At the IDMA Marketing and Sales Conference in Mumbai last week, I spoke on “Using digital to create customer engagement’ – a topic close to my heart.

I began by talking about how customer engagement is a topic that pharma discusses in posters glued on office walls, on slides of senior executives and in leisure. I asked the executives sitting in the audience if I was right to assume that 30 minutes into their day in office on Monday morning, they would get lost in numbers and results and ‘customers’ would be farthest from their minds. They all laughed in agreement.

That probably explains why while consumers would feel disappointed, betrayed and upset – maybe even angry – if brands like Coca Cola, Nike, Amazon and Starbucks did something wrong, not many would express similar feelings if some of the largest pharma brands – Lipitor, Seretide, Humira and Mixtard – did something wrong.

Actually, when Starbucks was caught in a racial discrimination scandal in May last year, the global CEO took to the radio, social media and actually apologised to consumers. When was the last time we remember a global pharma CEO publicly apologising to consumers?

The power of consumers is on the rise. There is data to show that while on one hand, consumers are willing to spend 140% more if they enjoy the engagement and the experience the brand creates, on the other, half of them are likely to walk away and boycott brands who do not engage meaningfully with them.

It is therefore, not a coincidence that the Gartner Group estimates that almost 90% of organizations intend to compete primarily on customer experience. The oil that fuels this paradigm shift is data. No wonder then that data is considered the new oil. The more companies and brands obsess over customers and create meaningful engagement – both online and offline – the more data they collect about the customer. This data is what sharpens their understanding of customer preferences which are all too important for brands to meaningfully engage customers by providing them superlative experiences.

Is it any wonder therefore, that some of the largest health companies – that are investing large amounts of money into understanding the needs of the sick and the healthy in order to create meaningful experiences, services and products for them – are Google, Apple, Microsoft, Amazon and even a well-known shoe-maker called Nike?

In my opinion this is only because pharma exited the services space. The area where it invested in engaging doctors, patients and caregivers to truly understand what could make them live better and healthier lives. Today most pharma executives may see these initiatives as expenses and are prone to conclude that the returns on them aren’t viable enough.

Smart entrepreneurs saw the white spaces created by pharma’s exit and built great products and services that focused not on selling medicines, but on engagement, experience and therefore, improving clinical outcomes. Private capital worth $37 billion has since flowed into that space. To put this in context, the Indian pharma market is worth about $33 billion. While the two numbers aren’t comparable (as $37 billion flowed into digital health tech over 10 years while the pharma industry turns over $33 billion every year), $37 billion is a very large sum of money that pharma left on the table.

Hence the largest players in healthcare now are those that operate on the intersection of technology and health.

So why are these companies so successful? This is because they know how to deploy technology to create ecosystems for great customer experience and not a website here or an app there which are more random acts of digital than meaningful ecosystems.

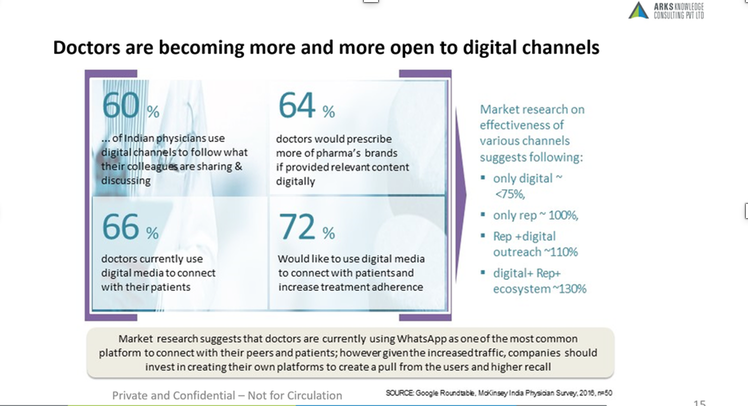

In a roundtable conducted by Google and McKinsey in 2016, Indian doctors had said that they track the content that their colleagues and influencers consume, connect with patients through digital tools and would be willing to prescribe pharma brands if promoted digitally. They also thought that digital offers them scope to help their patients to adhere to their suggested treatment.

