Introduction

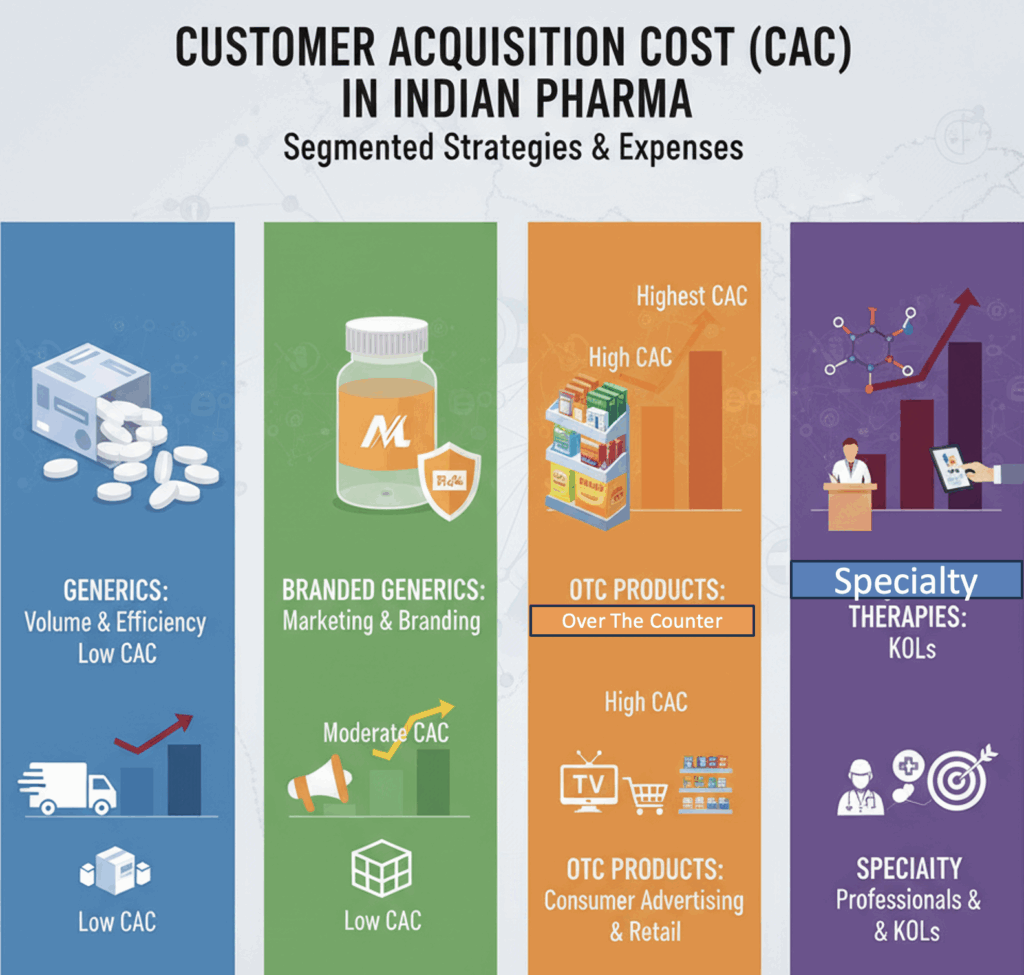

Customer Acquisition Cost (CAC) is a key metric representing the total expense incurred to acquire a new customer. In the Indian pharmaceutical sector, which is segmented into generics, branded generics, OTC products, and specialty therapies, CAC is central to strategic marketing and sales decision-making.

