Why India Must Urgently Reinvent Healthcare for a 100-Year Life — And How Pharma Can Lead the Charge

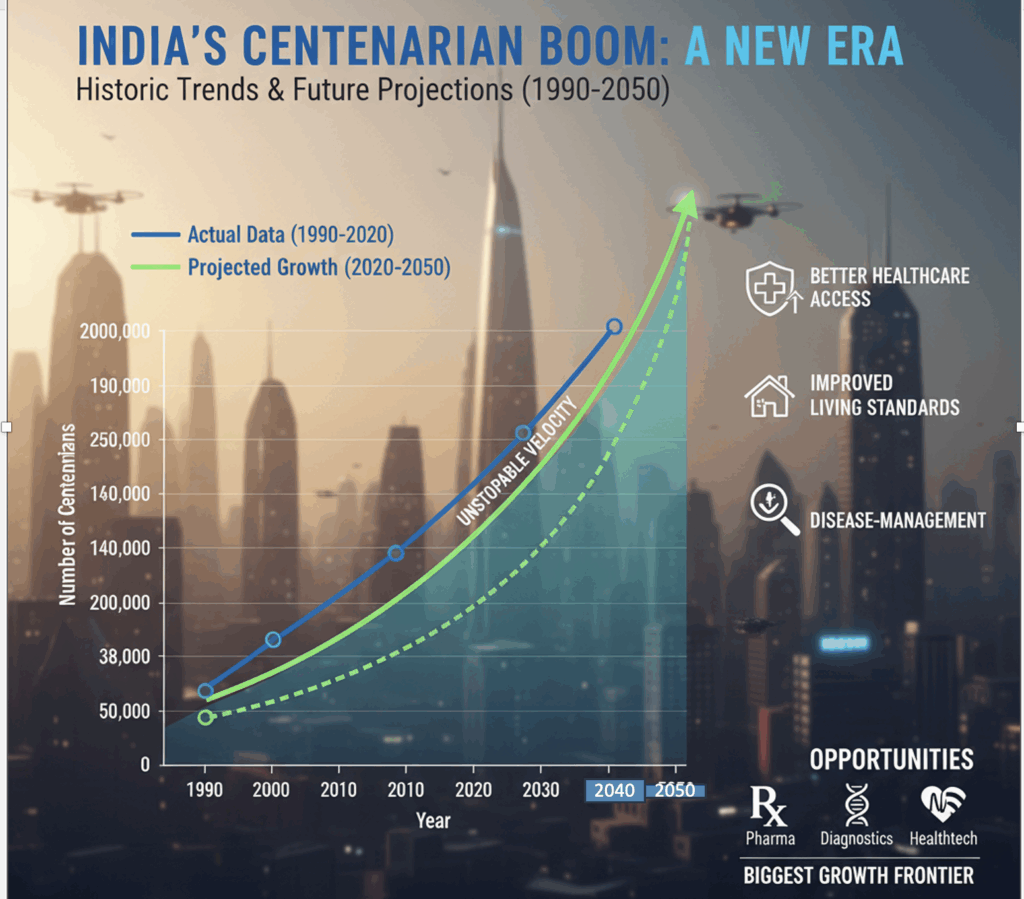

India is entering a longevity era unlike anything in its history. New global data shows the rise of centenarians is no longer a fringe trend—it’s a demographic wave gaining unstoppable velocity. Japan leads with 123,330 centenarians, followed by the U.S. (73,629), China (48,566), and India ranks fourth with 37,988 according to recent global estimates [1].

People are living longer due to better healthcare access, improved living standards, and stronger disease-management ecosystems [2]. But as lifespans stretch, the cracks in India’s health and social systems are widening fast.

This isn’t just an aging issue.

This is a system competitiveness issue, a policy-readiness issue, and a market-making opportunity.

And for pharma, diagnostics, and healthtech—this is the single biggest growth frontier of the next two decades.

