversations about the sector were driven by industry observers rather than the industry leaders.

The transformation (2020)

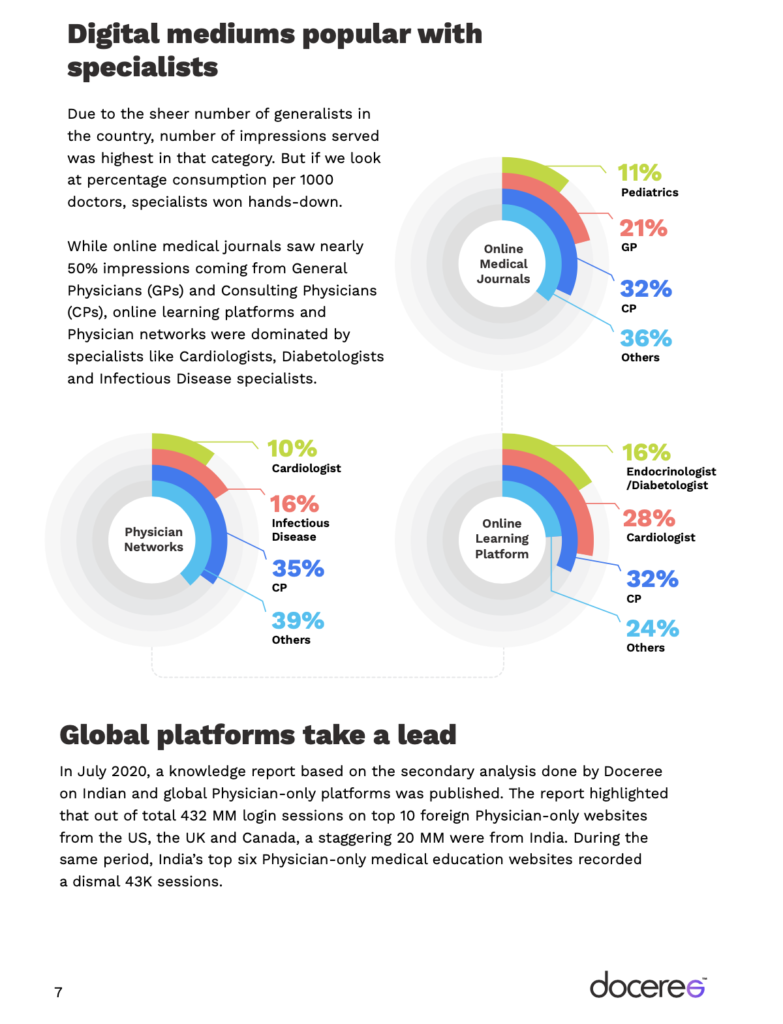

This transformation, led by technology will impact pharma on two ends – distribution and doctor engagement.

On the distribution side, like happened in consumer goods, manufacturing done by contract manufacturing firms, labelled and sold by retailers may emerge as a business reality. This will be similar to the US market, dominated by few, which in India’s case would be e-pharmacies. The technology impact for customers started some years back with the introduction of newer technologies like continuous glucose monitoring, and wearable devices. These developments at customer end motivated doctors and healthcare delivery to enhance their technology adoption. The COVID pandemic has expedited need for technology across the healthcare spectrum including pharma. E-consultation is already booming. Pharma field force is connecting with HCP’s online. An annual meeting of healthcare players this year was predominantly about hospital design in post COVID world! We still don’t know the shape of things to come when hospitals begin normal operations.

Incidentally, both technology and pharma are two sectors that took India on a global stage. Indian pharma has always found its strengths in adversity. Perhaps it’s time for leaders of Indian pharma to discuss with the leaders of India’s IT what we can do together.

Noumaan Qureshi is pursuing his doctoral research in communications and has been associated with healthcare sector for two decades. Views expressed are personal.