Zydus’ ZYCUBO May Be the Proof Point the Industry Needed

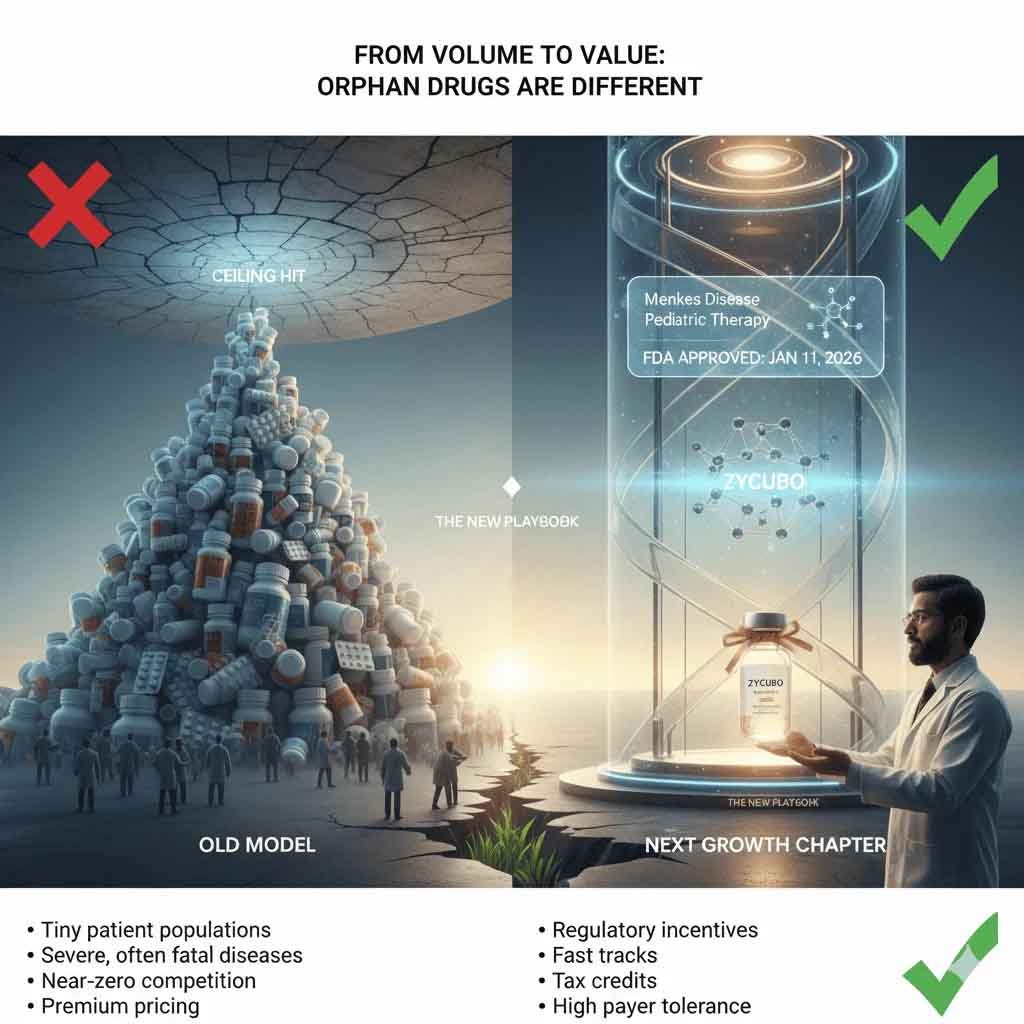

For decades, Indian pharma has won by playing the volume game—generics, cost arbitrage, regulatory stamina, scale. That model built giants. It also hit a ceiling.

On January 11, 2026, Zydus Lifesciences quietly signalled what the next growth chapter could look like. Through its US arm Sentynl Therapeutics, Zydus secured FDA approval for ZYCUBO (copper histidinate)—the world’s first approved therapy for pediatric Menkes disease, a fatal X-linked genetic disorder with no prior approved treatments.

This wasn’t just a regulatory milestone. It was a strategic pivot.

ZYCUBO doesn’t sell into millions of patients. It doesn’t compete on price. It doesn’t fit the old Indian pharma playbook. And that’s precisely why it matters.

