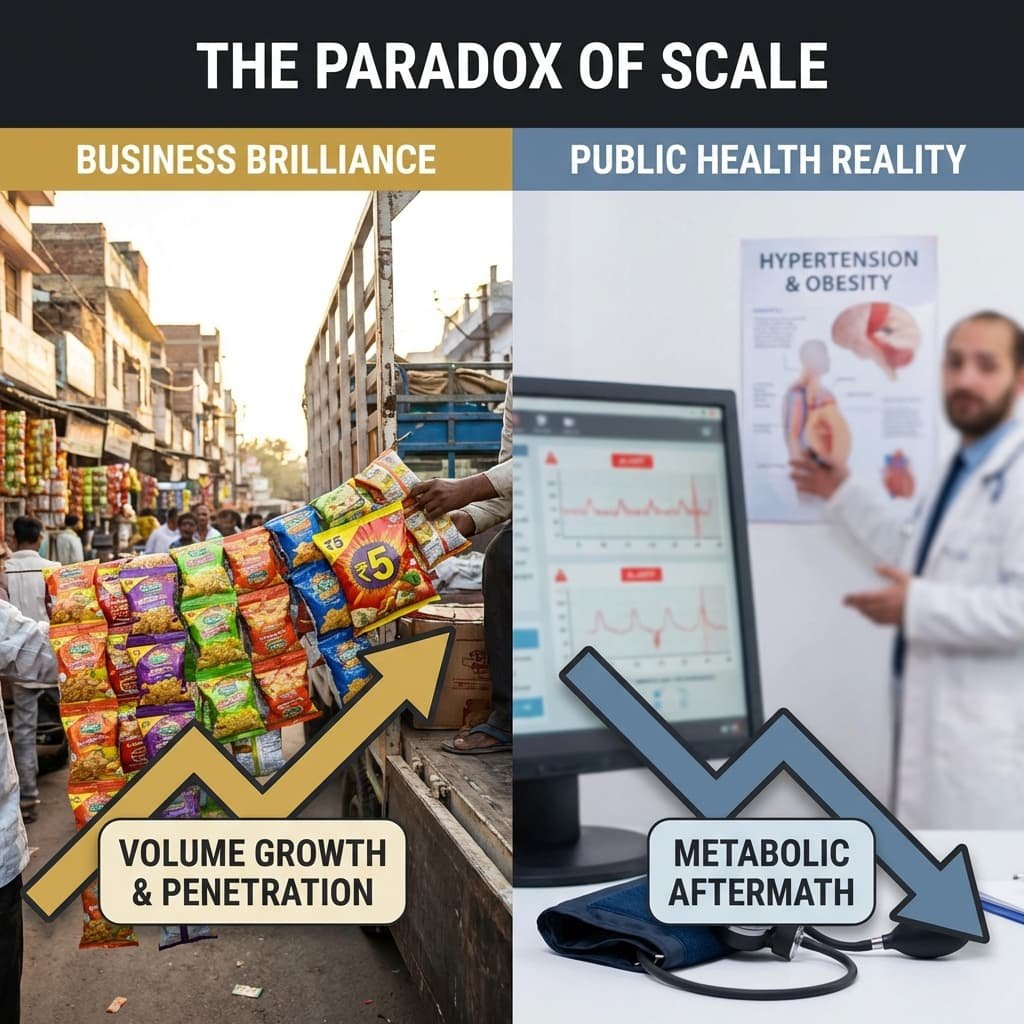

Executive Summary — The Paradox of Scale

In the annals of Indian FMCG, the ₹5 snack SKU is a masterclass in behavioral economics. It represents the perfect distillation of price-point penetration, supply chain wizardry, and impulse capture. It is, by any business standard, brilliant.

However, from a physiological standpoint, this same ₹5 packet is a metabolic Trojan horse. While the corporate sector celebrates volume growth and rural penetration, the public health infrastructure is left to deal with the aftermath: a wave of salt-induced hypertension, trans-fat-driven adiposity, and glucose dysregulation.

This brief deconstructs the machinery behind the munchies and diagnoses the slow-motion collision between shareholder value and national health.

1 | Market Dynamics: The Great Unlocking

The Indian snacks market is not just growing; it is formalizing and deepening at a velocity that rivals telecom adoption.

