For more than fifty years, the MRI industry treated liquid helium as destiny.

Superconducting magnets needed it. End of discussion.

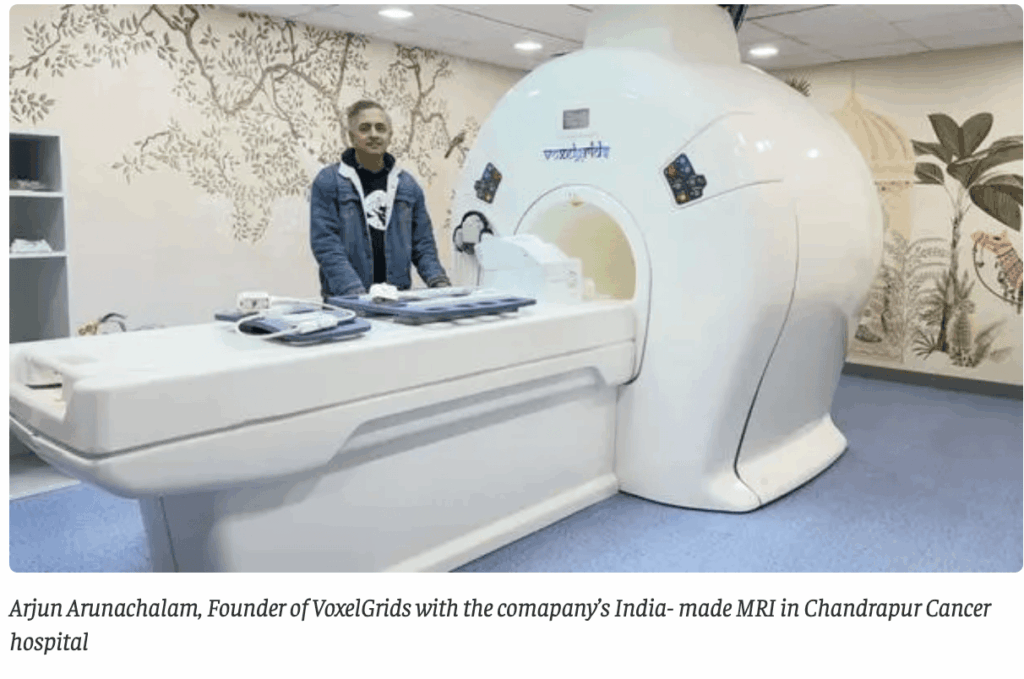

Arjun Arunachalam didn’t buy that premise.

For twelve years, mostly off the radar and far from the marketing muscle of global imaging giants, he worked on a single, deeply unfashionable idea: an MRI that uses no helium at all. Not less. Not “near-zero.” None.

On December 25, 2025, at the Chandrapur Cancer Care Foundation in Maharashtra, that idea became clinical reality. A 1.5 Tesla MRI scanner, built by Voxelgrids Innovations Pvt Ltd and backed by Zoho, went live—scanning real patients—without a single litre of liquid helium.

That moment matters far more than the press cycle around it suggests.

Because this wasn’t a feature upgrade.

It was a foundational deletion.