From Volume to Value: Why Orphan Drugs Are Different

Orphan drugs flip traditional pharma economics on their head.

• Tiny patient populations

• Severe, often fatal diseases

• Near-zero competition

• Premium pricing

• Regulatory incentives (orphan exclusivity, fast tracks, tax credits)

• High payer tolerance when outcomes are transformative

Globally, this model is no longer niche. Orphan drugs already account for over 20% of global pharma revenues, despite serving less than 5% of patients. The math works because value—not volume—drives returns.

Indian pharma, historically locked into scale-driven generics, has largely sat out this shift. ZYCUBO suggests that era may be ending.

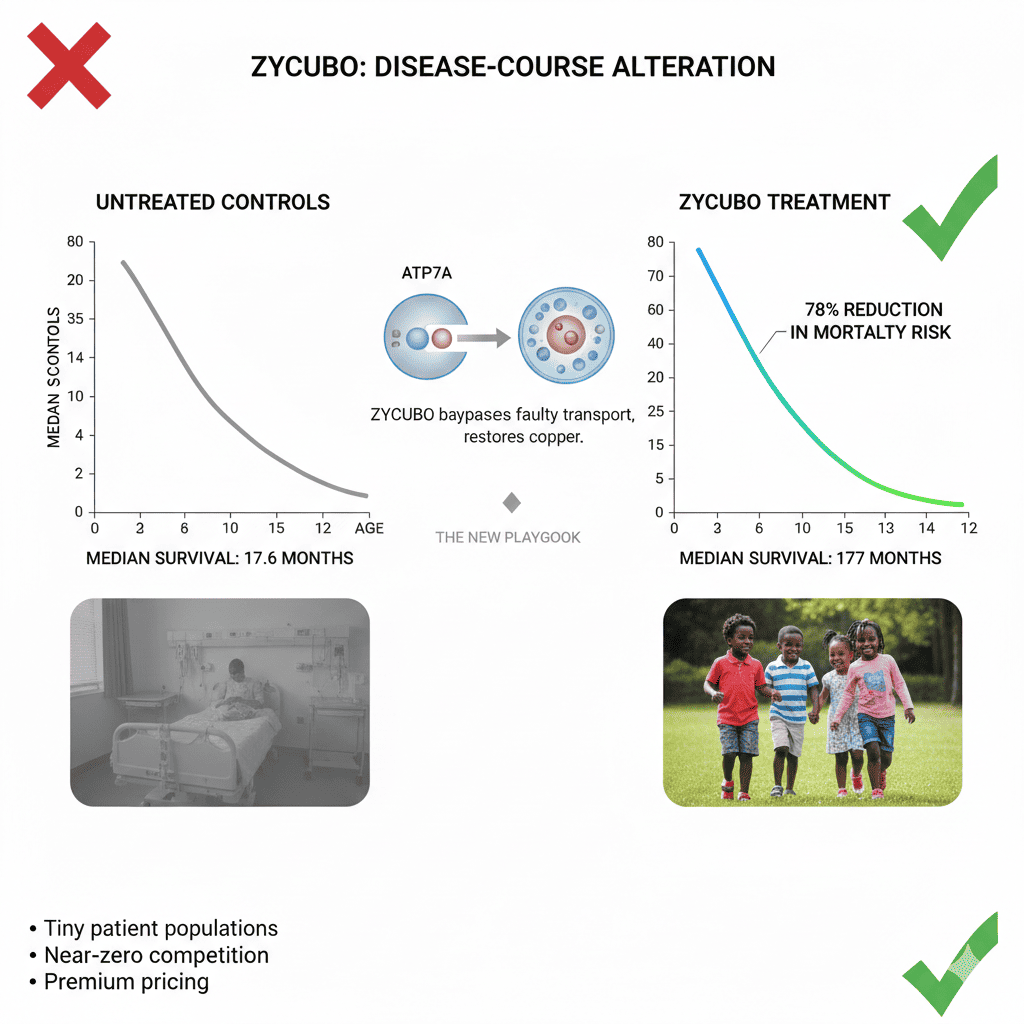

ZYCUBO and Menkes Disease: Solving the Unsolvable

Menkes disease is brutal biology.

