Indian pharmaceuticals have long been known as the “pharmacy of the world” — supplying affordable generics globally. But the industry is visibly pivoting: instead of volume-driven, low-margin generics alone, it’s embracing specialty drugs, branded portfolios, clinical platforms, and consolidated delivery ecosystems — and Private Equity (PE) is steering that shift.

The recent news that Warburg Pincus is close to acquiring Integrace Health for ₹1,200 crore illustrates this trend. Integrace — built through acquisition and brand roll-ups — has become a specialty generics and therapy-oriented player — exactly the type of asset PE likes to scale, consolidate, and exit at a premium.

This article unpacks why PE is flooding into Indian pharma now, how it is reshaping the business landscape, and what it means for patients — the ultimate users of these medicines.

Why Private Equity Is Betting Big on Indian Pharma

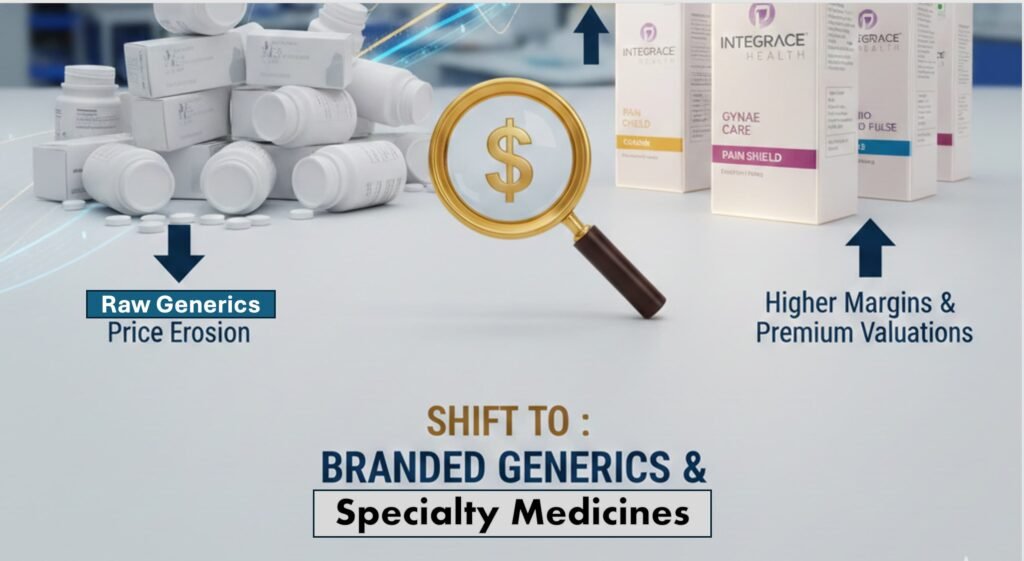

1. Shift from Raw Generics to Branded & Specialty Medicines

India’s traditional strength in cost-effective generics has been challenged by persistent price erosion and narrow margins, especially in matured markets like the U.S.

As pricing pressure chips away at unbranded volume revenues, pharma players — and investors — are reallocating capital toward:

• Branded generics (more pricing power within India),

• Specialty drugs (higher margins & stickier prescriptions),

• Niche portfolios that justify premium valuations (e.g., pain management, gynae therapies).

This dynamic turns companies like Integrace into attractive investment platforms because they have strong brands and scale in specific therapy areas — the kind of asset PE can sharpen and grow.