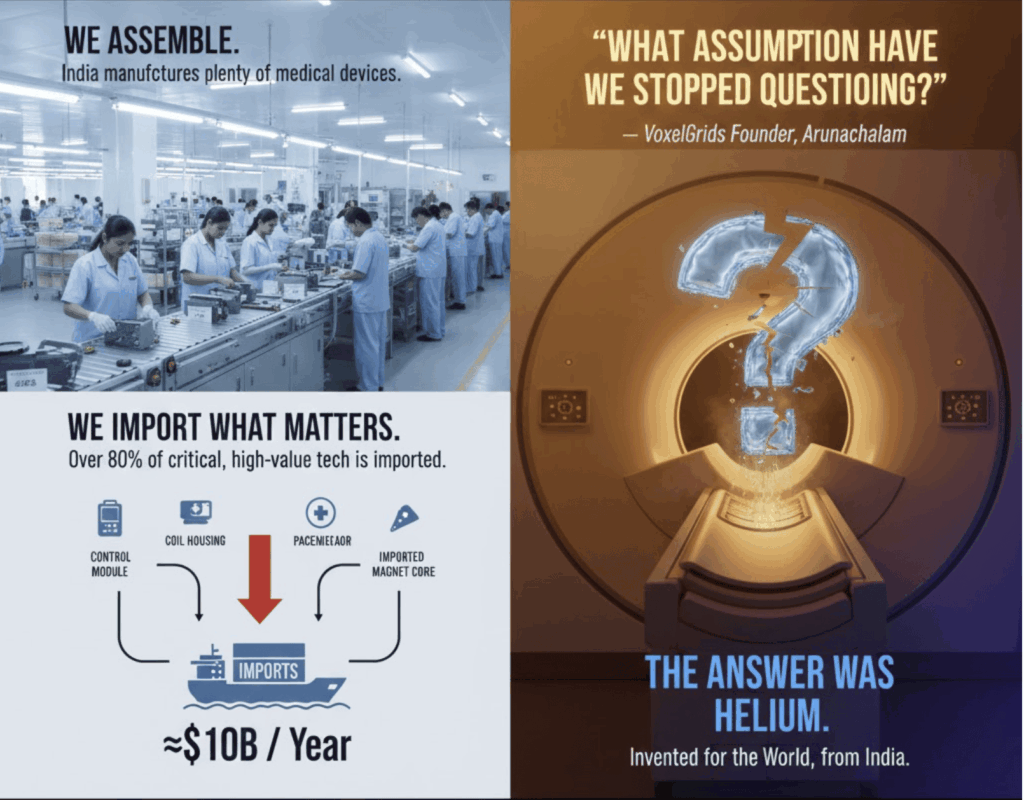

Why This Isn’t Just Another “Make in India” Story

India assembles plenty of medical devices.

It imports almost everything that truly matters.

Over 80% of India’s medical devices are imported, pushing the annual import bill toward $10 billion. MRI scanners are among the most capital-intensive symbols of that dependence—high-cost, high-maintenance, and designed for health systems that don’t resemble India’s.

Arunachalam didn’t start by asking, “How do we make MRI cheaper?”

He asked a more dangerous question:

“What assumption have we stopped questioning?”

The answer was helium.