A defective ATP7A gene prevents copper transport, leading to rapid neurodegeneration, seizures, connective tissue failure, and death—often by age three if untreated. Until now, treatment was limited to compassionate-use copper injections with inconsistent outcomes and no regulatory backing.

ZYCUBO changes that.

Administered subcutaneously, copper histidinate bypasses the faulty transport mechanism and restores bioavailable copper. FDA approval was based on two open-label studies comparing treated infants to natural-history controls:

• Neonatal treatment (<4 weeks)

• Median survival: 177 months

• Untreated controls: 17.6 months

• 78% reduction in mortality risk

• Some children now alive beyond 12 years, a previously unheard-of outcome

This isn’t marginal benefit. This is disease-course alteration.

The Regulatory Signal That Matters

Equally important is how ZYCUBO was approved.

The FDA accepted external natural-history controls instead of randomized trials—acknowledging that in ultra-rare pediatric diseases, traditional trial designs are impractical and unethical.

This lowers the barrier for future orphan programs—if companies invest early in registries, diagnostics, and long-term follow-up.

For Indian pharma companies accustomed to FDA scrutiny on generics, this is familiar terrain—applied now to innovation.

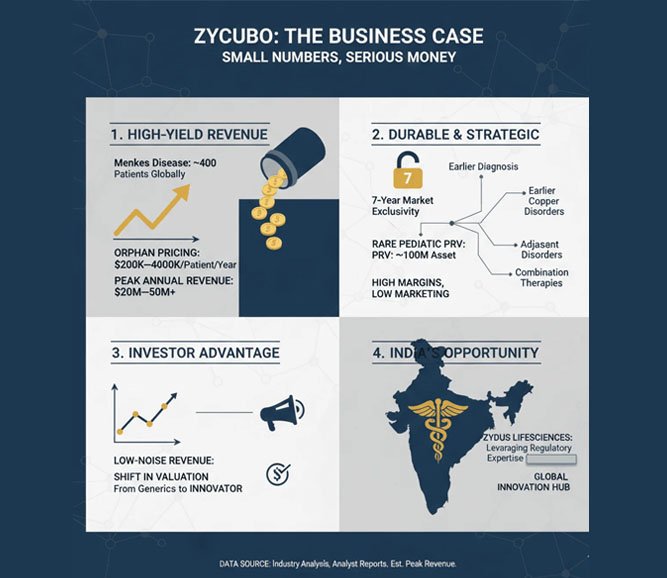

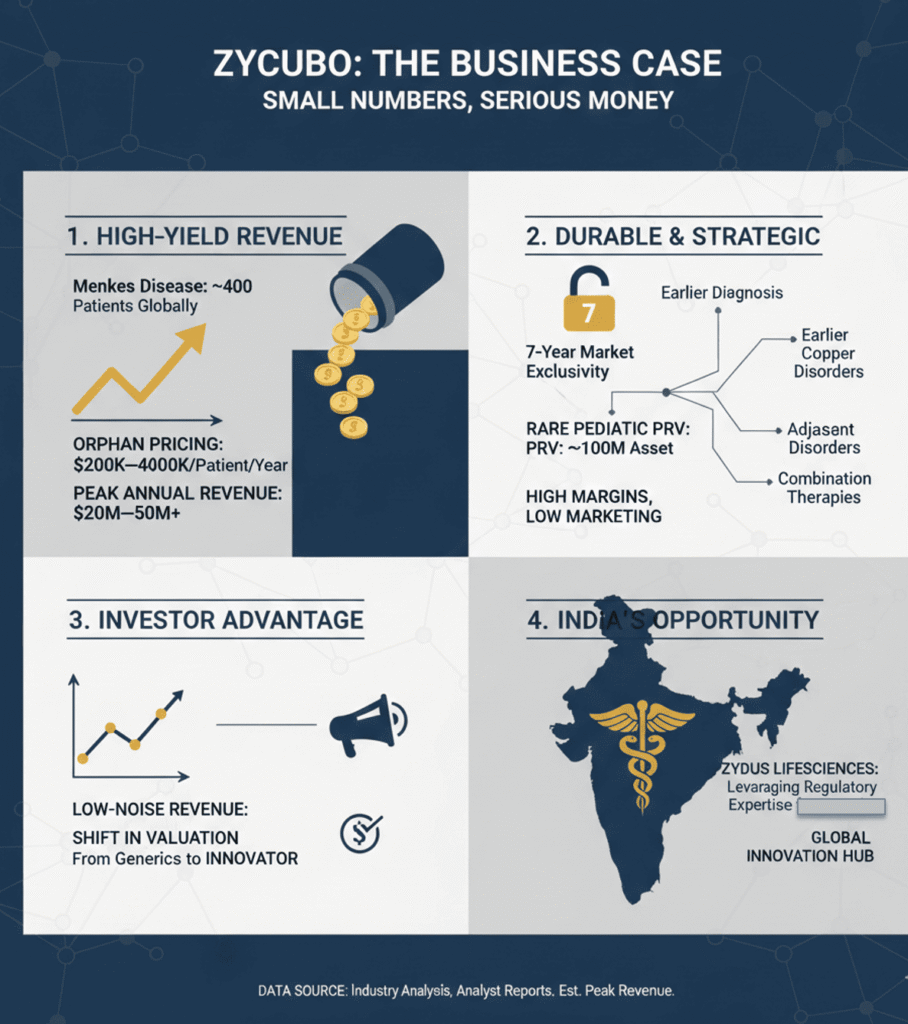

The Business Case: Small Numbers, Serious Money

Menkes disease affects only a few hundred diagnosed patients globally. Yet ZYCUBO is expected to command orphan-level pricing, likely in the $200,000–400,000 per patient per year range in developed markets.

That translates to:

• Tens of millions in annual revenue at peak for a single ultra-rare indication

• High margins, limited marketing spend, and durable exclusivity

• Strategic optionality for lifecycle expansion (earlier diagnosis, adjacent copper disorders, combination therapies)

This is not blockbuster math—but it is high-quality, low-noise revenue. Exactly the kind investors increasingly reward.

Why This Matters for Indian Pharma—Beyond Zydus

ZYCUBO is not an isolated success. It’s a template.

Indian pharma already has:

