India’s digital health landscape saw a significant leadership change as PharmEasy co-founder Siddharth Shah announced his resignation from the CEO post at API Holdings, the company’s parent, after over a decade of steering the business from its inception through an intense period of growth, challenges, and transformation

About the Transition

- Effective Date: The changes officially come into force from August 27, 2025[2][3][4].

- Siddharth Shah’s New Role: Shah will transition to become Vice Chairman and Director of API Holdings. In this strategic role, he is expected to guide the company’s long-term vision, governance, and future growth initiatives, moving away from daily operational control[1][2][4][5].

- Successor Announced: Rahul Guha, CEO of Thyrocare and President of Operations at API Holdings, has been appointed as the new Managing Director and CEO of API Holdings. Guha brings deep expertise in diagnostics and operational synergies, having led Thyrocare’s integration post its 2021 acquisition by PharmEasy[2][3][4][5][6][7].

Context and Background

- Co-founder Exodus: Shah’s resignation marks the last founder stepping away from operational roles. Earlier in 2025, co-founders Dharmil Sheth, Dhaval Shah, Harsh Parekh, and Hardik Dedhia exited their executive responsibilities to launch a new startup in architectural and interior design called All Home. They retain board-level or observer roles[2][3][4][8][9].

- Financial Reset: This leadership overhaul follows a steep business reset. PharmEasy’s FY24 revenue declined 15% YoY to ₹5,564 crore, while net losses were halved to ₹2,531 crore through aggressive cost control. The company’s valuation dropped sharply from $5.6 billion to $700 million in April 2024 after a fundraising round[3][8][5].

- IPO Ambitions: The change in management is seen as part of succession planning ahead of a potential IPO, which had been put on hold after filing for a public debut in 2021 and withdrawing in 2022. The company is now pursuing tighter operational execution and improved profitability across pharmacy and diagnostics verticals in preparation for renewed public market activity[3][4][8][5].

Significance and Future Direction

- Professionalization of Leadership: The transition from founder-led to professionally managed operations is a trend among Indian startups entering their next growth phase, prompted by intense funding headwinds and market corrections. Guha’s elevation is expected to drive operational excellence, strategic clarity, and financial discipline within the group[3][8][5][6][7].

- Dual Leadership Model: With Rahul Guha managing execution and Shah guiding strategic vision, PharmEasy aims to restore investor confidence and reposition its brand in the competitive Indian health-tech space[3][8][5].

Key Takeaways

- Siddharth Shah, PharmEasy’s last operational founder, steps down as CEO, becoming Vice Chairman of API Holdings[1][2][3][4].

- Rahul Guha, CEO of Thyrocare, becomes the new Managing Director and CEO of API Holdings, effective August 27, 2025[2][3][4][5][6][7].

- Leadership changes are timely, coming after a sharp valuation correction, co-founder exits, and a pause on IPO ambitions[3][8][5].

- The company will focus on operational streamlining, improved profitability, and a possible IPO reboot in the coming years[3][8][5].

PharmEasy’s journey now enters a new era—one of professional management and strategic consolidation—seeking stability and sustainable growth in India’s rapidly evolving digital health sector.