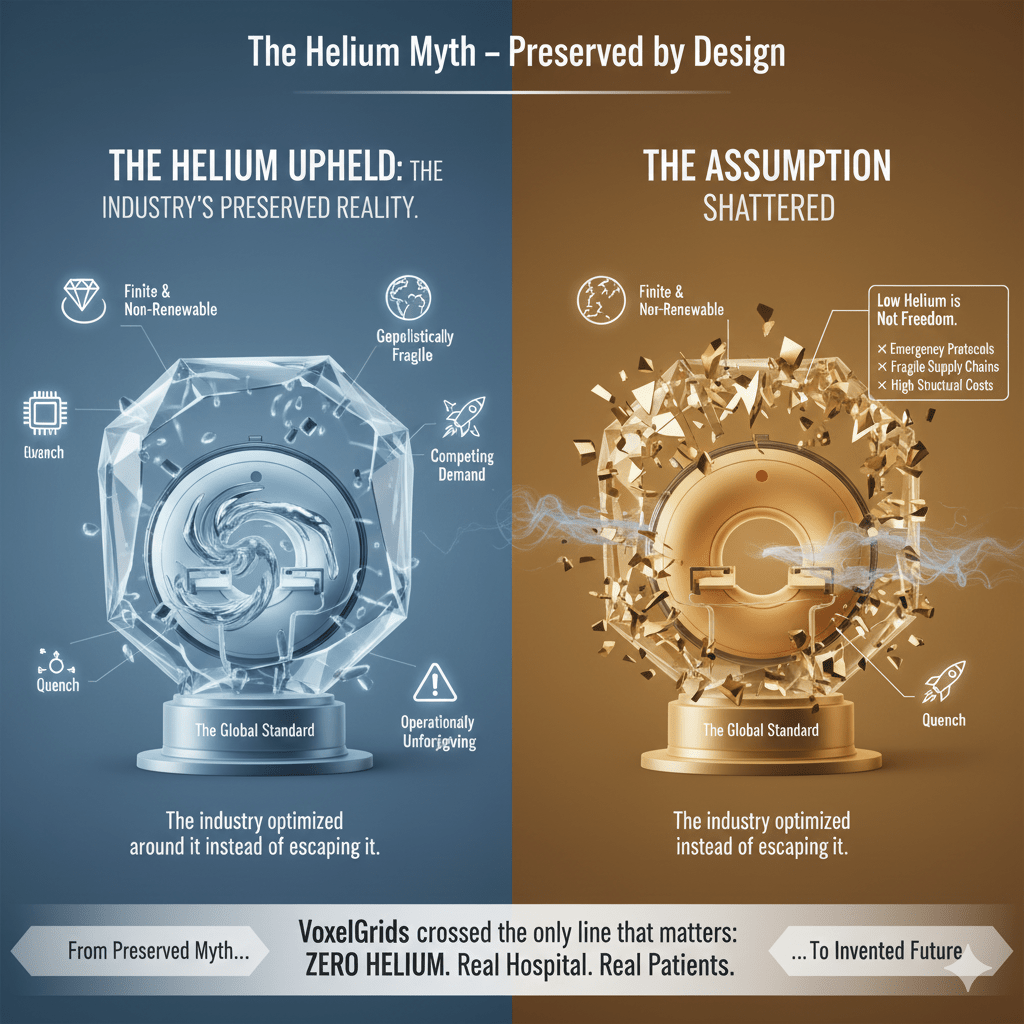

The Helium Myth—and How the Industry Preserved It

Liquid helium is:

- Finite and non-renewable

- Geopolitically fragile

- Competing with semiconductors, aerospace, and defence

- Operationally unforgiving (once lost, it’s gone forever)

Yet the global MRI industry optimised around it instead of escaping it.

Even celebrated innovations like Philips’ BlueSeal MRI—often marketed as revolutionary—still rely on helium. Yes, it’s only ~7 litres instead of thousands. That’s progress. But it’s still dependency.

Low helium is not freedom.

As long as helium exists in the system:

- Quench risk remains

- Emergency protocols persist

- Supply chains matter

- Operating costs stay structurally high

Voxelgrids crossed the only line that actually matters.

Zero helium. Real hospital. Real patients.

That leap—from controlled environments to clinical deployment—is what the incumbents have avoided.

