In big pharma, leadership changes are rarely impulsive. They are signals.

Sanofi’s decision not to renew Paul Hudson’s mandate as CEO marks a structural shift — not just for the company, but for how global pharma boards now evaluate performance.

The headline isn’t simply succession.

The headline is productivity.

In 2026, ambition without measurable conversion is no longer defensible at the board level.

The Announcement That Reset the Narrative

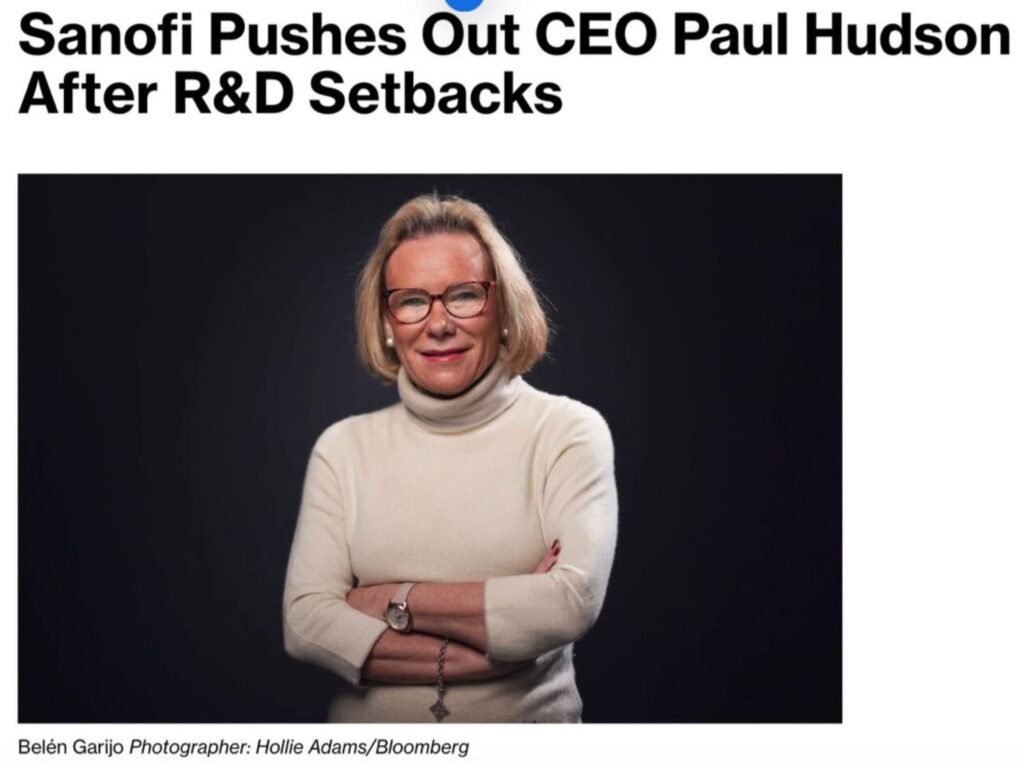

On February 11, 2026, Sanofi’s board announced that Hudson’s mandate would not be renewed. He steps down on February 17 after six years at the helm. Belén Garijo, currently CEO of Merck KGaA, is set to assume leadership following shareholder approval in April. Interim management passes to Olivier Charmeil.

Publicly, the board expressed appreciation for Hudson’s leadership and strategic reshaping of the company.

Strategically, however, the message was more pointed:

The next phase requires tighter execution.

