India’s pharmaceutical industry occupies a unique and powerful position in global healthcare. It supplies nearly half of all generic medicines consumed in the United States and is indispensable to public health systems across the world. Yet within India, generic medicines continue to face deep scepticism from doctors and patients alike.

This contradiction raises a fundamental question:

Do Indian pharmaceutical companies adhere to identical quality norms when supplying generics to the U.S. market and the Indian market?

The answer is clear, if inconvenient: they do not have to.

This divergence is not rooted in scientific incapacity, but in regulatory asymmetry, enforcement gaps, and market incentives that allow two parallel quality realities to coexist.

- One Industry, Two Regulatory Universes

When Indian companies supply medicines to the United States, they operate under the jurisdiction of the US Food and Drug Administration (USFDA)—arguably the most demanding drug regulator in the world.

For U.S. market access, manufacturers must demonstrate:

• strict compliance with current Good Manufacturing Practices (cGMP)

• bioequivalence with the reference (originator) drug

• full data integrity and audit trails

• readiness for unannounced inspections

• rapid corrective action under regulatory scrutiny

Failure is costly and public: warning letters, import alerts, plant shutdowns, and loss of market access.

By contrast, medicines sold exclusively in India fall under the Central Drugs Standard Control Organisation (CDSCO) and state drug authorities. While India’s legal framework recognises quality standards, enforcement intensity, inspection frequency, and evidentiary requirements have historically been uneven, particularly for generics already approved for sale.

The result is not illegal production—but differential regulatory expectation by destination market.