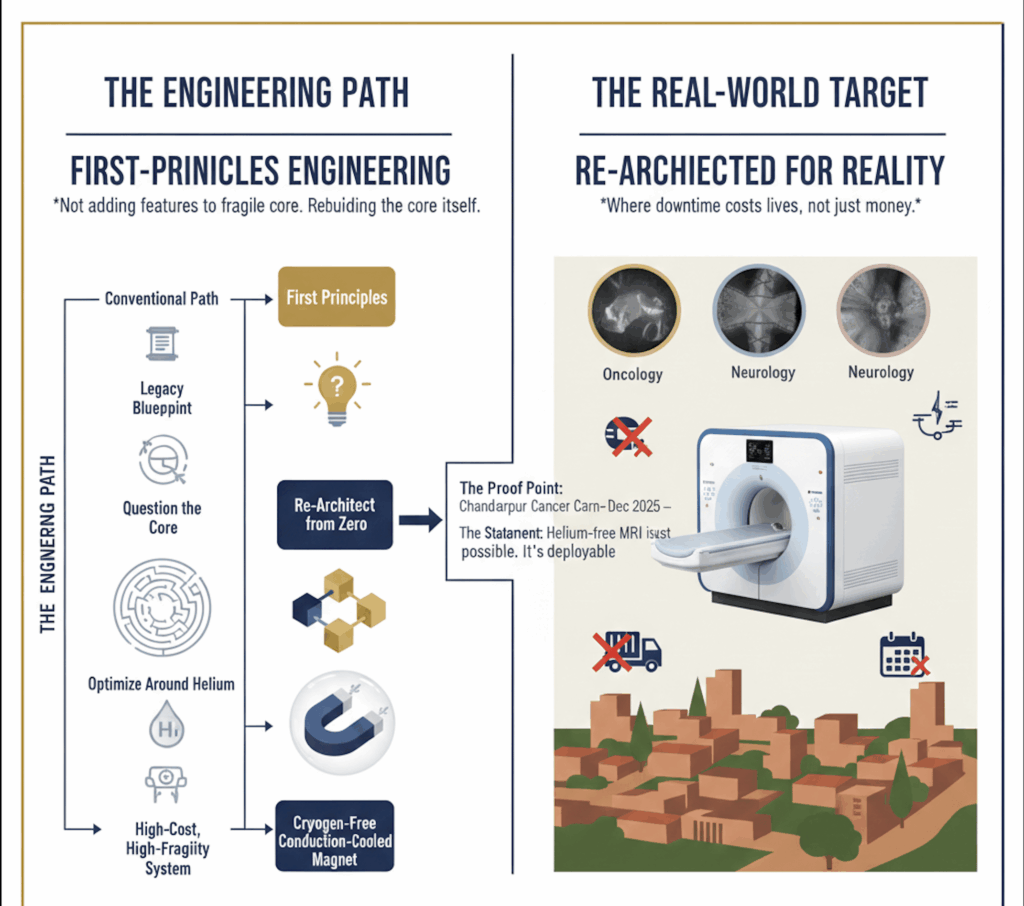

First-Principles Engineering, Not Feature Engineering

Voxelgrids’ scanner uses a cryogen-free, conduction-cooled magnet while preserving:

- Standard bore size

- Full 1.5 Tesla field strength

- Clinical-grade imaging for oncology, neurology, and MSK

This is not a compromised system for “emerging markets.”

It is a re-architected system for reality.

And reality, especially outside metros, is brutal:

- Helium trucks don’t arrive on time

- Infrastructure is fragile

- Downtime costs lives, not just money

The Chandrapur installation matters because it proves something the industry quietly doubted:

helium-free MRI isn’t just possible—it’s deployable.

