GCCs – Indian Pharma moves up the Value Chain – Sanofi, Amgen, Eli Lilly, J&J and others are investing billions in India’s new breed of Global Capability Centres

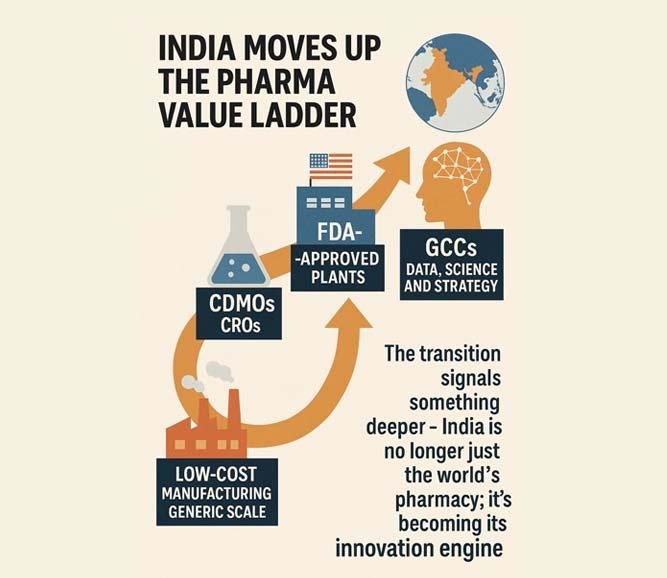

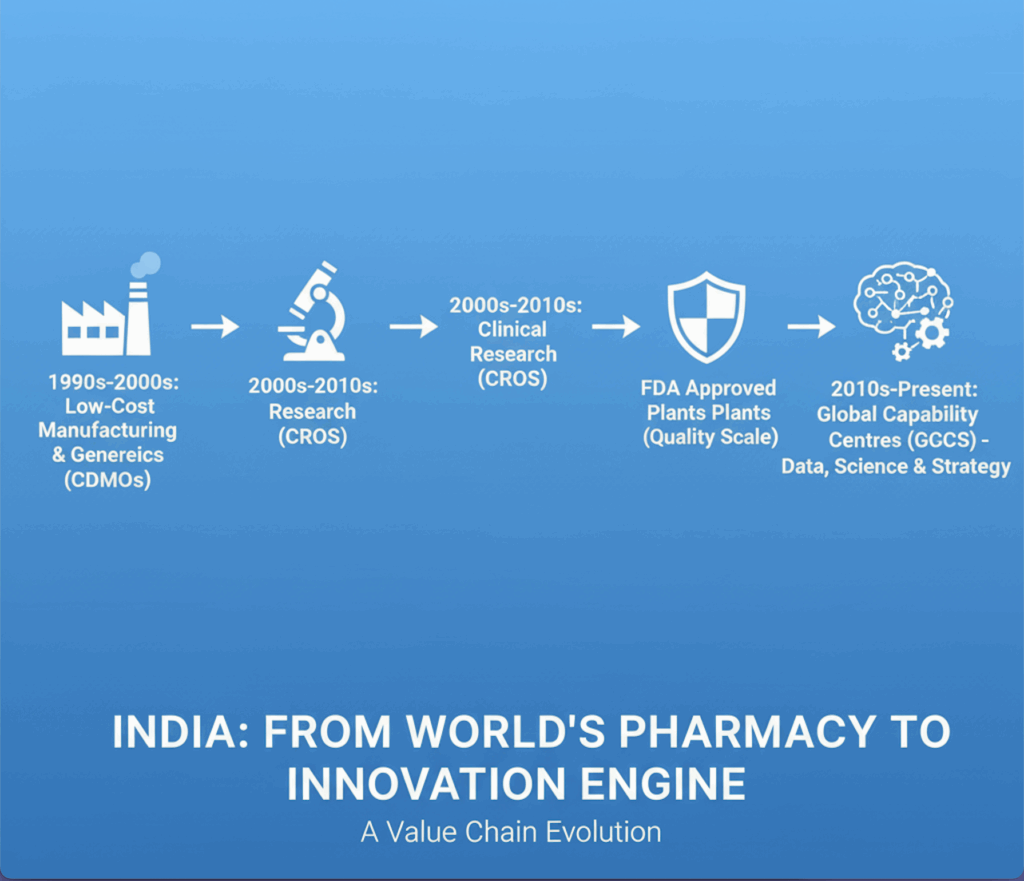

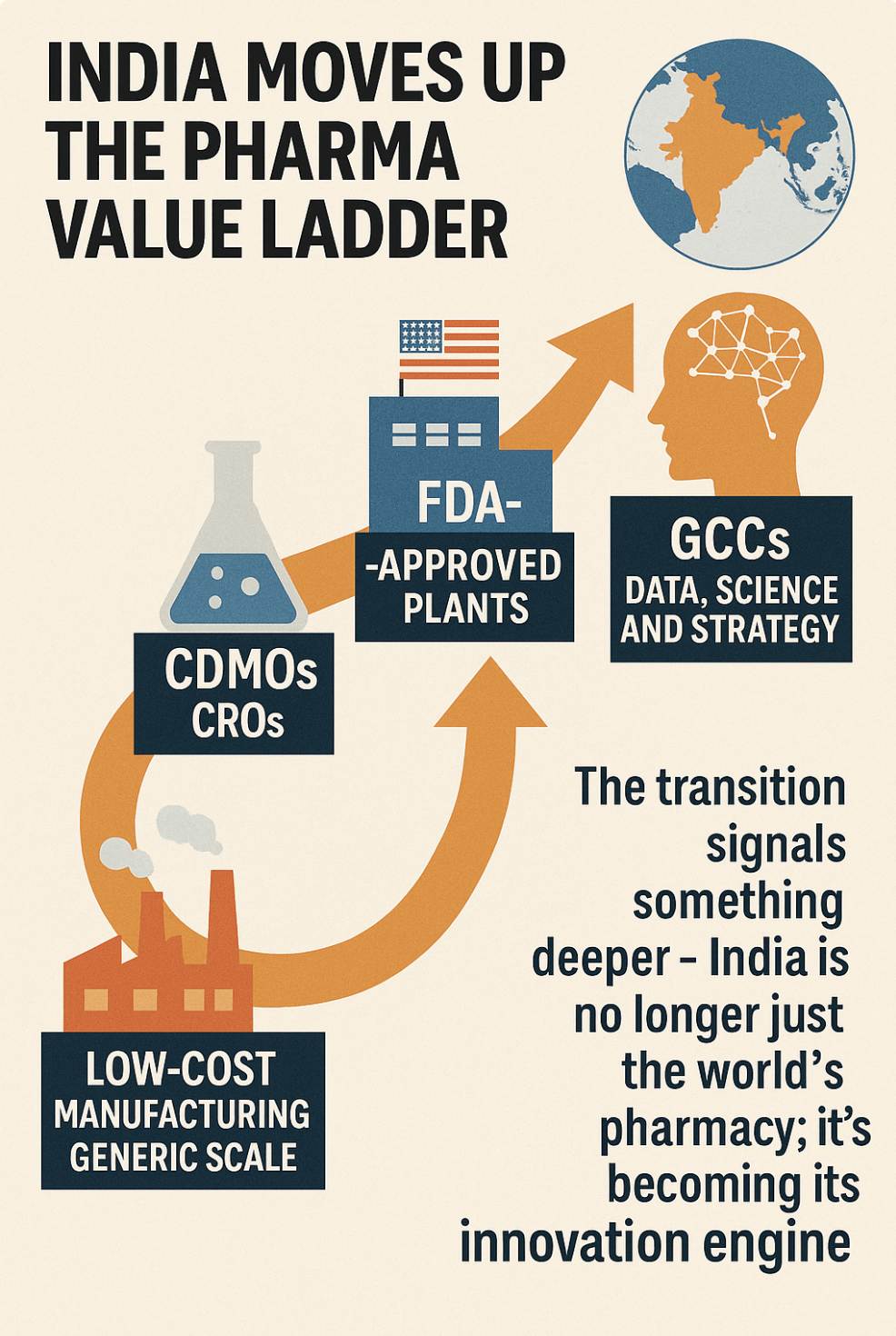

For decades, multinational pharma companies viewed India through a single lens — low-cost manufacturing and generic scale. Those days are gone. The India footprint has steadily climbed the value ladder: from contract development and manufacturing organisations (CDMOs) to clinical research organisations (CROs), then FDA-approved plants, and now Global Capability Centres (GCCs) that run on data, science and strategy.

