Biocon Biologics secures FDA approval for Bosaya™ and Aukelso™, biosimilars to Prolia® and Xgeva®. What this means for patients, payers, and Amgen.

A Landmark for Indian Biologics

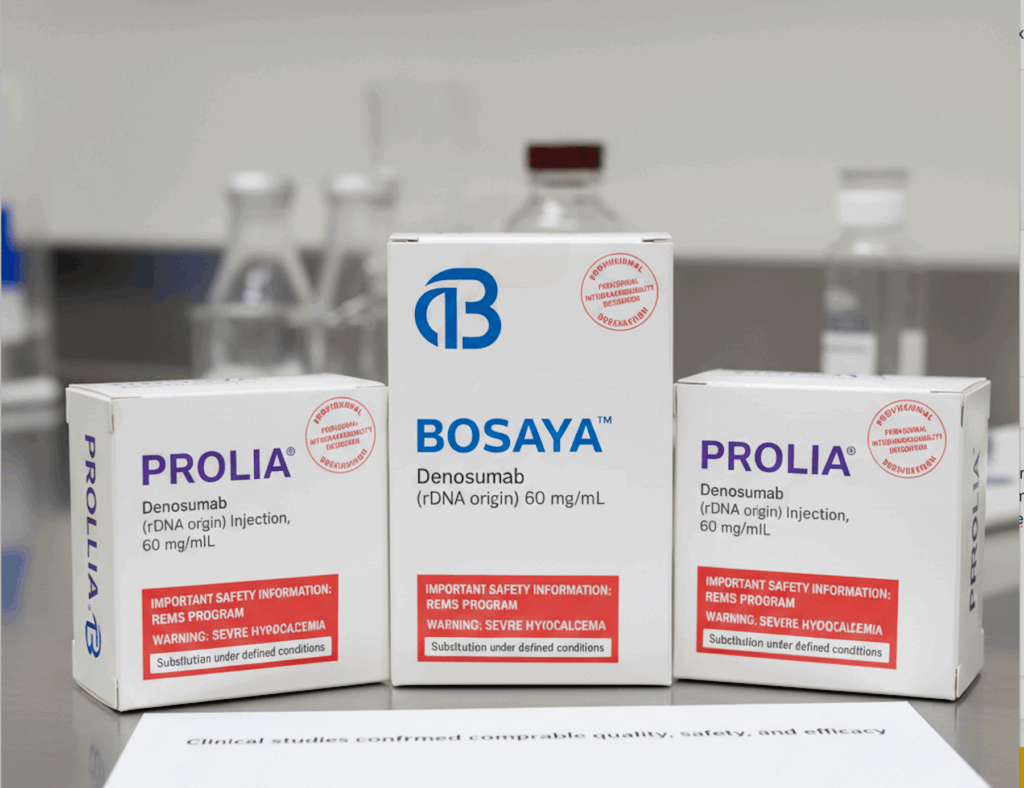

Biocon Biologics has secured U.S. FDA approval for two denosumab biosimilars — Bosaya™ and Aukelso™. These drugs, biosimilar to Amgen’s blockbuster brands Prolia® and Xgeva®, address critical needs in osteoporosis and oncology care.

This milestone reinforces India’s position in the global biologics market, signaling a shift from being primarily a generics supplier to competing in high-value specialty medicines.

Product Snapshots

• Bosaya™ (denosumab-kyqq) — Biosimilar to Prolia®

Approved for:

• Osteoporosis in postmenopausal women and men at high risk of fracture

• Glucocorticoid-induced osteoporosis

• Bone loss from certain cancer therapies

• Aukelso™ (denosumab-kyqq) — Biosimilar to Xgeva®

Approved for:

• Preventing skeletal complications in multiple myeloma and bone metastases from solid tumors

• Treating giant cell tumor of bone

• Hypercalcemia of malignancy unresponsive to bisphosphonates

Both approvals come with provisional interchangeability designation, enabling substitution under defined conditions. Clinical studies confirmed comparable quality, safety, and efficacy. Bosaya™ also carries the same REMS program as Prolia®, including warnings about severe hypocalcemia in advanced chronic kidney disease.

The Market at Stake

Denosumab is a multi-billion-dollar category in the U.S., generating nearly $5 billion annually. Osteoporosis affects over 10 million Americans above 50, while bone metastases impact more than 330,000 patients. Affordable biosimilars could significantly reduce cost barriers, broaden access, and improve adherence.

For Biocon, this is a high-stakes entry into a market where branded incumbents still hold strong ground.

Competitive Landscape — Amgen’s Challenge

Amgen’s Prolia and Xgeva are established revenue engines. With biosimilar competition now real, Amgen will likely respond with:

• Patent and legal defenses to delay or constrain market entry.

• Aggressive rebate and contracting strategies with payers and hospital systems.

• Enhanced service offerings (patient-support programs, adherence hubs, KOL engagement) to retain prescriber loyalty.

The fight will play out not only in courtrooms but also in payer negotiations and specialty pharmacy contracts.

Pricing and Access Dynamics

• Initial discounts: Biosimilars typically launch at 15–35% below reference price, widening over time as competition builds.

• Channel strategy: Success depends on specialty pharmacies, infusion centers, and integrated delivery networks (IDNs). These players demand reliability in supply, safety support, and competitive net pricing.

• Formulary decisions: Payers may accelerate biosimilar adoption to capture savings, but provider comfort with switching will shape uptake velocity.

For patients, greater affordability could mean more consistent treatment — particularly for those previously deterred by out-of-pocket costs.

What Biocon Must Deliver

Approvals are just the starting point. To gain traction, Biocon will need to:

1. Guarantee robust supply and seamless REMS compliance.

2. Offer flexible contracting with payers and hospital systems.

3. Build real-world evidence to reassure clinicians about switching.

4. Provide patient-support services (co-pay help, onboarding, adherence tools) to match or exceed Amgen’s programs.

Execution on these levers will determine whether Bosaya™ and Aukelso™ win meaningful share in the next 2–3 years.

Why This Matters

For India, this approval is symbolic: moving from volume generics to value biologics. For global healthcare systems, it signals a future where high-cost biologics face genuine competition.

For patients, the promise is straightforward — more accessible, affordable treatment for osteoporosis and oncology complications.

If Biocon delivers, the ripple effect will be felt far beyond the U.S. — reshaping the biosimilars playbook and redefining Indian pharma’s place in the global innovation chain.

Appendix: Sources

1. Biocon Biologics Receives U.S. FDA Approval for Bosaya™ and Aukelso™

2. ScanX News: Biocon Biologics Secures FDA Approval for Two Denosumab Biosimilars

3. Business Standard: Biocon Biologics Secures USFDA Approval for Bosaya™ and Aukelso™

All images are AI generated for illustration only – E&OE