· The Numbers Game: Valued at approximately ₹75,100 crore in 2022, the market is on a trajectory to breach ₹1.22 lakh crore by 2027. This ~62% expansion is not driven by premiumization, but by the opposite: the aggressive defense and expansion of the ₹5–10 price band.

· Distribution as Defence: Organised players (Haldiram’s, Balaji, ITC’s Bingo!, PepsiCo) now command over 50% of the market. They have achieved this by weaponizing the kirana store. In rural India, where disposable income is rising but remains highly price-elastic, the ₹5 packet is the “entry drug” to the branded economy.

· The Habit Loop: This price point lowers the cognitive barrier to purchase. It transforms snacks from an occasional purchase into a daily, almost utility-like, expense.

MedicinMan Take: The ₹5 SKU is a loss leader for the soul. It buys trial, builds habit, and hooks the consumer long before the health consequences manifest.

2 | Consumption Shifts: The Great Replacement

Indian diets, traditionally diverse and regionally specific, are undergoing rapid homogenization—towards salt, fat, and carbohydrates.

· Caloric Displacement: Multiple dietary surveys indicate that fried and extruded snacks are no longer just “chaat” or festive items. They are contributing significantly to daily caloric intake, effectively displacing micronutrient-dense foods like legumes and vegetables.

· Rural Convergence: The myth that obesity is an urban luxury is dead. Rural India is catching up rapidly, driven by the very FMCG distribution networks that solved for “last-mile” connectivity.

MedicinMan Take: We are witnessing the “Coca-colonization” of the Indian midday meal, but at a price point that makes water seem overpriced.

3 | The Metabolic Reckoning: The Dose-Response Relationship

The correlation between the proliferation of ultra-processed foods and the NCD epidemic is no longer theoretical; it is epidemiological fact.

Trending Metrics (The Damage Done)

· Obesity: Prevalence among adults has doubled in a decade across major states (NFHS data). Childhood overweight rates are spiking in both urban and rural demographics.

· NCD Burden: Non-communicable diseases—diabetes, cardiovascular disease, hypertension—now account for ~60% of all deaths in India.