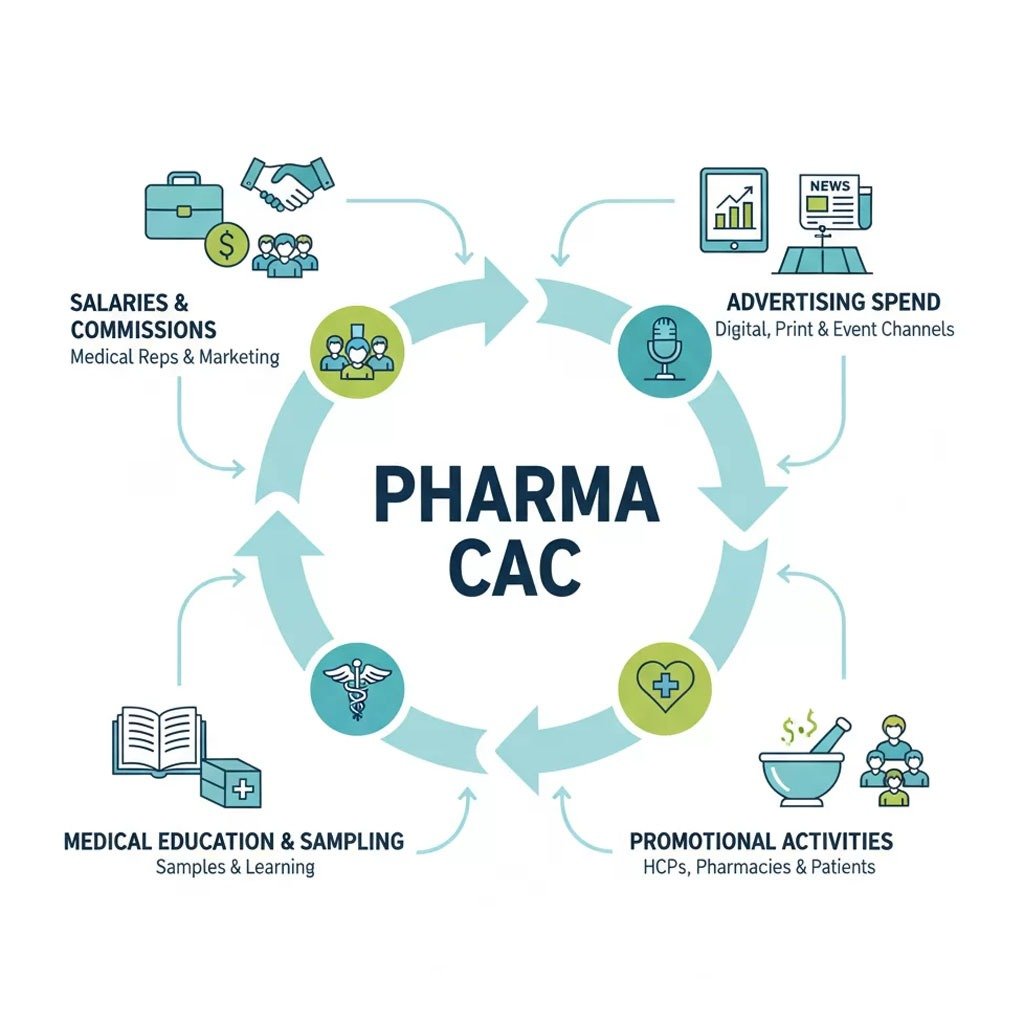

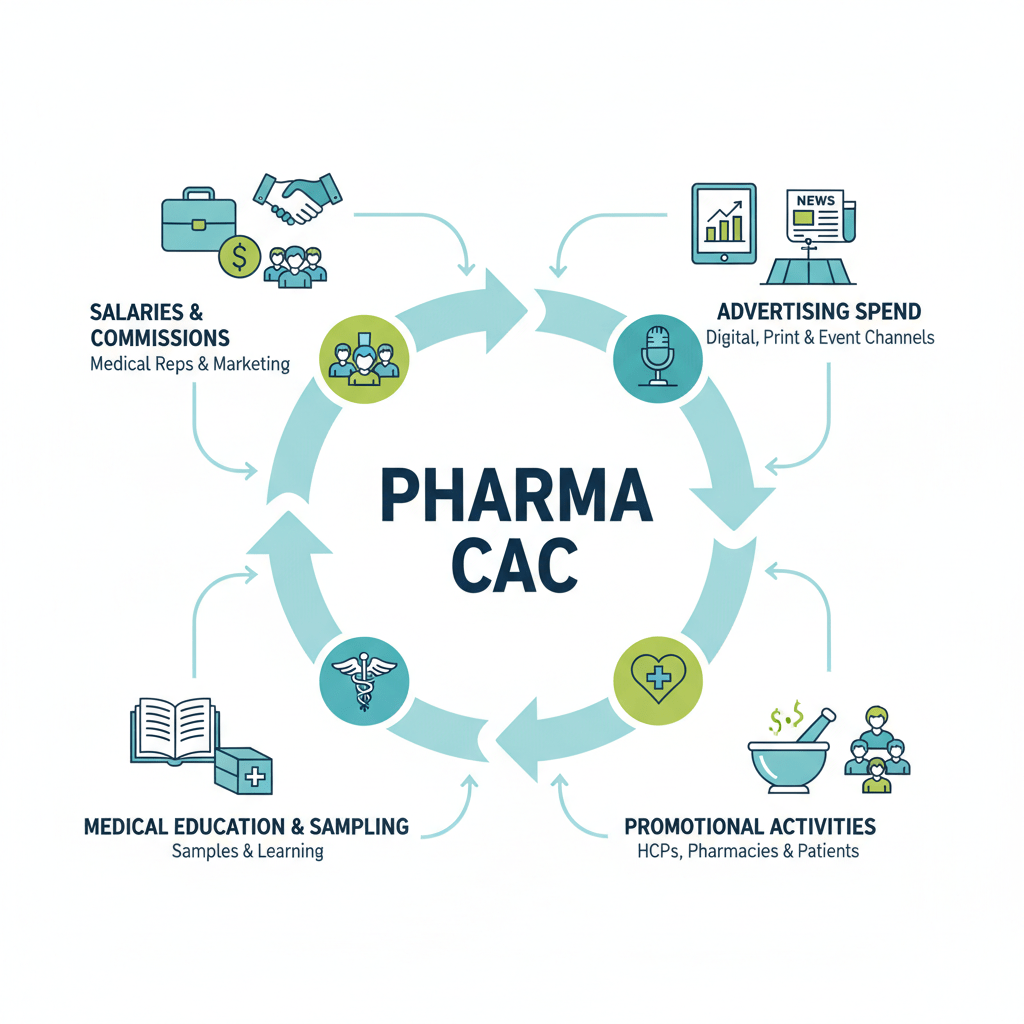

What Constitutes CAC in Indian Pharma?

CAC in pharma includes:

- Salaries and commissions of medical representatives and marketing teams.

- Advertising spend across digital, print, and event channels.

- Medical education and sampling costs.

- Promotional activities directed at healthcare professionals, pharmacies, and patients.

