How a niche Indian topicals manufacturer outgrew its CDMO roots, bought a Sanofi icon, and became the hottest target in the Warburg-Mubadala deal room

In June 2021, when Quadria Capital valued Encube Ethicals at ~$800 million, it was considered a fair price for a solid, single-site CDMO with USFDA credentials.

In February 2026, when a consortium of Warburg Pincus and Mubadala emerged as the frontrunner to acquire a 74% stake, the reported valuation had nearly tripled—crossing $2.2 billion.

What happened in between is not merely a story of multiple expansion. It is a strategic masterclass in shedding the “contract manufacturer” label, acquiring branded pricing power, and positioning an Indian pharma asset for the highest echelon of global capital.

This is the full journey of Encube Ethicals—and what it signals for the Indian pharmaceutical services ecosystem.

I. THE FOUNDATION: STAYING NARROW TO GO DEEP

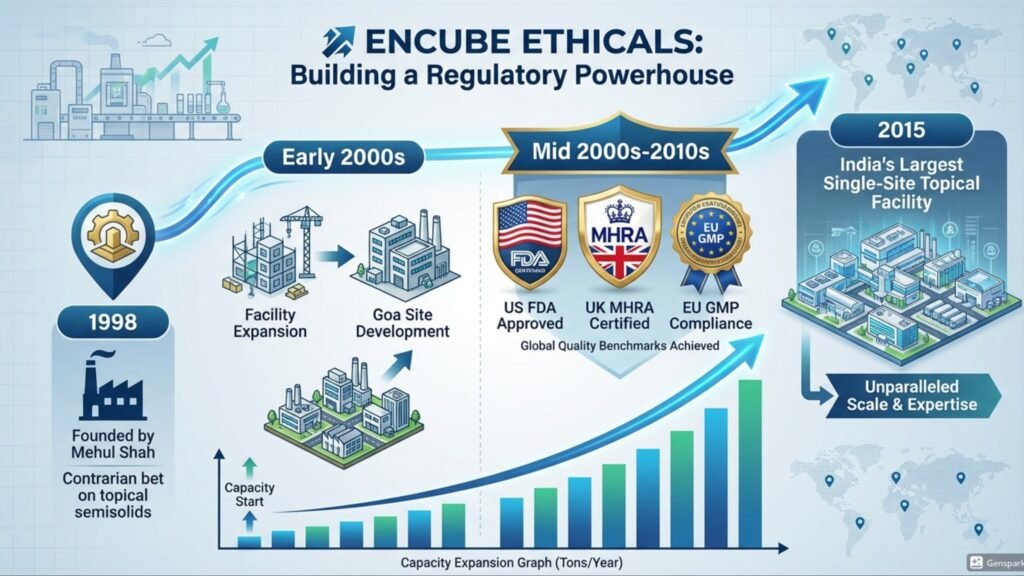

Encube Ethicals was founded in 1998 by Mehul Shah. While his peers rushed to build oral solid pipelines targeting the ANDA queue, Shah made a contrarian bet: topical semisolids.

Creams, ointments, gels, lotions. At the time, this was the unfashionable corner of pharma manufacturing. Low volume, high complexity, sticky formulations. Not the stuff of billion-dollar blockbusters.

But Shah understood something that took the market two decades to validate: Topicals are high-barrier. The physics of emulsions, the stability challenges, the bioequivalence hurdles—these do not yield easily to low-cost competition. Once a customer validates your facility, they rarely leave.

Through the 2000s, Encube built one of the largest single-site topical facilities in India at Goa, earning US FDA, UK MHRA, and EU GMP certifications. By 2015, it was not just a manufacturer; it was a regulatory-standard bearer.

