Indian Pharma in September 2025: Momentum, Disruption & Caution

By MedicinMan Editorial Team

Published: October 2025

💊 Introduction

September 2025 marked a turning point for India’s pharmaceutical industry. The market continued to grow in value despite regulatory tremors, safety controversies, and global trade pressures. On the brighter side, innovation and chronic-care therapies kept fueling demand, signaling long-term resilience.

This analysis blends insights from PharmaTrac MAT Sep 2025 data with contemporary reporting from Business Standard, Reuters, Economic Times, and other leading outlets.

⚖️ 1. Market Overview — Strong Growth amid Shifting Dynamics

IPM Performance

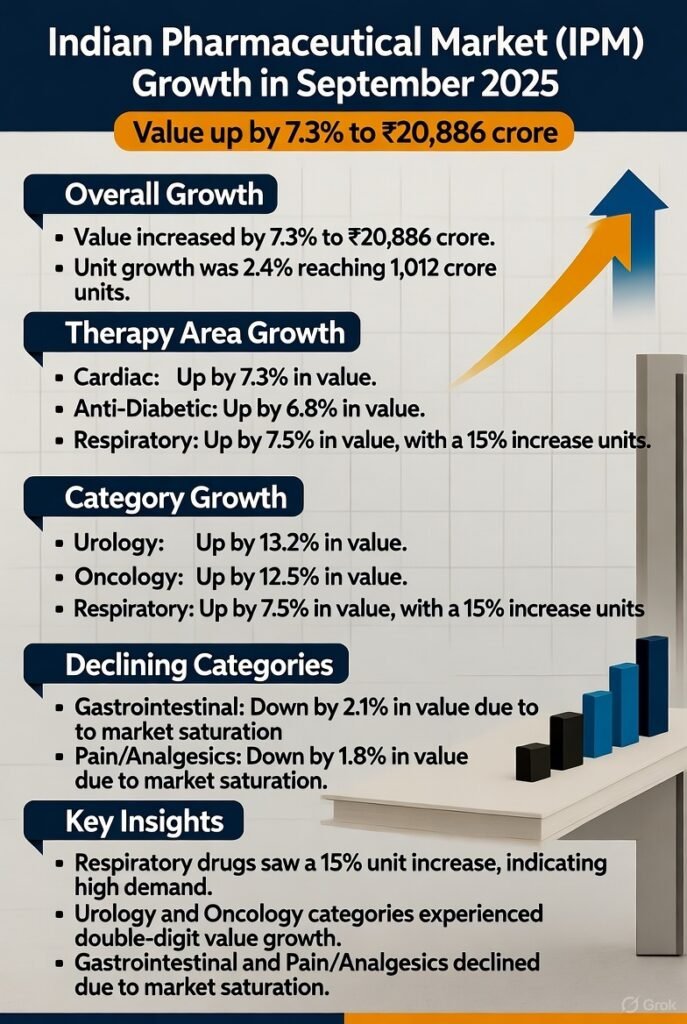

According to PharmaTrac (MAT Sep 2025), the Indian Pharmaceutical Market (IPM) registered a 7.3% value growth, reaching ₹20,886 crore in September.

Therapy-wise trends show:

Cardiac, Anti-Diabetic, and Respiratory therapies dominated growth.

Respiratory drugs increased by over 15% in units.

Urology and Oncology segments continued their double-digit surge.

The Gastrointestinal and Pain/Analgesics categories experienced a decline in volume due to market saturation.

Growth Drivers

The growth was primarily price-led (≈ 5.5 %) and new-launch driven (≈ 2.5 %), with overall volume nearly flat.