India’s Big Blind Spot: Adding Years, Not Quality

The average Indian is living longer—but not necessarily healthier [3]. Our healthcare architecture is tuned for acute, episodic care, even as the 80+ population struggles with:

• Multiple chronic diseases

• Declining mobility

• Cognitive challenges

• Limited financial buffers

• Social isolation

• Everyday infrastructure barriers

The centenarian surge is outpacing India’s readiness on every metric—from geriatric workforce capacity to long-term care frameworks [5].

The New Indian Reality: Fewer Caregivers, More Seniors

The joint-family safety net—India’s traditional eldercare system—is eroding.

• Nuclear families dominate

• Migration is rising

• Seniors increasingly live alone

• Social isolation is accelerating [12]

This demands new frameworks blending community models, tech-enabled support, and professionalized care.

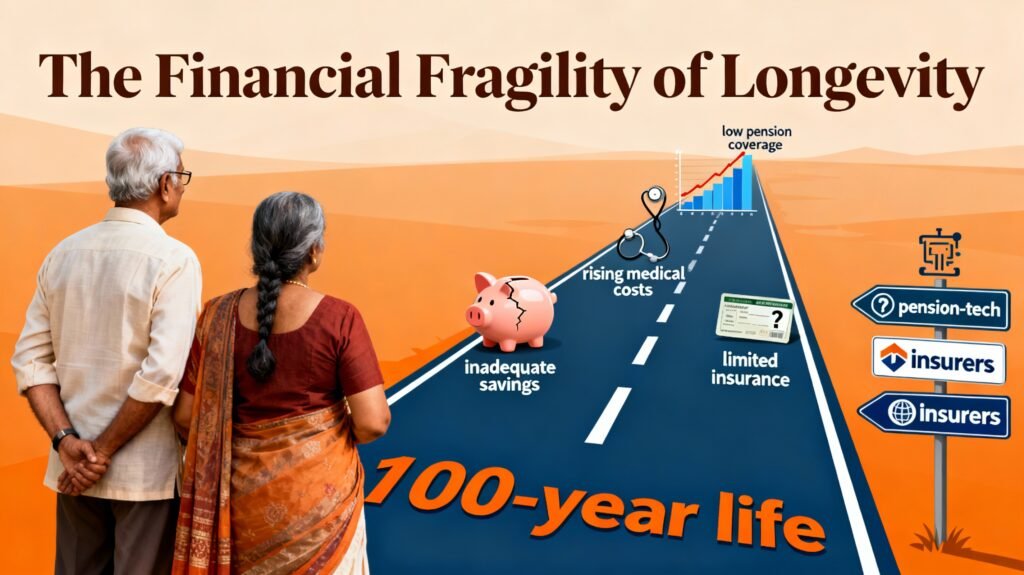

The Financial Fragility of Longevity

A 100-year life demands 100-year financial planning. Yet most Indians plan only for 60–70. NSSO and Economic Survey data highlight:

• Inadequate savings

• Rising medical costs

• Low pension coverage

• Limited insurance penetration [12, 13]

This creates a massive opportunity for pension-tech, insurers, and wealth-to-wellbeing platforms.

Mental Health: The Silent Epidemic Within Aging

Loneliness, depression, and cognitive decline spike after 80 [3].

Yet India has:

• Minimal dementia-care infrastructure

• Sparse geriatric psychiatry capacity

• No large-scale cognitive health programs [8]

The whitespace includes memory clinics, VR-based cognitive training, tele-psychiatry for seniors, and companionship-as-a-service.

India’s Cities Are Not Senior-First

From broken sidewalks to chaotic traffic, Indian cities systematically disadvantage seniors.

Universal design is still seen as a “special feature,” not a foundational principle [5].

What India needs:

• Senior-friendly mobility

• Age-inclusive housing

• IoT-enabled safety

• Accessible public spaces

• Urban planning aligned with WHO age-friendly guidelines [6]

Healthy aging is as much an infrastructure mandate as a medical one.

The Longevity Economy Is India’s Next Big Healthcare Growth Engine

Globally, the silver economy is a powerhouse [9]. For India, it is a multi-trillion-rupee opportunity spanning pharma, diagnostics, med-tech, wearables, and digital health.

