The latest PharmaTrac report for December 2025 offers a compelling snapshot of the Indian Pharmaceutical Market (IPM) at a pivotal moment. As the industry navigates post-pandemic normalization, evolving therapy landscapes, and disruptive innovations, the data reveals not just numbers, but narratives of change, challenge, and opportunity. Here’s an analytical breakdown of what the report tells us about the state of Indian pharma—and what lies ahead.

1. IPM Overview: Steady Growth Amid Realignment

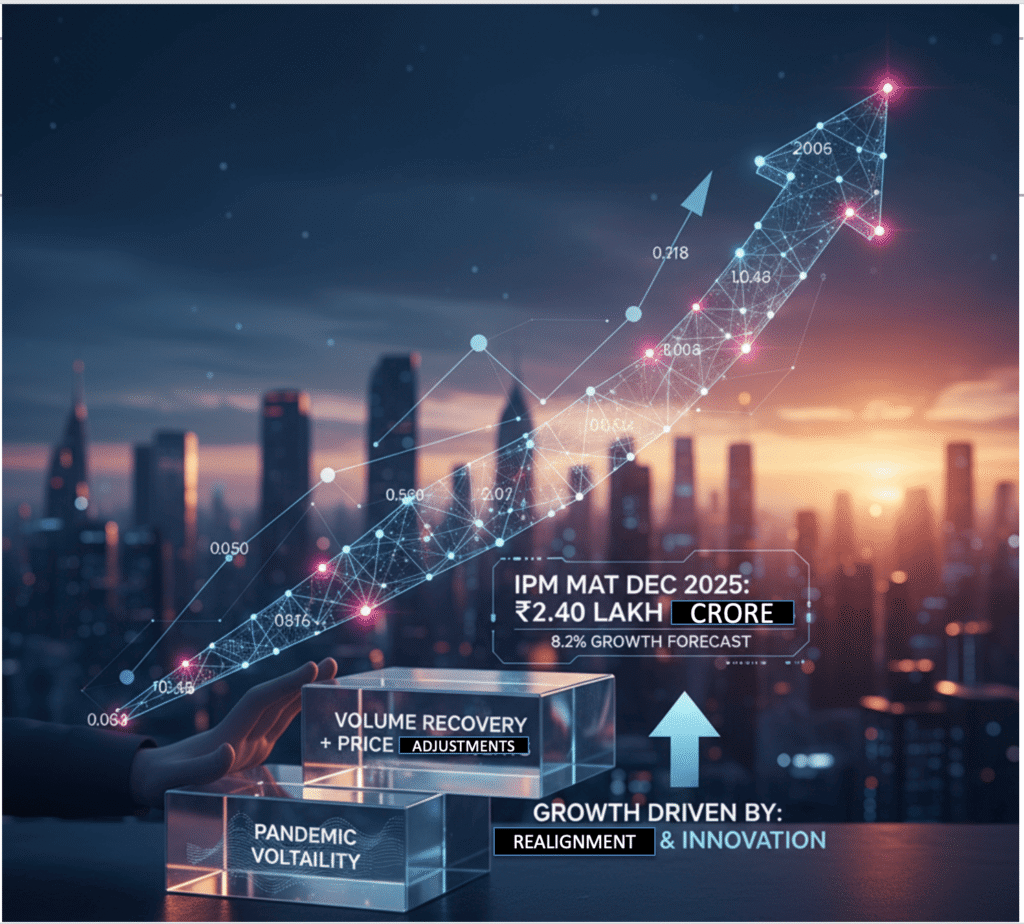

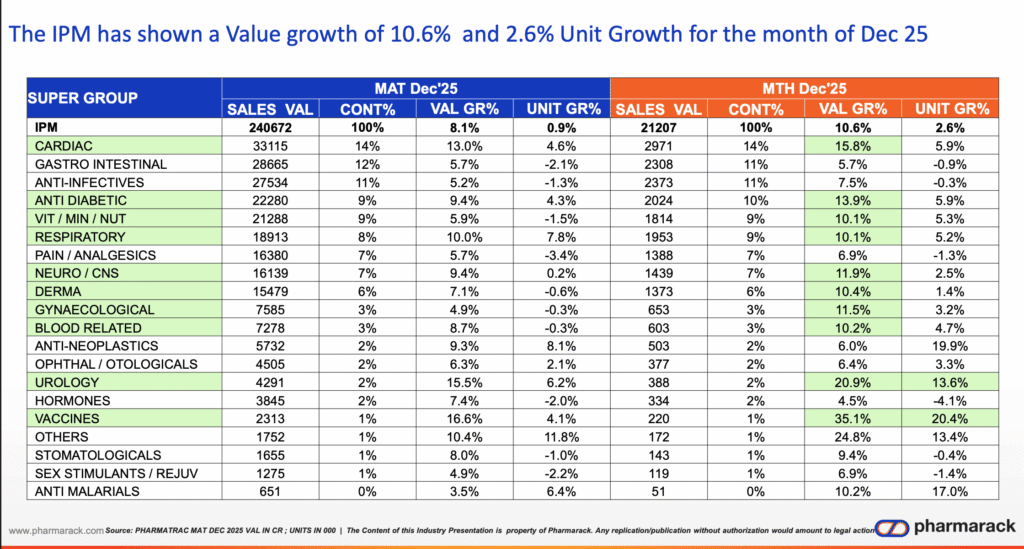