• World-class chemistry and biologics capabilities

• Deep FDA regulatory experience

• Cost-efficient development engines

What it has lacked is risk appetite for low-volume, high-impact innovation.

That is changing.

Sun Pharma’s rare-disease bets, Biocon’s biologics push, and now Zydus’ orphan approval point to a strategic reorientation: owning niches instead of fighting commodity wars.

India’s domestic ecosystem still lags—newborn screening is limited, orphan-drug incentives are weak, and CDSCO fast-tracks are inconsistent. But ZYCUBO proves that global-first orphan strategies are viable—even if India adoption follows later.

The Bigger Picture: Orphan Drugs as India’s Next Export Engine

The global orphan-drug market is expanding rapidly, driven by genomics, diagnostics, and regulatory alignment. Western innovators dominate today—but cost pressures, pipeline risk, and manufacturing constraints open the door for new players.

Indian pharma doesn’t need to dominate this space to win. It needs to pick its battles intelligently:

• Ultra-rare, high-fatality diseases

• Clear biomarkers and endpoints

• Strong regulatory incentives

• Limited competition

ZYCUBO checks every box.

Bottom Line

ZYCUBO will save lives. That alone matters.

But strategically, it does something bigger: it proves that Indian pharma can move from copying molecules to creating markets.

Orphan drugs won’t replace generics. But they may become the next global growth lever—higher margin, more defensible, and aligned with where medicine is heading.

Zydus just showed the way.

The question now is: who follows—and how fast?

Sources

1. FDA Press Release – “FDA Approves First Treatment for Children With Menkes Disease” (Jan 11, 2026)

2. CNBC-TV18 – “Zydus Life’s US arm gets FDA nod for first-ever Menkes disease treatment” (Jan 13, 2026)

3. Zydus Lifesciences / Sentynl Therapeutics Press Release (Jan 2026)

4. NORD (National Organization for Rare Disorders) – Menkes Disease Overview (Updated 2024)

5. Global orphan drug market reports – Mordor Intelligence, BioSpace, PR Newswire (2024–2025)

6. Historical copper histidinate compassionate-use data cited in FDA review documents

All Images are AI Generated for Illustration Only. E&OE