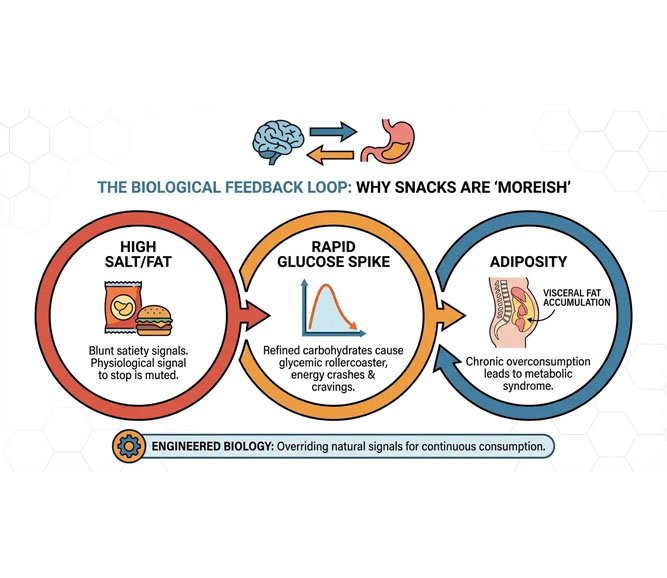

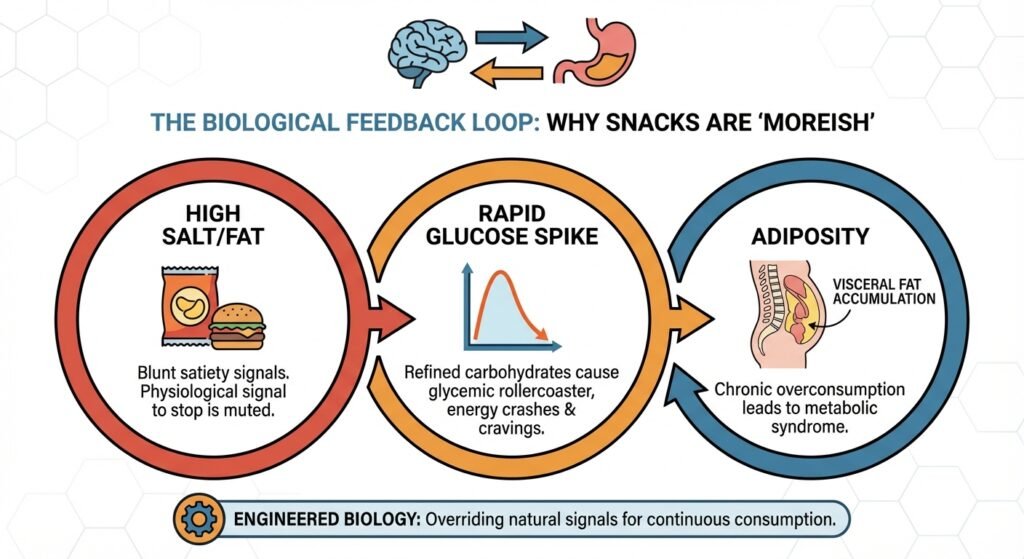

The Biological Feedback Loop

Why are these snacks so “moreish”? It’s not just taste; it’s engineered biology.

- High Salt/Fat: These ingredients blunt the brain’s satiety signals. You eat one packet, but the physiological signal to stop is muted.

- Rapid Glucose Spike: Refined carbohydrates cause a glycemic rollercoaster, leading to energy crashes and subsequent cravings.

- Adiposity: Chronic overconsumption of these energy-dense, nutrient-poor foods leads to visceral fat accumulation, the primary driver of metabolic syndrome.

MedicinMan Take: The ₹5 snack doesn’t just fill a stomach; it resets a metabolism. It is a high-frequency trader of health for momentary sensory pleasure.

4 | The Economic Burden: The Fiscal Hangover

What happens when a nation of a billion people snacks itself into metabolic distress? The bill comes due, and it isn’t paid in rupees alone.

· Healthcare Costs: Rising NCDs translate directly to rising out-of-pocket expenditures. For the poor, a diabetes diagnosis can be a catastrophic financial event.

· Productivity Drag: Obesity and NCD morbidity reduce workplace productivity. A workforce in glycemic distress is a less efficient workforce. This creates a hidden tax on the economy, eroding the very “demographic dividend” these snack companies are currently harvesting.