Pharma: From Products to Lifetime Health Outcomes

Pharma can lead India’s shift from illness management to longevity management through:

• Geriatric-focused formulations

• Polypharmacy solutions

• Personalized dosing

• Long-acting therapies

• Preventive and disease-modifying programs [11]

The future is outcome-delivered, not molecule-delivered.

Diagnostics: The New Frontline of Healthy Aging

Diagnostics will become the early warning system for India’s seniors.

Future-ready models include:

• Subscription-based screening

• At-home diagnostics

• Predictive biomarker panels

• AI-led risk scoring for chronic and age-related disease [9, 14]

This shift aligns perfectly with India’s emerging preventive-care orientation.

Medical Devices & Wearables: Tech as the 24/7 Caregiver

The next decade will see rapid adoption of:

• Fall detection sensors

• Remote cardiac monitoring

• Glucose & sleep trackers

• Cognitive and mobility trackers

• Medication adherence devices

• Voice-first interfaces for impaired dexterity [14]

This is where med-tech will become an enabler of daily independence.

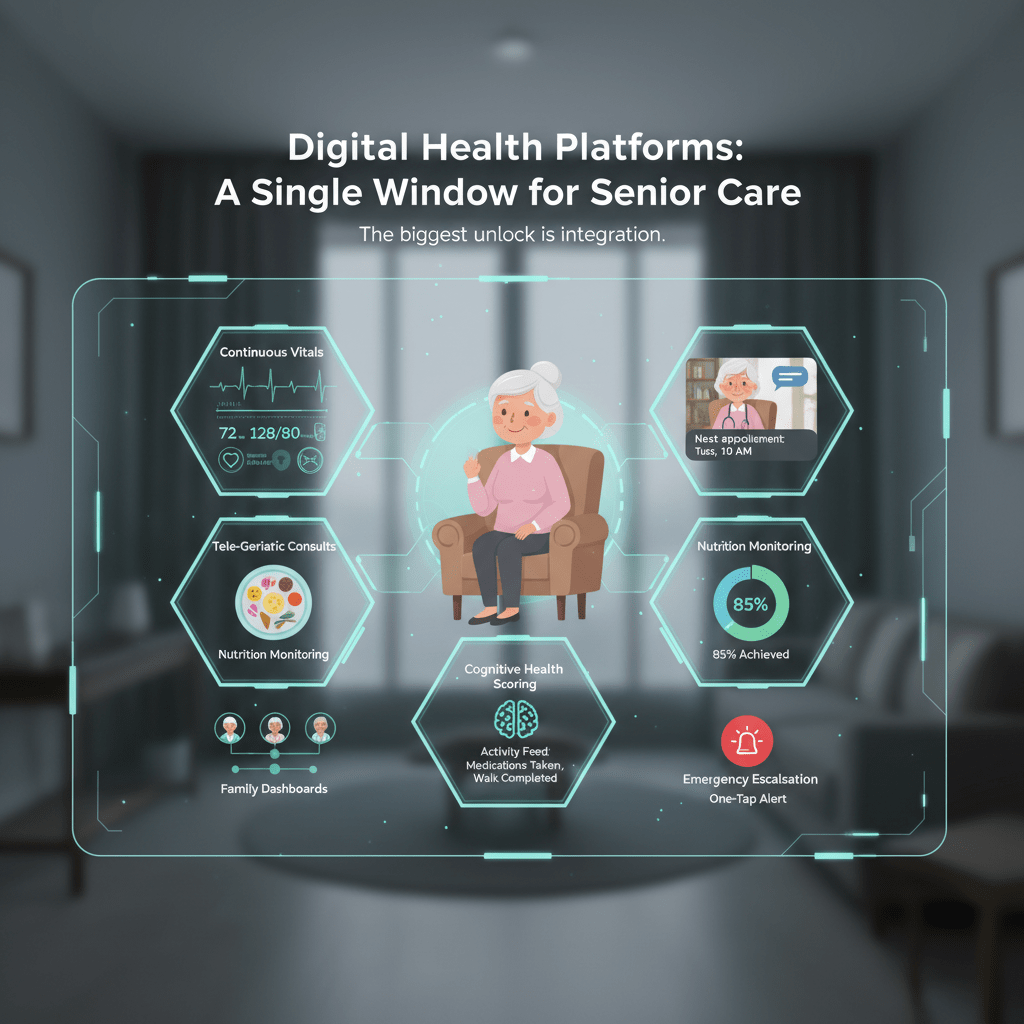

Digital Health Platforms: A Single Window for Senior Care

The biggest unlock is integration. Platforms must unify:

• Continuous vitals tracking

• Tele-geriatric consults

• Nutrition monitoring

• Cognitive health scoring

• Family dashboards

• Emergency escalation workflows [7]

This creates a digital health operating system for the elderly.