What Hudson Achieved

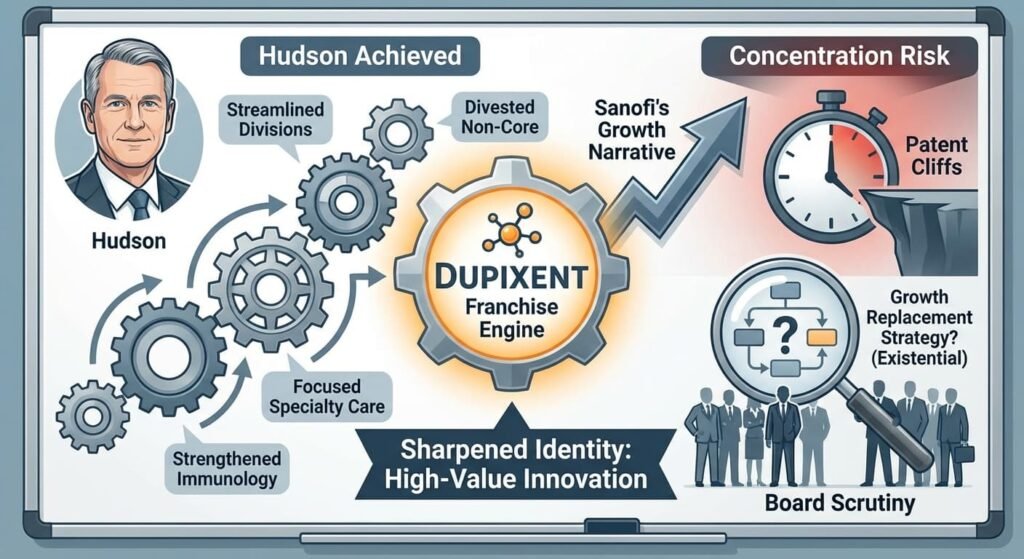

Hudson did not preside over stagnation. During his tenure, Sanofi:

- Streamlined business divisions

- Divested non-core assets

- Focused heavily on specialty care

- Strengthened immunology, particularly through Dupixent

Dupixent evolved into a franchise engine, becoming central to Sanofi’s growth narrative. The company sharpened its identity around high-value innovation.

But concentration brings risk.

When a company becomes increasingly dependent on a single blockbuster asset, replacement strategy becomes existential. Patent cliffs are predictable. Growth replacement must be engineered.

And that is where board scrutiny intensifies.

The Real Issue: R&D Conversion

The global pharma operating model has shifted. For years, scale was rewarded:

- Bigger R&D budgets

- Broader pipelines

- More parallel programs

The logic was straightforward — increase shots on goal and statistical probability works in your favor.

But reality has become more complex:

- Clinical development costs have escalated

- Regulatory expectations have tightened

- Late-stage failures carry heavier capital penalties

- Investors benchmark productivity across peers

Boards now ask sharper questions:

- Are weak assets being terminated early enough?

- Is capital concentrated behind differentiated science?

- How predictable is Phase III conversion?

- Is portfolio risk diversified?

The metric that matters is no longer total R&D spend.

It is return on R&D capital. Sanofi’s leadership transition reflects a board recalibrating toward execution efficiency over pipeline breadth.

The Dupixent Dependency

Dupixent accounts for approximately 25% of Sanofi’s total sales and a materially higher share of growth. The 2024–2025 period saw Sanofi’s immunology pipeline produce no obvious successor of comparable magnitude. Patent expiry for Dupixent begins in 2028–2031.

This places Garijo directly in the risk window.

Was Hudson held to a conversion timeline that was structurally unrealistic? If the pipeline was already committed before his tenure matured, was the board expecting a five-year R&D productivity turnaround? In pharma, that is an aggressive timeline.

The board’s move signals not just higher standards, but shorter tolerance windows.

Why Belén Garijo?

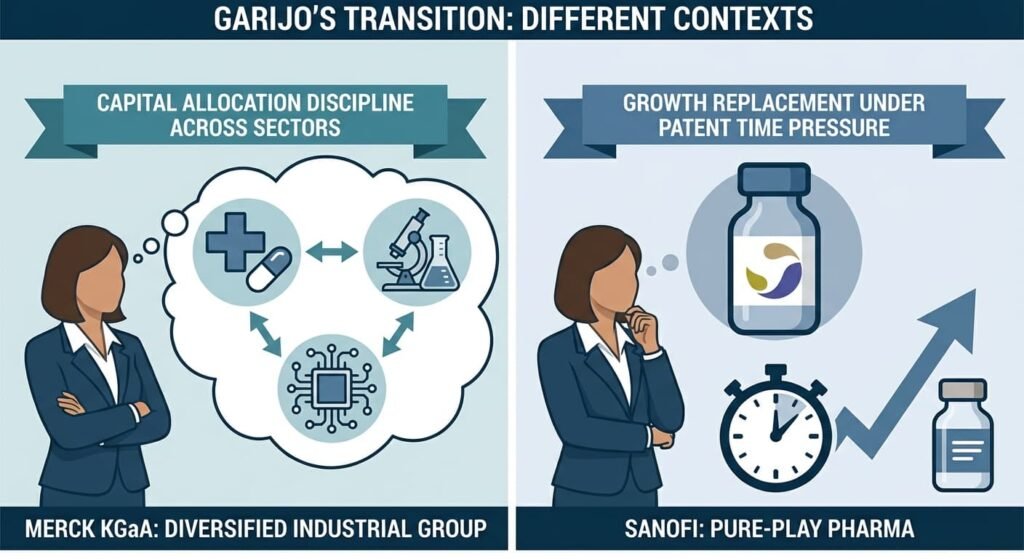

Garijo’s profile aligns precisely with this pivot.