- Bioequivalence: The Real Fault Line

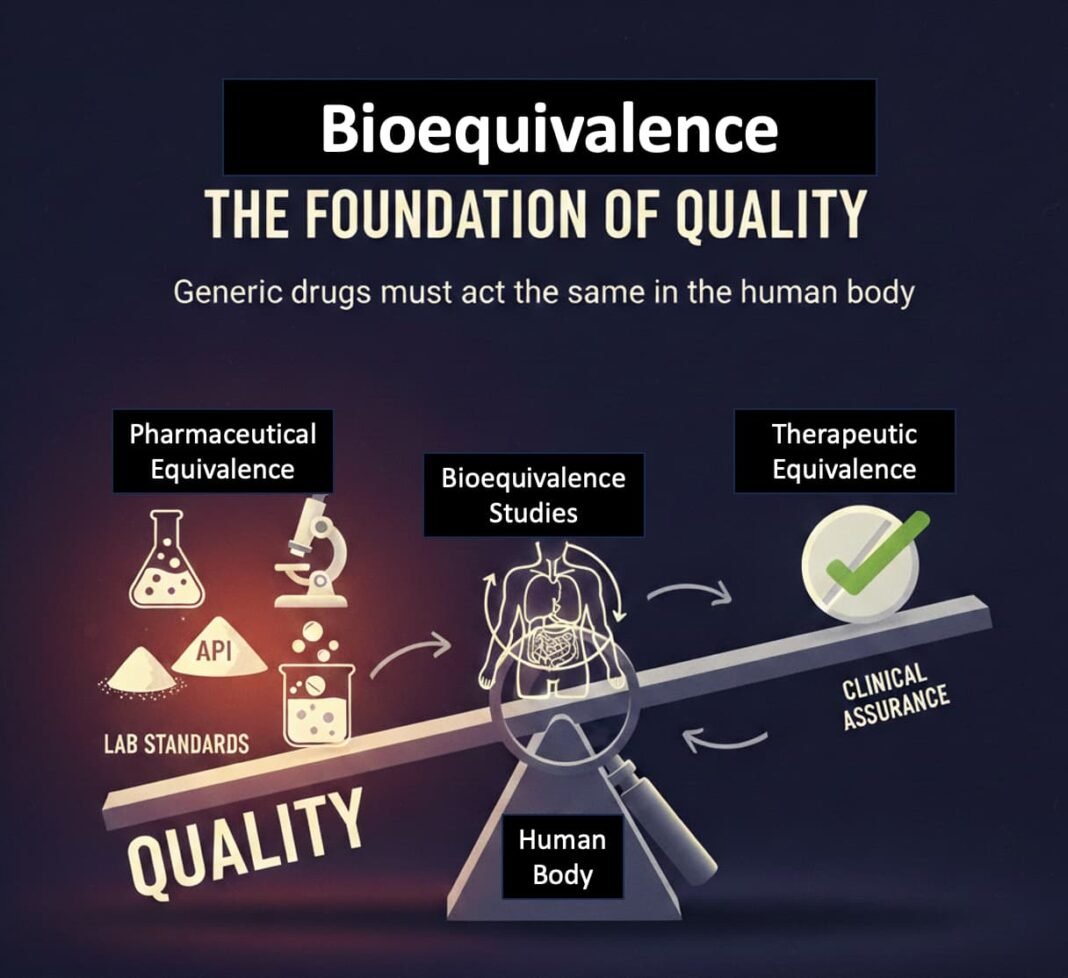

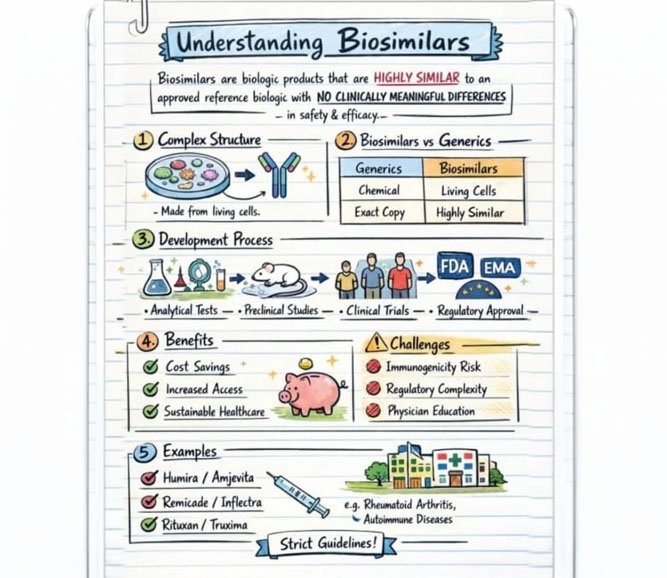

At the centre of the generics debate lies bioequivalence, not branding or pricing.

Bioequivalence ensures that a generic delivers the same amount of active ingredient, at the same rate, as the originator drug in the human body. In the U.S., this requirement is non-negotiable for every generic approved via the ANDA pathway.

In India, bioequivalence requirements:

• were introduced later,

• applied selectively,

• and have been phased or exempted for large segments of the domestic market over time.

Pharmaceutical equivalence (same molecule, same dose) does not guarantee therapeutic equivalence. Variations in formulation, dissolution, excipients, or manufacturing controls can alter clinical outcomes—especially for drugs with narrow therapeutic windows.

This gap explains a persistent reality: Indian doctors often trust brands more than the regulatory label “generic.”

- Branded Generics: A Trust Substitute, Not a Scientific Upgrade

India’s market dominance of branded generics is frequently misunderstood as a cultural or commercial anomaly. In reality, it is a rational response to regulatory ambiguity.

In an environment where:

• bioequivalence is not universally visible,

• post-marketing surveillance is limited, and

• enforcement varies across states,

branding becomes a proxy for accountability. Doctors prescribe branded generics not because they believe the molecule is superior, but because brand reputation signals consistency and perceived quality assurance.

In the U.S., this function is performed by the regulator. In India, it is outsourced to marketing.

