In a significant development for the Indian pharmaceutical industry, Kuala Lumpur-based private equity firm Creador has acquired a 7% stake in Ahmedabad-headquartered La Renon Healthcare for ₹800 crore. This investment values La Renon at nearly ₹11,000 crore, marking a major milestone in the company’s rapid growth journey and reflecting robust investor confidence in India’s pharmaceutical sector.

Background of the Deal

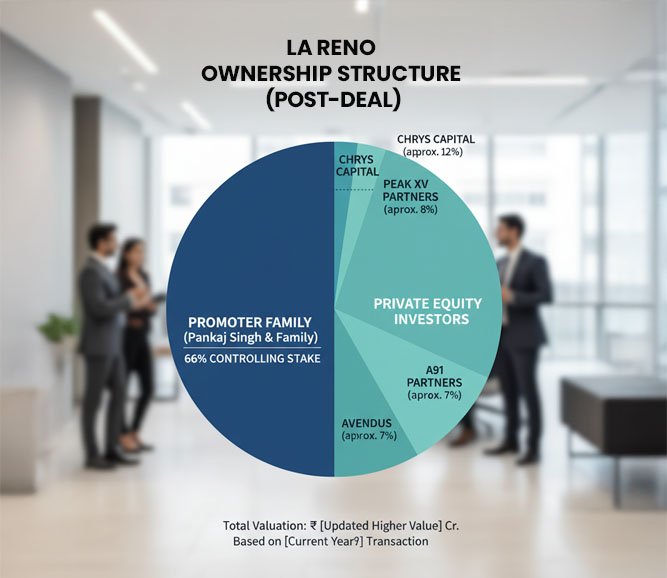

The new transaction builds on La Renon’s earlier funding successes and sharp valuation rise. Post-deal, the promoter family led by Pankaj Singh retains a controlling 66% stake, while private equity investors including ChrysCapital, Peak XV Partners, A91 Partners, and Avendus collectively hold 34%. Specifically, the promoter family is selling about 5% of equity, with Peak XV offloading around 2% to accommodate the new investment.

This is not Creador’s first foray into La Renon. In recent years, ChrysCapital acquired an 8% stake valuing the company at ₹6,500 crore in 2024. Avendus Future Leaders Fund also participated with minority investments during this period. The current deal values La Renon higher than ever, underscoring the growth narrative backed by strong fundamentals and expanding market presence.

About La Renon Healthcare

La Renon Healthcare is a well recognized name in India’s branded pharmaceutical formulations market. The company specializes in chronic therapies with a strong presence across therapeutic areas such as nephrology, central nervous system disorders, cardiometabolic diseases, gastroenterology, and gynecology. Its diverse portfolio now comprises over 340 formulations.

Notably, La Renon’s business focuses on branded generics, which target long-term conditions requiring ongoing medication — segments that are typically less vulnerable to pricing pressures and enjoy more stable demand. The company markets its products not only across India but also exports to over 40 countries globally, marking it as an important player in the international pharmaceutical market.

Financial Performance and Growth Projections

In FY25, La Renon reported revenues of ₹1,640 crore and EBITDA of ₹330 crore. The company is poised for accelerated growth, projecting revenues to exceed ₹2,000 crore and EBITDA to reach upwards of ₹450 crore in the current fiscal year.

To meet growing demand and expand production capacity, La Renon is investing in a new oral solid dosage manufacturing plant in Rajasthan. This facility, expected to ramp up production from 100 million to 400 million tablets and capsules monthly, will boost the company’s manufacturing footprint and support both domestic sales and exports.

Strategic Importance of Creador’s Investment

This fresh capital infusion from Creador represents a critical enabler for La Renon to scale operations, drive innovation, and strengthen its position in chronic therapy segments. Private equity firms like Creador bring not just funds but also strategic guidance, global networks, and operational expertise—assets invaluable for companies navigating the growing competitive pharmaceutical landscape.

India’s pharmaceutical industry is witnessing increased institutional investments as investors seek growth in branded generics and specialty therapies. La Renon, with its robust promoter backing and a focused chronic disease portfolio, stands out as a sustainable growth opportunity, attracting keen investor attention.

Investor Profiles

Creador manages $3 billion in assets with investments concentrated in South and Southeast Asia, aiming to back growth-stage companies with scalable business models. This recent investment in La Renon forms a part of their sixth fund, which closed at $800 million—above target—demonstrating strong market appetite for healthcare assets.

Other major investors such as ChrysCapital and Peak XV Partners have a history of backing promising pharmaceutical firms in India, reflecting a broader trend of private equity playing a strategic role in the sector’s evolution.

Future Outlook

The Creador-La Renon deal exemplifies the growing maturation and sophistication of India’s pharmaceutical ecosystem. Chronic therapies, which often require continuous care and medication, offer relatively stable cash flows and growth potential—attributes that align well with private equity investment criteria.

With the bolstered financial backing and expanded capacity, La Renon is well-positioned to consolidate its leadership in chronic disease management through branded generics. The company’s global ambitions, reflected in its exports to diverse international markets, further underscore its growth trajectory.

For investors and stakeholders alike, this transaction symbolizes confidence not only in La Renon’s strategy but also in India’s broader pharmaceutical market, which continues to evolve amid rising healthcare demand and increasing global integration.

Conclusion

Creador’s acquisition of a 7% stake in La Renon Healthcare for ₹800 crore highlights a decisive moment in the company’s journey and the Indian pharmaceutical investment landscape. It reinforces La Renon’s position as a leading branded formulations company focused on chronic therapies, backed by strong promoter control and an evolving base of private equity investors.

As La Renon expands manufacturing capabilities and strengthens its therapeutic offerings, it exemplifies the opportunities that well-managed Indian pharmaceutical companies present for strategic growth, investor interest, and healthcare innovation in India and beyond.