When Eli Lilly announced plans to build a $6.5 billion manufacturing facility in Houston, Texas, it made headlines far beyond the pharmaceutical sector. The facility will produce active ingredients for orforglipron, Lilly’s experimental oral GLP-1 therapy for obesity and type 2 diabetes—an innovation with blockbuster potential in a market already reshaped by injectable weight-loss drugs.

But the announcement is more than a story of a single plant. It’s a case study in how corporate strategy, market opportunity, and shifting political winds converge to shape billion-dollar decisions.

A Mega-Project with Mega Ambitions

The new site, located in Generation Park near George Bush Intercontinental Airport, is expected to:

- Create Jobs & Capacity: Support 4,000 construction roles during build-out and ~615 permanent, high-skill jobs in operations.

- Strengthen Supply Chains: Manufacture critical small-molecule active pharmaceutical ingredients (APIs), particularly for orforglipron but also for oncology, immunology, and neuroscience medicines.

- Go Live Quickly: Lilly targets operational readiness within five years, an aggressive timeline for a project of this magnitude.

- Leverage Incentives: Secure roughly $146 million in Texas state incentives plus a $5.5 million Texas Enterprise Fund grant.

The move is part of Lilly’s broader $27 billion U.S. expansion strategy, which includes four new domestic manufacturing sites.