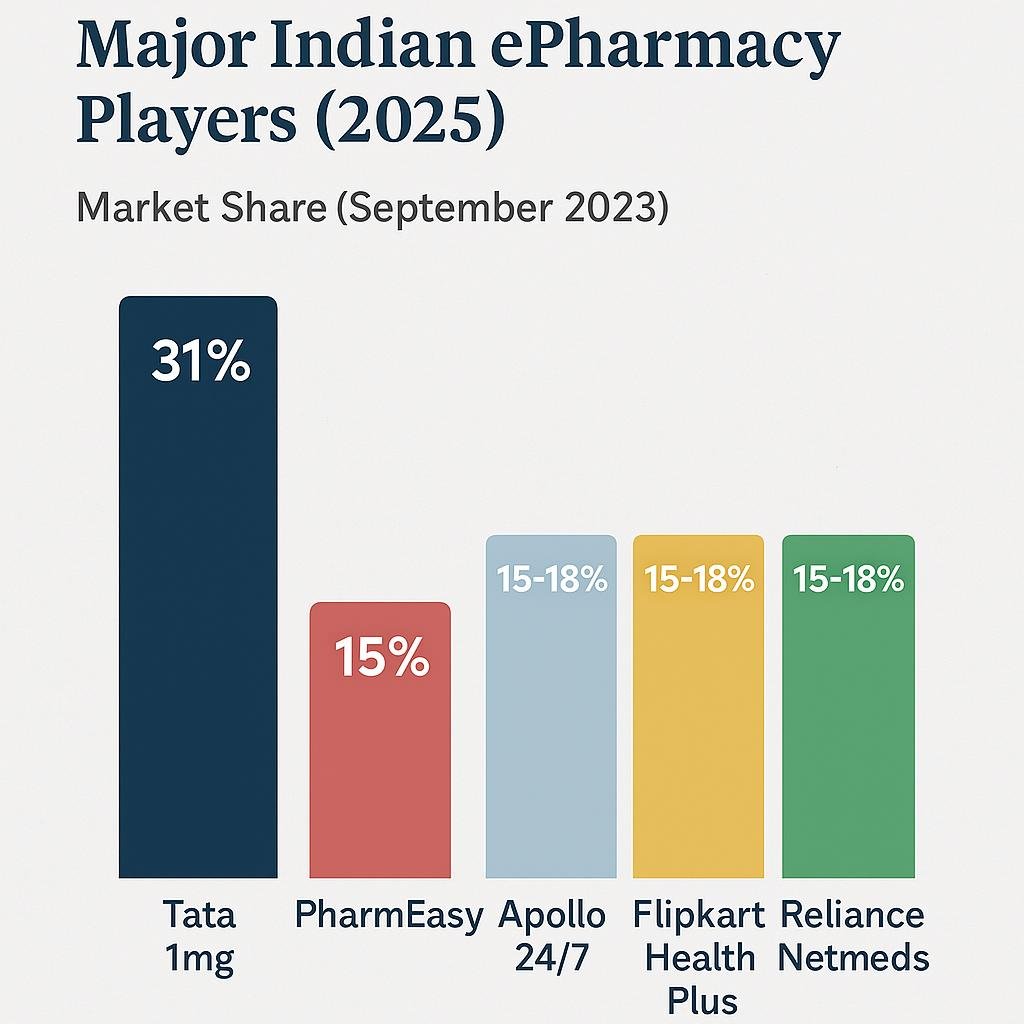

Comparative Analysis of Major Indian ePharmacy Players (2025)

India’s ePharmacy sector is highly competitive, with multiple players vying for leadership.

Platform Market Share Trend

Tata 1mg 31% Now market leader, driven by Tata Digital’s backing and aggressive growth.

PharmEasy 15% Declined due to reduced marketing spend and focus on profitability.

Apollo 24/7 ~15–18% Stable share; benefits from Apollo Hospitals network.

Flipkart Health Plus ~15–18% Stable; uses Flipkart’s e-commerce reach.

Reliance Netmeds ~15–18% Stable; supported by Reliance’s distribution network.

Key Differentiators

• Tata 1mg – Strongest brand trust, diversified services (medicines, diagnostics, teleconsults), and highest growth rate.

• PharmEasy – Largest diagnostics network via Thyrocare, strong Tier-II presence, now focusing on profitability.

• Apollo 24/7 – Deep integration with Apollo Hospitals, credible telehealth and health plans.

• Flipkart Health Plus – Leverages e-commerce infrastructure for fast delivery and broad reach.

• Reliance Netmeds – Strong supply chain muscle, potential for offline-online integration.

Sector Trends

• Shift to Profitability: Deep discounting is giving way to sustainable financials.

• Diagnostics Integration: Increasing revenue contribution from bundled health services.

• Corporate Backing Wins: Tata, Reliance, Flipkart, and Apollo leverage strong parent networks.

• Regulatory Watch: Growth continues amid pending regulations; leaders invest in compliance.

Conclusion

• Tata 1mg is the current market leader in share and execution.

• PharmEasy is consolidating operations with renewed financial discipline and leadership change.

• Apollo, Flipkart, and Netmeds remain strong contenders, but have not overtaken the top spot.\

Sources:

Outlook Business | Economic Times | Moneycontrol | Unlisted Zone | Business Standard