The IPM closed MAT December 2025 at approximately ₹2.40 lakh crores, with a realistic growth forecast of 8.2%. Actual performance closely matched projections, reflecting a market that is stabilizing after years of pandemic-driven volatility.

Key takeaway: Growth is now driven by volume recovery, price adjustments, and new product penetration, rather than pandemic tailwinds.

2. Therapy Performance: The High-Growth Engines

Several therapy areas emerged as clear growth leaders:

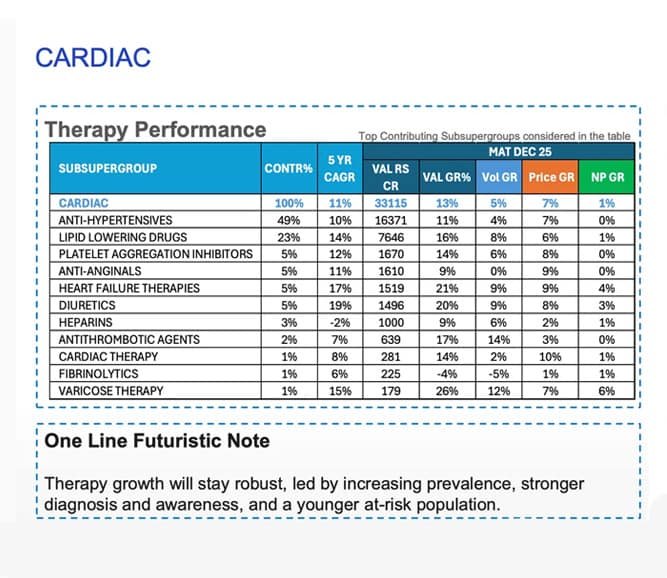

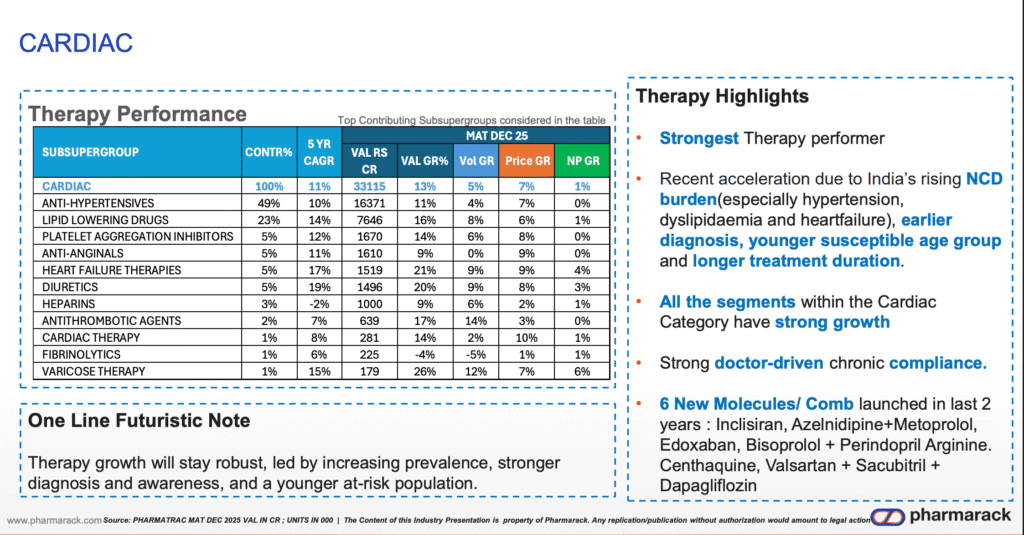

- Cardiac Therapies (13% growth): Driven by rising NCD burden, earlier diagnosis, and chronic compliance. New molecules like Inclisiran and Sacubitril combos are expanding treatment paradigms.

