Summary

Torrent Pharmaceuticals (TRP) has signed definitive agreements to acquire a 49.2% controlling stake in JB Chemicals and Pharmaceuticals (JBCP) for ₹126.4 billion and plans to acquire the remaining 50.8% through a share swap valued at ₹140.4 billion. This results in a total enterprise value of ₹266.3 billion, marking Torrent’s largest acquisition to date.

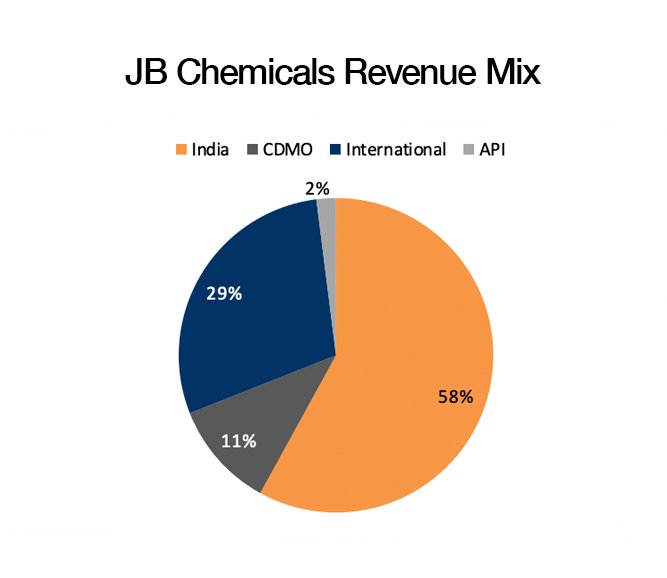

The deal makes TRP the 5th-largest pharma company in India, with a stronger presence in cardiac, gastro, ophthalmology, nephrology, and CDMO segments. Execution will be key, given the scale, complexity, and integration risks.

✅ 7 Key Takeaways

- 🔁 Deal Structure

- Torrent will first acquire 46.39% from KKR and 2.8% from employees at ₹1,600/share.

- Then, it will merge JBCP into TRP via a 51:100 share swap, valuing the remainder at ₹140.4B.

- Timeline: 15–16 months for full closure, with CCI approval expected in 6 months.

- 📈 Strategic Synergies

- Cost synergies: Procurement, field-force, and manufacturing efficiencies expected from year one.

- Revenue synergies: Scale-up in chronic therapies, CDMO, and entry into new segments like ophthalmology and nephrology.

- 💸 Financial Impact

- EPS dilutive in year 1, breakeven by FY28, with ROCE returning to 28% by FY28.

- Payback period estimated at 14–15 years, considered long but acceptable for the scale.

- 📊 Post-Merger Scale

- Torrent’s domestic revenues grow by 34.5%, adding ₹23B from JBCP.

- Combined entity expected to reach ₹195.6B in revenue by FY27 with 33%+ EBITDA margins.

- ⚠️ Risks

- Execution complexity due to size and cultural integration.

- Regulatory delays or brand divestment (e.g., Rantac) may be required.

- Torrent is entering unfamiliar ground with international and CDMO operations.

- 💰 Financing & Leverage

- No QIP planned; funding via debt and internal accruals.

- Net debt expected to reduce from ~2.8x post-deal to <0.5x by FY29.

- Interest costs expected to remain <8%.

- 📊 Valuation & Guidance

- Target price: ₹3,657 (13% upside from current ₹3,242).

- Retains a LONG rating with estimated EPS of ₹93.7 in FY27 and ₹111.5 in FY28.

- Analysts have not yet factored the full acquisition into earnings estimates.