Eli Lilly is in a rare position. Its GLP-1 juggernaut — Mounjaro/Zepbound (tirzepatide) — has become one of the most successful launches in modern pharma. Demand is outpacing supply. Revenue is accelerating. The industry is recalibrating around what high-potency incretin therapies can achieve for metabolic disease and longevity.

So the obvious question is:

Why would a company that already dominates the injectable GLP-1 space suddenly commit $6 billion to build a manufacturing facility centered around an unapproved oral GLP-1, orforglipron?

Because Lilly understands that the next frontier isn’t just efficacy — it’s accessibility.

And accessibility, not potency, is what scales.

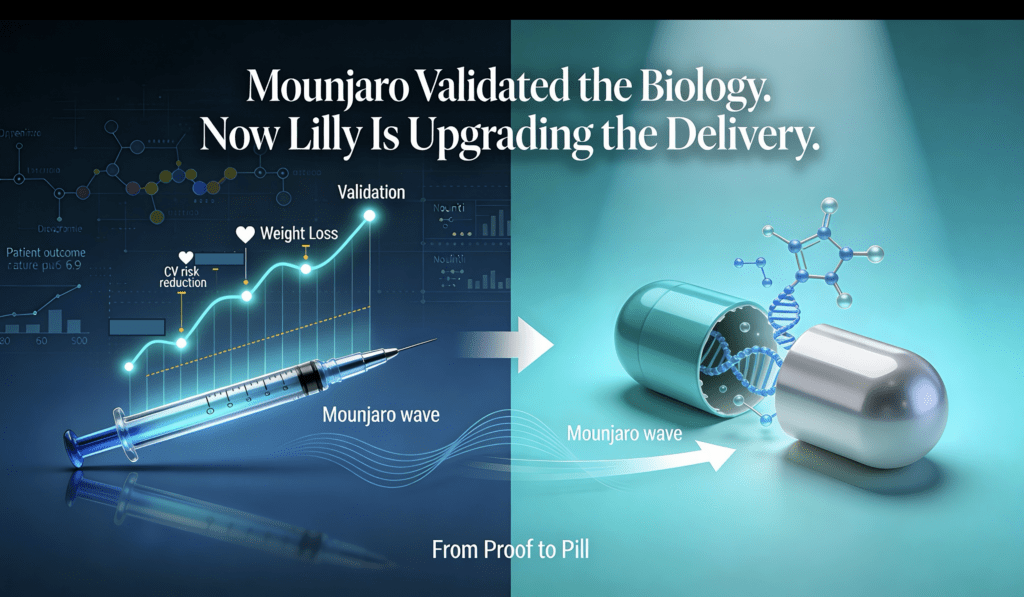

1. Mounjaro Validated the Biology. Now Lilly Is Upgrading the Delivery.

Mounjaro proved that powerful incretin therapies can deliver transformational results across weight loss, metabolic health, cardiovascular risk, and even emerging longevity metrics. It gave Lilly the clinical credibility and consumer trust to double down.

But Lilly also learned something deeper from the Mounjaro wave:

Injectables deliver outcomes. Orals deliver adoption.

Millions of people want the benefits of GLP-1s — but a meaningful percentage won’t touch a needle.

Not weekly. Not monthly.

Not ever.

The result?

A scientifically validated therapy class with a built-in adoption bottleneck.

Orforglipron, a once-daily oral GLP-1, is Lilly’s answer.