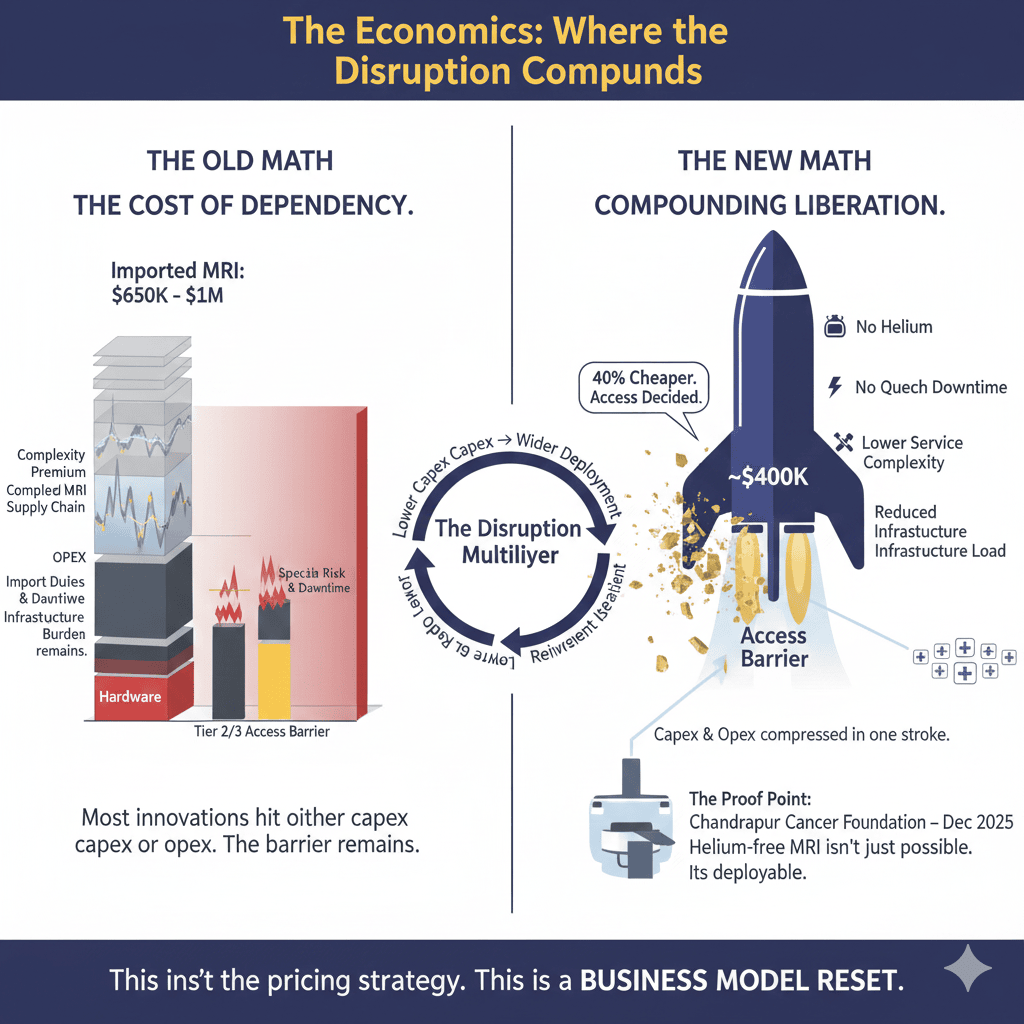

The Economics: Where the Disruption Compounds

This is where the story shifts from impressive to dangerous—for incumbents.

Capital Expenditure

- Imported 1.5T MRI: $650,000–$1,000,000

- Voxelgrids MRI: ~$400,000

- Roughly 40% cheaper upfront

That difference decides whether Tier 2 and Tier 3 hospitals ever own an MRI at all.

Operating Expenditure

- No helium refills

- No quench-related shutdowns

- Lower service complexity

- Reduced infrastructure and energy burden

Most medtech innovations hit either capex or opex.

Voxelgrids compresses both.

That’s not a pricing strategy.

That’s a business model reset.

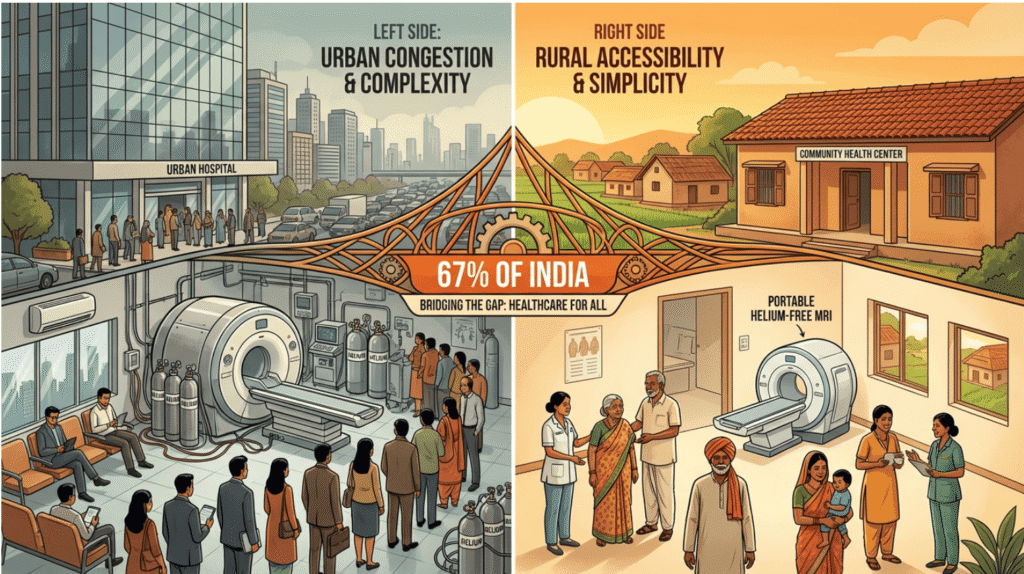

India’s MRI Gap Is Not a Technology Gap

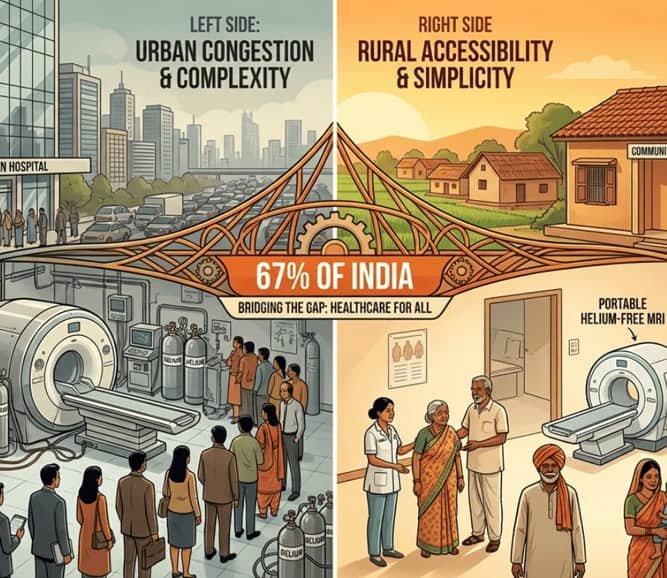

India has roughly 1–2 MRI scanners per million people.