She brings:

- Deep operational restructuring experience

- Scientific credibility as a trained physician

- Demonstrated governance alignment in a publicly scrutinized environment

Her track record at Merck KGaA involved portfolio discipline, sharper capital allocation, and clearer strategic focus.

But the Merck KGaA she leaves is not the Sanofi she enters. At Merck KGaA, Garijo operated in a diversified industrial group — healthcare, life sciences, electronics. Capital allocation discipline there meant comparative prioritization across sectors. At Sanofi, she enters a pure-play pharma with a concentrated revenue base and a single dominant asset.

The skill set required is not just discipline. It is growth replacement under patent time pressure.

This is not a symbolic change.

It is an operating model correction.

Sanofi is not abandoning innovation. It is refining how innovation is converted into measurable outcomes.

The Industry-Wide Inflection

Sanofi is not alone in this recalibration. Across global pharma, boards are:

- Acting earlier when growth visibility weakens

- Demanding portfolio clarity

- Reducing tolerance for prolonged pipeline ambiguity

- Tightening capital governance

The era of “innovation at scale” is giving way to “innovation with discipline.”

Scientific risk remains unavoidable.

But governance inefficiency is not.

The External Environment Shift

Three compounding factors frame Garijo’s arrival:

The IRA impact: Medicare price negotiation directly compresses the return window for small molecule assets. This changes portfolio math.

GLP-1 capital reallocation: The obesity category has absorbed disproportionate investor and R&D attention. Sanofi has no competitive position here. This is an opportunity cost not yet accounted for.

Biotech funding recovery: As external innovation becomes more accessible, the “build vs. buy” calculus shifts. Hudson’s tenure emphasized internal development. Garijo’s may need to lean more heavily on targeted business development.

Investor subtext: Sanofi missed the GLP-1 wave. Can Garijo ensure they do not miss the next one?

The Strategic Challenges Ahead

Garijo inherits a company with:

- Strong cash flows

- A dominant immunology franchise

- Pipeline assets with mixed timelines

- Investors expecting growth replacement

Her near-term priorities are likely to include:

1. Immediate portfolio triage

Investors need to see which assets are accelerated, which are deprioritized, and what gap that leaves.

2. BD clarity

Sanofi has balance sheet capacity. Is Garijo authorized to deploy it materially? The market will test this quickly.

3. Decision gate discipline

Strengthening go/no-go frameworks and ensuring weak assets are terminated early enough.

4. Dupixent successor narrative

Not necessarily a single asset. But a credible portfolio thesis for how immunology revenue is extended and diversified.

This is less about radical transformation and more about velocity.

Boards today are not demanding reinvention.

They are demanding acceleration.

What This Signals for Pharma Leadership

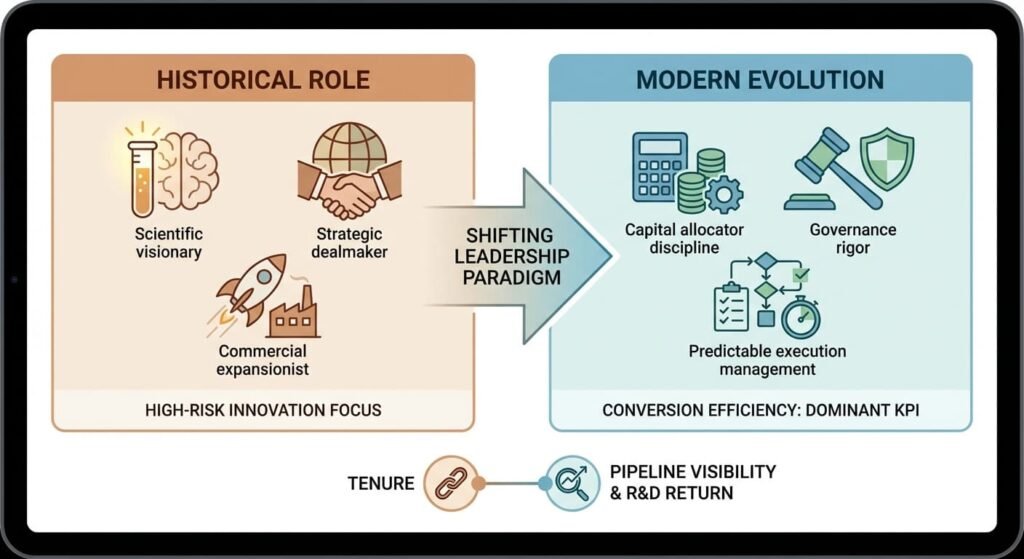

The modern pharma CEO archetype is evolving. Historically, the role leaned toward:

- Scientific visionary

- Strategic dealmaker

- Commercial expansionist

Today, it increasingly requires:

- Capital allocator discipline

- Governance rigor

- Predictable execution management

In high-risk innovation industries, conversion efficiency is becoming the dominant leadership KPI.