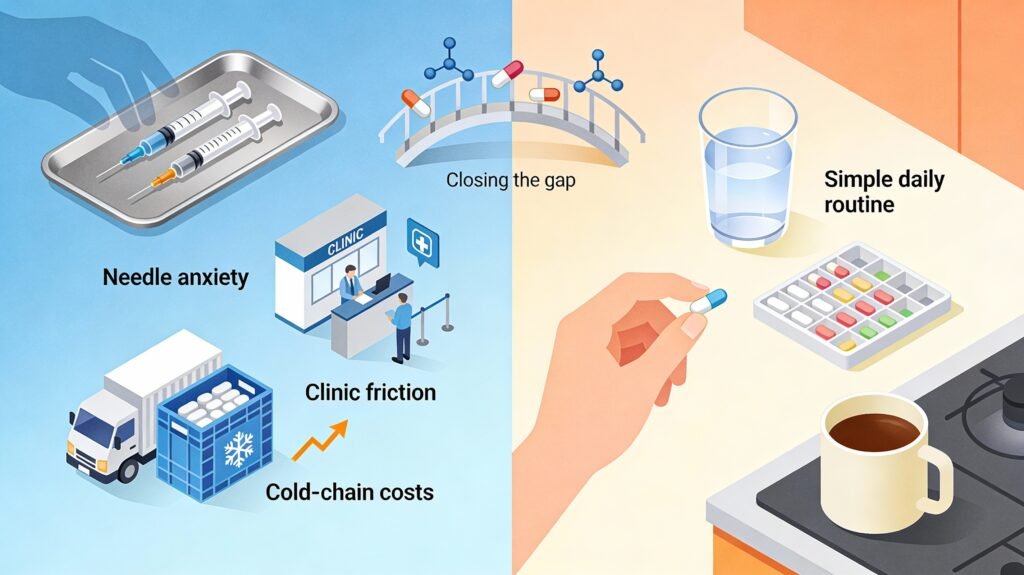

2. The Real Barrier: Fear of Needles, Not Lack of Efficacy

The longevity and metabolic health ecosystem today is dominated by injectable formats:

- GLP-1 injections

- Peptide injections

- IV drips

- High-touch protocols requiring clinic visits

These are powerful, but they exclude a large portion of the population because:

- Needle anxiety is widespread

- Clinic visits create friction

- Cold-chain logistics inflate costs

- People prefer simple, familiar routines

A therapy can be clinically perfect and still fail in real-world adoption.

That’s the strategic gap Lilly is aiming to close.

3. Why Orals Scale Faster: The Manufacturing and Psychology Advantage

Orforglipron isn’t just about convenience — it’s about industrial scalability.

✔ Easier to manufacture

Small-molecule pills are simpler to produce than complex peptide injectables.

No cold chain.

Lower marginal cost.

Higher global deployability.

✔ Easier to distribute

Oral meds fit into existing pharmacy, retail, and primary-care ecosystems.

✔ Easier to adopt

Taking a pill is a familiar, low-friction behavior — and adherence naturally rises when a therapy fits into daily life.

Even if an oral GLP-1 delivers slightly less dramatic outcomes than Mounjaro, the size of the eligible user base could be exponentially larger.

This is not a compromise. It’s a scale strategy.

4. Lilly’s $6 Billion Signal: Capacity Before Approval

The new Huntsville, Alabama manufacturing site is designed for:

- API production

- Mass-scale oral formulation capacity

- Future pipeline flexibility

And Lilly is committing this capital before the FDA has approved orforglipron.

That tells us everything:

Lilly isn’t betting on one molecule.

Lilly is betting on a delivery format that unlocks the next 50 million users.

This is the kind of long-horizon infrastructure move that defines leaders — the Amazon-style “build before the demand hits” confidence.

5. The Longevity Industry Should Take Note

Today’s longevity landscape still prioritizes:

Efficacy first. Delivery second.

But the next decade belongs to brands that flip this logic.

Data across nutrition, dermatology, metabolic health, and adherence research is clear:

Most people achieve their health goals not with the most potent protocol — but with the most sustainable one.

The winners will be the companies that:

- Reduce friction

- Simplify access

- Maintain meaningful efficacy

- Design for everyday behavior

Orals, strips, patches, micro-dosed combinations — formats that meet consumers where they already are.

6. What Lilly’s Move Means for Market Dynamics

Here’s the broader strategic implication:

Potency created the GLP-1 boom.

Accessibility will shape the GLP-1 era.

Lilly is now positioned to own both ends of the curve:

- Injectables → peak performance + clinical potency

- Orals → mass adoption + everyday use

This dual-platform strategy isn’t just commercially smart — it creates resilience, optionality, and long-term category leadership.

Conclusion: Simplicity Scales

Orforglipron isn’t just an unapproved pill.

It’s Lilly’s roadmap for what metabolic medicine looks like when it’s no longer held back by needles, logistics, or fear.

Mounjaro won the efficacy game.

Orforglipron is designed to win the accessibility game.

And in healthcare — especially longevity — the product that reaches the most people ultimately has the biggest impact.

Lilly understands that.

The rest of the industry should, too.

All Image are AI Generated for Illustration Only. E&OE

Appendix — Sources

Strategic & Market Reporting

- Lilly’s $6B manufacturing investment and facility build-out in Huntsville.

Source: Investing.com (News report on orforglipron-focused manufacturing expansion) - Reuters update on the plant’s role, API strategy, and broader supply chain positioning.

Source: Yahoo Finance (Reuters syndicated content) - Industry summary on GLP-1 manufacturing expansion and domestic production priorities.

Source: LinkedIn News (U.S. GLP-1 manufacturing expansion brief)

Clinical & Scientific Insights

- Overview of orforglipron clinical data and Phase 3 weight-loss findings.

Source: Healthline (Clinical efficacy and trial outcome summary)