Market Forces Driving the Decision

1. The Obesity & Diabetes Boom

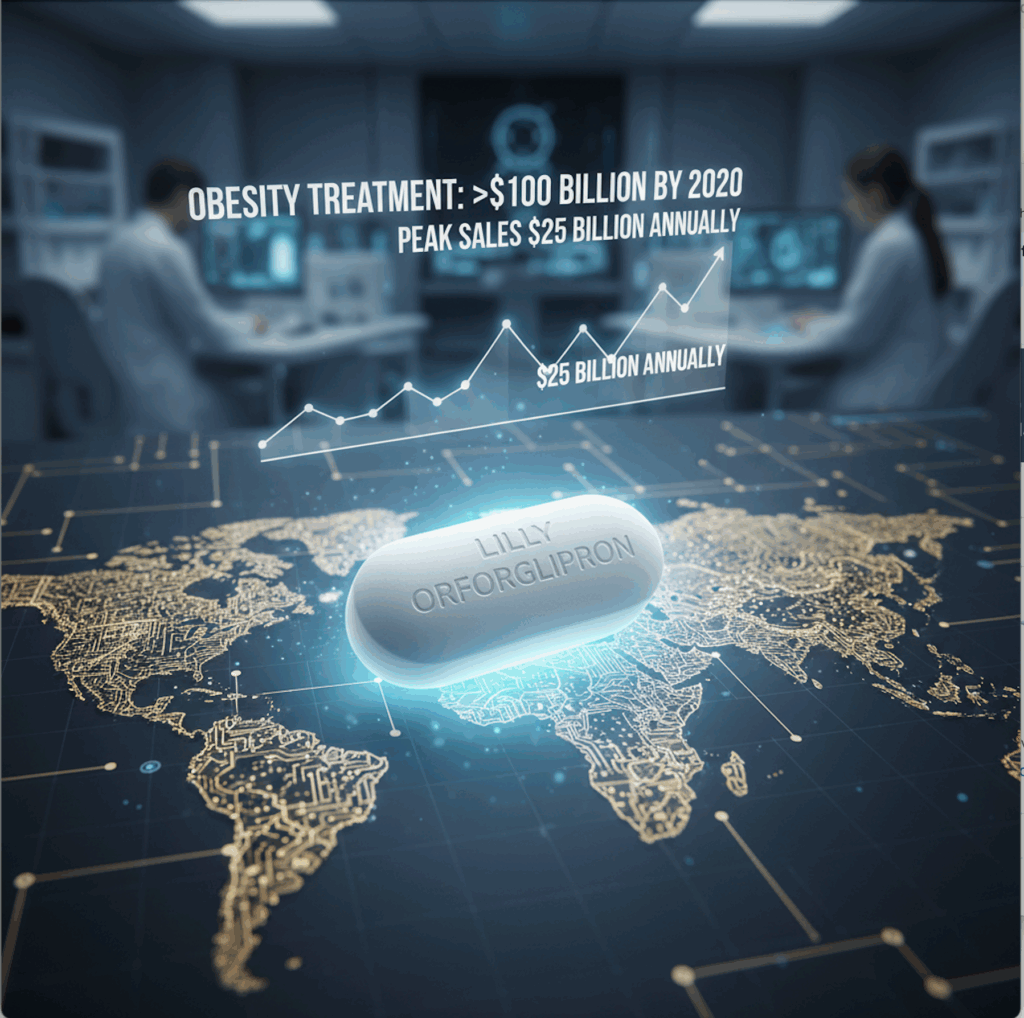

GLP-1 drugs like Ozempic and Mounjaro have transformed obesity treatment, creating a market projected to exceed $100 billion annually by 2030. Lilly’s orforglipron aims to capture a share of that market with a pill-based alternative, eliminating the injection barrier for millions of potential patients. Analysts estimate peak sales could reach $25 billion annually if the therapy succeeds.

