Summary of Performance of Top 30 Metros in IPM – Dec’24

Overall Market Performance

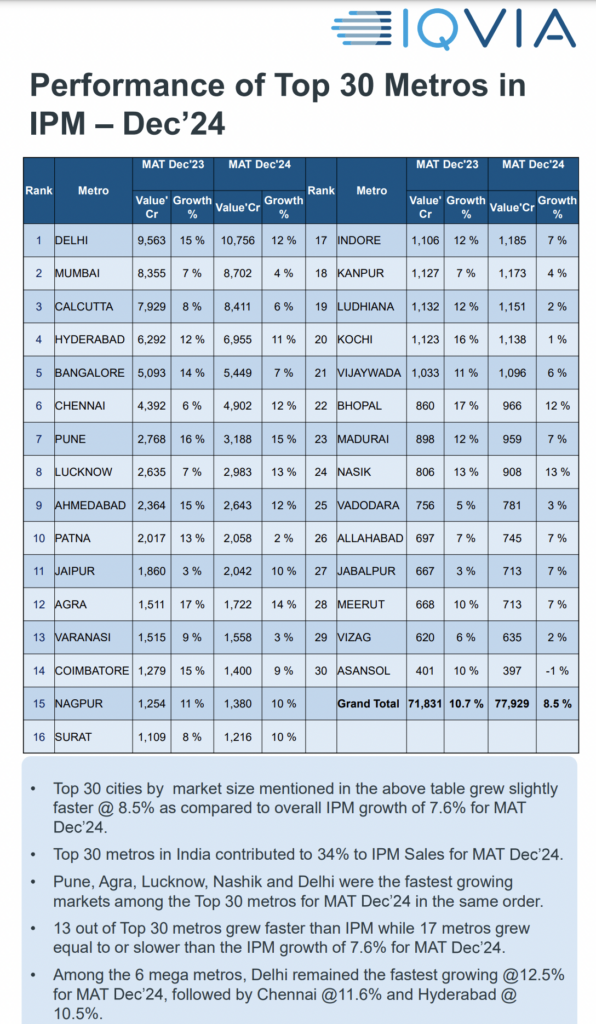

• The top 30 metros in India contributed 34% to the total IPM (Indian Pharmaceutical Market) sales for MAT (Moving Annual Total) Dec’24.

• These cities grew at a rate of 8.5%, slightly higher than the overall IPM growth of 7.6%.

• The total market value of these 30 metros increased from ₹71,831 Cr (Dec’23) to ₹77,929 Cr (Dec’24), showing a ₹6,098 Cr increase.

Fastest-Growing Markets

• Top 5 fastest-growing metros:

1. Pune (15%)

2. Agra (14%)

3. Lucknow (13%)

4. Nashik (13%)

5. Delhi (12.5%)

• Among the six mega metros, Delhi grew the fastest at 12.5%, followed by Chennai (11.6%) and Hyderabad (10.5%).

Growth Trends & Insights

• 13 out of 30 metros grew faster than the IPM growth rate (7.6%), while 17 metros grew at or below the IPM growth rate.

• Cities like Delhi, Hyderabad, Bangalore, and Chennai remain dominant in total market value, with Delhi leading at ₹10,756 Cr.

• Smaller cities like Bhopal (12%) and Nashik (13%) showed strong growth, indicating increasing pharmaceutical demand in Tier-2 cities.

Conclusion

The Indian pharmaceutical market continues to grow robustly, especially in urban centers. While mega metros remain strong contributors, smaller cities like Lucknow, Pune, and Agra are emerging as high-growth markets. The steady expansion of IPM in these metros suggests increasing healthcare accessibility and demand for pharmaceutical products in urban India.

Reach out to Anup Soans: anupsoans@medicinman.net or use the social media buttons below.