5 | Policy Gap: The Free Market Fallacy

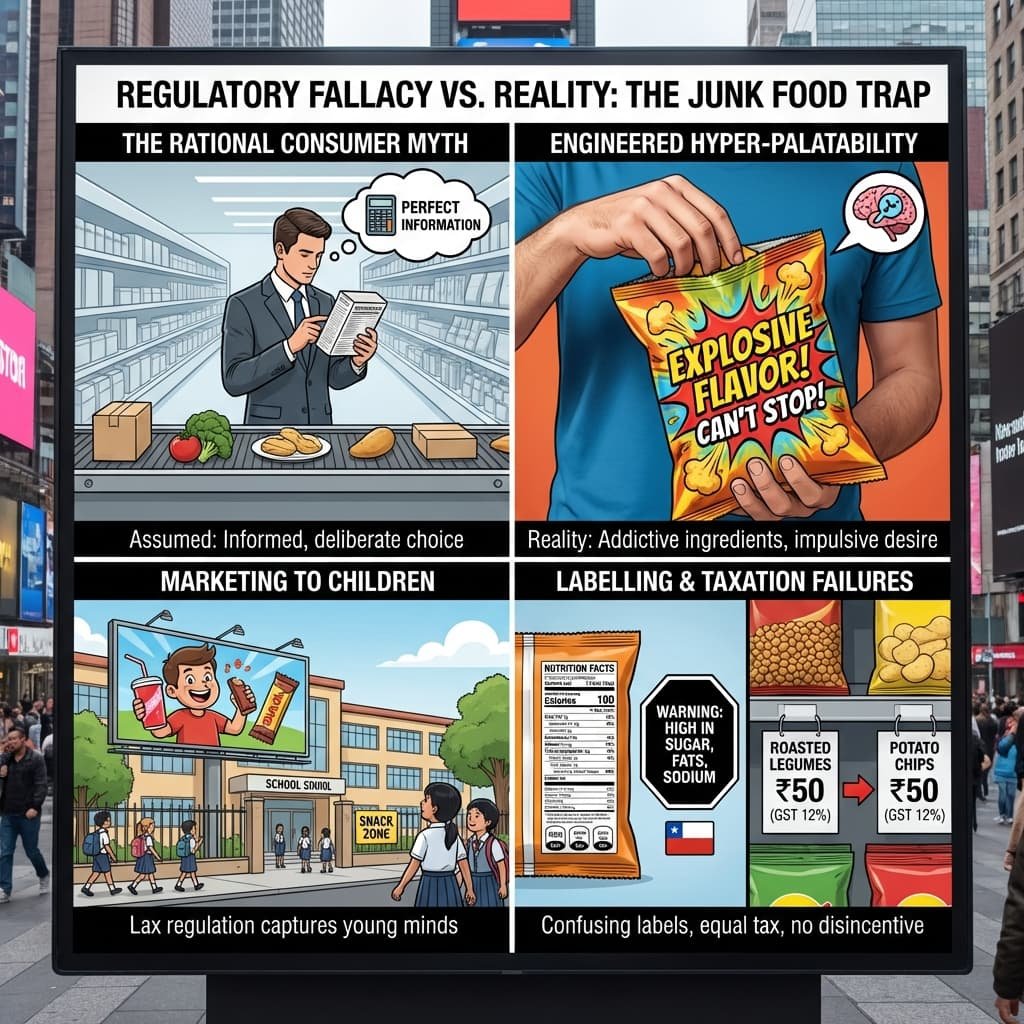

The current regulatory architecture assumes a rational consumer with perfect information. This is a fallacy in the face of engineered hyper-palatability.

· Marketing to Children: Lax regulation allows aggressive branding and placements near schools, capturing consumers before they develop critical agency.

· Labelling Obfuscation: Current labelling standards are confusing. Front-of-Pack labelling (FOPL) in India remains weak compared to warning labels in Chile or Mexico, which have demonstrably altered buying behavior.

· Taxation: The GST structure treats a packet of healthy roasted legumes and a packet of fried, high-fat potato chips with alarming similarity, failing to disincentivize the harmful choice.