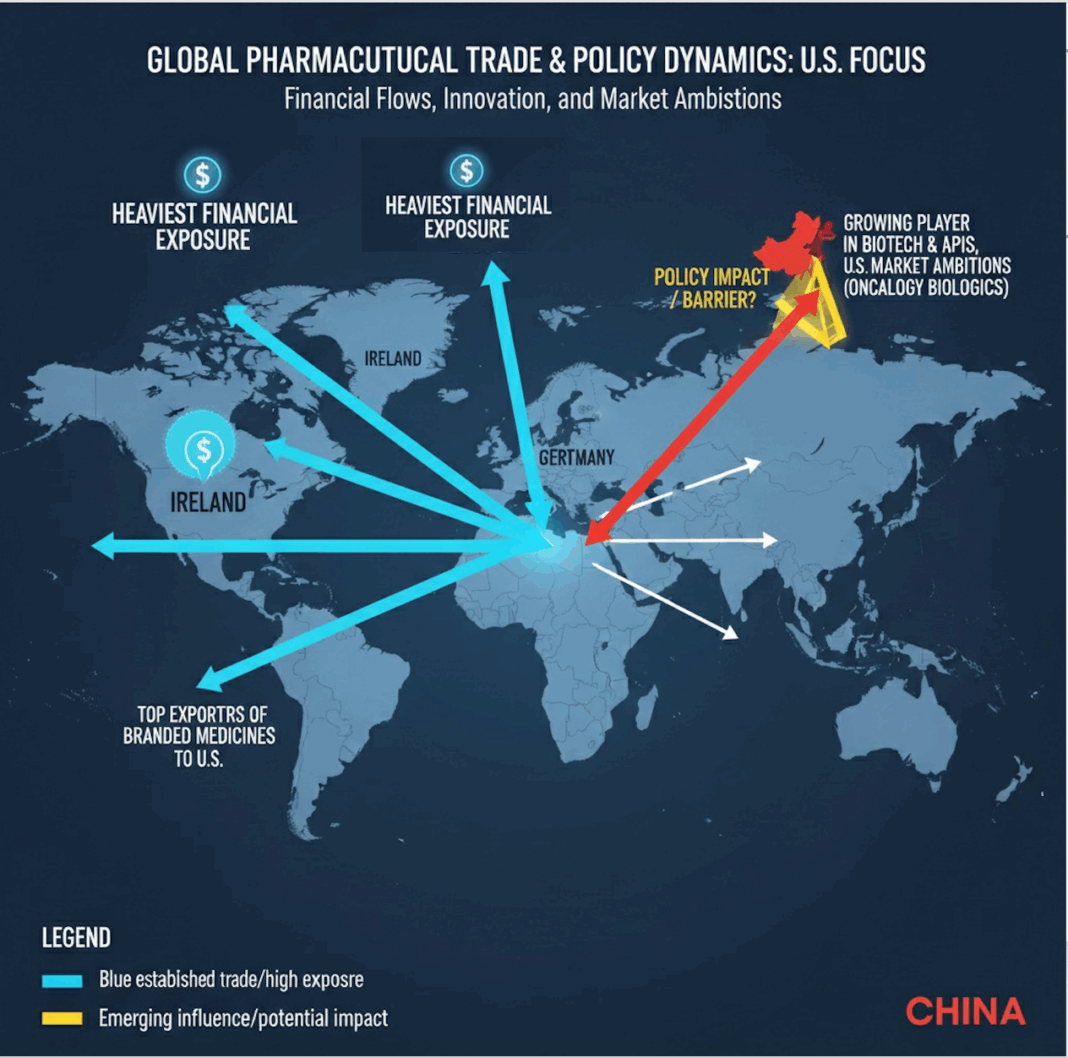

2. Supply Chain Resilience

After pandemic disruptions and geopolitical tensions, pharmaceutical companies are eager to reduce dependence on overseas manufacturing. Onshoring not only mitigates risk but also gives companies tighter control over quality and regulatory compliance.

3. Competitive Advantage

By scaling U.S. manufacturing early, Lilly ensures capacity to meet soaring demand, shorten lead times, and negotiate from a position of strength in a fiercely competitive space dominated by Novo Nordisk and other rivals.

Policy Winds at Lilly’s Back

While market fundamentals alone justify the investment, the political climate under the Trump administration provides an added tailwind:

- Regulatory Easing: A 2025 executive order—“Regulatory Relief to Promote Domestic Production of Critical Medicines”—seeks to streamline FDA and EPA approvals, making large-scale builds faster and less risky.

- Tariff Signals: Public discussions of tariffs on imported pharmaceuticals create an incentive to hedge against potential cost shocks by manufacturing in the U.S.

- Pro-Business Messaging: Even before specific policies take effect, consistent messaging about reshoring critical industries influences corporate capital allocation.

These moves don’t cause a $6.5 billion investment overnight, but they help tilt the risk-reward equation toward domestic production.

Beyond Politics: The Bigger Drivers

It’s important to note that Lilly’s U.S. manufacturing push predates recent policy changes. The company announced major domestic expansion plans well before the latest executive orders. And while federal policy may sweeten the deal, other factors remain decisive:

- Local Talent & Infrastructure: Houston’s deep chemical engineering workforce and industrial base are critical for a high-tech pharmaceutical site.

- State & Local Incentives: Texas’ competitive incentive packages reduce upfront costs.

- Strategic Control: Long-term supply reliability and intellectual property protection weigh more heavily than any single political cycle.

Lessons for Business Leaders

Lilly’s move illustrates three key insights for executives across industries:

- Policy Signals Matter, but Fundamentals Rule

Government incentives and regulatory changes can accelerate decisions, but projects of this scale ultimately rest on market demand and operational logic. - Reshoring Is Now Strategic, Not Just Patriotic

What began as a political talking point is now a risk-management imperative. Supply chain resilience has become a board-level priority. - Location is a Competitive Weapon

Houston’s rise as a pharmaceutical manufacturing hub underscores how talent, infrastructure, and incentives can reshape industry geography.

The Takeaway

Eli Lilly’s Houston plant is more than a factory—it’s a symbol of a new era in pharmaceutical manufacturing. It reflects a convergence of explosive market growth, strategic reshoring, and political tailwinds that together are redefining where and how life-saving medicines are made.

For investors, policymakers, and industry peers, the message is clear: innovation isn’t just about the science of new drugs; it’s about building the capacity to deliver them at scale, securely and sustainably.

What do you think?

Will policy-driven reshoring continue to reshape global pharma manufacturing, or will market forces remain the dominant driver? Share your thoughts below.

AI generated images for illustration only E&OE