The transition signals something deeper — India is no longer just the world’s pharmacy; it’s becoming its innovation engine.

What’s driving this shift?

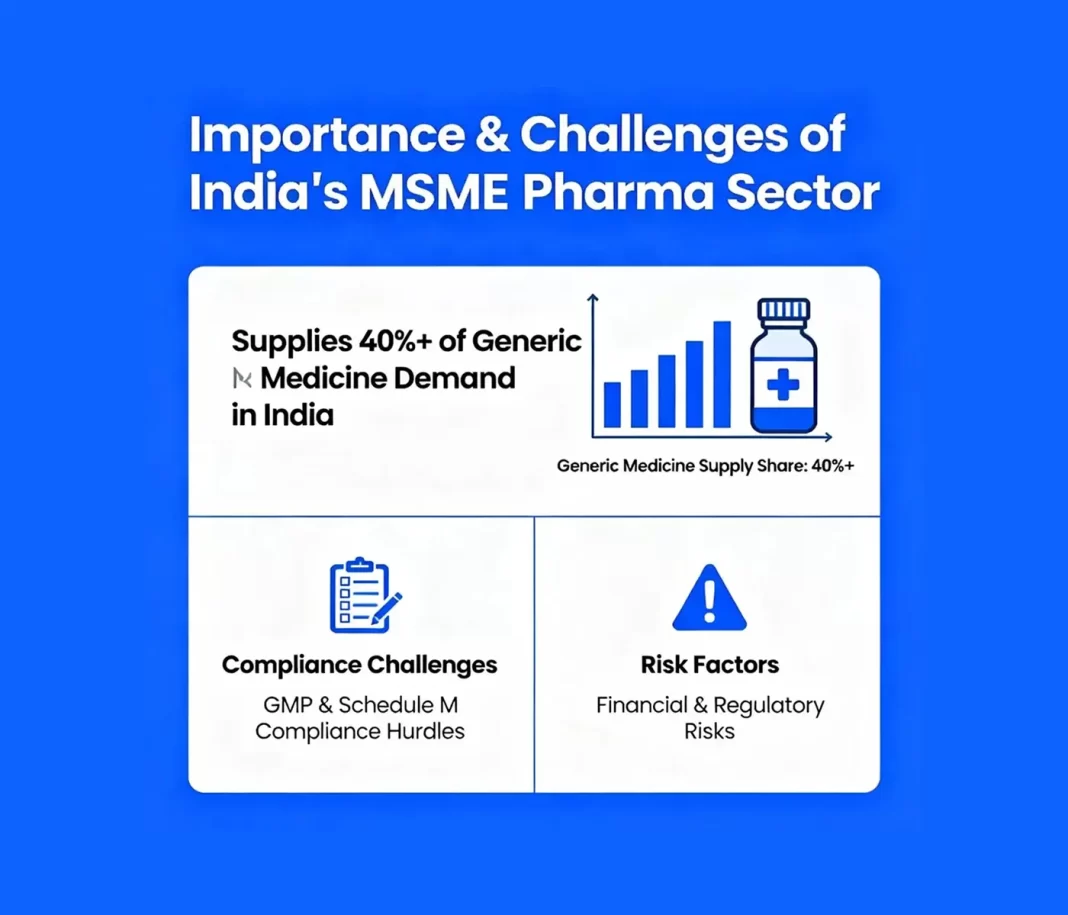

1. Regulatory trust: With the world’s highest number of US FDA-approved plants outside America, India has proven its manufacturing quality and compliance maturity.

2. Digital depth: Over two decades of IT and analytics outsourcing have created a dense pool of data, AI, and regulatory expertise — exactly what modern pharma needs.

3. Policy push: States like Telangana and Karnataka have cut red tape, enabling “single window” approvals for global life-sciences investors.