CAC in Indian Pharma vs. MNC Pharma: Key Differences

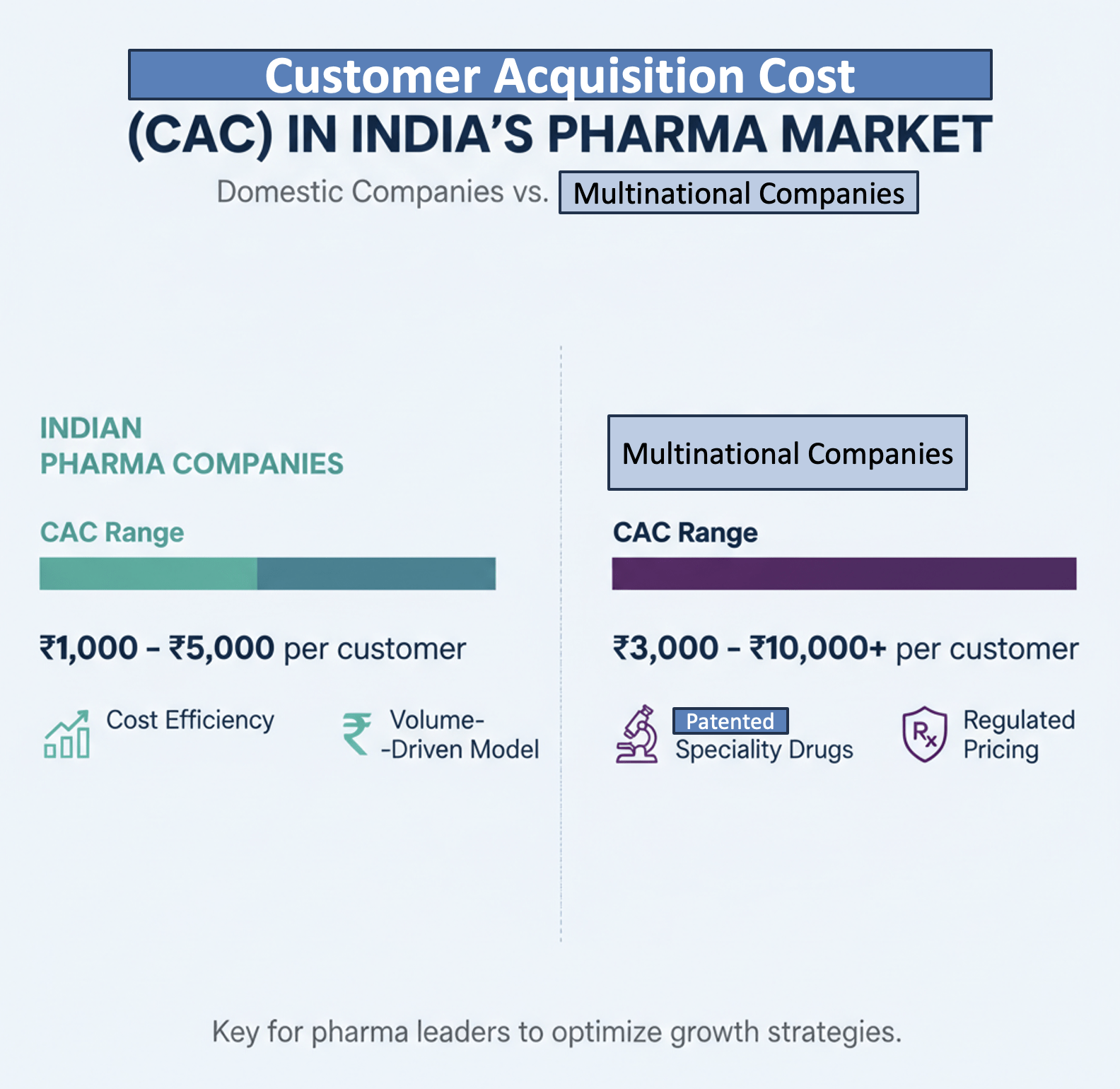

| Factor | Indian Pharma | MNC Pharma in India |

|---|---|---|

| CAC Range (₹) | ₹1,000 – ₹5,000 | ₹3,000 – ₹10,000+ |

| Market Focus | Branded generics and OTC market | Specialty niche therapies, patented drugs |

| Marketing Approach | Cost-effective, high-volume tactics | Specialist sales teams, high-touch marketing |

| Challenges | High competition, price sensitivity | Regulatory price controls, global pricing impact |

| Sales Cycle | Short to moderate | Long, due to super-specialized products |

| Digital Adoption | Growing but moderate | Increasing focus on data-driven, targeted campaigns |

MNCs typically incur a higher CAC in India due to factors such as the high cost of innovator/patented drugs, focused targeting of specialty niches (like oncology), and complex regulatory requirements. Their campaigns often involve intense physician and hospital engagement, requiring significant investment in education and relationship management.

Conversely, Indian pharma companies focus more on branded generics and OTC segments with mass marketing and large salesforce networks, resulting in a comparatively lower CAC but high volume of customers. Their agility in market compliance and understanding of local dynamics allows optimized acquisition cost management.

