KKR’s Investments in India’s Medical Devices Market: Strategic Implications and Key Investors

Introduction

The Indian medical devices sector is witnessing unprecedented growth, fueled by rising healthcare demands, government initiatives, and increasing foreign investments. Among the leading global investors, KKR (Kohlberg Kravis Roberts & Co.) has made significant inroads into India’s medical devices market, reflecting its strategic vision for capitalizing on the country’s healthcare transformation. This article examines KKR’s investments, their broader implications, and the other key investors shaping India’s medical devices landscape.

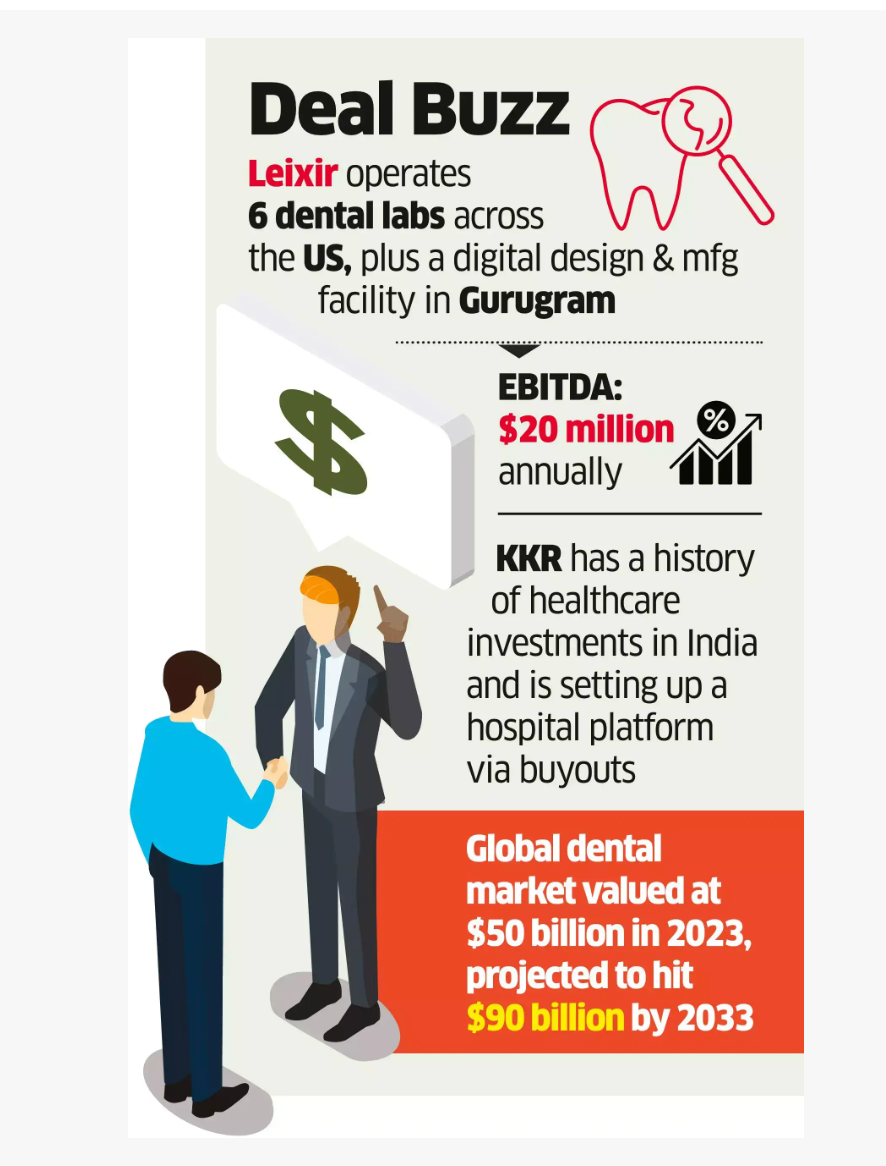

https://economictimes.indiatimes.com/industry/healthcare/biotech/healthcare/kkr-in-talks-to-acquire-us-dental-labs-chain-leixir/articleshow/119768931.cms: India’s Medical Devices Market: Strategic Implications and Key InvestorsKey Points

KKR’s Investments in India’s Medical Devices Market

KKR has aggressively pursued opportunities in India’s healthcare and medical devices sector, with a focus on enhancing local manufacturing capabilities, reducing import dependence, and leveraging export potential.

1. Acquisition of Healthium Medtech

- Transaction Value: ₹7,000 crore (~$840 million)

- Revenue (FY24): ₹820 crore

- EBITDA (FY24): ₹256 crore

- Strategic Significance: Healthium Medtech, formerly known as Sutures India, is India’s largest surgical needle producer and the fourth-largest surgical suture manufacturer globally. KKR’s acquisition aims to strengthen domestic production and expand international exports.

2. Past Investments & Exits

- Healthium Medtech (2018): KKR initially acquired the company from TPG Growth before exiting in 2022 when Apax Partners took over. The re-entry in 2024 underscores its confidence in India’s medtech sector.

- Max Healthcare (2018-2023): KKR’s investment in Max Healthcare, alongside Radiant Life Care, led to a fivefold return upon exit in 2023, demonstrating the firm’s ability to extract substantial value from India’s healthcare space.

3. Strategic Focus Areas

- Localization of Manufacturing: India imports 80% of its medical devices, creating an opportunity for domestic manufacturing growth.

- Export Potential: India’s medical device exports are expanding at a CAGR of 20%, positioning it as a global supplier.

- Regulatory Tailwinds: The Production Linked Incentive (PLI) scheme and National Medical Devices Policy (2023) are catalyzing sectoral expansion.

Other Major Investors in India’s Medical Devices Market

Several global and domestic investors are actively funding India’s medical devices and healthcare sector, recognizing its rapid expansion and untapped potential.

| Investor | Recent Investments | Key Focus |

|---|---|---|

| TPG Growth | Acquired Sai Life Sciences (2021) | Pharma, contract development, manufacturing |

| Blackstone | Acquired Care Hospitals (2023) | Hospitals, diagnostics |

| Carlyle Group | Stake in Medanta Hospitals (2020) | Hospitals, medical infrastructure |

| Temasek Holdings | Invested in Dr. Agarwal’s Eye Hospital (2023) | Specialty healthcare services |

| Advent International | Acquired Supriya Lifesciences (2022) | Pharma APIs, life sciences |

| Everstone Capital | Invested in Sahajanand Medical Technologies (2023) | Cardiovascular devices |

Summary

KKR’s investments in India’s medical devices sector reflect its strategic bet on the country’s healthcare transformation, driven by local manufacturing growth, export opportunities, and policy support. With a focus on scalability and value creation, KKR’s re-entry into Healthium Medtech signals strong confidence in India’s medtech ecosystem. Additionally, other major investors, including TPG Growth, Blackstone, and Carlyle, are reinforcing the sector’s investment attractiveness.

Conclusion

India’s medical devices industry is poised for remarkable growth, with global investors recognizing its vast potential. KKR’s sustained investments demonstrate a long-term vision aligned with the sector’s evolution. As regulatory frameworks mature and domestic capabilities strengthen, India is set to emerge as a global leader in medical devices manufacturing, offering lucrative opportunities for investors and stakeholders alike.

A MedicinManAI Feature