4. Strategic mindset: MNCs want to de-risk dependence on the West and tap India’s hybrid of life sciences and digital engineering.

GCCs: India’s new nerve centres

GCCs are no longer just back offices. They’re the strategic brain extensions of global pharma, handling everything from clinical data management to AI-driven drug discovery.

At the top end of this new wave:

• Sanofi is expanding its Hyderabad GCC to over 2,600 employees, investing €400 million to embed digital, data, and patient-centric functions.

• Amgen has leased ~500,000 sq. ft. in HITEC City for analytics, AI and commercial strategy work.

• Eli Lilly has committed $1 billion+ to India, setting up an integrated manufacturing and capability hub in Hyderabad.

• Johnson & Johnson (Innovative Medicine division) is establishing its own GCC at RMZ Nexity, HITEC City — with multiple job listings suggesting it’s already operational.

These hubs now drive real-time clinical analytics, global regulatory filings, AI model development, and market access insights for launches across 100+ countries.

🌏 Scale of the ecosystem

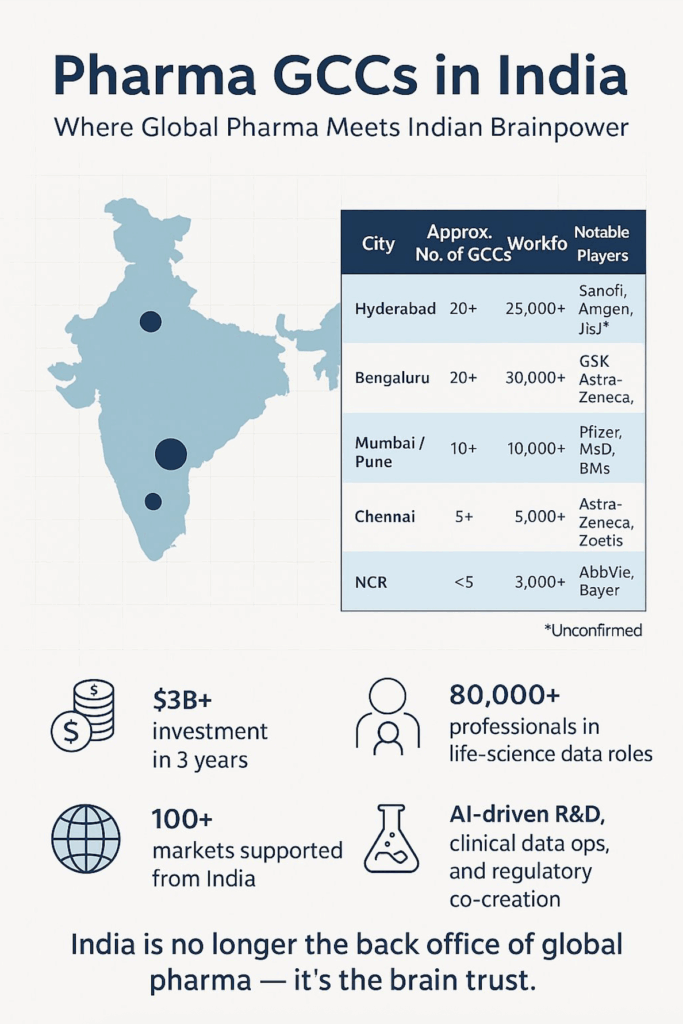

• India now hosts 40–60 pharma and life-sciences GCCs, spread across roughly 95 facilities nationwide.

• Collectively, they employ tens of thousands of high-value professionals — biostatisticians, regulatory writers, data engineers and scientists.

• Bengaluru and Hyderabad lead the race, thanks to their deep tech-biotech convergence, talent density, and proactive state support.