- Anti-Diabetes (9.4% growth): While traditional OADs and insulin hold volume, GLP-1 agonists are the spotlight, with 127.9% growth—fueled by obesity indication launches and premium pricing.

- Urology (15.5% growth): One of the fastest-growing therapies, propelled by ageing demographics, reduced stigma, and branded generics in BPH and OAB segments.

- Neuro/CNS (9.4% growth): Under-penetrated but rising fast due to mental health awareness, ageing, and new launches in depression and psychosis.

3. The Anti-Obesity Revolution: From Premium to Mass

The report dedicates significant attention to the anti-obesity segment, particularly GLP-1 agonists.

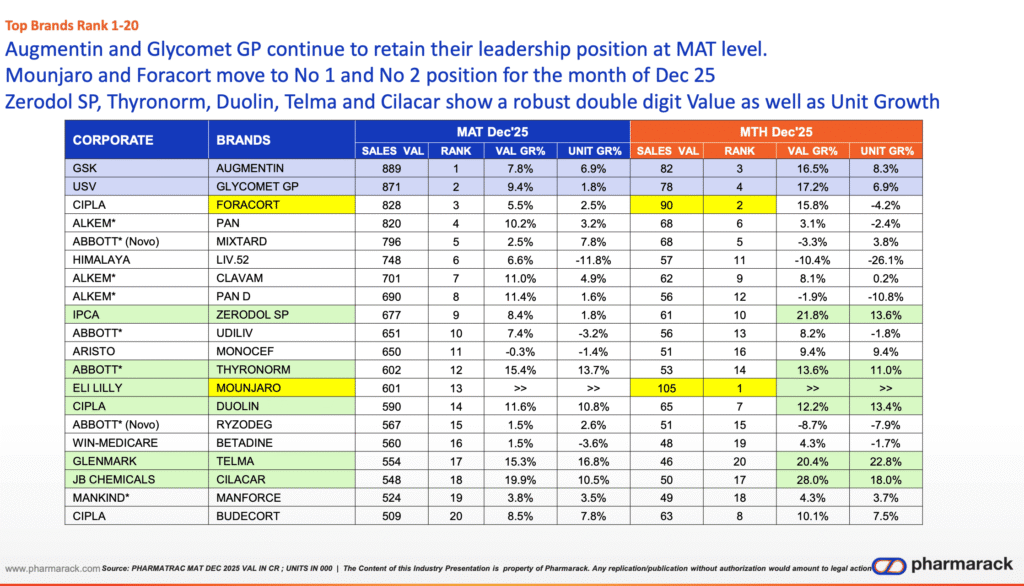

- Mounjaro (Tirzepatide) and Rybelsus (Semaglutide) have reshaped the market, moving to top brand ranks in monthly sales.

- Branded generics are expected from March 2026, likely priced at 20–35% of innovators, which could trigger a 2x–5x volume surge in the first few months.

- Indian companies like Cipla, Dr. Reddy’s, Sun Pharma, and Lupin are poised to capitalize, potentially democratizing access.

4. Mature Therapies: Stability with Seasonal Swings

Categories like Gastro Intestinals (5.7%), Anti-Infectives (5.2%), and Pain/Analgesics (5.7%) show moderated growth, reflecting:

- Acute and seasonal demand patterns.

- Regulatory scrutiny on irrational combinations (especially in anti-infectives).

- OTC shift diluting prescription momentum.

5. Oncology & Specialty Care: Niche but High-Potential

- Anti-Neoplastics (9.3% growth): Driven by rising incidence, biosimilars, and targeted therapies. Monoclonal antibodies grew at 26% CAGR.

- Respiratory (10% growth): Pollution and urban lifestyle are fueling chronic demand, though seasonal infections add volatility.

6. Corporate Landscape: Leadership in Flux

- Sun Pharma leads in value share, with 12.2% MAT growth.

- Cipla, Intas, and Torrent show strong double-digit growth, reflecting robust chronic and acute portfolios.