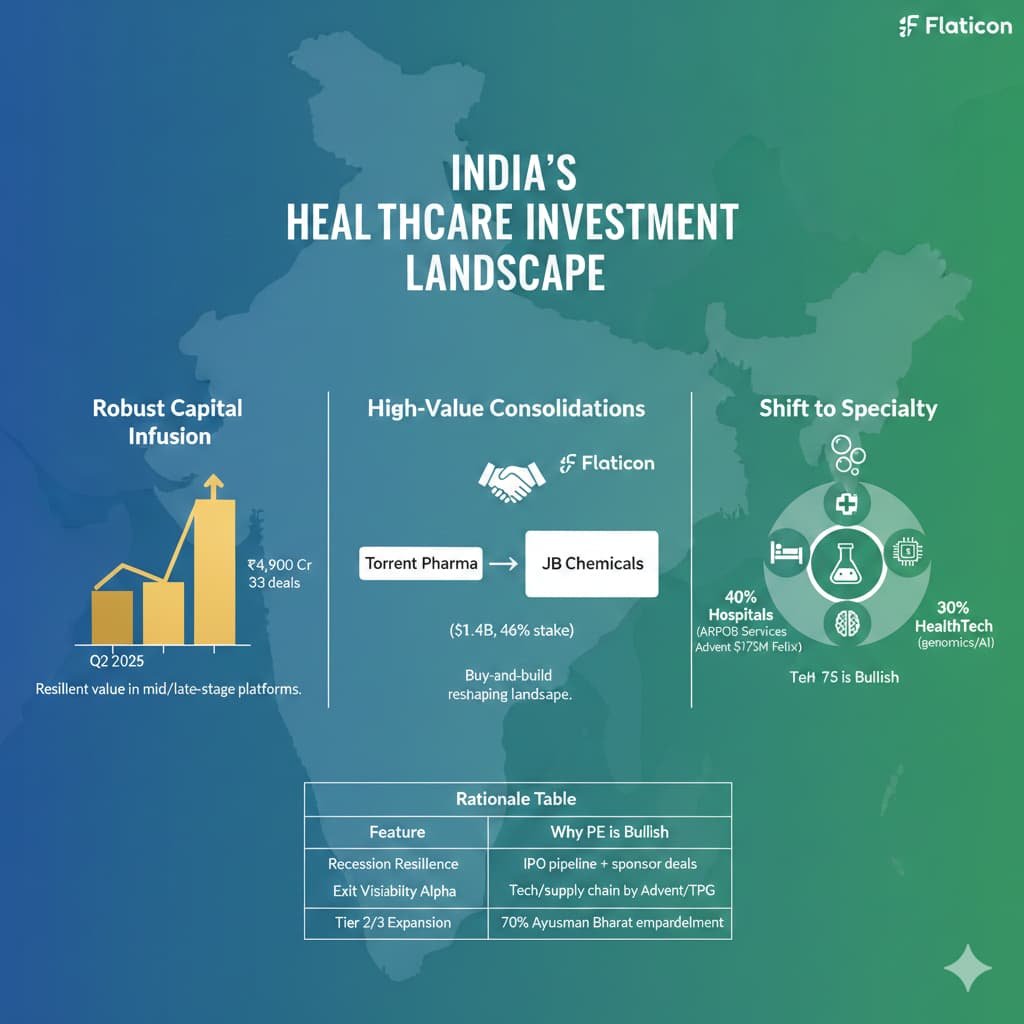

2. Private Equity Momentum & Deal Flow

PE investments in Indian pharma and healthcare remain significant — though fluctuating — as investors chase scale, predictability, and exit pathways.

• In 2025 Q2 alone, PE/VC pumped ~₹4,900 crore into Indian healthcare, with pharma deals capturing notable value and signalling confidence in scalable assets.

• Deal volumes and values have been strong through 2025–26, with a mix of acquisitions, minority investments, and buyouts across healthcare subsectors.

These investments aren’t random — they reflect a broader strategic pivot toward healthcare as institutional capital seeks recession-resilient and high-growth portfolios.

How the Industry Structure Is Changing

3. Consolidation & Platform-Building

Private equity isn’t buying standalone assets; it’s building platforms:

• Multiple brands consolidated under one roof.

• Networks of clinics, specialty providers, and pharma portfolios.

• M&A pipelines that deliver recurring revenue streams.

This mirrors global PE playbooks where value creation arises from integration, efficiency, and scale, not just pure ownership.

Across India’s healthcare sector, structured consolidation — not fragmented individuality — is becoming the norm.