CDMOs, CROs, and FDA plants — the foundation beneath

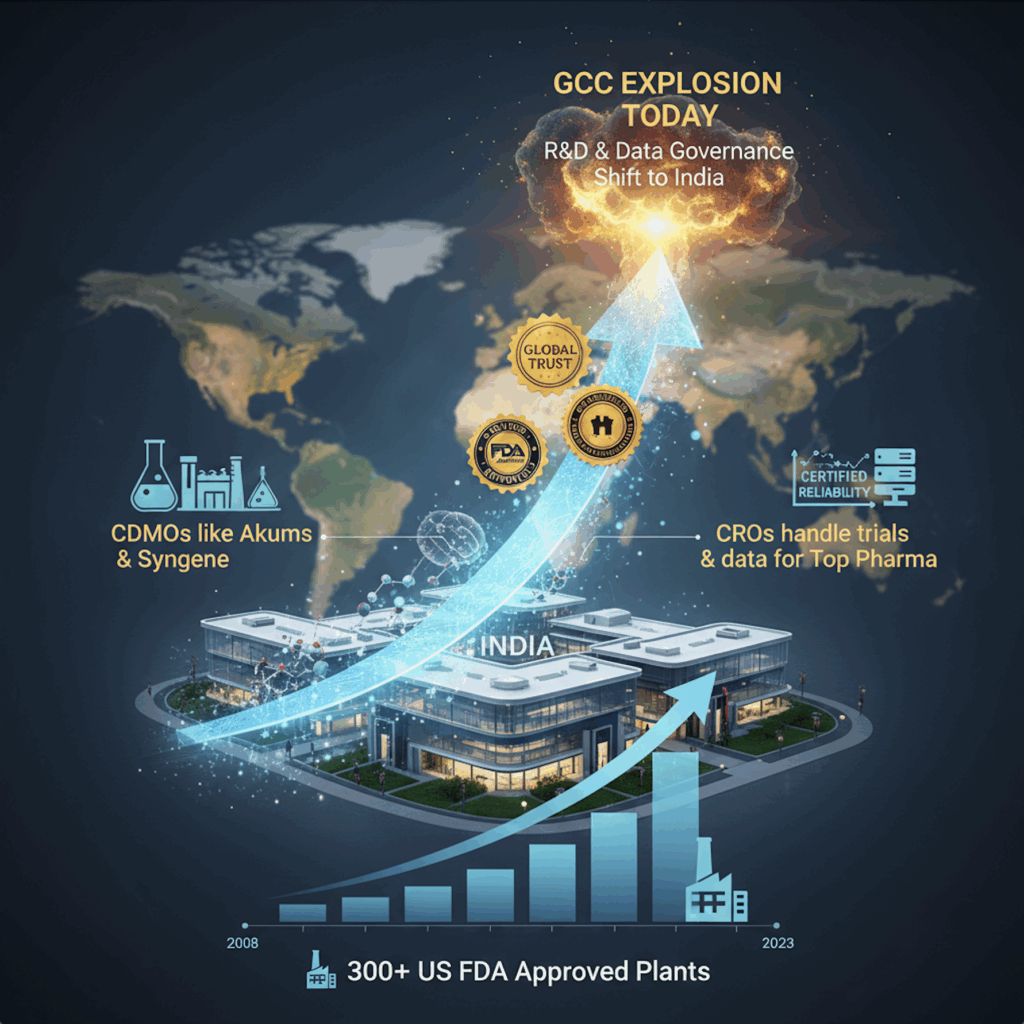

India’s surge in CDMO and CRO capabilities over the last 15 years has created the trust base for today’s GCC explosion.

• Indian CDMOs like Akums and Syngene built global reputations for reliability and regulatory rigor.

• India’s CROs now handle trials and data management for dozens of top-20 pharma companies.

• More than 300 Indian plants have US FDA approval — the largest cluster outside the U.S.

That manufacturing credibility makes global firms confident to shift R&D and data governance operations here.