6 | Strategic Rx: Aligning Incentives with Health

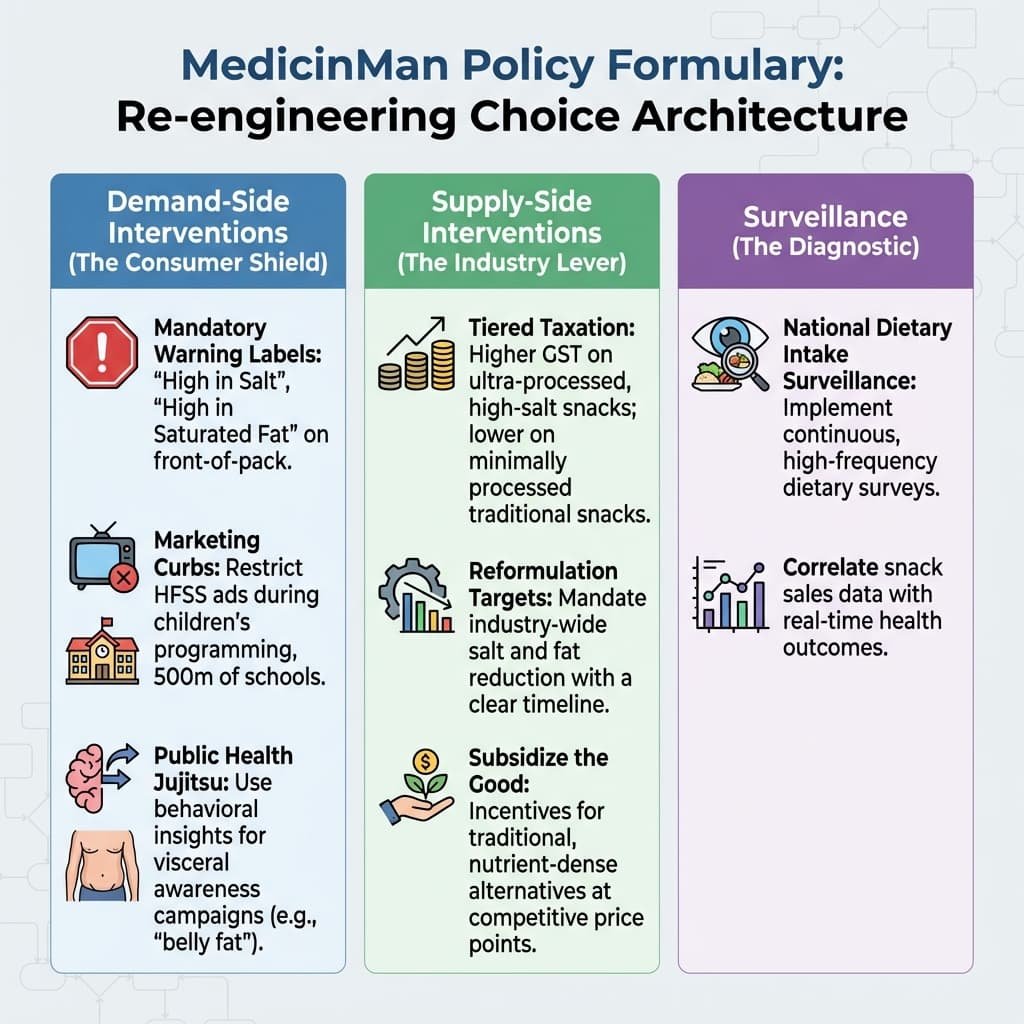

The solution isn’t to ban snacks; it is to re-engineer the choice architecture. Here is the MedicinMan policy formulary:

Demand-Side Interventions (The Consumer Shield)

· Mandatory Warning Labels: Implement stark, front-of-pack warning labels (“High in Salt,” “High in Saturated Fat”) for products exceeding nutrient thresholds. Industry will scream, but the data from Latin America proves it works.

· Marketing Curbs: Restrict advertising of high-fat/sugar/salt (HFSS) foods during children’s programming and within 500 meters of school zones.

· Public Health Jujitsu: Use the same behavioral insights used by FMCG companies (loss aversion, social norms) to drive public awareness campaigns. Show the visceral reality of “belly fat,” not abstract future disease.

Supply-Side Interventions (The Industry Lever)

· Tiered Taxation: Implement a health cess or differential GST. Tax ultra-processed, high-salt snacks at a higher rate than minimally processed traditional snacks (like roasted chana or makhana).

· Reformulation Targets: Mandate industry-wide salt and fat reduction targets, akin to the UK’s salt reduction program. Give them a timeline to make the product less toxic.

· Subsidize the Good: Provide incentives (tax breaks, procurement support) for companies manufacturing traditional, nutrient-dense alternatives, making them competitive at the critical ₹5–10 price point.

Surveillance (The Diagnostic)

· National Dietary Intake Surveillance: India tracks agriculture output and disease prevalence but has a massive blind spot regarding what people actually eat. We need a continuous, high-frequency dietary survey to correlate snack sales data with health outcomes in real-time.

Conclusion: The Shareholder vs. The Stakeholder

The ₹5 snack economy is a testament to Indian capitalism’s ability to execute. It is efficient, scalable, and deeply profitable. But from a public health perspective, it is an uncontrolled variable.

The FMCG sector views the consumer’s stomach as a market to be captured. The public health system views it as a host to be protected. These two views are currently on a collision course.

The question for policymakers is not whether to curb the snack economy, but how to channel its immense power towards outcomes that don’t bankrupt the very population it serves. Failure to act means trading short-term corporate profits for long-term, systemic metabolic debt.

Appendix — Sources & Data Landscape

A | Market Growth & Consumption Trends

- Market Size: Industry reports (CRISIL, NielsenIQ) on Indian Snacks Market Forecast 2022–2027.

- Organised Share: RoC filings and annual reports of Haldiram’s, ITC, PepsiCo India; analysis by brokerage firms (Motilal Oswal, ICICI Securities).

- Consumption Patterns: Recent rounds of the National Sample Survey Office (NSSO) data on household consumption expenditure.

B | Health & Nutrition

- Obesity Trends: National Family Health Survey (NFHS-4 vs. NFHS-5) data on adult BMI.

- NCD Mortality: WHO Global Health Estimates; ICMR-State Level Disease Burden Initiative.

- Ultra-Processed Foods: Studies published in The Lancet Diabetes & Endocrinology and Public Health Nutrition on the Indian dietary transition.

- Childhood Overweight: Comprehensive National Nutrition Survey (CNNS) 2016–18 data.

C | Regulatory & Policy

- FOPL Standards: FSSAI’s draft regulations on Front-of-Pack Labelling; comparisons with global best practices (Chile, Mexico).

- Marketing Reviews: Reports by NGOs (like CSE) and WHO reports on marketing of HFSS foods to children in the Southeast Asia region.

All Images are AI Generated for Illustration Only. E&OE