OECD countries average 15–20 per million.

This gap isn’t about clinical demand. It’s about:

- Cost

- Logistics

- Reliability

The MRI industry built for Berlin and Boston, then tried to adapt downward. Voxelgrids inverted the equation—designing for Chandrapur first.

That inversion is why this matters beyond one installation.

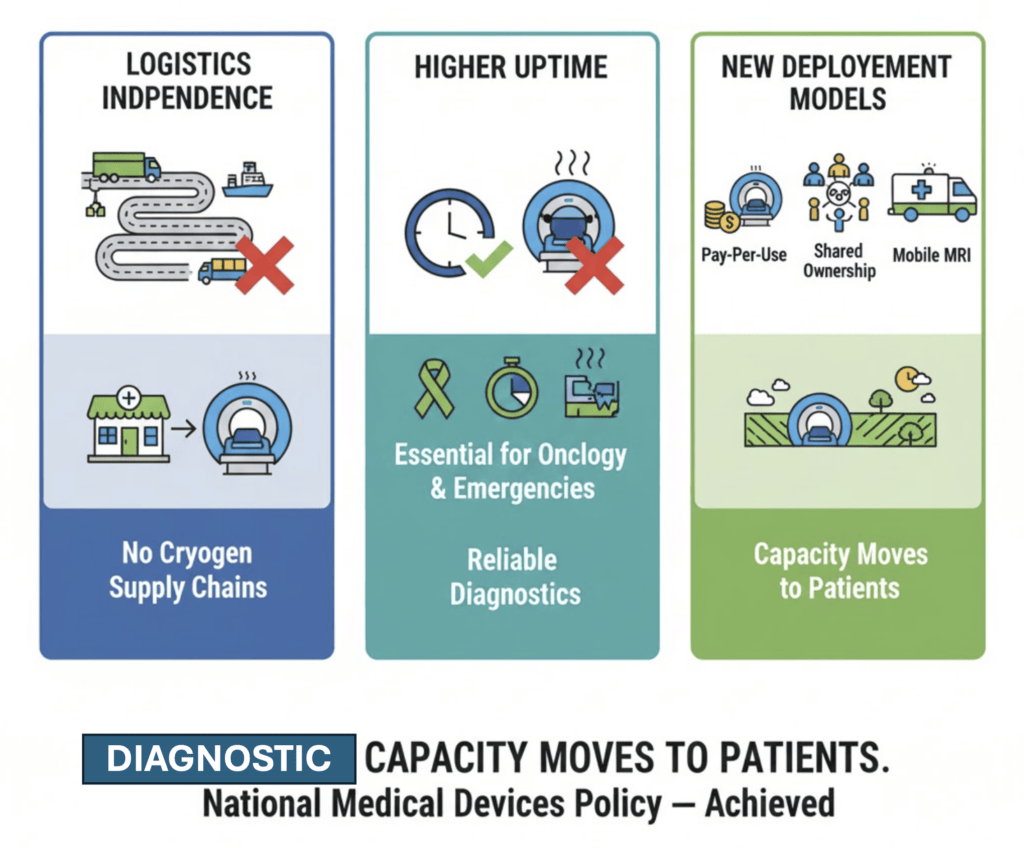

Tier 2 & Tier 3 India: The Actual Battlefield

Nearly 67% of Indians live outside major metros. This is where helium dependence quietly kills diagnostic access.

Helium-free MRI unlocks:

- Logistics independence: no cryogen supply chains

- Higher uptime: essential for oncology and emergencies

- New deployment models: pay-per-use, shared ownership, mobile MRI

This isn’t decentralisation as a buzzword.

It’s diagnostic capacity moving to where patients actually live.