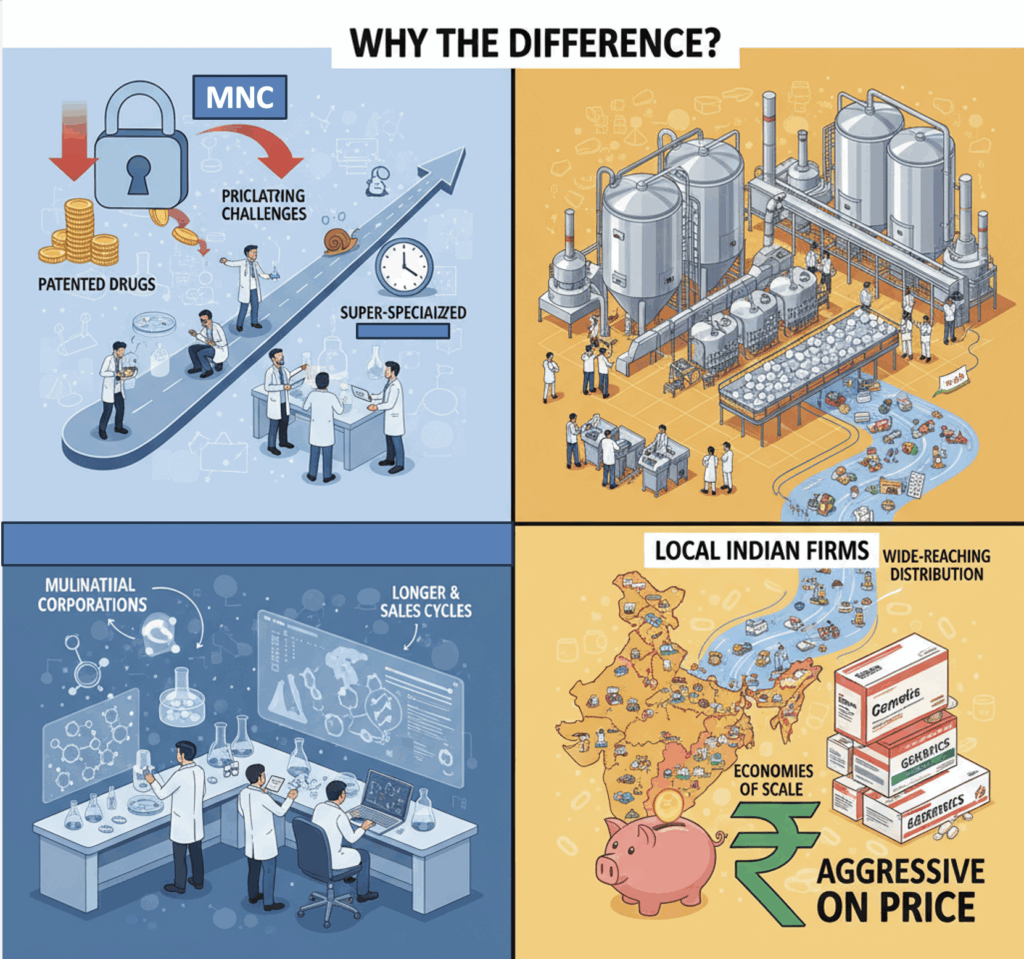

Why the Difference?

- MNCs face regulatory pricing challenges limiting the price of their patented drugs in India compared to global markets, reducing their revenue per customer.

- Local firms leverage economies of scale in generics production and wide-reaching distribution.

- MNCs devote proportionally more budget to super-specialized therapeutic segments that require longer sales cycles.

- Indian firms often compete aggressively on price while MNCs emphasize value and innovation.

Strategic Imperative: Balancing CAC and Customer Lifetime Value (CLV)

Both Indian and MNC pharmaceutical companies aim to align their CAC with Customer Lifetime Value by improving patient adherence, expanding therapy areas, and enhancing market access.

Conclusion

The Indian pharmaceutical landscape presents contrasting CAC dynamics for domestic companies versus MNCs. Indian pharma’s cost efficiency and volume-driven model allows a CAC range of roughly ₹1,000–₹5,000 per customer, while MNCs, focusing on patented specialty drugs and regulated pricing, face significantly higher CACs of ₹3,000–₹10,000 or more. Understanding these differences is critical for pharma leaders optimizing growth strategies in India’s complex market.