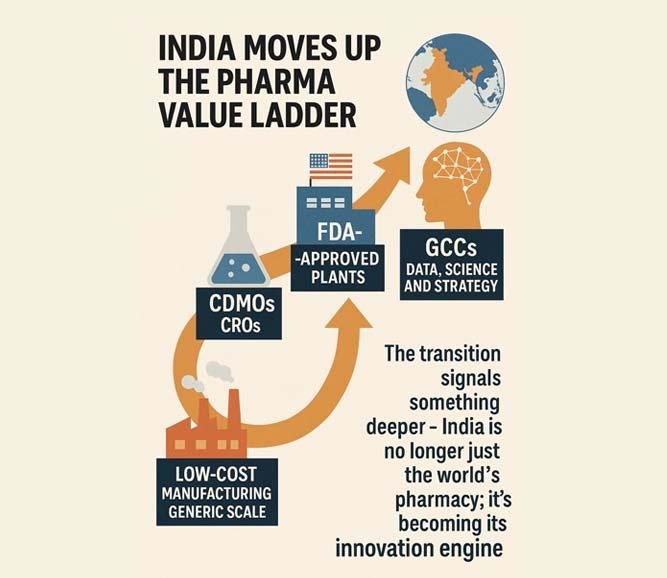

This indicates a maturing market where innovation and specialization — rather than mass generics — are now key levers.

🏥 2. Industry Highlights & Brand Movers

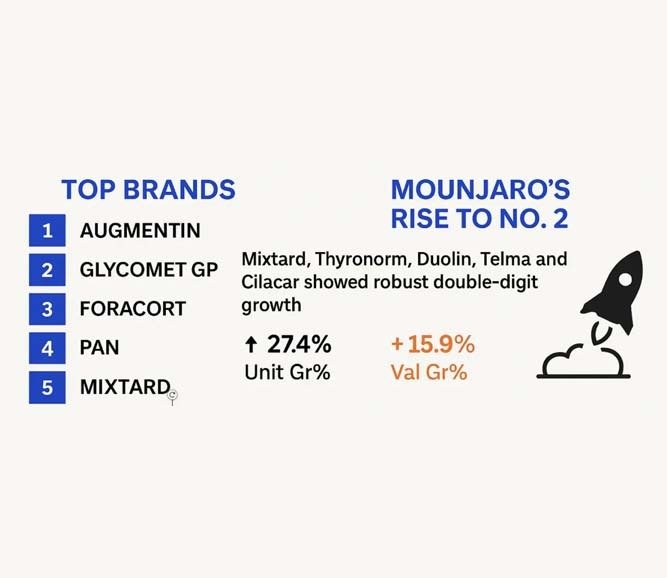

Top Brands

- Augmentin (GSK) retained leadership.

- Glycomet GP (USV) and Foracort (Cipla) sustained strong positions.

- Mounjaro (Eli Lilly) disrupted the rankings, becoming the No. 2 brand in India within just six months of launch, earning ~₹ 80 crore in September and ₹ 233 crore cumulatively since March 2025.

Leading Corporates

Top performers included Sun Pharma, Abbott, Cipla, Intas, and Torrent, all posting > 10 % annualized growth.

Mid-tier firms like La Renon and Nutricia outpaced the market, signaling strong niche penetration in chronic care and nutrition.

⚙️ 3. Regulation, Safety, and Compliance Challenges

September wasn’t without setbacks. A series of cough-syrup-related deaths triggered a regulatory storm. The Central Drugs Standard Control Organisation (CDSCO) flagged multiple testing and compliance failures among small manufacturers.

Authorities suspended operations at Shape Pharma, Rednex Pharmaceuticals, and others after detecting substandard batches. Several state drug controllers faced suspension for oversight lapses.

The incidents reignited conversations around Good Manufacturing Practices (GMP), stricter audits, and possible tiered licensing for MSME players.