Exactly what the National Medical Devices Policy promised—but rarely achieves.

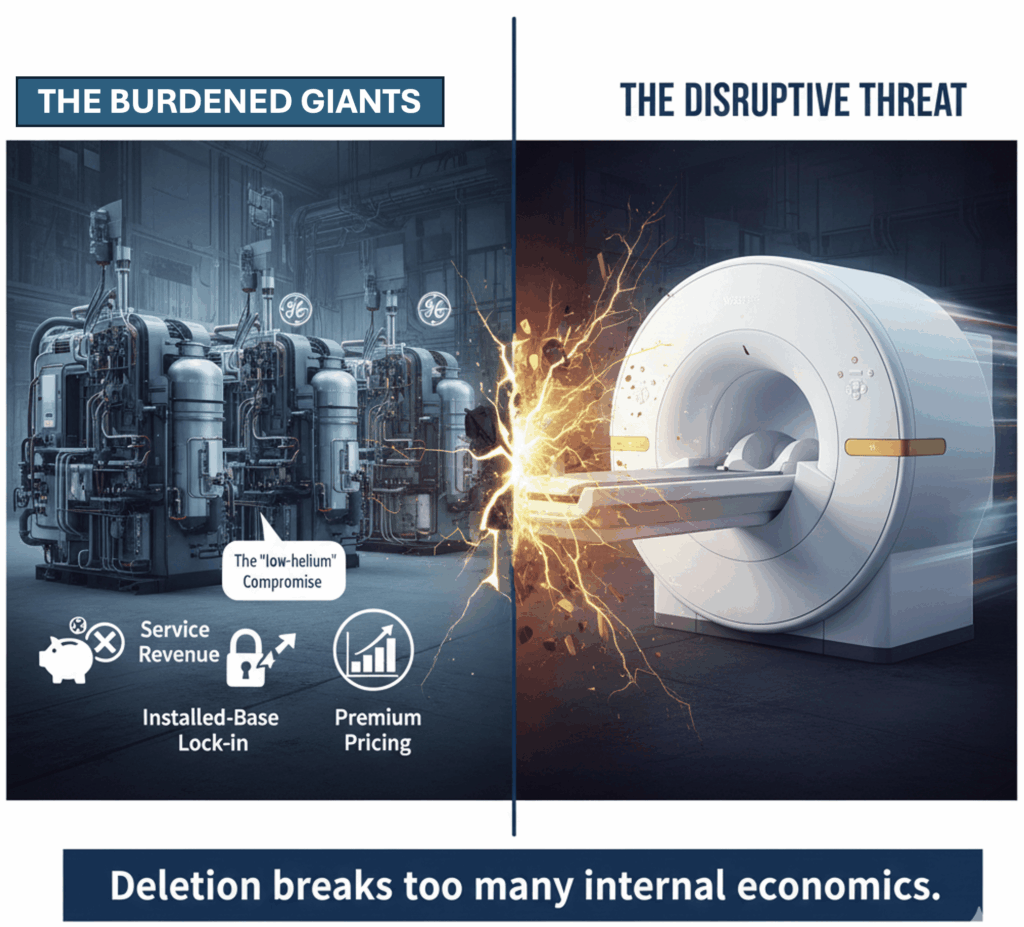

Competitive Teardown: Why the Giants Are Exposed

Let’s be clear-eyed.

Siemens, GE, and Philips control nearly 90% of the global MRI market. Their systems are clinically excellent—but strategically burdened.

They are:

- Locked into helium-dependent architectures

- Optimised for high-margin, high-infrastructure markets

- Structurally slow to delete legacy assumptions

A true helium-free MRI threatens:

- Service revenue models

- Installed-base lock-in

- Premium pricing justification

This is why incumbents flirt with “low-helium” narratives but stop short of deletion.

Deletion breaks too many internal economics.

The Hard Part Starts Now

Voxelgrids’ challenges are real:

- Scaling manufacturing beyond 20–25 units annually

- Building long-term clinical trust

- Competing against brands radiologists have trusted for decades

But every industry reset begins the same way—not at scale, but with proof.

Chandrapur is proof.