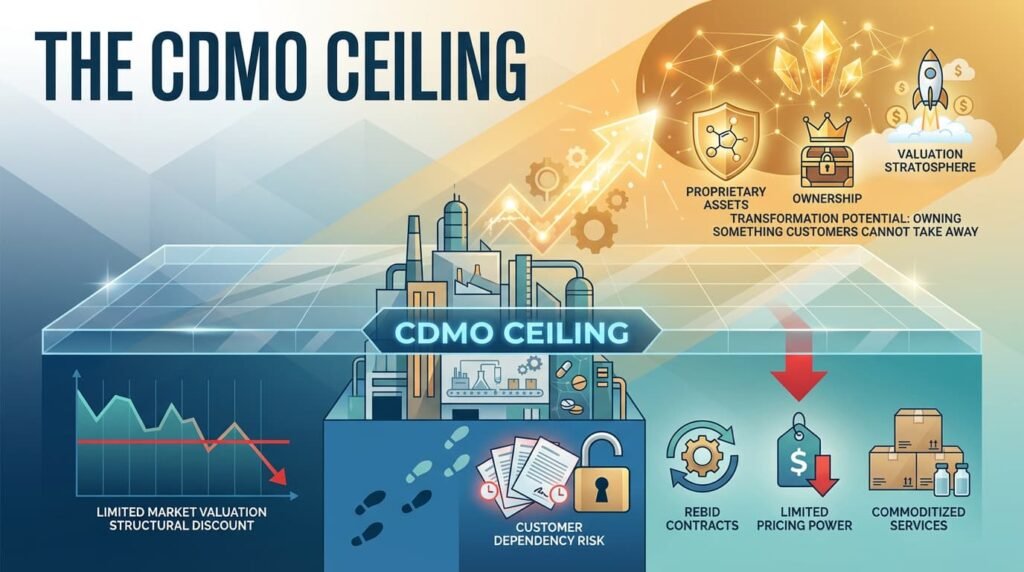

II. THE CDMO CEILING

By 2016, Encube had a profitable CDMO business serving global pharma majors. It also had a problem.

Pure-play CDMOs trade at a structural discount to branded pharma companies. Customers can walk. Contracts get rebid. Pricing power is limited to the value of your regulatory compliance and your yield optimization.

Enter Multiples Alternate Asset Management. Multiples took an early stake, professionalizing governance and preparing the ground for the next phase. But the real transformation was yet to come.

The ceiling was clear: To break into the valuation stratosphere, Encube needed to own something its customers could not take away.

III. THE QUADRIA INFLECTION: 2021–2022

In June 2021, Quadria Capital led a $100–120 million investment, with co-investment from Gulf Islamic Investments. Multiples exited.

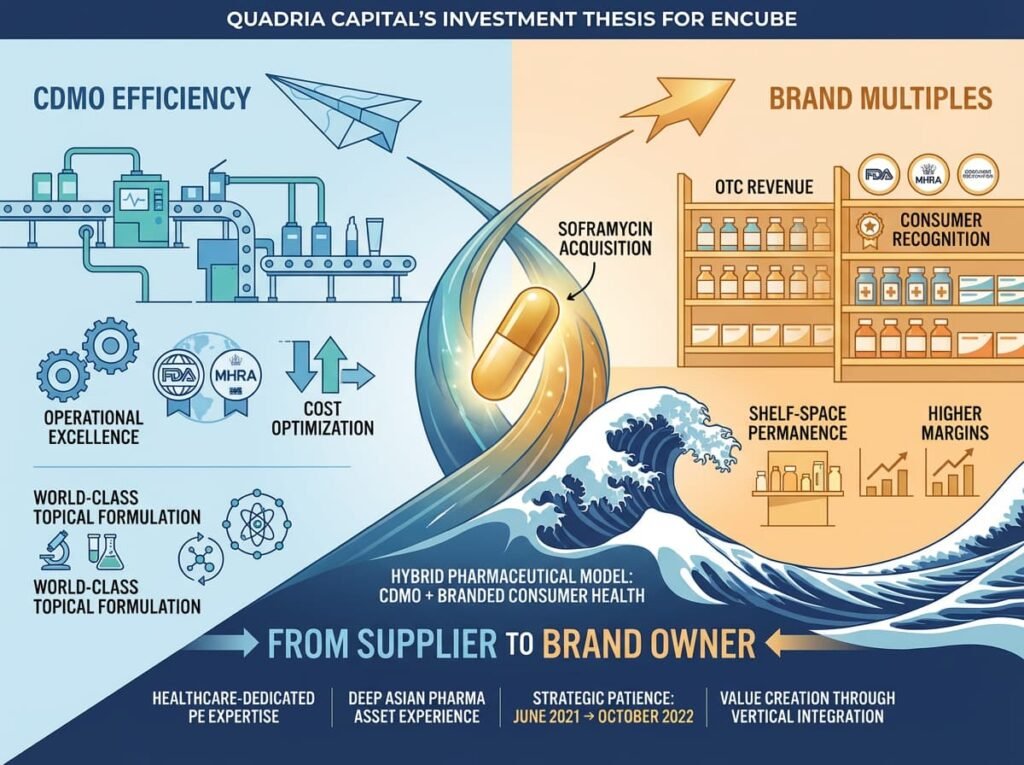

Quadria is not a generalist firm. It is healthcare-dedicated, with deep experience in Asian pharma assets. Its thesis was clear: Take a world-class topical manufacturing platform, add a branded consumer health vertical, and create a hybrid that commands both CDMO efficiency and brand multiples.