🌍 4. Investment, Exports & Policy Outlook

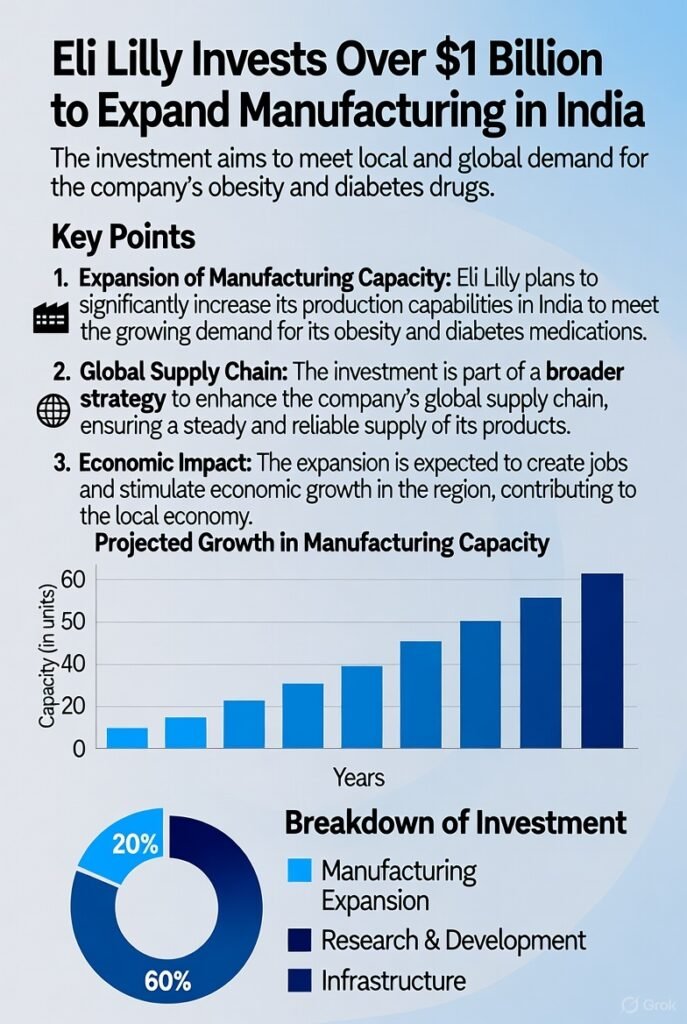

- Eli Lilly announced an investment exceeding $ 1 billion to expand manufacturing capacity in India, aimed at meeting local and global demand for its obesity and diabetes drugs.

- Rating agency ICRA forecasted 7–9 % revenue growth for FY 2026, despite U.S. regulatory headwinds.

- The Drug Marketing & Manufacturing Association (DMMA) cautioned that costly new bio-equivalence (BE) study norms could jeopardize over 5,000 MSME pharma units, as each study costs ₹ 20–40 lakh per formulation.

- Meanwhile, reports of potential 100 % U.S. tariffs on branded drugs caused a temporary stock sell-off in late September.

📉 5. Reading the Market Signals

| Positives | Watch-Outs |

|---|---|

| Innovation and price-led value growth | Volume stagnation in mature categories |

| Major investments by global players | Mounting quality-control scrutiny |

| Domestic demand resilience | Export risks and global trade tensions |

| New biologics and metabolic drugs gaining traction | MSME stress from compliance costs |

The sector stands at an inflection point — where trust, transparency, and differentiation will decide the next phase of leadership.

🧭 6. Outlook for the Coming Quarters

- Expect normalization of distribution flows post-GST revision.

- Metabolic, Oncology, and Respiratory therapies will continue to outpace IPM averages.

- Digital sales analytics and patient-centric launches are poised to become mainstream levers.

- Consolidation among top players will intensify, while niche innovators may carve premium spaces in specialty care.

📚 Appendix: Sources & References

Primary Data

- PharmaTrac IPM Performance – MAT Sep 2025

Pharmarack Analytics, Sheetal Sapale Presentation (Internal Dataset)

Market & Growth

- Business Standard – Indian pharma market grows 7.3 % in September 2025

- DD India – Indian pharma sector to log 7–9 % growth in FY26 despite US headwinds: ICRA

Brand & Corporate Trends

- Moneycontrol – Weight-loss drug Mounjaro is India’s second-highest selling pharma brand in Sep 2025

- Economic Times – Eli Lilly’s obesity drug Mounjaro’s India sales hit a sweet spot within six months of launch

Quality & Regulatory

- Reuters – India flags testing lapses at pharma firms after cough syrups deaths

- Economic Times – Sresan Pharma maker of Coldrif broke multiple rules: Officials

- Times of India – Govt orders suspension of production at two pharma firms

- Economic Times – Rajasthan cough syrup row: 11 child deaths trigger suspension of drug controller; Kaysons drugs pulled from market

Policy & MSME Impact

- Times of India – Regulatory burdens threatening pharma MSMEs: DMMA

Global & Trade

Investments

✍️ Author’s Note

This blog synthesizes quantitative insights from Pharmarack with verified journalistic reporting to provide a holistic view of the Indian pharma landscape. The aim is to equip MedicinMan readers — industry leaders, marketers, and healthcare professionals — with actionable intelligence grounded in both data and context.