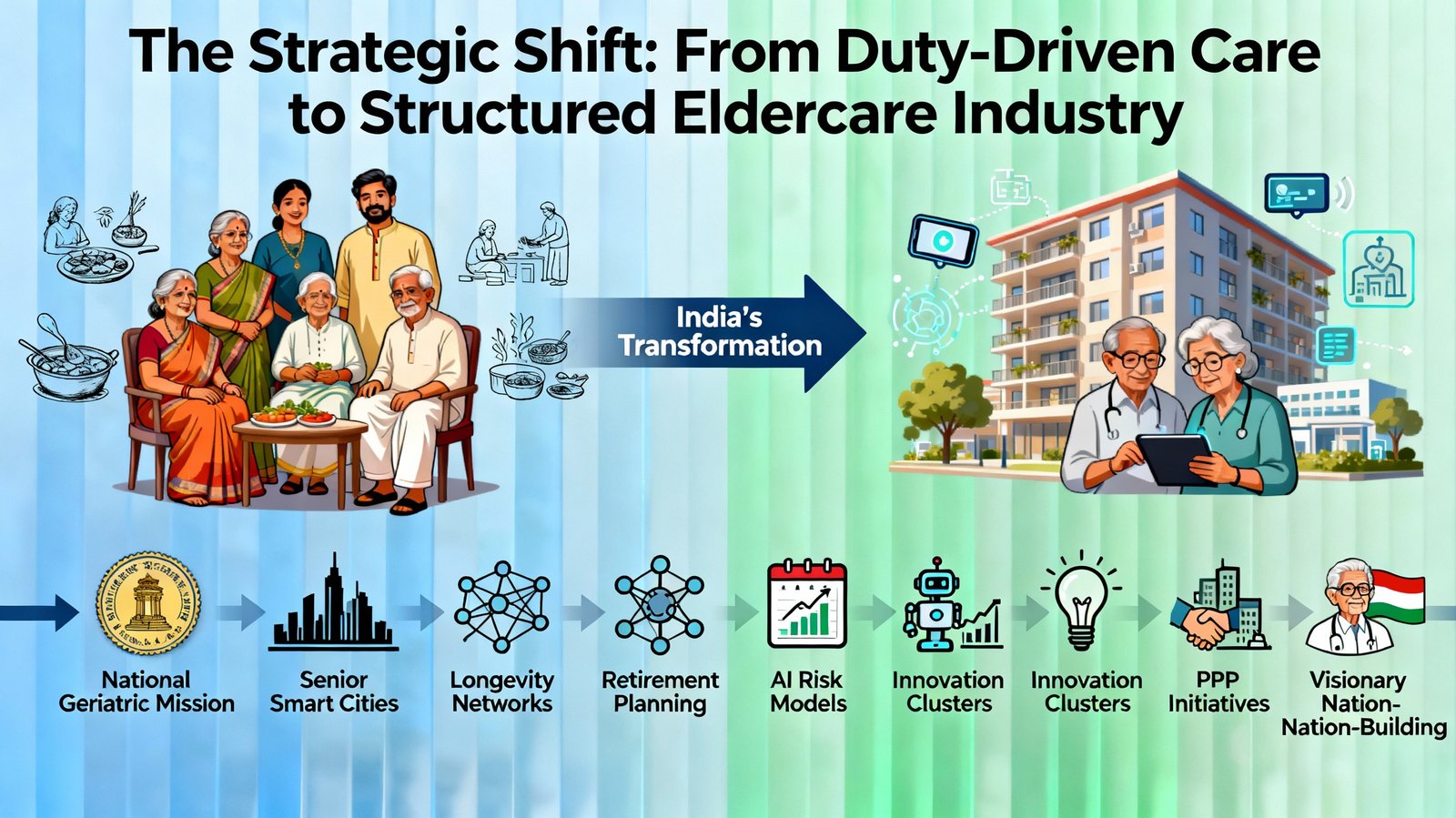

The Strategic Shift: From Duty-Driven Care to a Structured Eldercare Industry

India needs a formal eldercare industry—regulated, skilled, scalable, and supported by insurance and standards [10].

This is not just a healthcare transformation.

This is nation-building.

THE FUTURE ROADMAP: What India Must Build—Now

• A national geriatric care mission [5]

• Senior-friendly smart cities [6]

• Integrated longevity-care networks [7, 9]

• Incentivized retirement planning [13]

• AI-enabled risk prediction models [11, 14]

• Longevity innovation clusters [10]

• PPP-led senior wellbeing initiatives [5]

A longer life must also be a better life. That’s India’s strategic imperative.

The Closing Argument

India’s centenarian boom isn’t a projection—it’s here.

This demographic shift will redefine healthcare, urban planning, family structures, pensions, and national competitiveness.

For pharma, diagnostics, devices, and healthtech, this is the next frontier.

The chance to lead.

The chance to innovate.

The chance to shape how India ages—with dignity and independence.

If we get this right, India won’t just manage aging.

India will redefine global best practices for longevity-first healthcare.

Appendix: References

1. World Population Review (2025).

Global Centenarian Statistics: Country-wise Breakdown of Individuals Aged 100+.

Source for Japan, U.S., China, India centenarian figures.

2. United Nations – World Population Prospects 2024.

Longevity Trends, Aging Demographics, and Projected Dependency Ratios for India.

3. Longitudinal Aging Study in India (LASI), Wave 2.

National-level data on chronic diseases, geriatric conditions, mental health, functional ability, and social support patterns.