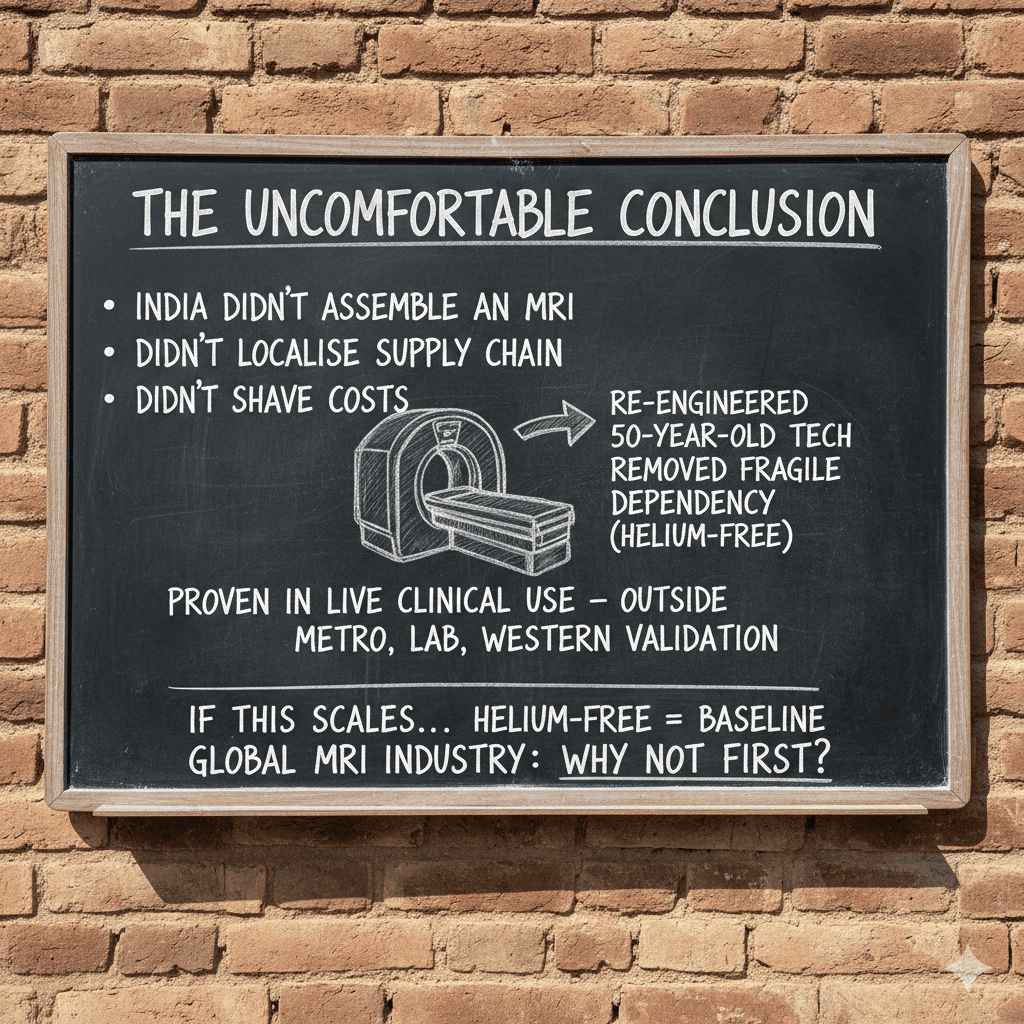

The Uncomfortable Conclusion

India didn’t assemble an MRI.

It didn’t localise a supply chain.

It didn’t shave costs at the margin.

It re-engineered a 50-year-old technology, removed its most fragile dependency, and proved it in live clinical use—outside a metro, outside a lab, outside Western validation loops.

If this scales, helium-free will stop being a differentiator.

It will become the baseline.

And the global MRI industry will have to explain why it didn’t get there first.

Appendix: Sources & References

- Voxelgrids Innovations Pvt Ltd – Founder interviews, product disclosures, clinical deployment details

- Digital Health News India – Coverage of the Chandrapur clinical installation

- Zoho-backed deep-tech investment reports – Funding and scale strategy

- Philips BlueSeal MRI technical documentation – Helium-light vs zero-helium comparison

- Government of India – National Medical Devices Policy (2023)

- OECD Health Statistics / WHO medical imaging access reports