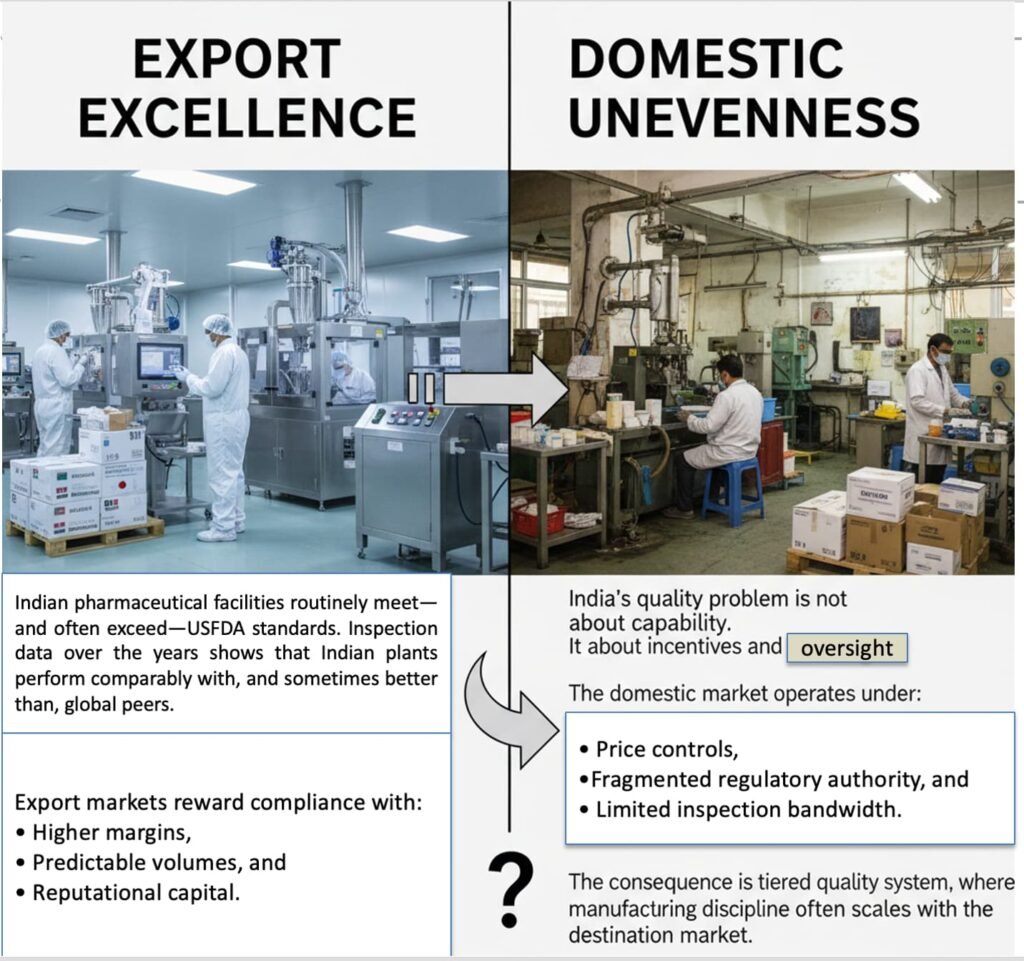

- Export Excellence, Domestic Unevenness

Indian pharmaceutical facilities routinely meet—and often exceed—USFDA standards. Inspection data over the years shows that Indian plants perform comparably with, and sometimes better than, global peers.

This proves a critical point:

India’s quality problem is not about capability. It is about incentives and oversight.

Export markets reward compliance with:

• higher margins,

• predictable volumes, and

• reputational capital.

The domestic market operates under:

• price controls,

• fragmented regulatory authority, and

• limited inspection bandwidth.

The consequence is a tiered quality system, where manufacturing discipline often scales with the destination market.

- When the USFDA Looked Inside: Case Studies That Matter

The claim of dual standards is not theoretical. It is documented in regulatory history.

Ranbaxy Laboratories

Once India’s flagship generic exporter, Ranbaxy’s downfall followed USFDA investigations revealing data falsification and systemic quality failures. The company ultimately paid one of the largest penalties ever imposed on a generic manufacturer and lost access to the U.S. market. The same facilities had been supplying the Indian market without comparable scrutiny.

Wockhardt, Sun Pharma, and Others

Multiple Indian manufacturers have faced USFDA warning letters and import alerts citing:

• inadequate quality systems,

• failure to investigate deviations,

• manipulation or absence of reliable data. In many cases, these plants continued supplying the Indian market while exports were restricted—legally highlighting the regulatory asymmetry between domestic and foreign oversight.

These episodes are not evidence that Indian medicines are unsafe by default. They are evidence that rigorous inspection uncovers issues that lighter oversight may not.

- Regulatory Comparison: USFDA vs CDSCO

Bioequivalence Mandatory for all generics Historically selective / phased

Approval Pathway ANDA with deep data review Multiple pathways, variable depth

Inspections Routine, unannounced Infrequent, often state-led

Data Integrity Zero tolerance Enforcement inconsistent

Post-market Surveillance Robust and transparent Limited and fragmented

Enforcement Powers Import alerts, bans, recalls Slower, corrective-focused

Public Disclosure High Limited

- Why This Matters Beyond Policy

This regulatory duality has real-world consequences:

• Doctors hesitate to prescribe unbranded generics.

• Patients remain confused, equating price with quality risk.

• Public trust erodes, undermining generic substitution policies.

• India’s credibility as a global pharma leader is quietly compromised at home.

The debate is not generics versus brands. It is assured quality versus assumed quality.

- One India, One Standard

India does not need new slogans or coercive prescribing mandates. It needs regulatory convergence.

That means:

• universal bioequivalence enforcement,

• stronger central oversight of state regulators,

• transparent reporting of quality failures, and

• investment in surveillance and testing capacity.

When Indian patients receive medicines manufactured under the same standards demanded by the USFDA, the branded–generic divide will collapse naturally.

Until then, branding will continue to substitute for trust—and the conundrum will remain unresolved.

All Images are AI Generated for Illustration Only. E&OE

Editor’s Note

This article builds on arguments first articulated by Anup Soans in The Wire Science (2017), which examined why quality—not price—remains the central issue in India’s generic medicines debate. It also draws on his subsequent analysis published on www.medicinman.net revisiting the generics versus branded generics discourse in the context of persistent regulatory asymmetry between domestic and export markets.

Excellent idea. Adding an appendix with verified sources would significantly bolster the article’s credibility and provide a pathway for readers to explore the topic further. Below is a proposed “Sources & Further Reading” appendix, categorized by the article’s key claims.

Appendix: Sources & Further Reading

This article is based on publicly available regulatory documents, scholarly analysis, and reports from authoritative institutions. The following sources provide verification and deeper context for the arguments presented.