Challenges and friction points

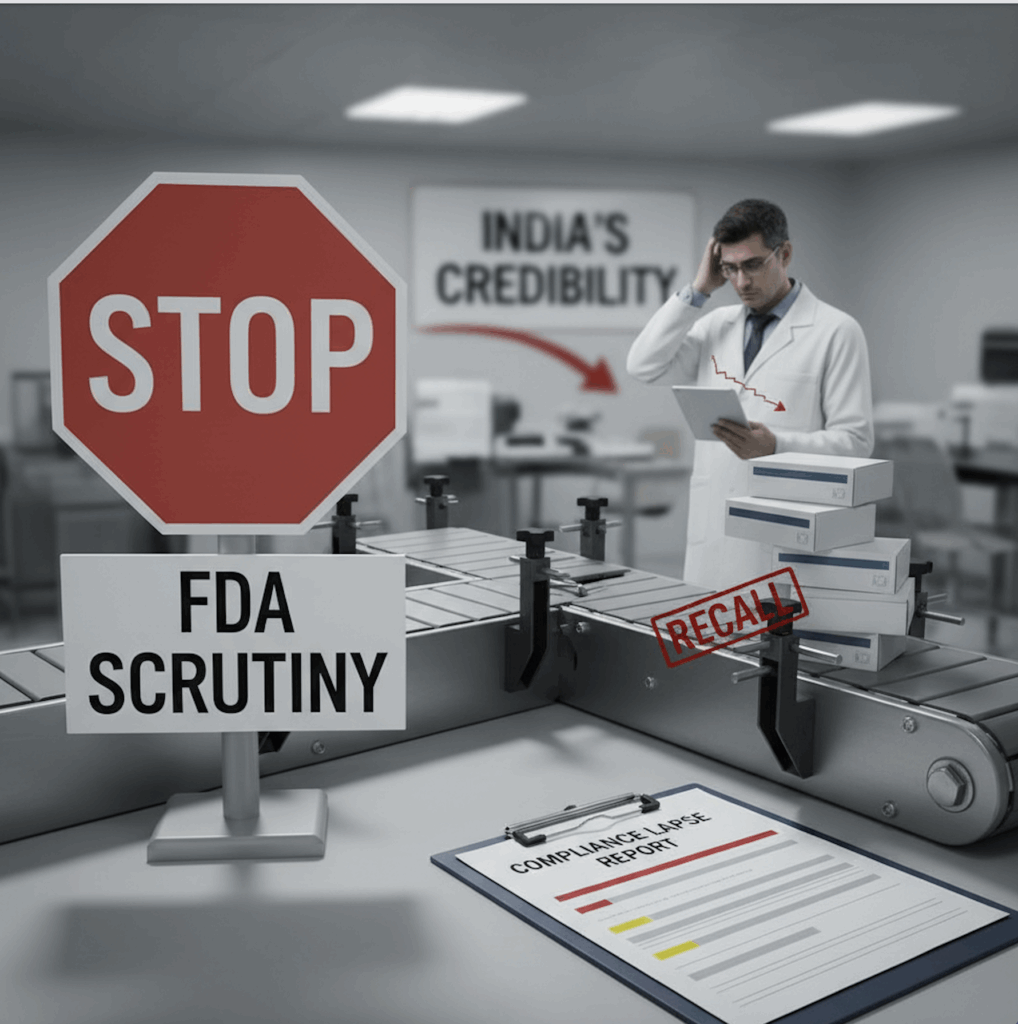

• Quality vigilance: Repeated compliance lapses in some manufacturing units have drawn FDA scrutiny — a reminder that India’s credibility must be constantly earned.

• Talent crunch: Pharma GCCs are now vying with FAANG firms and AI startups for the same digital talent.

• Rising real-estate costs: Hyderabad’s HITEC City and Bengaluru’s Whitefield are heating up, pushing companies to explore Tier-2 locations like Pune, Ahmedabad, and Chennai.

What this means

• For policymakers: Speed, transparency, and life-sciences skilling are the new currency.

• For global pharma leaders: India is no longer a cost-saving destination — it’s a strategic value creator.

• For young professionals: This is the new “biotech-plus-data” career wave. The future roles will be hybrid — where biology meets algorithms.