Additionally, doctors said that they considered a pure play digital outreach (minus reps) to be less effective than a rep + digital combination, their preference of choice was digital + rep + digital ecosystem. When I asked the audience how much pharma has experimented with this, most of their hands went up with examples of a product website or an app or a discussion board that they had created. Yet no one could describe a digital ecosystem that they had created with the purpose of engaging their customers and providing them with great experiences that made them want to come back more and more.

No wonder then that health tech companies are so successful at engaging them. Also, this answers many of the usual questions – why will the doctor open my email, why will he come to my website, what is the guarantee that he will Rx my brand. Doctors (and patients) seek an ecosystem to engage. No one wants partial information and will not access different websites for pieces of information.

What does an ecosystem look like?

As Nitro Digital describes it, Pharma has a long way to go in establishing truly patient-centric ecosystems. A typical example of the more advanced pharma-created digital ecosystems seen in the market today might include: a disease awareness website; an app and/or website for support, incorporating information, stories, medication reminders; and maybe some dedicated medication resources, depending on location and legal approach. Such approaches still fall well short of an ecosystem that truly serves patient needs or one that is geared towards delivering significant increases in patient outcomes.

Probably one step before an ecosystem would be to map a customer journey and identify areas where engagement can improve or the experience improved? Once we get this right, we could identify tens of opportunities for services, tech-enabled products and entirely new revenue streams. This would truly be “selling beyond the pill”.

The first thing to get right in thinking of better engagement and experience in the journey would be by considering every touch point as a date. If the customer were someone you were dating, how would you expect to treat them? What sort of experience would you like them to have? Date every customer through the journey!

Today’s customers are informed, presumptuous and impatient. They know quite a lot about the products and services that you offer. They research you well. And if you aren’t present where they are looking for you, you can kiss them goodbye. If you are there and they find you, they get irritated if you get them to fill up long forms of information and if it distracts them from what they seek.

“But regulations…..” is the excuse that we hide behind with. Here I would encourage you to look and learn from the banking industry. What can be more regulated than an industry that handles your hard-earned money? Decades ago, they transformed their business model so much that today you can’t remember the last time you physically went to the bank! Why then, should an industry that is desperately seeking out differentiation, insulate itself from transformation and hide behind regulations?

I concluded by summing up Pharma’s problems. It still flogs a tired, old commercial model that is broken – reps are less welcomed by doctors, shorter in-clinic time, lack of differentiation between brands and content that is valued lesser by customers every cycle.

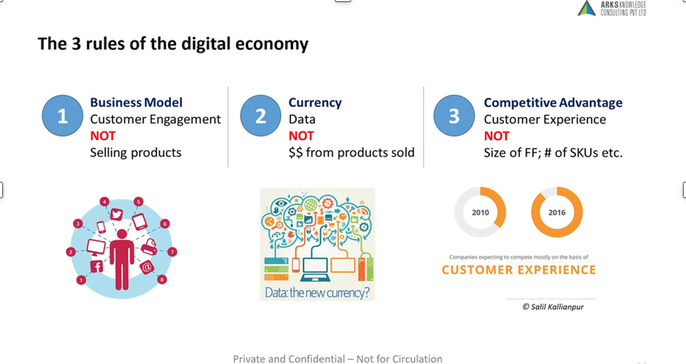

In the desperate seeking of differentiation, consider the three new rules of the digital world:

- Your business model is to engage customers meaningfully through a combination of online and offline interventions.

- Your competitive advantage is to create excellent customer experiences. This is what will create loyalty amongst customers.

- The fuel that drives these two important initiatives is data – the more you get of it, the better. Data is the new currency, the new oil.

It is said that it takes about $1 billion and 10-12 years for pharma to invent a new product. Recently, Amazon invested the same amount – $1 billion in one quarter, to improve customer experience by delivering to Prime customers in one day instead of two.

These are the competitors that pharma is up against. Ignoring the new rules of differentiation through engagement and experience can soon become an existential threat, relegating pharma to a mere supplier, as customers move away, versus a front-runner in the health industry.

———————————————————–

Salil Kallianpur is Executive Editor at MedicinMan and Founder – ARKS Knowledge Consulting. He has worked in senior roles at Dr. Reddy’s, Novartis, Pfizer and GSK.