A. Regulatory Frameworks & Asymmetry

- U.S. Generic Drug Approval (ANDA) & cGMP Requirements:

- U.S. Food and Drug Administration (FDA). (2023). Generic Drug Facts. https://www.fda.gov/drugs/generic-drugs/generic-drug-facts

- U.S. FDA. Facts About the Current Good Manufacturing Practices (CGMPs). https://www.fda.gov/drugs/pharmaceutical-quality-resources/facts-about-current-good-manufacturing-practices-cgmps

- India’s Regulatory Structure & Evolution:

- Central Drugs Standard Control Organisation (CDSCO). About CDSCO. https://cdsco.gov.in/openems/openems/en/About-us/

- Key Legal Update: Ministry of Health and Family Welfare, Government of India. (2018). The Drugs and Clinical Trials Rules, 2018. (This mandated bioequivalence studies for new generic approvals). https://cdsco.gov.in/openems/openems/en/Notifications/Gazette-Notifications/

B. Bioequivalence (BE) Requirements: The Critical Divergence

- U.S. BE Standards:

- U.S. FDA. Bioavailability and Bioequivalence Studies. https://www.fda.gov/media/88063/download

- India’s BE Journey & Gaps:

- Academic Analysis: Gulati, N., & Kumar, S. (2022). Bioequivalence and interchangeability of generic drugs in India: A review. Journal of Generic Medicines. This paper outlines the historical and current landscape of BE in India.

- Government Committee Report: Report of the High-Level Committee to Review the Drugs & Cosmetics Act, 1940 (2015). (The “Kokate Committee” report highlighted significant gaps in India’s regulatory capacity and enforcement). Available via CDSCO or public health repositories.

C. Case Studies: Documented Regulatory Actions

All FDA Warning Letters, Import Alerts, and Consent Decrees are publicly searchable.

- Ranbaxy Laboratories:

- U.S. Department of Justice. (2013). Generic Drug Manufacturer Ranbaxy Pleads Guilty and Agrees to Pay $500 Million to Resolve False Claims Allegations, cGMP Violations, and False Statements to the FDA. Press Release

- U.S. FDA. Ranbaxy Import Alert 66-40 (Detaining all products from specific facilities). https://www.accessdata.fda.gov/cms_ia/importalert_117.html

- Wockhardt, Sun Pharma, and Others:

- U.S. FDA Inspection Database (FOIA): Search for “Form 483” inspection observations and “Warning Letters” for specific companies. This is primary-source evidence.

- Example – Wockhardt Warning Letter (2013): https://www.fda.gov/inspections-compliance-enforcement-and-criminal-investigations/warning-letters/wockhardt-limited-09252013

- Database Access: The FDA’s Inspections, Compliance, Enforcement, and Criminal Investigations page is the portal for this information.

- U.S. FDA Inspection Database (FOIA): Search for “Form 483” inspection observations and “Warning Letters” for specific companies. This is primary-source evidence.

D. Analysis of the “Two-Tiered” Quality System

- Scholarly Work on Regulatory Divergence:

- Eban, K. (2019). Bottle of Lies: The Inside Story of the Generic Drug Boom. HarperCollins. (A thoroughly researched journalistic account, with extensive documentation, focusing on Ranbaxy and the broader systemic issues in the global generic industry).

- Report: U.S. Government Accountability Office (GAO). (2020). Drug Safety: FDA Needs to Better Address Significant Deficiencies in Foreign Inspections. GAO-21-202. (While about the FDA’s foreign inspection program, it implicitly highlights the disparity between markets reliant on FDA oversight vs. those reliant on local regulators).

- The “Branded Generics” Phenomenon in India:

- World Health Organization (WHO) Study: Kaplan, W. A., et al. (2012). The World Medicines Situation 2011: Medicines Prices, Availability and Affordability. WHO. (Has sections analyzing the branded generics market structure in countries like India).

- Academic Analysis: Bate, R. (2010). Making a Killing: The Deadly Implications of the Counterfeit Drug Trade. AEI Press. (While focused on counterfeits, it includes analysis of how weak regulation fosters markets where branding becomes a necessary proxy for quality).

E. Data on India’s Market Share & Inspection Metrics

- India’s Share of U.S. Generics:

- U.S. FDA. (2019). Advancing Regulatory Science at the FDA: Focus Area 3 – Improving Generic Drug Review and Ensuring Equivalence. (Contains data on application volumes by country of origin).

- U.S. Congressional Research Service (CRS) Reports on pharmaceutical supply chains often cite this data.

- FDA Inspection Data (For performance comparison):

- U.S. FDA. Drug Inspection Reports by Country. Data Dashboard. (Allows for high-level comparison of inspection outcome rates by country, including India).