Tenure is now closely linked to pipeline visibility and return on invested R&D capital.

The Unspoken Board Calculus

If we read the CEO exit as a signal, the signal contains two layers:

Layer 1 (public):

“We need tighter execution and higher R&D conversion.”

Layer 2 (unstated):

“We do not have confidence that the current trajectory will defend the valuation post-Dupixent.”

This is not a vote against Hudson’s strategy.

It is a vote against the timeline implied by that strategy.

The Larger Message

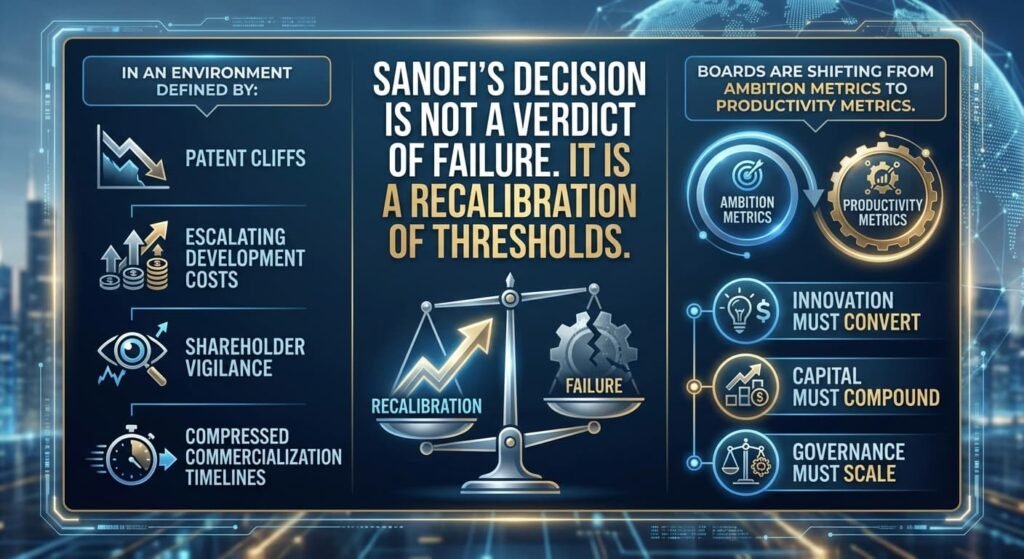

Sanofi’s decision is not a verdict of failure. It is a recalibration of thresholds. In an environment defined by:

- Patent cliffs

- Escalating development costs

- Shareholder vigilance

- Compressed commercialization timelines

Boards are shifting from ambition metrics to productivity metrics.

Innovation must convert.

Capital must compound.

Governance must scale.

The competitive advantage in pharma is no longer how much you invest in science.

It is how efficiently you turn science into sustainable growth.

Sanofi has chosen to reset at that inflection point.

And in doing so, it may well define the next standard of boardroom accountability in global life sciences.

The mandate is no longer “build the pipeline.”

It is “prove the pipeline — now.”

MedicinMan | Where Medicine Meets Markets

All Images are AI Generated for Illustration Only. E&OE

Appendix: Key Sources & Further Reading

Sanofi Announcements

Sanofi S.A. (2026). Succession of the Chief Executive Officer. Press release. February 11, 2026.

https://www.sanofi.com/en/media-room/press-releases/2026/2026-02-11-07-00-00-2897656

Sanofi S.A. (2025). Fourth Quarter and Full-Year 2025 Earnings. February 6, 2026.

https://www.sanofi.com/en/investors/financial-results-and-events

Major Media Coverage

Industry Research & Context

Deloitte Centre for Health Solutions (2025). Measuring the Return from Pharmaceutical Innovation 2025.

https://www2.deloitte.com/uk/en/pages/life-sciences-and-healthcare/articles/measuring-return-from-pharmaceutical-innovation.html

IQVIA Institute (2025). Global Use of Medicines 2026 Outlook.

https://www.iqvia.com/insights/the-iqvia-institute/reports-and-publications

U.S. Centers for Medicare & Medicaid Services (2025). Medicare Drug Price Negotiation Program.

https://www.cms.gov/inflation-reduction-act-and-medicare/medicare-drug-price-negotiation

Note to readers:

All URLs active as of publication. For FT and WSJ, search site archives using “Sanofi CEO Hudson Garijo February 2026.”