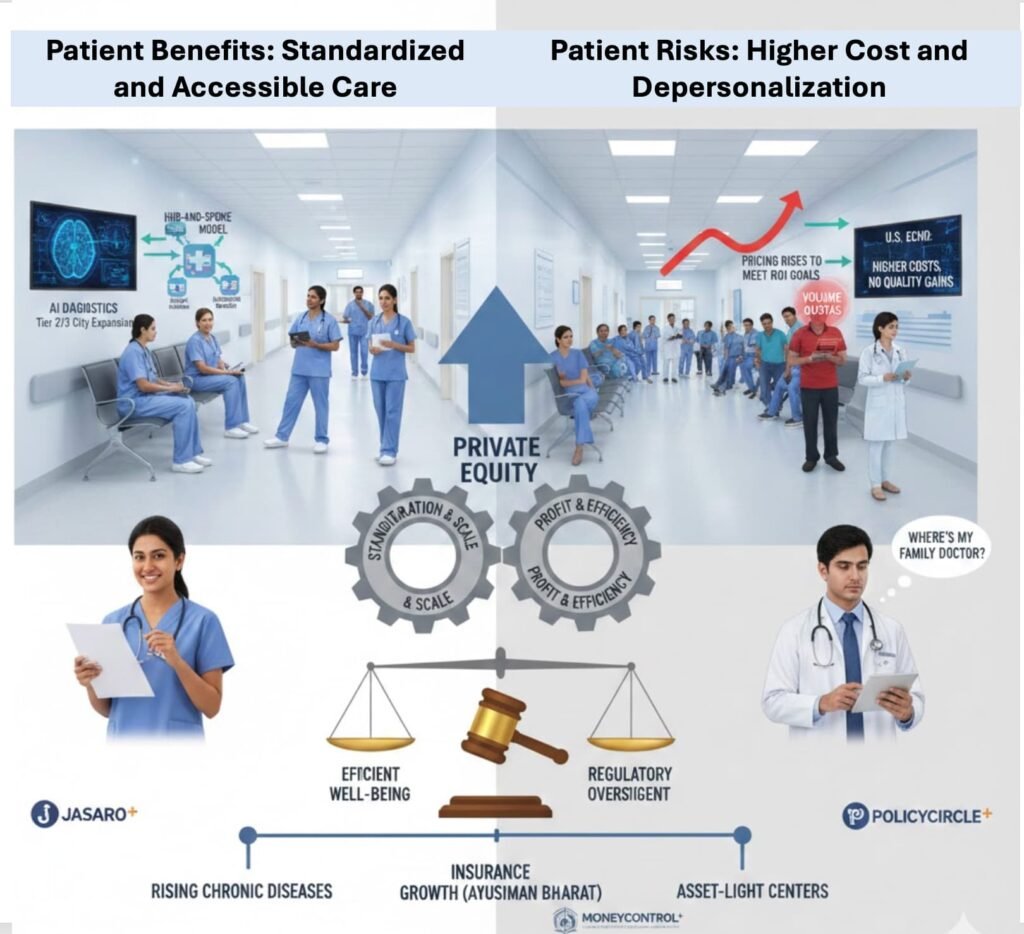

4. Alignment with Healthcare Demand Shifts

India’s healthcare demand is evolving:

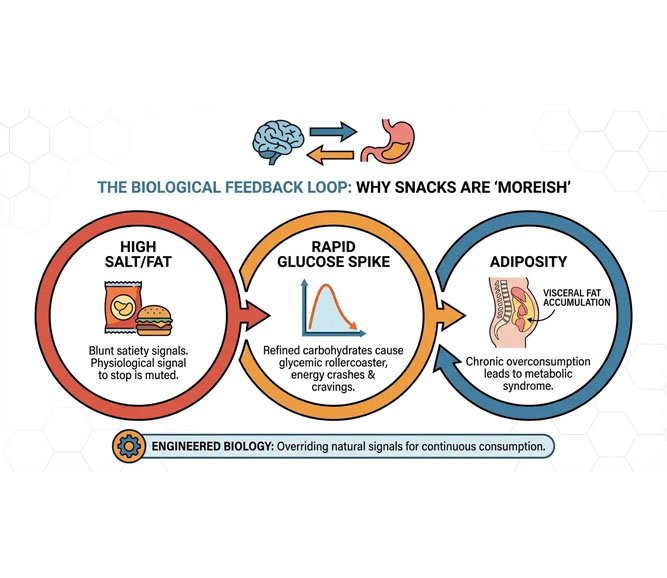

• Rising chronic and lifestyle diseases.