- Mounjaro (Eli Lilly) and Foracort (Cipla) topped monthly brand rankings, underscoring the impact of innovation and volume-driven chronic brands.

7. Key Growth Levers: Volume, Price, New Products

For the first time in recent memory, all three growth levers—volume, price, and new product contribution—are positive for most top therapies in December 2025. This signals a healthy, balanced market recovery, not just price-led inflation.

8. The Road to 2026: Four Strategic Segments

The report categorizes IPM into four future-facing segments:

- High-growth, lifestyle-led therapies (e.g., GLP-1, Cardiology, Urology)

- Demographics-driven therapies (e.g., Neuro, Oncology)

- Mature acute therapies (e.g., Gastro, Anti-infectives)

- OTC/OTx-oriented categories (e.g., Derma, Nutritionals)

9. Risks and Realities

- Regulatory pressures (NLEM, FDC bans) continue to shape pricing and portfolio strategies.

- Generic erosion is imminent in high-value segments like anti-obesity.

- Channel shifts toward OTx, OTC, and e-pharmacy are disrupting traditional Rx models.

Conclusion: Strategic Imperatives for 2026

The IPM is at an inflection point. Growth is no longer pandemic-driven but innovation-led, demography-anchored, and access-expanded. Companies must:

- Invest in chronic and specialty portfolios with strong patient-compliance ecosystems.

- Prepare for generic waves in premium segments like GLP-1.

- Leverage OTC and digital channels to capture self-care demand.

- Monitor policy shifts and realign portfolios toward rational, evidence-based therapies.

The Indian pharma market remains one of the world’s most resilient and dynamic. For those willing to decode its signals—like this PharmaTrac report—the opportunities are as vast as the challenges are real.

This analysis is based on the PharmaTrac MAT December 2025 report.

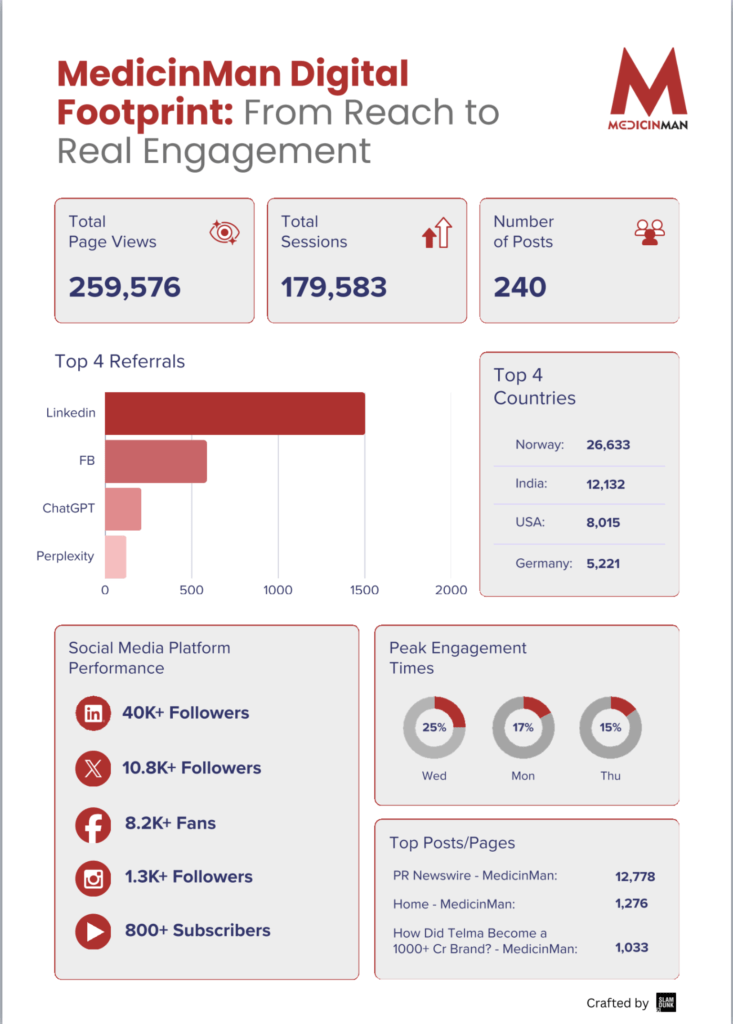

Published on www.medicinman.net

Author: Insights Team

Date: January 28, 2026