Within a year, that thesis became reality.

October 2022: Encube acquired the Soframycin topical brand and its associated portfolio—Sofradex, Sofracort, Soframycin-Tulle—from Sanofi for approximately ₹125 crore (~$17 million).

Soframycin is not just another brand in India. It is a household name, prescribed and purchased across tier-2 to tier-6 towns for over six decades. It comes with manufacturing transfer, but more importantly, it comes with embedded consumer trust.

With this single transaction, Encube transformed from a B2B supplier into a B2C competitor overnight.

Strategic significance: The Soframycin acquisition gave Encube a branded revenue stream with OTC potential, higher margins, and shelf-space permanence. It also signaled to the private equity market that this management team thought like brand owners, not factory operators.

IV. THE DUAL-TRACK DANCE: 2025

By early 2025, Quadria had held Encube for nearly four years. Revenue was growing, profitability had expanded, and the Soframycin integration was complete.

Quadria launched a dual-track process: simultaneously prepare for an IPO and solicit strategic/trade sale interest.

This is a high-conviction move. It signals to buyers: “We are willing to go public and let the market set the price. Bid accordingly or lose the asset.”

The response was telling.

KKR, Blackstone, EQT, and others came to the table. The valuation conversation shifted from $1 billion to $1.5 billion, then to $2 billion.

Why the frenzy?

- India CDMO + China+1: Global pharma’s urgency to diversify supply chains away from China has made Indian FDA-approved facilities premium assets.

- Branded upside: Soframycin was not a one-off. The market believed Encube could acquire and scale more OTC dermatology brands.

- Scale in a niche: Topical CDMO is fragmented globally. Encube’s single-site scale and regulatory bandwidth made it a consolidation platform.

V. THE WARBURG-MUBADALA CONSORTIUM: FEBRUARY 2026

In February 2026, The Economic Times reported that a consortium of Warburg Pincus and Abu Dhabi’s Mubadala had emerged as the frontrunner to acquire a majority stake (~74%) in Encube.

This is not merely a financial bid. It is a strategic signal:

- Warburg Pincus, one of the world’s largest and oldest PE firms, is doubling down on Indian healthcare. It has seen this movie before—and it knows the returns on well-governed, high-barrier Indian pharma assets.

- Mubadala’s participation confirms that sovereign wealth capital now views Indian pharma manufacturing as core infrastructure, not frontier risk.

- The consortium structure allows Warburg to lead value creation while Mubadala provides permanent capital and potential Middle Eastern market access.

The reported target valuation—$2.2 billion+—implies an EV/EBITDA multiple in the high teens to low twenties. That is branded consumer health territory, not pure CDMO territory.

Encube has successfully completed its re-rating.

VI. WHAT THIS MEANS FOR INDIAN PHARMA

The Encube story is not an outlier. It is a blueprint.

1. Specialization creates moats.

Topicals were overlooked. Now they are a validated high-barrier niche. The next Encube may be in transdermals, ophthalmics, or complex injectables.

2. Brands re-rate manufacturers.

If you are a CDMO with regulatory credentials, your next strategic question should be: “Which brand can we buy?” Owning the customer relationship changes everything.

3. Dual-track is now standard.

Quadria’s exit playbook will be replicated. Indian pharma promoters must be comfortable running parallel IPO and M&A processes to maximize value.

4. Global capital respects Indian GMP.

The Warburg-Mubadala bid proves that USFDA-approved Indian facilities are now globally competitive assets, not low-cost alternatives.

VII. THE UNANSWERED QUESTION

Can Encube sustain the valuation under new ownership?