• Growing insurance coverage and preventive care focus.

• Capacity gaps in quality, accessible treatment.

PE funds are betting on solutions that can deliver predictable outcomes, patient volumes, efficient delivery, and transparent value.

This is not just pharma manufacturing — it’s healthcare delivery and services — from hospitals to single-specialty chains backed by capital.

What This Means for Patients

At its best, PE involvement can accelerate access, quality, and innovation. At its worst, it can create commercialized healthcare with pricing pressures. Here’s a nuanced breakdown:

Potential Upsides for Patients

• Better access to specialty medicines: Scale and brand focus can reduce shortages for important therapeutic categories.

• More predictable supply chains: Capital can strengthen production, quality systems, and pharmaceutical R&D.

• Expanded care infrastructure: Investor capital often funds capacity expansion — benefiting patients in Tier 2/3 cities.

Possible Risks

• Pricing and profitability pressures: Profit mandates might pressure drug pricing, especially in non-regulated segments.

• Healthcare cost inflation: Consolidation of hospitals and care services under investor ownership can lead to billing practices aligned with revenue growth — a concern already observed globally in PE-owned health systems.

• Focus on profitable therapies: PE might underweight less profitable but socially critical conditions.

While data on pricing impact is still emerging for India specifically, global trends in PE-owned hospitals show higher billing and reduced patient cost predictability. (Contextual industry observation — not direct Indian data.)