4. NITI Aayog (2023).

Senior Care Reforms and Roadmap for India’s Aging Population.

5. Ministry of Health & Family Welfare (MoHFW), Government of India.

Reports on geriatric care programs, National Programme for Health Care of the Elderly (NPHCE), and eldercare infrastructure.

6. World Health Organization – Global Report on Ageism (2021).

Insights on global health challenges linked to aging, care models, and social determinants.

7. Indian Council of Medical Research (ICMR) – Geriatric Health Updates (2022–24).

Studies on multimorbidity, polypharmacy, cognitive decline, and preventive care models.

8. International Longevity Centre – India (ILC-I).

Reports on elder abuse, active aging strategies, and policy readiness.

9. McKinsey & Company (2023).

“The Silver Economy: Capturing the Economic Opportunity of Global Aging.”

10. World Economic Forum – Future of Healthy Aging (2024).

Frameworks for tech-enabled senior care, longevity innovation, and workforce implications.

11. Harvard T.H. Chan School of Public Health – Global Aging Insights (2022–2024).

Research on centenarian health patterns, functional longevity, and quality-of-life metrics.

12. National Sample Survey Office (NSSO), Ministry of Statistics & Programme Implementation.

Data on household structures, caregiving, out-of-pocket expenditure, and senior living arrangements in India.

13. Economic Survey of India (2023–24).

Analysis of health expenditure, demographic transition, and financial preparedness of the aging population.

14. Ernst & Young – “The Rise of the Longevity Economy in Asia” (2024).

Market insights into pharma, diagnostics, and healthtech opportunities across aging populations.

All Images are AI Generated for Illustration Only. E&OE