🚀 The next chapter

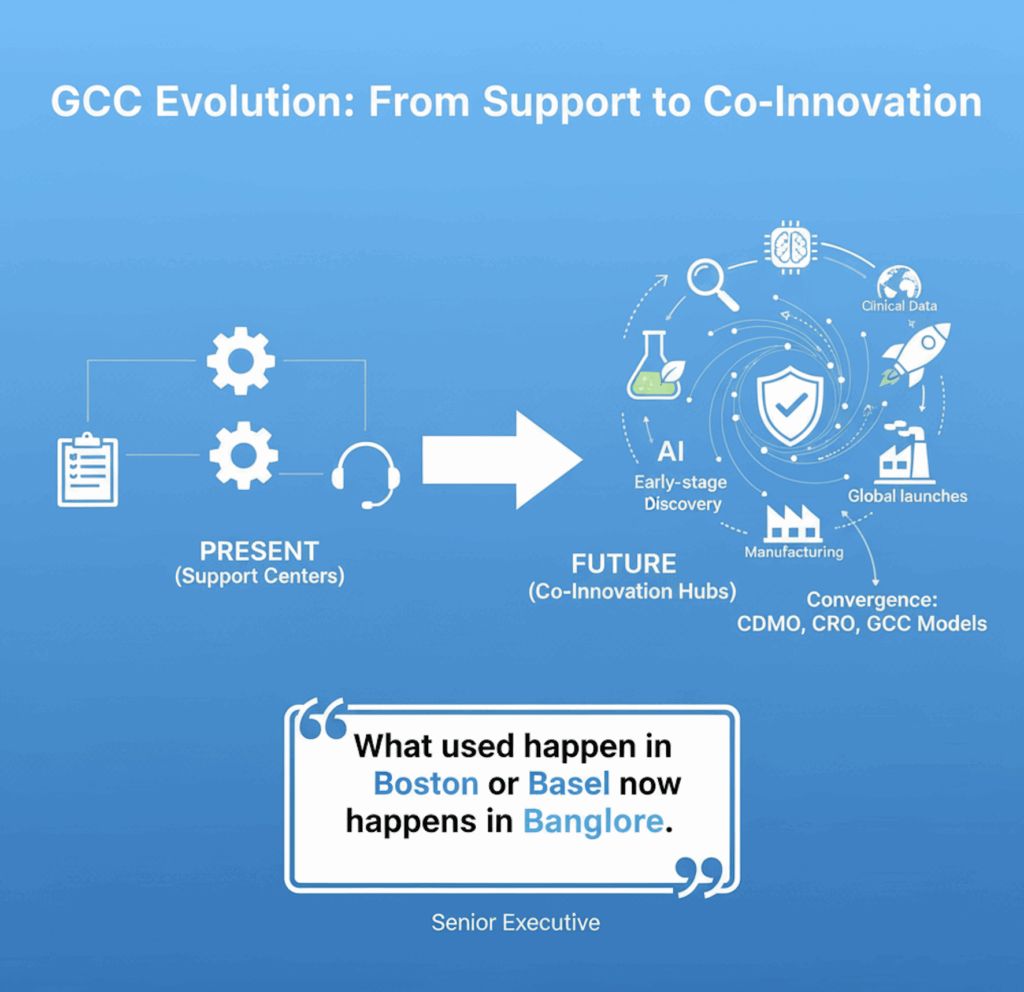

The next five years will see GCCs evolve from “support centres” to co-innovation hubs that shape early-stage discovery, regulatory strategy, and global launches.

Expect AI, clinical data, and manufacturing to converge — blurring lines between CDMO, CRO, and GCC models.

As one senior executive put it, “What used to happen in Boston or Basel now happens in Bangalore.”

India’s life-sciences transformation isn’t a sprint — it’s a marathon of credibility, capability, and creativity. The baton has officially changed hands.

📚 Appendix — Sources & Further Reading

1. Sanofi Global Capability Centre expansion — Sanofi Press Release, 2024

2. Amgen Hyderabad GCC lease — Economic Times, 2024

3. Eli Lilly $1B India investment — Bloomberg India, 2024

4. OPPI Report — Global Capability Centres 2025: Pharma & Life Sciences

5. Akums Pharma — CDMO India Market Report, 2024

6. CareEdge — US FDA-Approved Facilities in India 2024

7. ICON plc Insights — How GCCs Deliver Value for Healthcare Companies, 2023

8. Government of Telangana — Life Sciences Investment Policy 2023

9. Local coverage — J&J GCC at RMZ Nexity (HITEC City), 2025

AI Generated Images for Illustration Only. E&OE