Strategic Implications for the Industry

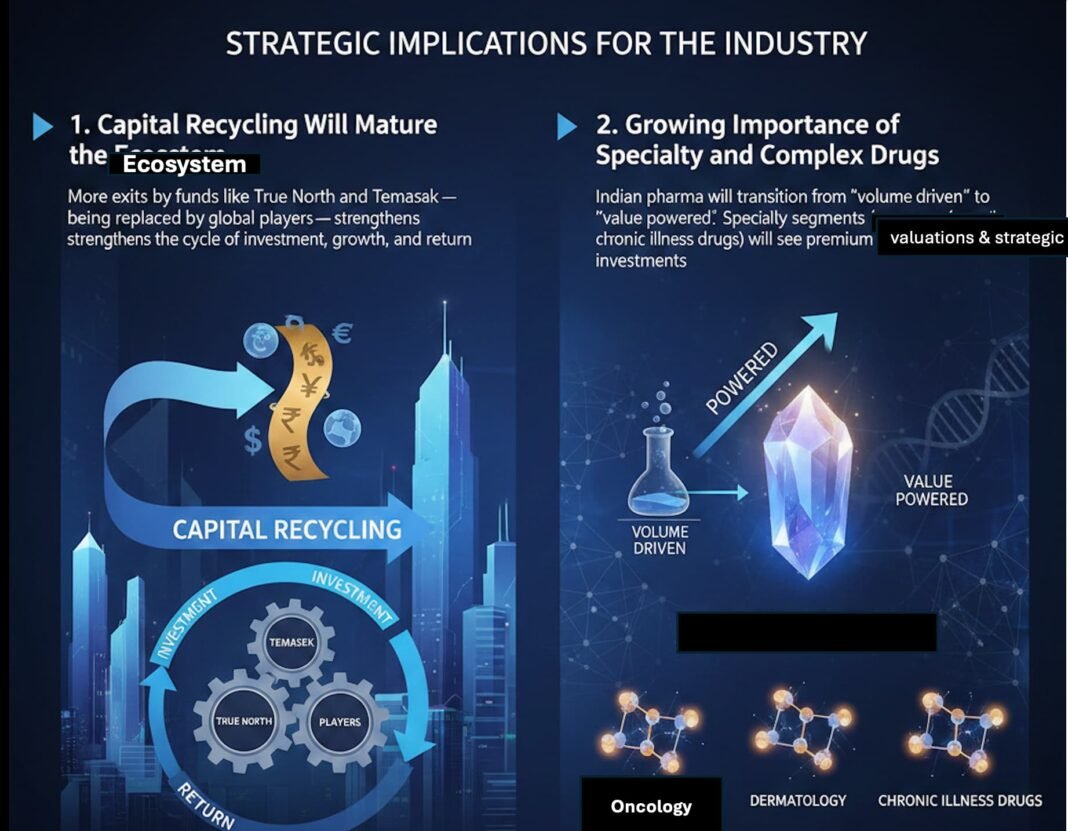

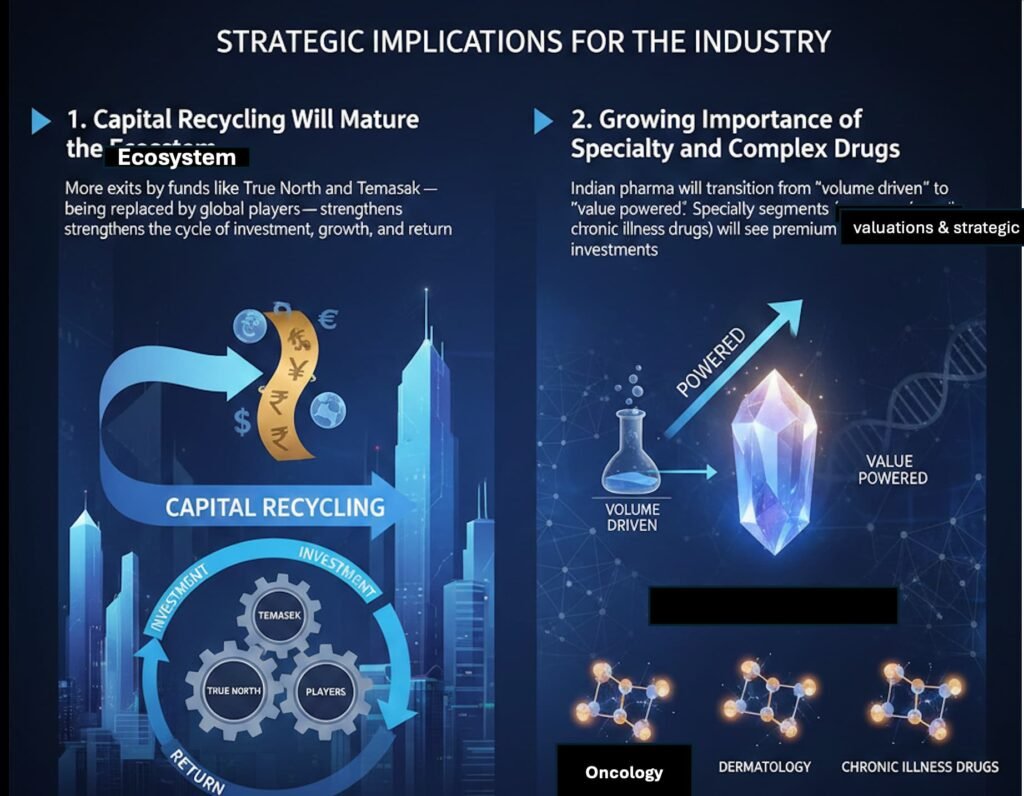

1. Capital Recycling Will Mature the Ecosystem

More exits by funds like True North and Temasek — being replaced by global players — strengthens the cycle of investment, growth, and return.

2. Growing Importance of Specialty and Complex Drugs

Indian pharma will transition from “volume driven” to “value powered.” Specialty segments (oncology, dermatology, chronic illness drugs) will see premium valuations and deeper strategic investments.

Conclusion

The Indian pharmaceutical ecosystem is at a tipping point. The traditional generic manufacturing model is evolving into a brand-centric, specialty-oriented, and investor capital–led industry. Private equity isn’t merely funding this change — it’s actively structuring it.

For patients, this could mean faster access to newer therapies and more robust supply chains — as long as commercial incentives are balanced with affordability and equitable access.

All Images are AI Generated for Illustrations Only. E&OE

Sources:

1. Warburg Pincus in advanced talks to buy Integrace Health — Business and deal specifics.

2. Private Equity investments in Indian healthcare — ₹4,900 crore in Q2 CY25.

3. Pharma & healthcare deal growth trends — Q3 2025 M&A and PE activity.

4. Surge in pharma & healthcare deals in 2024 — illustrating broader consolidation.

5. India pharma market fundamentals — India as a generics powerhouse with biotech growth.