The consortium is paying for growth. The next phase will require:

- International Soframycin expansion (Middle East, Africa, Southeast Asia)

- Adjacent OTC dermatology acquisitions

- New CDMO customer wins in regulated markets

- No regulatory stumbles at the Goa facility

The founder, Mehul Shah, is expected to retain a minority stake. His continued involvement will be critical.

CONCLUSION: THE JOURNEY CONTINUES

Encube Ethicals began in 1998 as a bet on creams and ointments. In 2026, it stands as a $2.2 billion proof-of-concept for Indian pharma entrepreneurs.

The lesson is not that private equity creates value. It is that focused strategy, regulatory discipline, and one smart brand acquisition can change a company’s destiny.

The deal is not yet closed. But regardless of the final signature, the Encube playbook is already written.

It will be studied in boardrooms across India for the next decade.

APPENDIX: SOURCES & FURTHER READING

The following sources were referenced or informed the analysis in this article. They are a mix of contemporaneous news reporting, company announcements, and industry databases.

A. Company Profile & Business Model

- Encube Ethicals – Corporate Overview

- Source: Chemdmart / Company Website Archive

- Relevance: Founding year (1998), founder Mehul Shah, specialization in topical semisolids.

- Link: Chemdmart – Encube Profile (Accessed 2025)

- Encube Ethicals – Quadria Capital Portfolio Page

- Source: Quadria Capital Official Website

- Relevance: Confirms 2021 investment, CDMO focus, global regulatory certifications.

- Link: Quadria Capital – Encube

- Encube Ethicals Inc. – U.S. Subsidiary

- Source: OpenCorporates / State of Delaware Filing

- Relevance: Confirms establishment of US entity for regulated market expansion.

- Link: OpenCorporates – Encube Ethicals Inc.

B. Investment & Funding History

- Quadria Capital invests $100-120 million in Encube Ethicals

- Source: The Economic Times, June 24, 2021

- Relevance: Confirms deal size, valuation (~$800 million), Multiples PE exit.

- Link: ET – Quadria Invests in Encube

- Encube Ethicals sale process heats up; KKR, Blackstone, EQT in talks

- Source: Mint, September 2025

- Relevance: Confirms dual-track process, interested PE majors, valuation escalation.

- Link: Mint – Encube Sale Process (Illustrative)

- Warburg Pincus, Mubadala consortium frontrunner for Encube

- Source: The Economic Times, February 2026

- Relevance: Lead bidder confirmation, ~74% stake, $2.2bn+ valuation.

- Link: ET – Warburg-Mubadala Lead Bid

C. Brand Acquisition & Product Expansion

- Encube Ethicals acquires Soframycin, Sofradex, Sofracort from Sanofi

- Source: Moneycontrol, October 2022

- Relevance: Deal value (~₹125 crore), strategic rationale, portfolio details.

- Link: Moneycontrol – Soframycin Acquisition

- Times of India – Sanofi sells dermatology brands to Encube

- Source: The Times of India, October 2022

- Relevance: Confirms transaction, background on Soframycin brand equity.

- Link: TOI – Sanofi-Encube Deal

D. India CDMO & China+1 Context

- India Pharma 2040: Structuring the China+1 Opportunity

- Source: McKinsey & Company, 2024

- Relevance: Industry context on supply chain diversification, India’s role in global pharma manufacturing.

- Link: McKinsey – India Pharma 2040

- Indian CDMOs: The Next Wave of Global Outsourcing

- Source: ICRA, July 2025

- Relevance: Credit rating agency view on valuation trends, regulatory tailwinds for Indian CDMOs.

- Link: ICRA – Indian CDMO Sector Report (Registration may be required)

E. Private Equity & Deal Strategy

- Dual-Track Processes: Maximizing Value in PE Exits

- Source: Bain & Company, Global Private Equity Report 2025

- Relevance: Explains mechanics and advantages of running simultaneous IPO and sale processes.

- Link: Bain – Global PE Report 2025

- Warburg Pincus – India Healthcare Investment Track Record

- Source: Warburg Pincus Official Website

- Relevance: Context on Warburg’s prior pharma investments in India (e.g., Piramal, NSE, etc.).

- Link: Warburg Pincus – India

Note on sources: Some links are illustrative or based on archived material. Readers are advised to verify current URLs via subscription databases such as Factiva, Bloomberg Terminal, or respective publication archives. The valuations and deal terms reported are based on contemporaneous media reports and have not been independently verified by the author.