Appendix: Sources

- Indian Pharma Market Overview – MedicinMan, April 2025

- Pharma Franchise Help – Understanding Customer Acquisition Cost, 2024

- Indian Healthcare and Pharma Deal Trends – Economic Times, 2025

- India Pharma Market Growth and Trends – IMARC Group, 2025

- Indian Pharma Industry Insights – IBEF, October 2025

- Pharma MNC Market Share & Strategy – NDTV Profit, 2024

- Pharmaceutical Marketing Economics – LinkedIn Articles, 2025

- Market Study on Pharmaceutical Sector in India – CCI, 2025

- Pharma Sector Overview – Bajaj Broking, 2025

- Pharma MNCs in India Analysis – Financial Express, 2025

[1] NIFTY Pharma – Moneycontrol https://www.moneycontrol.com/indian-indices/nifty-pharma-41.html

[2] Nippon India Pharma Fund Direct Growth – Groww https://groww.in/mutual-funds/nippon-india-pharma-fund-direct-growth

[3] MNC Pharma Stocks – Live Stock Quotes, Stock Price Update and … https://www.equitymaster.com/stockquotes/0-MPHARMA/mnc-pharma-group-stocks

[4] MNC and Indian Pharma cos in Clinical Research – Cliniminds https://cliniminds.com/home/mnc-and-indian-pharma-cos

[5] MNC Pharma Companies India | PDF – Scribd https://www.scribd.com/document/883268186/MNC-Pharma-Companies-India

[6] TOP CUSTOMER ACQUISITION COST STATISTICS 2025 https://www.amraandelma.com/customer-acquisition-cost-statistics/

[7] Is The Thrill Gone? MNC Pharma’s Future in India – NDTV Profit https://www.ndtvprofit.com/opinion/is-the-thrill-gone-mnc-pharmas-future-in-india

[8] [PDF] top-50-pharma-companies.pdf – Dr. Reddy’s https://www.drreddys.com/media/31409/top-50-pharma-companies.pdf

[9] Average Customer Acquisition Cost by Industry – Vena Solutions https://www.venasolutions.com/blog/average-cac-by-industry

[10] Pharma MNCs continue to lose India market share – Industry News https://www.financialexpress.com/business/industry/pharma-mncs-continue-to-lose-india-market-sharenbsp/3872761/

[11] Best Mutual Funds In Pharma Sector to Invest with High Returns https://dhan.co/mutual-funds/mf-to-invest/best-pharma-mutual-funds/

[12] [PDF] winning in the indian pharmaceutical market – iqvia https://www.iqvia.com/-/media/iqvia/pdfs/india/winning-in-the-indian-pharmaceutical-market.pdf?_=1610873724999

[13] [PDF] Market Study on the Pharmaceutical Sector in India https://www.cci.gov.in/images/marketstudie/en/market-study-on-the-pharmaceutical-sector-in-india1652267460.pdf

[14] [PDF] MNCs in Pharmaceutical Industry in India after TRIPS – ISID https://isid.org.in/wp-content/uploads/2022/09/WP170.pdf

[15] [PDF] Killer Acquisitions in Indian Pharma – Nishith Desai Associates https://www.nishithdesai.com/fileadmin/user_upload/pdfs/Research_Papers/Killer_Acquisitions_in_Indian_Pharma.pdf

[16] [PDF] Pharmaceutical Market and Drug Price Policy in India https://gidr.ac.in/pdf/rdc_pharma-article-3310.pdf

[17] Pharma Sector in India: A Complete Overview | Bajaj Broking https://www.bajajbroking.in/blog/overview-of-pharma-industry

[18] Are pharma MNCs good for Indian consumers? – YES https://www.thehindubusinessline.com/opinion/Are-pharma-MNCs-good-for-Indian-consumers-YES/article20701972.ece

[19] View of MARKETING STRATEGIES OF DIFFERENT … https://jddtonline.info/index.php/jddt/article/view/771/471

[20] The impact of mergers and acquisitions on performance of firms: A pre https://www.sciencedirect.com/science/article/pii/S2667111523000063

All Images are AI Generated For Illustration. E&OE